Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Robin Respaut of Reuters reports, Public pension funds seek infrastructure as market heats up:

The California Public Employees’ Retirement System recently bought a stake in a private Indiana toll road with a troubled history, one sign of how popular infrastructure investments have become among U.S. pension funds.

In May, CalPERS bought a 10 percent stake of the road’s concession, representing the first U.S. transportation investment for the nation’s largest public pension fund. The Indiana Toll Road had been acquired out of bankruptcy in 2015 for about 50 percent more than its original 2006 price by a fund made up of more than 70 U.S. pension plans.

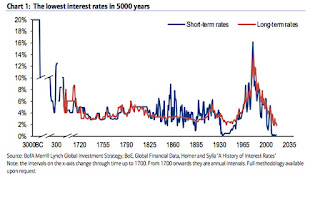

Infrastructure – such as roads, bridges, rail, airports, water storage, utilities, and pipelines – has long been favored by pension funds in Canada, Australia, and the United Kingdom. Now, as an era of strong returns in stocks and bonds is believed to be winding down, more U.S. public pension funds are looking to buy real assets for their portfolios, seeking cash-generating, stable investments in a low-interest environment.

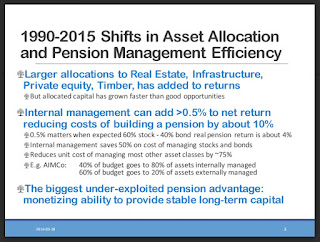

The number of institutional investors with stakes in infrastructure has more than doubled since 2011 to more than 2,750 from 1,300, according to Preqin, an alternative assets research firm. Among the top 10 public pension funds investing in infrastructure, allocations more than quadrupled over the past five years to $17.7 billion.

The pace is likely to continue. Forecasts for infrastructure are more bullish than other real assets, such as real estate or private equity, with the majority of fund managers planning to increase the pace of investment in the next year, according to a 2016 report by Preqin and financial services firm BNY Mellon.

For a graphic on rising demand for infrastructure assets, click here.

Such competition has made it more difficult for public pension funds to secure revenue from projects like Indiana Toll Road.

“There’s too much capital chasing too few deals,” said Randy Gerardes, Wells Fargo Securities Senior Analyst.

On Monday, CalPERS plans to discuss a new bill that would spur the state to identify needed California infrastructure projects. The state would then propose that CalPERS directly invest in the projects, while the state guarantees a favorable return rate.

The bill is part of a push by the legislature to improve the state’s aging infrastructure, estimated to need $77 billion-worth of repairs, according to state estimates.

CalPERS began purchasing infrastructure projects in 2008 – in an effort to diversify its portfolio amid plunging equity markets – and later set an ambitious goal to invest $5 billion, about 2 percent of the portfolio.

The long lifecycles of road, airport, and energy projects correspond well with funds’ long-term liabilities. Pension funds seek investments that are large enough to house billions of dollars, and infrastructure projects typically require huge commitments of capital. There’s also the allure of inflation protection, as toll revenues often rise at a similar pace.

Interest has intensified as confidence in the equity markets has waned.

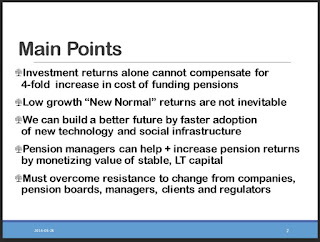

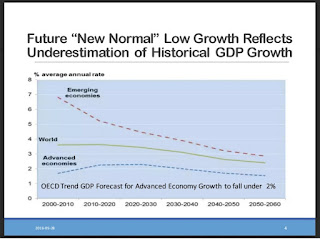

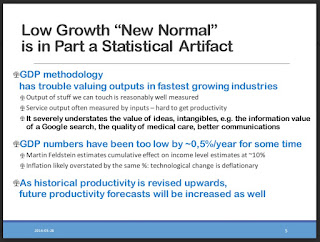

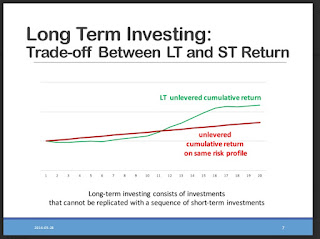

“We think we’re entering a world of much lower average returns, particularly in the developed world’s bond and equity markets,” said Richard Hobbs, McKinsey Global Institute Council Director.

Public pension funds, many under intense pressure to achieve returns of at least 7.5 percent, often seek projects that offer the right combination of low risk, steady cash returns, and good price.

