Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Lawrence Delevingne of CNBC reports, World peace through hedge funds? Ask the UN:

One of the largest pension funds in the world is close to using hedge funds, a move many of its peers have already made.

The United Nations Joint Staff Pension Fund, which managed $52.4 billion as of January on behalf of more than 190,000 participants, is in the final stages of deciding how it will add to its mix of alternative investments.

The U.N. is considering investing directly in external money managers or using a broader fund of hedge fund structure—or both—according to a person familiar with the situation. Either way, the pension staff views hedge funds as an important portfolio diversification tool that would add to current alternative investments in private equity funds and a non-hedge fund vehicle managed by Ray Dalio‘s Bridgewater Associates.

Buck Consultants, an external advisor to the pension plan, is set to complete a study as early as this summer that will recommend the best approach to investing in hedge funds for the first time, including in what amount, according to the person.

A spokesman for the U.N. secretary-general declined to comment on the hedge fund plans. Buck, which is owned by Xerox, also declined to comment.

The U.N. has so far stayed clear of hedge funds even as many large institutional investors have embraced them.

The California Public Employees’ Retirement System, the nation’s largest pension fund, made waves in September when it said it planned to cut most of its hedge funds. But industry assets have continued to climb thanks to fresh cash from other pensions, endowments and other institutional investors.

“They would be well served by adding hedge funds,” said Michael Weinberg, a hedge fund expert who teaches a class on pension investing at Columbia Business School. “Many other pensions have already seen their value either to improve returns with the same risk as stocks or bonds, or similar returns to them with less risk.”

Money from institutions represents 66 percent of the capital invested in hedge funds, according to the Managed Funds Association. Pensions represent the highest percentage of that at 39 percent, according to recent Preqin data. Of the pensions that do invest in hedge funds, public plans allocate an average of 7.8 percent of their portfolios to them; for private sector plans it’s 10.5 percent, according to Preqin.

A previous target for alternative investments in the U.N. plan was 6 percent of assets. That figure is being updated by Buck, but a 4 percent allocation to hedge funds, for example, would be more than $2 billion. Tereza Trivell is head of the U.N.’s alternative investing unit.

The U.N. fund, whose investments are led overall by recent appointee Carol Boykin, has 63.5 percent of assets in stocks and 24.5 percent in fixed income, according to a report on the portfolio as of December. It also has 5.2 percent in real assets like real estate, timberland and infrastructure. Just 3 percent is in alternatives, including private equity, commodities and the “risk parity” strategy.

The risk parity allocation is managed by Bridgewater through its All Weather strategy. Dalio pioneered the concept, a conservative mix of asset classes that is designed to perform in any economic environment over the long term. Bridgewater also happens to be the largest manager of hedge funds, which are more trading-oriented and charge higher fees.

A spokesman for Bridgewater declined to comment on if the firm was being considered for the U.N.’s likely hedge fund allocation.

The U.N. pension is more than 90 percent funded, meaning it is still slightly short of having all the cash necessary to fund payments it has promised. That amount is better than many other pensions. The average corporate and public pension plan is about 80 percent funded, according to data from consulting firms Mercer and Wilshire Associates.

The U.N. fund averaged a return of 6.18 percent from 2004 to 2014, according to U.N. materials. That outperformed its policy benchmark return of 5.84 percent (a mix of 60 percent stocks and 31 percent bonds), but was behind global stocks (6.6 percent).

The HedgeFund Intelligence Global Index, representing all hedge fund strategies, gained 5.83 percent net of fees over the same 10-year period.

Funds of hedge funds, the other means in which the U.N. is considering accessing the strategy, are vehicles that allocate to various independent managers for an extra layer of fees. They are a way to gain exposure to multiple hedge funds at once without the hassle of independently selecting and monitoring each manager.

Funds of funds have declined in popularity in recent years given relatively muted returns and concerns around their oversight of managers (some were invested in the Bernard Madoff Ponzi scheme. Click on image below to see funds of funds performance).

The U.N. pension fund was the 71st largest by assets, according to a 2014 Towers Watson ranking (click on image below).

So the United Nations Joint Staff Pension Fund is the latest large pension fund to discover the “diversification benefits” of hedge funds (insert rolls eyes here). I’m sure their consultant will provide them with a polished report touting how great hedge funds are and they will likely invest via a few funds of funds as well as invest directly in brand name funds like Bridgewater to show their board of directors just how responsible they are, investing with a well known global macro fund with a stellar track record.

