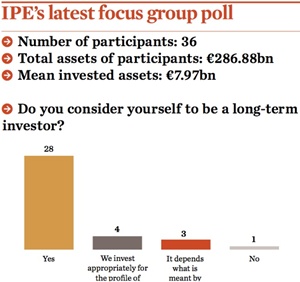

One-quarter of respondents to the Focus Group survey for the November issue of IPE said 3-5 years constituted a ‘long-term’ view, while nearly 78% of respondents considered themselves to be long-term investors.

Only one respondent rejected the label outright.

One UK pension investor pointed to the need for a long-term approach based on long-term liabilities, while an Austrian pension fund argued that it was important to take a generational view – at least when managing the assets of beneficiaries up until 45.

There was less agreement among the 36 European respondents, managing nearly €290bn in combined assets, as to what constitutes ‘long term’ when investing in public market assets.

More than one-third of pension investors said taking a 7-10 year view was long term, whereas nearly 14% believed the better definition was considering investments over the course of a business cycle.

One-quarter of funds said a 3-5 year time horizon was adequate, and 17% argued in favour of a generational view, spanning 15-25 years.

One respondent, a UK local authority scheme, said the long-term perspective manifested itself in asset allocation decisions, pointing to the development of emerging markets over the course of a generation.

The fund added: “Stock selection does tend to take a shorter view, and this is probably dysfunctional.”

A second UK corporate fund questioned whether the idea of long-term investing in public markets was compatible.

“The idea that long-term investment should be public market inherently seems to be at odds with long-term investing,” it said.

“Public markets are driven by short-term liquidity and [mark-to-market] ideology, which is anathema to long-term investing, which is about long-term, sustainable cash flows.”

Despite this, nearly half of respondents did not see a problem in finding external public market asset managers “willing and able” to invest for the long term, and only 9% rejected the notion out of hand.

One-quarter of respondents said asset managers could be found, but only for certain asset classes.

A Swedish investor blamed the regulatory environment, not asset managers.

“[The] main hassle is the short-term view of the regulator and new regulations where you value your liability against a short-term model,” it said.

A second Swedish investor concurred.

“If anything,” it said, “regulation is a problem – in particular, its tendency to change radically every 5-10 years.”

When asked which factors prevented long-term investing, 24% cited the regulatory environment and 21% the maturity of their liabilities.

Only 20% said the asset management industry’s unwillingness or skill was at fault.

One respondent cited the career risk of misguided long-term investments.