Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

The CBC reports, Joe Oliver to consult on ‘voluntary’ Canada Pension Plan boost:

Finance Minister Joe Oliver says his government is ready to start consulting Canadians on allowing larger, “voluntary,” contributions to the Canada Pension Plan.

“We are open to giving Canadians the option to voluntarily contribute more to the Canada Pension Plan to supplement their current retirement savings,” he told the House of Commons on Tuesday.

Oliver said the move would build on the Harper government’s record of creating more options for retirement savings, including the pooled pension plans and tax-free savings account alternatives championed by the Conservatives. A statement released by his office said that “by providing voluntary, flexible savings tools, Canada’s retirement system is, in fact, now among the best in the world.”

No more details were provided in his brief answer to a planted question from a Conservative caucus colleague. It’s unclear how the voluntary contributions would work, or what limits would apply.

But Oliver reiterated his government’s position on hiking basic premiums, something federal government talking points have called a “mandatory, job-killing, economy-destabilizing, pension-tax hike on employees and employers.”

“What we will not do is reach into the pockets of Canadians with a mandatory payroll tax, like the Liberals and the NDP would do,” Oliver said in question period.

“A one-size fits all pension tax hike is not what Canadians want, nor what they need,” Oliver’s release said.

Policy reversal?

This is the second time in two years the government has seemingly done an about-face on the CPP issue.

In 2010, then-finance minister Jim Flaherty announced consultations had begun to expand CPP, calling the program “the envy of the world.”

He said the expansion should be “modest and phased in,” and that provinces were on board.

Then, in 2013, he abruptly backtracked and started referring to the CPP as a “payroll tax” that the country couldn’t afford until there was more economic growth.

Employees and employers are each required to contribute up to almost $2,480 annually on income up to $53,600.

This year, the CPP pays out a maximum benefit of $12,780.

Past proposals have suggested doubling both the contribution cap and the maximum payout. Although Flaherty had made it clear he wasn’t in favour of going that high, he never publicly outlined what numbers he had in mind.

Oliver now intends to spend the summer months ahead of a coming election consulting with “experts and stakeholders,” on what voluntary contributions to the CPP might look like.

Finance critic NDP MP Nathan Cullen questioned what he called the Conservatives’ “death-bed conversion” to CPP enhancement.

“It’s incredibly vague. It’s a non-announcement today. This is at the very last minute. If they were serious about this, we would have seen something a lot sooner,” he said.

Ontario Liberal MPP Mitzie Hunter, the associate minister of finance, dismissed the announcement, saying the federal government “has made it clear they have no real interest in enhancing CPP.”

“It’s disappointing that the federal government is only concerned with their short-term election prospects instead of providing a secure retirement for millions of Canadians.”

Canada’s most populous province recently passed a bill approving the creation of a provincial pension plan that would start in 2017. Ontario’s plan, which would be phased in over a two-year period, would be for those who don’t have a workplace plan.

Bill Curry and Steven Chase of the Globe and Mail also report, Tories propose voluntary expansion of Canada Pension Plan:

The federal Conservative government is proposing a voluntary expansion of the Canada Pension Plan, adding a pre-election twist to the politically charged debate over how best to boost Canadian savings.

Finance Minister Joe Oliver made the announcement Tuesday in the House of Commons, promising that consultations will take place over the summer on the details.

The general premise is that Canadians who choose to pay higher CPP premiums would receive higher guaranteed payments in retirement.

The announcement marks a significant shift for the Conservatives, who have long resisted changes to the CPP on the grounds that higher premiums would represent job-killing payroll taxes.

It also amounts to a key campaign promise because this measure will not be in place before an expected Oct. 19 federal election.

“Our Conservative government believes all Canadians should have options when saving for their future. That is why we intend to consult on giving Canadians the voluntary option to contribute more to the Canada Pension Plan to supplement their retirement savings,” Mr. Oliver said.

Though the announcement represents a significant policy shift, the Finance Minister did not take questions from the media and few details were provided.

This expansion of the CPP on a voluntary, instead of compulsory, basis is an attempt by the Conservatives to offer voters another way to save for retirement without obliging them to do so.

The Tories have been at loggerheads with the opposition parties – and most provinces – over the issue for years.Labour groups and the seniors advocacy group CARP have long argued that voluntary savings vehicles do not work and that a mandatory CPP expansion is needed to ensure that all Canadians are saving enough for retirement.

The Conservatives have sided with business groups, such as the Canadian Federation of Independent Business, that argue that increasing mandatory contributions to the CPP by employees and employers would be damaging to the economy.

The CFIB said Tuesday that it was “delighted” by Mr. Oliver’s proposal, provided that it would also be a voluntary decision as to whether or not employers make larger contributions for employees.

Susan Eng, the vice-president of CARP, also responded positively, although she stressed that mandatory increases are still likely to be needed.

Mr. Oliver said the voluntary plan would build on other government initiatives, including tax-free savings accounts and pooled registered pension plans.

He suggested that the Tories give Canadians more choice than the Liberals and the NDP.

However, Liberal finance critic Scott Brison noted it was his party that advocated both a mandatory and a voluntary expansion of the CPP in the 2011 election campaign.

