Ed Mendel is a reporter who covered the capital for nearly three decades, most recently for the San Diego Union-Tribune. More of his stories are at CalPensions.com

A state attempt to create a retirement savings plan for 6 million private-sector California workers not offered one on the job, Secure Choice, got a boost last week during the White House Conference on Aging.

President Obama said he has directed his labor department to propose rules showing states how to create what in California could be an “automatic IRA,” a payroll deduction that puts money into a tax-deferred savings plan unless workers opt out.

The rules are expected to answer a key question: Is Secure Choice exempt from a federal retirement law, ERISA, that not only has employer administrative costs but may also expose employers to liability for failed investments and other problems?

An ERISA exemption is one of several limits California legislation placed on Secure Choice: No state budget for development ($1 million was donated), self-sustaining when operating, IRS tax approval, and legislative approval of the final savings plan.

The payroll deduction, believed to be an important way to increase retirement savings, is intended to be a supplement for Social Security. Nearly half of California workers are said to be on track to retire with incomes below $22,000 a year.

Obama said Congress ignored repeated calls for an automatic IRA. Taking alternative action, he said the new labor rules will encourage a handful of states that have enacted new retirement savings plans and 20 other states considering similar plans.

In May, the President received a letter from 26 U.S. senators urging clarification of federal labor and tax laws hampering states trying to develop retirement savings plans. California and Massachusetts were mentioned.

“A major cause of the retirement crisis is that almost half of employees work for an employer that does not sponsor a retirement plan,” the senators said in the letter. “Employees without access to a plan at the workplace are much less likely to save.”

In March, state Senate President Pro Tempore, Kevin De Leon, D-Los Angeles, the author of Secure Choice (SB 1234 in 2012) and state Treasurer John Chiang, whose office houses Secure Choice, met with Obama administration officials to discuss the bill.

“President Obama’s action removes the most significant barrier to state action across the country,” De Leon said in a news release last week. “California, and states that follow our lead, will now be able to ensure tens of millions of hard-working men and women will have a shot at retiring with dignity.”

Chiang’s response was more cautious last week as he gave a previously scheduled update of Secure Choice to his fellow members of the California Public Employees Retirement System.

“It’s a major development,” Chiang told the CalPERS board. “It’s hopeful. At least we know we are going to have some rules.”

Obama called on his labor secretary, Tom Perez, to propose the new rules by the end of the year. Chiang said Secure Choice hoped to be ready to take a plan to the Legislature by the end of the year, but could act quickly if the rules allow the plan.

With the $1 million in donations, half from the Laura and John Arnold Foundation, a market analysis and plan design is being prepared by Overture Financial and others under a $500,000 contract. K&L Gates has a $275,000 legal services contract.

In a blog post last week, Secretary Perez said a number of states have asked for clarity about whether their retirement savings plans would be “preempted or nullified” by ERISA, the federal Retirement Income Security Act.

“Although the federal courts, not the Department of Labor, are the ultimate arbiter on that question, the department can try to help reduce the risk of litigation challenges to state retirement savings initiatives,” Perez said.

The President told the aging conference last week that Social Security, the basic federal retirement system that would be supplemented by the savings plan, is not in “crisis” as often claimed by those who want to cut the program.

Social Security, like Medicare, is “facing challenges” because of the “demographic trends” of the Baby Boomers, he said. A population bulge turning 65 at the rate of a quarter million a month also is expected to have a longer life span.

“Number one, we have to keep Social Security strong, protecting its future solvency,” Obama said without mentioning specific solutions. “And I think there are ways, creative ways that people are talking about to protect its future solvency.”

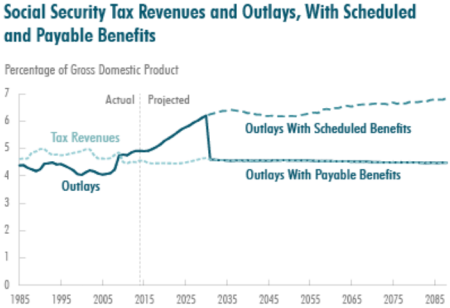

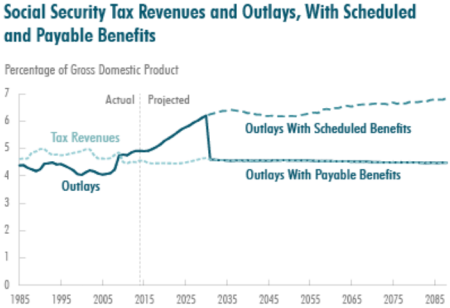

In a presentation to the CalPERS board last week, a UC Davis economist, Ann Huff Stevens, said the Social Security “trust fund” now covering a funding gap is widely expected to drop to zero around 2035-40. (see graph above)

If a solution is not enacted before then, payments presumably would be reduced to the amount covered by annual Social Security tax revenue from employers and employees, currently 6.2 percent of pay from each each.

Huff Stevens said Social Security funding gaps have been closed in the past. In 1975, the tax rate was increased and benefits reduced. In 1983, some benefits were taxed and retirement ages increased.

A federal lobbyist, Tom Lussier, told the CalPERS board Congress seems unlikely to consider Social Security funding until after the presidential election last year. He said an apparently growing concern about retirement security may take the talks beyond cuts.

“If we are really going to acknowledge the retirement security crisis that we are talking about, the discussion should be about expanding Social Security and making it a richer benefit as opposed to going the other way,” Lussier said.

A third point made by the President last week, in addition to the retirement savings plan and Social Security solvency, is a proposed labor rule that attempts to “crack down” on self-serving financial advice sometimes given to consumers.

“The goal here is to put an end to Wall Street brokers who benefit from backdoor payments or hidden fees at the expense of their clients,” Obama said.

Lussier said another rule, pending at the labor department and in Congress, would require retirement savings and investment plans, such as IRAs and 401(k)s, to give individuals an estimate of their value at a normal retirement age.

He said the belief is that “most people will be frightened” by the number and motivated to save more.