Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Mary Childs and John Authers of the Financial Times report, Canada quietly treads radical path on pensions:

Half a decade ago, the top brass of New York City’s comptroller’s office hopped on a plane to learn from a Canadian pension plan. Then-mayor Michael Bloomberg and comptroller John Liu sent their deputies to study the model of their northern neighbours in an effort to develop a reform plan for the city’s five separate pensions.

When it comes to investing retirees’ funds, the Canadian model means building strong in-house teams and empowering them to make unorthodox decisions.

As a result, the Ontario Teachers’ Pension Plan (OTPP) and the Caisse de dépôt et placement du Québec, which manages the savings of the province’s public sector workers, as well as a handful of other Canadian public pension funds, now own an eclectic mix of assets.

That includes half of luxury retailer Neiman Marcus and a chunk of Stuyvesant Town in New York City; luxury retirement homes and dental service providers; toll roads in Chicago and airports in London as well as lotteries in Massachusetts and the UK.

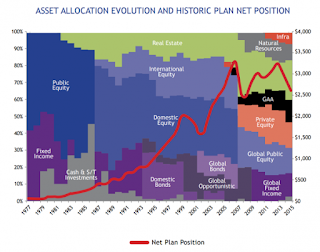

This is a radical departure from the bonds and equities that still dominate US public pension portfolios. The Canadian plans hold over a fifth of their funds in real assets, such as infrastructure, and OTPP also uses leverage by borrowing sums from the money markets worth about 28 per cent of its entire portfolio. By contrast, the New York City Employee Retirement System has about 17 per cent invested in alternatives to stocks and bonds.

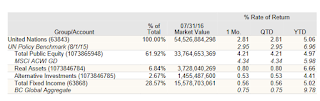

So far, the Canadian model is proving more successful. OTPP has made 8.2 per cent per year, net of fees, over the past decade. Nycers has generated 6.9 per cent a year over the same period — and this was before fees which in last fiscal year came to $183m paid to investment managers, per FT calculations based on accounts (click on image).

With the record low level of bond yields in developed economies making life harder for pension funds, the Canadian example is drawing more attention.

We noticed “a handful of pension funds who always beat us, in up as well as in down markets”, explains John Liu, who oversaw New York’s pension funds between 2010 and 2013. The one that stood out “consistently and by the greatest margin” was OTPP. “We didn’t think it was just dumb luck. They had managed to modernise their decision-making process by doing three things: by streamlining, by professionalising, and by depoliticising.”

The plan to emulate Canadian success in New York included creating a single board to manage the combined $120bn held in the five separate plans’ funds in a move that would give the city more heft as an investor as well as reduce costs.

While the ambition ran into political roadblocks, some major global pension funds are following suit, including Norway’s oil fund, the Danish pension group ATP, New Zealand’s superannuation system and Singapore’s sovereign wealth fund GIC. Even programmes within Texas and New Mexico are creeping in this direction.

It is not simply their asset mix that is helping the Canadian public retirement funds. Experts says governance is also critical. “They have been able to separate the management decisions of investing these plans make from political considerations,” said Dana Muir, a professor at the University of Michigan’s graduate business programme. “That would be difficult to accomplish in the US system.”

That, in turn, has given the funds greater ability to experiment in the search for returns.

“Because we know we have to innovate, we also have to have a little bit of tolerance for failure,” says Ron Mock, chief executive of OTTP. “Our very first private equity deal did not go very well, but yet we still had the support of the board, and management had the tenacity to learn and build.”

Another critical difference is “you actually capture enough of the knowledge and skills that you need to execute a long-horizon investment internally”, says Keith Ambachtsheer of the University of Toronto, a leading world authority on pensions. “To do that you have to have pay scales that allow you to attract those kind of people. The Americans don’t have that. Instead, they have to try to incentivise the Blackstones of the world to do it for them. That’s second best.”

The Canadian plans insist they do not want to add risk, but instead use their longer time horizon as an advantage over other investors, even if that means sacrificing the liquidity — or ability to sell easily — some of the assets they invest in.