NDP finance critic Nathan Cullen called the move a “deathbed conversion” by the Conservatives.

“You can tell when the government’s serious about something: They ram it through an omnibus bill. When they’re not serious about it, they launch a series of consultations over the summer on the eve of an election as if somehow they were going to be converted at the very last minute,” he said. “This is about polls. It’s about the Conservatives realizing they’re in trouble.”

At one point during the past several years of debate over CPP reform, the Conservatives spoke out against the idea they now propose.

In 2010, Jim Flaherty, then the finance minister, took the view that further voluntary savings vehicles were not enough.

The government later changed course. While Mr. Flaherty briefly advocated for expanded mandatory CPP contributions, Prime Minister Stephen Harper has long opposed the idea in his public comments.The Ontario government has been among the most vocal advocates urging the federal government to support an expanded CPP. When Ottawa decided against the idea, Ontario proposed its own supplemental pension plan, which would begin in 2017 and would apply only to workers who do not have a company pension plan.

Ontario has suggested that if Ottawa changes its position and decides to support an expanded CPP, it would not go ahead with its own pension plan.

Ontario’s associate finance minister, Mitzie Hunter, described the federal proposal as “disappointing.”

“Two things are clear – people are not saving enough for retirement, and we don’t have a federal partner willing to tackle this problem,” she said in a statement.

Say it ain’t so? Have the Harper Conservatives who continuously pander to the financial services industry finally seen the light on why now is the time to enhance the CPP? Do they finally realize the benefits of defined-benefit plans and how enhancing the CPP is not only a good pension policy but good economic policy for a country teetering on disaster?

The federal government is also looking at relaxing the 30 percent rule to allow federal pensions to invest more in infrastructure in Canada, which makes a lot of sense if they allow all our public pensions to do so and open infrastructure investments to global pensions and sovereign wealth funds.

Unfortunately, this latest about-face on enhanced CPP is nothing more than a farce. Harper’s government doesn’t have a clue of what they’re doing on enhanced CPP and I can’t say the Liberals or NDP are any better (a bit better but far from perfect).

As an ultra cynical Greek-Canadian who is tired of seeing politicians in Greece and Canada talk from both sides of their mouth, let me give it to you straight up. This latest proposal is going nowhere and even if it’s implemented, the “voluntary” nature of it means it will only benefit the richest Canadians much like increasing the tax-free savings account limit to $10,000 a year (the few who need it the least will wisely sign on but the majority who really need it will opt out).

By the way, a new survey shows a third of Canadians won’t take advantage of new TFSA limits:

A new survey suggests about a third of Canadians don’t have the money to take advantage of new rules under which Ottawa almost doubled the amount that can be contributed each year to tax-free savings accounts.

The poll done for CIBC found that roughly 34 per cent of respondents said they either didn’t have the money to take advantage of the new $10,000 limit or had other investment plans.

Breaking the figure down, 18 per cent of those surveyed said they would probably contribute less than the old limit of $5,500, while 12 per cent said they would not have enough savings this year to make a contribution. Four per cent said they would contribute to other saving plans.

The survey found just 10 per cent said they typically contribute the maximum and would now invest $10,000, while an additional 17 per cent said they would try to increase their contributions above $5,500.

Twenty per cent of those responding did not have a TFSA account and had no plans to open one.

The online survey was conducted between April 30 and May 4, less two weeks after the federal budget announcement.

Shocking eh? Not really. Most Canadians are in debt up to their eyeballs, paying off multiple credit cards and trying to make their mortgage payment every month on their insanely overvalued homes (when you see official denial from the finance minister and our central banker, you know they’re worried about Canada’s housing bubble but don’t worry, according to some, Canada is the new Switzerland. Sigh!!).

I use my old Greek indicator to gauge economic activity. I talk to a few Greek taxi drivers and restauranteurs in Montreal to get the real scoop. They all tell me business is down across the board. Restauranteurs and cab drivers are praying the good weather holds up for the Grand Prix next weekend so they can make up for a devastating winter, but they tell me the economy is terrible and “people just aren’t spending like they used to” which is why many retail stores are closing in Montreal. Hopefully, the lower loonie and some tourism will help but that is only temporary relief.

Anyways, back to the Tories and their latest proposal. Why am I so skeptical? Easy. Enhanced CPP shouldn’t be voluntary, it should be mandatory for almost all Canadians (minus the poor and working poor). This is why behind the scenes, I’ve argued with some Liberals on their proposal because they too want to make enhanced CPP optional.

It doesn’t work that way folks. Yes, higher CPP premiums means less money to spend on the economy and housing but it in the long-run, it also means more Canadians will be able to retire in dignity and security. And people who receive defined-benefit pensions are able to spend more in their golden years, allowing the government to collect more in sales and income taxes.

More importantly, RRSPs and TFSAs are savings vehicles, not defined-benefit pensions, and they place the retirement onus entirely on individuals to make the right investment decisions to be able to retire comfortably. When it comes to their retirement, most Canadians need a reality check because they’re getting raped on fees investing in mediocre mutual funds which underperform the market over the long-run.

