Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Matt Wirz of the Wall Street Journal reports, Small Hedge Funds Get Bigger Share of Investors’ Money:

Hedge-fund upstarts attracted as much money as the titans of the industry last year, a shift for investors who have long favored larger firms.

Managers with assets of less than $5 billion took in roughly half of the $76.4 billion committed to hedge funds after collecting 37% of new capital invested in 2013. That reversed an imbalance of the previous four years, when investors put $93 billion into larger funds while pulling $63 billion from small and mid-size funds, according to data collected for The Wall Street Journal by HFR Inc., which first started tracking the flows in 2009.

Some pension funds and endowments said they are investing with smaller managers such as Hutchin Hill Capital LLC and Birch Grove Capital LP in search of better performance and lower fees compared with celebrity-run megafunds that are typically viewed as safer bets.

“I’d rather invest in funds that are small or midsize where managers are highly motivated and more aligned with us,” said Jagdeep Singh Bachher, chief investment officer for the University of California, which has about $91 billion in investment assets.

Mr. Bachher added that he is negotiating investments in two first-time fund managers launching funds of less than $1.5 billion each and is looking for more such opportunities.

Investors aren’t abandoning large hedge funds altogether, and some of the largest, such as Och-Ziff Capital Management Group LLC, continue to get bigger. During periods of economic turmoil in 2009 and 2012, clients pulled money from smaller funds, according to the HFR data.

By some measures, megamanagers are the better performers. Funds managing more than $5 billion have returned 9% on average since 2007, compared with about 6% for funds below that threshold, according to HFR.

But in a separate analysis of 2,827 hedge funds that specialize in stock picking, investment consultant Beachhead Capital Management found that funds with assets of $50 million to $500 million showed returns that were 2.2 percentage points higher over 10 years than larger funds.

“There have been a number of recent studies that have demonstrated consistent outperformance of smaller funds compared with large hedge funds,” said Mark Anson, head of billionaire Robert Bass’s family investment firm. Mr. Anson has more than half of his hedge-fund investments in firms with less than $1 billion in assets.

Long revered in financial circles for their trading smarts, hedge funds have lost some of their exalted status amid a difficult stretch for the industry. They performed better than many investments during the 2008 financial crisis but struggled to repeat that success in recent years. Returns of HFR’s hedge-fund index have trailed the S&P 500 index every year since 2008 by an average of 10.31 percentage points.

Large backers responded by taking a more skeptical look at hedge funds and comparing their performance to more traditional investment managers who charge lower fees. Some decided to pull their investments. The California Public Employees’ Retirement System, the largest U.S. pension plan, said last year it would exit from hedge funds altogether in part because of concerns about expenses. Hedge-fund managers typically charge higher fees than other money managers, historically 2% of assets under management and 20% of profits.

Others are shifting allocations to more diminutive hedge funds even as they cut back.