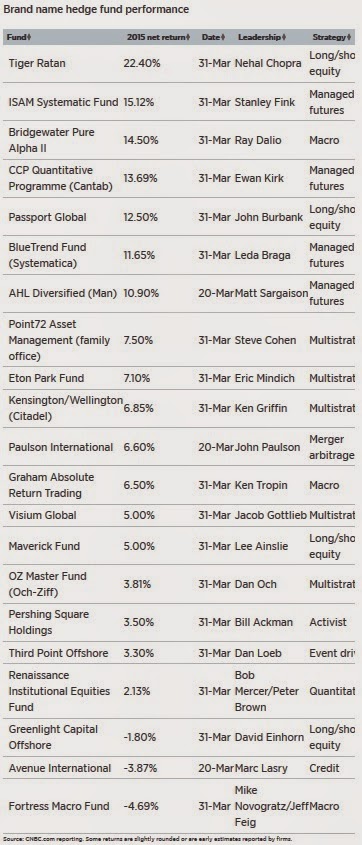

Don’t get me wrong, Bridgewater is an excellent fund, which is why it’s the largest hedge fund by far. In another CNBC article, Hedge funds take hit playing beat-up oil sector, Delevingne provides YTD performance data on some brand name funds (click on image below):

As you can see, Bridgewater’s Pure Alpha II is up almost 15% thus far this year. Not bad for a global macro fund managing $170 billion in assets. Bridgewater is a wet dream for large global allocators looking for scalability and excellent risk-adjusted returns. This is why Ontario Teachers’ Pension Plan and other large investors are heavily invested with them.

But I get nervous when I see these large mega funds attracting such huge inflows of capital. Maybe Ray Dalio has found the holy grail of investing but in my experience, all hedge funds including Soros Fund Management and Bridgewater, have experienced a serious drawdown at one time or another. This is especially true of so-called hedge fund titans that rise quickly and fall even quicker.

The other problem I have with Bridgewater, and I’m not shy to state it, is it collects 2 & 20 or 1.5 and 15 (for very large investors) on $170 billion! Do the math, this means Dalio and company collect a little over $3 billion in management fees alone just for turning on the lights. No wonder he’s now the richest man in Connecticut and #60 on the Forbes’ list of billionaires with a net worth of $15.4 billion and growing fast. He can easily afford serious and complex upgrades to the fund’s wooded campus in Connecticut.

So what? He and others at Bridgewater built a great investment fund and deserve the spoils of their hard work, right? Not that easy. As I stated in my interview with The Financial Repression Authority, a lot of these overpaid hedge fund gurus catapulted into the list of billionaires because they were the chief beneficiaries of the financialization of the economy and more importantly, the extraordinary shift of public pension assets into alternative investments.

And as much as I love Ray Dalio — having been among the first in Canada to invest in Bridgewater back in 2002 while working at the Caisse and going head to head with him on why deflation is the ultimate endgame when I worked at PSP back in 2004 — he and many other so-called hedge fund and private equity “gods” are a product of their era. They have ridden this alternatives wave to super fabulous wealth but unlike true entrepreneurs like Ray Kroc, Sam Walton, Bill Gates or Steve Jobs, they offer society very little in comparison. They are glorified by the media but that’s the problem, they’re just glorified asset gatherers charging huge fees to their clients sometimes offering great returns, sometimes not so great returns. The media loves schmoozing with them but I openly question what they offer in terms of broad economic and social benefits.

Don’t get me wrong, I know they employ many people but on a much larger scale, this employment is insignificant and they are part of the inequality problem pensions and sovereign wealth funds are fueling, which is ultimately very deflationary for our developed economies. The United Nations should smoke that in their hedge fund pipe!

As far as the U.N. pension fund, the long-term performance is nothing great but the problem there isn’t lack of hedge funds, it’s lack of proper governance. If there was ever a place fraught with political interference and unending political meddling by nation states wanting to appoint their candidates to key positions in internal committees or an investment board, the United Nations is it.

So now the U.N. pension fund is going to jump into hedge funds. Big deal! They’re going to be part of the pension herd getting raped on fees with little to show for it (especially if they invest via funds of funds). My advice to the pension fund managers overseeing this activity is to carefully read my comment on Ontario Teachers’ 2014 results. More importantly, if you’re not willing to commit the proper resources to investing in hedge funds, forget about them altogether and focus your attention on investing in top real estate and private equity funds where alignment of interests are much better than hedge funds. But even in these less liquid alternatives, things are frothy and very challenging.

I realize there are outstanding hedge funds and some performed extremely well in 2014. A lot of people will tell me to look at performance net of fees, which is what really counts. True, but if you’re paying hundreds of millions in fees for investment activities you can do internally or should be doing internally, there is something out of whack with your governance model. Period.

Finally, this from a reliable source at the U.N.:

I am not sure how the DRAFT actuarial study was leaked to the press, but it certainly was premature and ill advised. Normally, investment recommendations, including significant changes in the asset allocation, would be made by the RSG or investment professionals in IMD (the Investment Management Division) and discussed in meetings with the Investments Committee. The Investments Committee doesn’t meet until the middle of May and as far as I know, the actuarial report has not been finalized, so the full analysis and discussion of Hedge Funds has yet to take place.

Actuaries give many projections of potential results based on plausible forecasts of the future, but they are all guesses, based on prior statistical data. Their tidy graphs are the result of data smoothing, meaning that actuaries assume away any shocks and jolts that occur in the markets (especially in recent times). Because the actuarial projections are only hypothetical scenarios which are heavily biased to input assumptions, it is dangerous to rely solely on actuarial projections for investment decision-making.