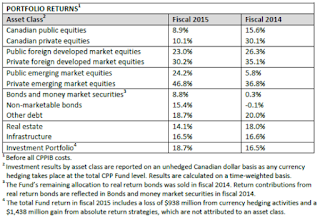

There is a much better option. Make enhanced CPP mandatory and have the money managed managed by the Canada Pension Plan Investment Board which just recorded a record 18.3% gain in fiscal 2015.

“But Leo, you just finished crucifying these guys for lacking a truly diverse workforce at all levels representing Canada’s multiculturalism and you still want to enhance the CPP for all Canadians?!?”

Absolutely! I’m very hard on the CPPIB because I hold them to a much higher standard than any other large Canadian public pension because they represent all Canadians and even though I like their governance and operations, I think there can be significant improvements (see my discussion here).

In particular, I’m a stickler for diversity in the workplace and give a failing grade in this department to all of Canada’s coveted top ten, not just CPPIB. And don’t kid yourselves, things are getting worse not better when it comes to diversity at Crown corporations, government organizations and private sector federally regulated businesses.

How do I know this? Because of my struggles to find full-time employment after I was wrongfully dismissed at PSP but also through my conversations with people with disabilities — much more disabled than me — who are frustrated with the lack of opportunities for them to find full-time work.

But aren’t federally regulated employers suppose to hire people regardless of their age, sex, ethnic background, sexual orientation or disability? That all sounds great on paper but the brutal reality is the unemployment rate for minorities, especially people with disabilities is sky-high, and the hiring decisions at these places are often done in a covert manner to circumvent our laws.

When Michael Sabia, Mark Wiseman, Gordon Fyfe, Andre Bourbonnais or Ron Mock want someone in, there in. And when they want them out, they’re out. It’s that simple (this goes on everywhere but these are public pensions).

I remember a conversation I had with Mark Wiseman where he told me he contributes to the Multiple Sclerosis Society of Canada. I felt like saying “that’s great but what are your doing as the leader of Canada’s biggest Crown corporation to hire people with disabilities?”

The only big federally regulated Canadian bank that actually has a diversity blueprint is the Royal Bank but I can tell you from experience this is a bogus program that doesn’t actively go out to search and hire minorities or people with disabilities and the jobs they offer are low level jobs that pay peanuts. But at least the Royal Bank has a diversity blueprint which is more than I can say for many other large private and public sector employers.

But my diversity qualms aside, I’m a huge believer in mandatory enhanced CPP for most Canadians and think the time has come that we do away with company pensions altogether and have pensions managed by our large well-governed public pensions that pool investment and longevity risks, lower costs by investing directly across public and private investments where they can and with top global funds where they can’t.

Imagine for a second if we didn’t have Air Canada, Bombardier, Bell pensions or AIMCo, OTPP, HOOPP, Caisse, OMERS, bcIMC, etc but several large, well-governed public pensions that operate at arms-length from the government and manage the pensions of all Canadians across the public and private sector. It wouldn’t be one CPPIB juggernaut but several CPPIBs and there wouldn’t be an issue of pension portability.

I’m telling you we have the people and resources to do this. All we lack is political will in Ottawa which is why Ontario is right to go it alone despite all the criticism Premier Wynne has faced. Some think the Conservative pension promise sets up showdown with Ontario but I don’t think so.

The sad reality is that our politicians have ignored the pension crisis in this country for far too long and that will impact our debt and deficit in the future as social welfare costs climb. Enhancing the CPP on a voluntary basis isn’t a good pension policy; it’s a dead giveaway to rich Canadians with high disposable income just like increasing TFSA and RRSP limits are a dead giveaway to the rich and the financial services industry. These aren’t the people that need help to retire in dignity and security.

If you have any questions or concerns on this comment and my views, feel free to reach me at LKolivakis@gmail.com. You don’t have to agree with me and I know I can be very blunt and “controversial” (euphemism for someone who highlights uncomfortable truths) but that is my style and I make no apologies whatsoever for it (ask Tom Mulcair, Gordon Fyfe, Mark Wiseman, etc.).

Bernard Dussault, Canada’s former Chief Actuary, shared this with me:

I will give an interview to CPAC on this matter at 1:30 this afternoon where my main two comments will be that:

- The federal government should first consult the provinces rather than the public because the CPP can be amended only with the approval of at least 7 provinces covering at least 2/3 of the Canadian population.

- Because participation in the CPP is mandatory, no voluntary contributions can be made to it. Voluntary contributions could only be made to a new plan (i.e. other than CPP), which would still require provincial approval because pensions are under provincial jurisdiction control.

I thank Bernard for his timely and wise insights. He is someone who understands what’s at stake when it comes to molding the right retirement policy.

Photo credit: “Canada blank map” by Lokal_Profil image cut to remove USA by Paul Robinson – Vector map BlankMap-USA-states-Canada-provinces.svg.Modified by Lokal_Profil. Licensed under CC BY-SA 2.5 via Wikimedia Commons – http://commons.wikimedia.org/wiki/File:Canada_blank_map.svg#mediaviewer/File:Canada_blank_map.svg