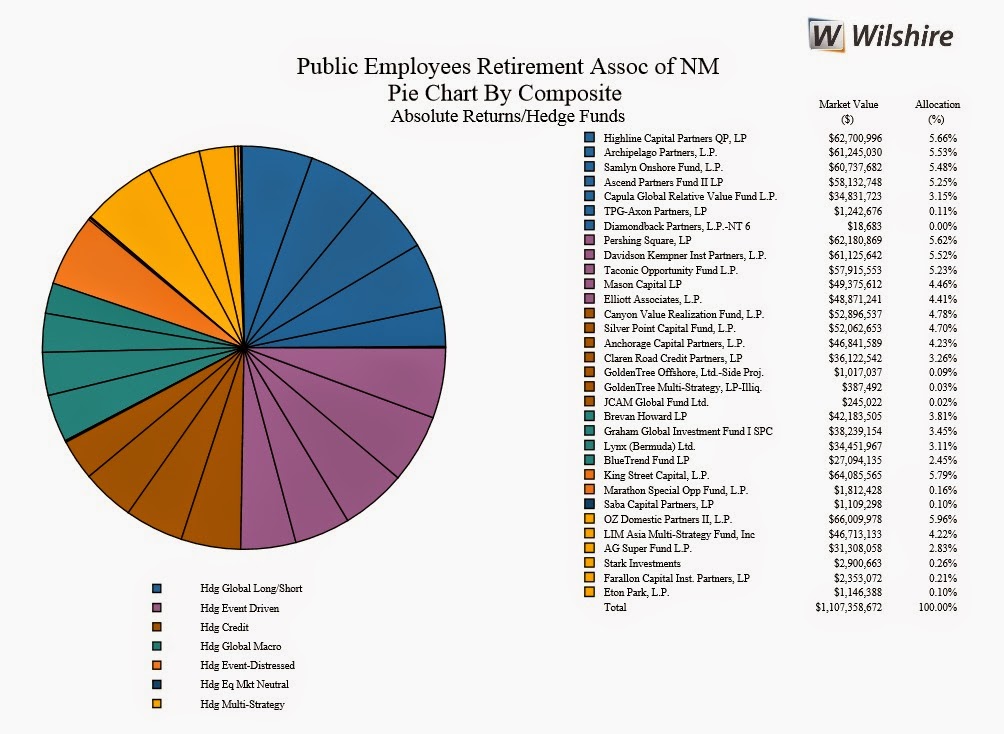

The Public Employees Retirement Association of New Mexico decided to reduce hedge funds to 4% of assets from 7.7% but give more money to smaller managers because they rely more on performance fees for their own compensation than larger competitors that collect big management fees, said chief investment officer Jonathan Grabel.

The $14 billion public pension system made the adjustments after a review found its absolute-return hedge-fund investments had underperformed a benchmark index by 1.64 percentage points since inception, according to an internal report reviewed by The Wall Street Journal.

“There’s nothing magical in hedge funds,” Mr. Grabel said. “We have to hold them as accountable as any other managers—in fact I think the level of scrutiny has to be higher because of the fees we’re paying them.”

One firm benefiting from the flood of money into smaller funds is Hutchin Hill, founded by former SAC Capital Advisors LP trader and mathematician Neil Chriss in 2008. The New York fund had averaged 11% annual returns since its inception, a person familiar with the matter said, but it wasn’t until last year that inflows took off as assets expanded to $3.2 billion from $1.2 billion.

New launches also are taking advantage of the surge. Jonathan Berger started his Birch Grove Capital hedge fund in August 2013 with $300 million of seed capital.

Since then the fund has more than doubled to over $700 million, “with half the growth from large institutions and family offices attracted by 20 consecutive positive months of performance,” he said.

Smaller funds chasing the influx of new money are committing more on infrastructure to lure big investors. When Mark Black left Tricadia Capital Management LLC in 2013 to start his own firm, Raveneur Investment Group, he spent a year building accounting and disclosure systems and hired his chief financial officer from hedge-fund giant Fortress Investment Group, people familiar with the matter said.

The work delayed launch of the fund to mid-2014 but ensured he could meet the requirements of public pension funds and large asset managers. Blackstone Group Inc. has invested $150 million in Raveneur, the people say.

“Smaller managers understand that in order to attract allocations from bigger investors they have to be more flexible,” said Melissa Santaniello, founder of the Alignment of Interests Association, a nonprofit group that serves hedge-fund investors.

This article raises many excellent points I’ve been hammering away at for a very long time. First and foremost, smaller hedge funds are a lot more focused on performance than asset gathering, which is why they typically outperform their larger rivals over very long periods.

Second, most investment consultants are useless because their focus is exclusively on large well known megafunds. These consultants have hijacked the entire investment process in the United States and they basically cater to the needs of the trustees of U.S. public plans which practice cover-your-ass politics and will rarely if ever take risks with smaller managers. To be fair to these trustees, there is no upside for them to take risks on smaller managers, which is part of a much bigger governance problem at U.S. public pension funds.