The California State Teachers Retirement System (CalSTRS), the nation’s second largest public pension fund, would like about 4 percent of its portfolio in infrastructure. But today, it has committed only 1.4 percent, or $2.7 billion.

CalPERS, too, has struggled to reach its target commitment. Infrastructure only makes up 1 percent of the funds’ behemoth $293.6 billion total portfolio – just half of the long-term target.

Still, CalPERS made considerable strides in the last three months, boosting its infrastructure investments to $3.1 billion from $2.3 billion with the purchase of stakes in California solar plants and the Indiana Toll Road.

Demand has driven deal prices to a record high of $528 million in 2015, compared to $337 million in 2010, and will likely force investors into riskier assets or different geographies, such as in emerging markets.

In April, Paul Mouchakkaa, CalPERS managing director for real assets, said opportunities were “much more tilted to outside the country,” but CalPERS has capped its investment abroad to 50 percent, arguing that any more would require the pension fund to hire “a significant amount of people.”

“These are extremely local markets,” Chief Investment Officer Ted Eliopoulos told the board in April. Potential returns must be weighed against risks of foreign currencies, tax codes, and laws. “You can’t just pick up and bring them back home.”

If I were CalPERS and CalSTRS, I would definitely use America’s infrastructure report card to open the eyes of state and federal legislators to start acting on fixing aging infrastructure. If it’s done right, not only will it create many jobs, it will help US public pensions invest in a very long-term asset class that can help them achieve their actuarial target rate of return (and they need all the help they can get to meet their unfunded liabilities).

In Canada, the federal government has approached large public pensions to help it deliver on its ambitious infrastructure program to kick start the economy. If done right, this will help the government finance projects by using the expertise at large Canadian public pensions to invest in much needed infrastructure assets.

The key difference between US and Canadian public pensions is governance and sophistication. Canada’s large public pensions are way ahead of their US counterparts in terms of investing in global infrastructure and some are even embarking in greenfield domestic infrastructure projects, like the Caisse’s project to build Montreal’s transportation system (see press conference here).

In order to invest properly in infrastructure or other private markets across the world, they need to hire the right people with the right skill set, especially when they’re delivering greenfield projects. These people don’t come cheap which is why you need to set the right governance to be able to attract and retain them.

Interestingly, on Monday I attended the Conference of Montreal where they had the 4th edition of the International Pension Conference of Montreal (IPCM) at the Hotel Bonaventure Montreal. This is an excellent conference with great speakers but I’m still preparing my notes and will come back to it later this week (it would help if they had a dedicated YouTube channel where they posted all of the panel discussions and presentations the day after).

Anyways, at the conference I hooked up with Leo de Bever, AIMCo’s former CEO, and he gave a great presentation on why pensions looking to scale up are missing a ton of opportunities to invest in very promising smaller companies with great innovative technology (by the way, Leo is the chairman of Oak Point Energy and is looking for an investor to complete a very interesting deal there which is too small for Canada’s large pensions even if there is no downside risk whatsoever).

You’ll recall that before heading up AIMCo, Leo was working in Australia and before that he was the head of risk at Ontario Teachers’ and was one of the first to invest in infrastructure. He will be the first to tell you that returns in infrastructure, real estate and private equity have come down a lot because “there’s too much money chasing too few deals”, bidding up valuations.

But one thing he told me is the Caisse’s greenfield infrastructure project makes a lot of sense because they can achieve a return in the “low teens” as long as they have the right people working on this project. I told him they do have the right people (people with actual operational experience at SNC Lavalin Group and elsewhere) and they are leagues ahead of their large Canadian peers when it comes to greenfield infrastructure projects.

But all of Canada’s large pensions are world-renowned infrastructure investors. They might not all invest in greenfield projects but they all invest directly in mature infrastructure assets across the world, foregoing any fees to fund managers.

Infrastructure is slowly displacing real estate as the most important asset class at large Canadian public pensions. And the reason? Well, we live in a world where the German 10-year sovereign bond yields just turned negative for first time ever.

Admittedly, jitters on the upcoming Brexit vote are contributing to this flight to safety but I expect ultra low rates and maybe even negative rates to persist for a very long time, adding fuel to the demand for long-term infrastructure and to a lesser extent, real estate assets.

Real estate makes me nervous in a deflationary world because unlike infrastructure, you don’t have much pricing power in terms of leases when unemployment is soaring and companies are folding. Sure, you have regulatory risk with infrastructure, but unless you have a “Greek debacle”, people are still going to pay tolls and other fees related to use of infrastructure.

Also, infrastructure assets have a much longer life cycle than real estate assets, offering predictable returns over a very long period, which makes them a better fit in terms of meeting the long dated liabilities of pensions (in finance parlance, the duration of infrastructure is a better match to the duration of pension liabilities).

