A long-sought CalSTRS rate increase, more than doubling the bite from school districts, is the reason given last week for a proposal to increase the lump-sum death benefit, unchanged in the last 13 years.

The CalSTRS board, unlike most California public pensions, lacks the power to raise employer rates, needing legislation instead. But the board is authorized to make annual increases in the lump-sum death benefit to keep pace with inflation.

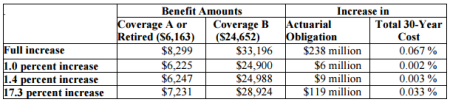

Because the system is underfunded, the CalSTRS board has made no inflation adjustment in the death benefit since 2002. The board was told that it could have increased the death benefit by about 34.7 percent during the period.

One level of coverage with a payment of $6,163 would have increased to $8,299, the payment for another from $24,652 to $33,196. The long-term CalSTRS actuarial obligation would have increased by $238 million.

Now the big phased-in rate increase enacted last year for school districts, with smaller increases for teachers and the state, allows the California State Teachers Retirement System to project reaching a funding level of 100 percent by 2046.

Last week the staff, responding to an earlier board request, recommended a plan to resume death benefit inflation adjustments, but only in years with better-than-expected investment returns.

The funding level could not drop below the path to full funding scheduled in the rate hike legislation. For example, the schedule expects 64.5 percent funding this year, and the latest funding level as of last year is 68.5 percent.

If the board had approved the plan, the death benefit could have been increased enough to drop the funding level back to 64.5 percent. But action was delayed until next April, mainly due to opposition from Gov. Brown’s appointees on the board.

The issue is not likely to go away. A retired school administrator, Dave Davini, told the board CalSTRS members would like some assurance that the board will continue to try to restore the original purchasing power of the death benefit if funding is available.

“What members are interested in is enhancing that benefit and keeping that benefit as the legislation originally intended,” Davini said.

The lump-sum benefit is regarded as a “vested right” that cannot be cut if increased. Pension boards also have a fiduciary duty under the state constitution (labor-backed Proposition 162 in 1992) to give member benefits priority over taxpayer costs.

Using a temporary funding “surplus” to pay for increased benefits or cuts in employer rates is a long-standing practice in the management of California’s public pension funds.

Twenty county retirement systems operate under a 1937 act that allows “excess” earnings, amounts exceeding 1 percent of total assets, to be diverted for retiree bonuses, retiree health care or lowering employer contributions.

Some city retirement systems allow a “13th check” bonus for retirees, if investment earnings exceed the annual forecast. In San Jose, the bonus check was eliminated by a pension reform approved by voters three years ago.

Two CalPERS funds that used “excess” earnings to maintain pension purchasing power, the Extraordinary Performance Dividend Account and the Investment Dividend Disbursement Account, were replaced by a different program in 1991.

As its funding soared to 138 percent during a boom in the late 1990s, CalPERS cut employer rates to near zero and sponsored a retroactive pension increase, SB 400 in 1999, telling legislators the surplus and “superior” earnings would cover the cost.

Under a lesser-known bill, AB 1509 in 2000, a quarter of the teacher contribution to CalSTRS (2 percent of pay from the total of 8 percent) was diverted for a decade into a new individual investment account with a guaranteed minimum return.

The Legislature was told, in an echo of the CalPERS claim for SB 400, that a decade-long diversion of a quarter of the teacher contribution would have “no effect to the solvency of STRS” and the cost would be absorbed by a funding surplus.

The CalSTRS individual investment account created by the bill, the Defined Benefit Supplement, and a similar account for part-time teachers, the Cash Balance Benefit, can be awarded additional earnings credit if there is “excess” funding.

After an analysis of the impact on long-term funding, the CalSTRS board last April adopted a tighter policy for awarding additional credit to the two individual investment accounts.

Last week, the board decided to get a similar actuarial analysis of the long-term funding impact before considering an increase in the death benefit next April, a move suggested by a Brown representative.

“I recognize the issue you have raised about constituents and the concern that it hasn’t been raised in a long time,” Eraina Ortega of Brown’s finance department said during the board discussion.

“I completely respect and understand that view,” she said. “But it feels to me that our primary concern ought to be the funding status overall before we consider any benefit changes.”

Paul Rosenstiel, a Brown appointee, reminded his colleagues that CalSTRS is considering shifting up to 12 percent of its portfolio, about $20 billion, to investments with less risk of big losses that could lower the funding level.

“Our investment consultants are saying we can move (the funding level) in the wrong direction and not be able to recover,” Rosenstiel said. “That’s what they told us yesterday.”

Controller Betty Yee and Treasurer John Chiang’s representative, Grant Boyken, agreed with the proposal to get an actuarial analysis of death benefit increases under the current policy that uses the consumer price index as a guide.

A CalSTRS staff survey of death benefits provided by 22 retirement systems throughout the nation, including one in Canada, found that CalSTRS is among the more generous.

Most of the retirement systems offer some form of continuing income to the survivors of retirees. Fewer provide income to the survivors of active workers. CalSTRS does both.

“In addition, only slightly more than half of the plans investigated provide a one-time lump-sum death benefit, other than the return of contributions and interest in the member’s account, to survivors of members who die while in active service and less than half provide a similar benefit to members who die after retiring,” said the staff report.

The standard lump-sum death benefit for members of the California Public Employees Retirement System is the return of contributions with interest.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.

Photo by TaxCredits.net

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712