Third, it’s high time institutional investors transform hedge fund fees, especially for larger funds run by overpaid hedge fund gurus which are much more focused on gathering assets than on delivering top performance. I have said this plenty of times, many of these large multi billion dollar hedge funds shouldn’t be allowed to charge any management fee whatsoever or a small nominal one (25 basis points or less).

Fourth, take this shift to smaller hedge funds with a grain of salt. The reality is small hedge funds are withering away as the world’s biggest investors don’t have the time or resources to run around after them so they prefer writing large tickets ($100 million+) to large funds which are trading in scalable strategies (like global macro, CTAs, and Long/ Short Equity, or large multi strat funds).

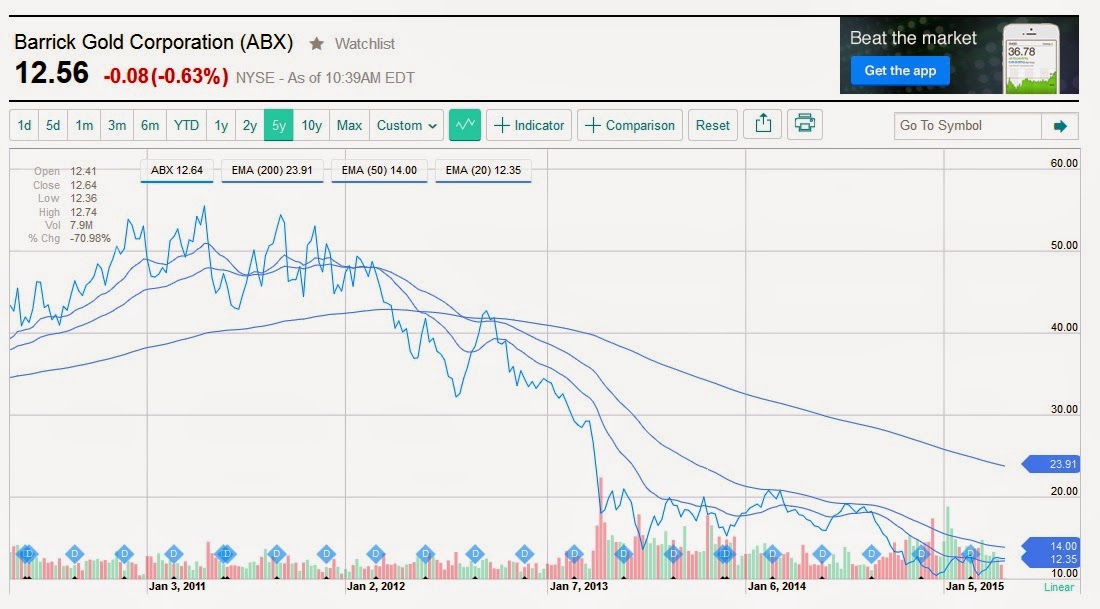

The article above mentions the Public Employees Retirement Association of New Mexico is shifting more of its absolute return program into smaller funds, but when I looked at its latest monthly board meeting packet, I noticed mostly large brand name funds which are well known to most hedge fund investors (from page 33, click on image below):

Now, perhaps they don’t list all their funds, but this group of hedge funds above makes up the bulk of their assets in their absolute return program and most of these funds are very well known, large funds (some are better than others).

At least they publicly publish in detail a list of all their major hedge fund, private equity and real estate partners, along with the performance of the programs, which is a must in terms of transparency. They also publish minutes of their board minutes, which is something else all public pensions should be doing (don’t get me started on good governance, I’ll eviscerate public pension funds, including Canada’s revered top ten which provide none of this information).

As far as Jagdeep Singh Bachher, chief investment officer for the University of California and the former CIO at AIMCo, and Mark Anson, the man who basically launched CalPERS into hedge funds, then moved over to Hermes and now runs Robert Bass’s family investment firm, I think they are both on the right track. Bachher is right to seed new funds which are very hungry and performance driven, and Anson is right to put the bulk of the Bass family’s investments in smaller hedge funds.