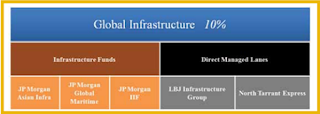

Most are pushing further into real estate and infrastructure, and are seeking to develop expertise in operating the infrastructure assets, whether airports, renewable energy or roads.

“Being involved in the operation of assets is a source of additional value creation,” says Michael Sabia, chief executive officer of the Caisse de dépôt et placement du Québec. Citing the fund’s plan to construct and operate Montreal’s rapid-transit system as a proof of concept, he adds that “our intention is to export that approach to other countries and in particular into the US”.

Everyone is facing the challenge of low returns on traditional assets, says Lim Chow Kiat, GIC’s chief investment officer “A lot of funds have to pivot into private markets.” The change will prove “quite challenging” for many.

Five years on, New York City has consolidated investment meetings for the five plans — down from 54 gatherings per year to six — but it has yet to fully grasp the nettle. “We are the financial capital of the world, and we have a clunker of pension plan,” says Sal Albanese, a former member of the New York City Council.

Mr. Albanese is absolutely right, New York City is the financial capital of the world but they haven’t been able to adopt the Canadian model and the compensation they provide to their public pension fund managers is lousy, especially by NYC standards.

I’ve discussed all this three years ago in a comment, NYC Pension Chief Faces Huge Hurdles. Larry Schloss moved on to become president of Angelo Gordon & Co., a well-known alternatives shop where I’m sure he was compensated extremely well (according to his LinkedIn profile, he no longer works there).

There is nothing radical in this article for someone like me who has been covering Canada’s pension trendsetters for a long time. I don’t want to overtout the Canadian pension model but the truth is Canada’s large well-governed DB pensions are able to do things others can only dream of precisely because they got the governance right and are able to pay their senior pension fund managers big bucks to manage assets internally across global public and private markets.

And some of Canada’s highly leveraged pensions — in particular, HOOPP and OTPP — are able to intelligently use derivatives and other forms of leverage to juice up their returns even more than their large Canadian peers that are not allowed to leverage up their balance sheet.

As far as infrastructure, it’s a very hot asset class right now and I believe it will become the most important asset class in a world of low or negative interest rates. And Michael Sabia is right, those that have operational experience in infrastructure will have an enormous competitive advantage relative their peers and they will generate additional value creation along the way.

The Caisse is way ahead of everyone on this front, hiring many infrastructure experts with actual operational experience. This is why I praised Macky Tall and his team at CDPQ Infra in my comment on Canada’s pensions bankrolling infrastructure. By gathering an experienced team with operational experience, they are able to invest in greenfield infrastructure projects, allowing them to control these investments every step of the way.

Of course to do this, you need to hire the right people and pay them properly. In the US, public pensions can’t hire experienced people so they farm assets out to private funds that rake them on fees.

As I wrote in my last comment on the big bad Caisse:

[…] over the long run, nothing beats a large well governed defined-benefit plan which can invest directly across public and private markets all over the world and choose the top funds in public and private markets where it can’t invest directly. Canada’s Top Ten pensions have the size and expertise to do this efficiently which is why it’s very hard to top their long-term performance.

By the way, my last comment on the Caisse generated quite a few reactions. One Montreal hedge fund manager emailed me: ” Ton commentaire sur la Caisse m’a complètement déprimé!!!! Il ne reste plus qu’a me jeter en bas du pont Jacques-Cartier…ou attendre le nouveau Pont Champlain.” (“Your comment on the Caisse totally depressed me. Only thing left to do is jump off the Jacques-Cartier bridge or wait to jump off the new Champlain bridge”).

But another senior former senior pension fund manager who worked with me at the Caisse sent me this after reading my comment:

This was one of your best articles, certainly of recent months, if not years.

Can I address a couple of points you make.

Firstly, “Why are you bothering me with this?” Because you are one of the few places people can find a voice and be heard. You have a reputation for speaking truth to power, and that is important. If not you, who?

Secondly, I agree what you say about better management of all the defined benefit schemes and I think all pension funds should be thinking hard about their future structures.

