South Korea’s national pension fund – the third largest pension fund in the world with $415 billion in assets under management – will be investing for the first time in hedge funds later this year.

The fund has picked two investment firms to lead the foray into hedge funds: BlackRock and Grosvenor, who will each be in charge of $500 million.

More from Reuters:

South Korea’s National Pension Service (NPS), the world’s third-largest pension fund, said it had chosen a BlackRock Inc unit and Grosvenor Capital Management to manage investments in funds of hedge funds in 2016.

[…]

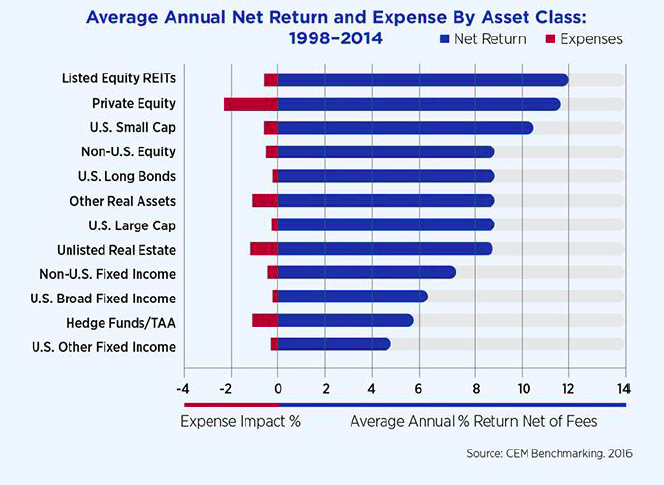

“The upcoming hedge fund investment is expected to contribute to the generation of stable profits by diversifying risk for the fund’s entire portfolio,” NPS Chief Investment Officer Kang Myoun-wook said in the statement.

A bit of background from PulseNews:

Last year, NPS operation committee decided to invest in funds of hedge funds as an alternative investment as part of efforts to diversify its asset allocation and improve returns on its investments in a low interest rate environment. NPS initially planned to start to invest in hedge funds late last year, but delayed the process following the strife between former NPS CEO Choi Kwang and Hong Wan-sun then-chief investment officer at the National Pension Fund Investment Office.

In April, the fund drew up a guideline to evaluate investment performance in hedge funds and set a goal to invest 1 trillion won in funds of foreign hedge funds this year. Korea’s largest institutional investor plans to start to invest funds of foreign hedge funds and then gradually expand its investment in other hedge funds, according to an unnamed NPS official. Global consulting company Mercer is said to be advising NPS hedge fund allocations.