Go back to read my comment on Ron Mock when he became Ontario Teachers’ new CEO, where he told me flat out:

…the “sweet spot” [for Teachers] lies with funds managing between $500M and $2B. “Those funds are generally performance hungry and they are not focusing on marketing like some of the larger funds which have become large asset gatherers.” He told me the hedge fund landscape is changing and he’s dismayed at the amount of money indiscriminately flowing into the sector. “Lots of pension funds are in for a rude awakening.”

Ron has experienced a few harsh hedge fund lessons so he knows what he’s taking about. And he’s right, a lot of pensions are in for a rude awakening in hedge funds, mostly because they don’t know what they’re doing and are typically at the mercy of their useless investment consultants shoving them in the hottest hedge funds they should be avoiding at all cost.

No doubt about it, there are excellent large hedge funds, but my message to you is don’t get carried away with any superstar hedge fund manager even if their name is Ray Dalio, Ken Griffin, David Tepper or whatever. You’ve got to do your job and keep grilling your hedge fund managers no matter how rich and famous they are. And if they don’t want to meet you, redeem your money fast and find a manager whose head is not up his ‘famous ass’ and is more than happy to meet you and answer your tough questions.

Let me end by plugging an emerging hedge fund manager who I really like and is getting ready to launch his new fund with some super bright people. Gillian Kemmerer of Hedge Fund Intelligence reports, Visium, Sabretooth alum Bryan Wisk preps quant fund with ex-GS, JPM techs:

Former Visium Asset Management and Sabretooth Capital Management alumnus Brian Wisk is prepping a quantitative trading fund that aims to profit from market dislocations. His recently launched firm, Asymmetric Return Capital, has contracted with Kirat Singh and Mark Higgins, the architects of prop desk trading and risk management systems at Bank of America, Goldman Sachs and JPMorgan, to design its risk management system.

“I was one of the last clerks to join the floor of the Chicago Options Exchange in the midst of everything becoming electronic,” Wisk told Absolute Return. “When I went to the buy-side, I found a serious drop-off in the level of technology. It was something people were playing catch-up with, particularly in the options and derivatives space.” Wisk aims to bring the capabilities of a large bank’s derivatives desk to his fund, which will capture data, such as macroeconomic indicators, down to a millionth of a second.

“Many institutional investors are still running their derivatives business in Excel. It’s unfortunate. Our specialized skillset post Dodd-Frank should be available to a large pension fund.”

Wisk began his career as a primary market marker for Citigroup on the Chicago Board Options Exchange. He departed in 2006 for Visium Asset Management, where he served as a senior derivatives trader. He worked as an analyst at Tiger Management-seeded Sabretooth Capital Management in 2011, and departed in 2012, when the fund liquidated, to launch ARC.

According to portfolio manager Adam Sherman, ARC is poised to take advantage of increased volatility across asset classes as quantitative easing measures slow. “We are starting to see market dislocations as central bank policies shift,” he said. “Correlations are starting to break down.”

The fund will trade futures and options across asset classes, including commodities, equity indices, rates, and individual stocks. The portfolio will manage twenty to thirty themes—the differential between commodity and equity volatility was one example given—and will trade multiple securities within that theme (in the previous example, the fund may trade individual options on the S&P 500, WTI and Brent crude oil futures). The fund may hold up to 200 individual positions, and aims to balance exposure across asset classes. The fund will take long-term volatility bets, as well as conduct intra-day and episodic trading around volatility spikes.

Kirat Singh and Mark Higgins—the men Wisk has contracted to design his fund’s trading platform—have modernized Wall Street’s prop desks for over a decade.

Singh was the architect of SecDb (Securities Database) in the late nineties, Goldman Sachs’ framework for real-time derivatives pricing and risk management. SecDb has been touted as one reason why the bank made it through 2008 relatively unscathed, and Higgins co-implemented the platform while running Goldman’s foreign exchange and New York interest rate strategies teams.