I would, however, argue that Quebec needs an alternative to the Caisse; Ontario has Teachers, OMERS, HOOPP, etc and I believe that something similar would be good for Quebec over all. As the current fiasco at the McInnis cement project shows, the Caisse hasn’t learned from their previous mistakes.

You are 100% right that the finance industry in Quebec needs to adapt to a changing world, just as we ourselves have demanded that the companies we invest in adapt to NAFTA, China, or the latest technology. It’s painful, but history shows us that you adapt or die, and too many industries here have failed to adapt. Objecting to change because the current insiders don’t benefit

What Quebec needs to do is to sit down and think about what it wants from its finance industry, and to look at it as a whole – quite literally from the hundreds of students in Finance we graduate every year from our universities, to the layers that get laid off every time the next chief at the Caisse decides to make his mark, and especially the AMF.

I am blown away by the talented students I get to teach, and it hurts me that the only career advice I can give them is to head west. Why are we spending all that money subsidizing their education if we then put up insurmountable barriers to them getting jobs. It is reminiscent of our provincial politicians blowing hot air as they tell us how modern a Quebec is, how techno-savvy we are, even as they try and ban Uber.

The Caisse is the way it is because Quebec wanted bragging rights for the biggest pension fund in Canada. Well that era is past, CPPIB has that sown up forever. At the same time, we as Quebecers suffered because the concentration of risk meant that all the really bad mistakes hit us all. Clearly, what is good for the Caisse isn’t necessarily good for Quebec, and not all major decisions about Quebec’s financing should be routed through there either.

And Quebec needs to understand that the AMF is part of the problem not part of the solution; as Françoise Bertrand’s article in the Globe and Mail showed, the great and the good here are woefully out of touch.

Why does this justify a “QMERS”?

The Caisse, like CPPIB, needs big deals to have an impact on their returns. They have moved beyond economies of scale to the onset of dysfunctionality. A new company would rapidly gain the economies of scale that the municipal pension funds so badly need, but still be able to function profitably in the lower tiers of the market. As part of the set up, it could be included in their mandate that they have to invest say 1% of assets in Canadian Emerging Managers (if the Caisse were sensible they would follow suit but ask the new firm to run that for them), whilst the AMF could be brought in to see how it might stop discouraging start ups and favouring the BIG players.

But who could bring such a vision to life? Who understands the needs for scale, yet appreciates the benefits of a truly modern dynamic start up industry? Needs to be someone who knows the industry, but isn’t beholden to it. Someone who is used to going toe to toe with the big boys, but has a reputation for independent thinking. It’s on the tip of my tongue….

Yeah, thanks mate but I’m not really interested in such a position. However, if the board of directors at Finance Montréal wants you and me to come in to give them an earful of suggestions, I’ll let you know (don’t hold your breath).

Look, I agree with some of the things my friend mentions. The AMF (Quebec’s securities regulator) is part of the problem. Yes, following several highly publicized scandals, regulators need to be vigilant to make sure all funds are kosher but they’ve taken it to extremes to the point where only the big players can meet their increasingly taxing demands.

Second, maybe Quebec does need a new DB pension to handle all private pensions. The Caisse can still handle public sector pensions but we can introduce a new DB pension where large and small corporations are able to offer their employees an enhanced Quebec Pension Plan (enhanced QPP modeled after the enhanced CPP).

This new DB pension can hire experienced pension fund managers from CN, Air Canada and other Quebec pensions and investment outfits and it would be a great idea for a lot of reasons.

Where I disagree with my friend is that under Michael Sabia’s watch the Caisse has done a great job in tightening governance and oversight in all its investment and operational activities. Is it perfect? No but none of Canada’s Top Ten are perfect. If the next president of the Caisse can hold the same governance standards and even improve on them, I have no issue with the big bad Caisse gaining more power.

Alright, let me wrap it up. Those are my thoughts on Canada’s radical pensions. If you have anything to add, shoot me an email at LKolivakis@gmail.com and I’ll be glad to share your thoughts.