The pair departed for JPMorgan Chase in 2006, pioneering the Athena program, a cross-asset trading and risk management system. Singh built the core group that deployed Athena, which began in the fixed income business and was later rolled out across the trading desks in JPMorgan’s investment bank. Higgins implemented the trading system while running the FX, commodities, and global emerging markets (GEM) quantitative research team. The pair parted ways in 2010 when Singh departed for Bank of America Merrill Lynch to design Quartz, a derivatives and securities trading and risk analytics platform. Higgins remained at JPMorgan, rising to co-head of the quantitative research group, and moved to the foreign exchange desk as a managing director in 2012.

The duo reunited in 2014, co-launching Washington Square Technologies, a consulting firm that delivers trading and risk management systems. While the pair are not in-house, they have reached an exclusive deal with Asymmetric Return Capital to design the fund’s risk management infrastructure.

Wisk eyes a June launch for Asymmetric Return Capital, which is based in Manhattan and has five employees, including chief executive Daniel King, who previously served as a managing director and head of the financial institutions group for interest rate sales at Bank of America Merrill Lynch; chief operating officer Steven Gilson, former director of operations at Visium Asset Management; portfolio manager Adam Sherman, who most recently served as a founding partner at Quantavium Management, a systematic fixed income fund; and portfolio manager Andrew Chan, a former portfolio manager at Chicago Trading Company .

The firm will launch with a founder’s share class, the terms of which were not disclosed.

I highly recommend all my institutional readers investing in hedge funds contact Bryan Wisk and the folks at Asymmetric Return Capital. When I first met Bryan in New York City a while ago, I was very impressed with his deep knowledge of the hedge fund industry and the dangers of group think.

Another emerging manager that really impressed me is an activist / event-driven fund manager in Toronto. I met an associate of his yesterday and he told me things are moving along and this manager, who has great experience running a previous fund in California, is on his way to managing his own fund for a big alternatives outfit in Toronto.

As for Quebec, last I heard the SARA fund is closing due to poor performance and they lost a pile of dough for their investors which included the Caisse. This is hardly surprising as these are brutal markets for hedge funds, especially start-ups. And to be brutally honest, most Quebec and Canadian hedge funds stink, they simply can’t compete with the talent pool in the U.S. or England where emerging managers come from pedigree funds (there might be a few exceptions but in general, avoid Canadian hedge funds, they truly stink!).

There is another problem in Quebec and rest of Canada, we simply don’t have the ecosystem to support start-up hedge funds. The Desmarais and Weston families are too busy worrying about mutual funds, insurance companies and their bread and butter businesses, they’re not interested in seeding hedge funds. Canada desperately needs a Bass family but we got a bunch of risk averse billionaires up here and I don’t really blame them given the talent pool just isn’t here.

Having said this, Ontario Teachers is seeding a multi strat fund up here and even though the SARA fund blew up, there is a new initiative going on in Quebec. In particular, Fiera Capital, Hexavest and AlphaFixe Capital set up a $200 million fund to seed Quebec’s emerging managers. It remains to be seen how this new venture will work out but I wish them a lot of success and will be glad to talk to Jean-Guy Desjardins and Vital Proulx about talented managers worth seeding (no bullshit, I’ll give it to them straight up!).

Of course, this is Quebec, and Quebecers are terribly jealous and petty when it comes to people succeeding in finance or business. Look at the media circus surrounding the sale of Cirque du Soleil to private equity firm TPG. Some idiots in Quebec are lambasting the founder Guy Laliberté for cashing out and selling his stake but if I ever see him at LeMéac restaurant again, I’ll be the first to shake his hand and tell him bravo!! (don’t know the man but he sat behind my girlfriend and I one brutally cold winter night a couple of months ago).

Photo by Roland O’Daniel via Flickr CC License