Still, let’s not rain on real estate as it remains the most important asset class at all public pensions. In fact, Sara Tatelman of Benefits Canada reports, Sovereign pension plans investing heavily in real estate:

Real estate has become the main driver of increasing alternative allocations for sovereign investors, according to Invesco’s 2016 global sovereign asset management study.

From 2012 to 2015, sovereign investors’ real estate assets grew to 6.5 per cent from three per cent of their portfolios, which represented faster growth than that of private equity and infrastructure combined, according to the report released today. For many large pension plans, common alternative investments comprise up to 30 per cent of portfolios.

While infrastructure offers stable returns and inflation protection, “the queues to get into a manager and then the queues to actually get the deal executed and the money invested are getting longer and longer,” says Michael Peck, senior vice-president of institutional investment at Invesco Canada Ltd. in Toronto. “So because these sovereign wealth funds tend to be net cash-flow positive, as a general rule, these delays can be harmful to them sometimes. So they’ve discovered that real estate is an area where they can get their money invested a lot more quickly.”

Earlier this month, the British Columbia Investment Management Corp. launched an in-house real estate management firm, an arrangement Peck says is common for large sovereign plans. But while internal real estate managers can handle what Peck calls “vanilla” transactions, such as Canadian core commercial real estate, many sovereigns funds will still work with external managers for innovative international assets. “Real estate is very much a local game,” he says.

The Invesco study also noted it’s easier for sovereign funds to find real estate asset managers than infrastructure asset managers. That’s primarily because institutions have been investing in real estate for a very long time, says Peck. Opportunities to invest in Canadian infrastructure, on the other hand, only became available in the 1990s, he notes, adding the construction of the Greater Toronto Area’s Highway 407 was the first “really big deal.”

Peck also points out smaller pension plans looking to invest in real estate may not buy physical buildings but will often do so indirectly instead. “If I just draw a parallel to our business here, we have a number of Canadian plans that buy U.S. real estate through us because you can get access to 120-odd properties in one investment,” he says. “If you’re only deploying $10 million or even $50 million, you can’t even buy a building for that.”

When it comes to Canadian pension plans looking to invest in physical buildings abroad, the U.S. market recently became much more attractive. In December 2015, the United States amended its Foreign Investment in Real Property Tax Act of 1980 so qualified foreign pension plans were exempt from paying the levy, says Peck.

The change made the United States a much more attractive investment option. The tax had “never stopped people but it was always factored into the risk/reward analysis,” says Peck.

My advice to to small (and large plans) is to cool off on real estate, especially publicly traded REITs, and focus their attention on infrastructure by seeking advice from experts at OMERS Borealis to provide them with solutions to meet their infrastructure needs.

Smaller plans can also talk to experts like David Rogers and Stephen Dowd at Caledon Capital Management or invest in private infrastructure funds like the one at Fiera Infrastructure or invest in shares of publicly traded Brookfield Infrastructure Partners (BIP).

When I talk about real estate with Leo de Bever, he tells me it makes him “very nervous” but he sees more opportunity in unlisted real estate than listed real estate. He co-authored a report for Norway discussing his ideas but they didn’t take his advice and instead listened to the other experts (in my opinion, this was a terrible decision, one that Norway will regret).

Anyways, back to the growing demand for infrastructure. Last week, Barbara Shecter of the Financial Post reported, Canada Pension, Ontario Teachers’ make $1.35 billion bet on Latin America infrastructure:

Canada Pension Plan Investment Board has made its first infrastructure investment in Mexico in a partnership with the Ontario Teachers’ Pension Plan and Latin American infrastructure group IDEAL.

The move comes as Ottawa seeks way to entice the Canadian pension giants to invest in infrastructure developments at home.

CPPIB and Teachers are kicking in a combined $1.35 billion to the partnership to acquire a 49 per cent stake in a new company formed by the partners to house one of the largest toll road concessions in Mexico, the group said Thursday.

IDEAL, an infrastructure development and operating company that is among the holdings of Mexican billionaire Carlos Slim Helu, is folding in its 99 per cent stake in Arco Norte S.A de C.V., the concessionaire of the Arco Norte toll road, in exchange for a 51 per cent stake in the new company.

Cressida Hogg, global head of infrastructure at CPPIB, said the relationship with IDEAL is a desirable as the Canadian pension giant pushes forward with plans for more infrastructure investments in Mexico and elsewhere in Latin America.

“They’re a highly regarded partner and we’ve known them by reputation for some time,” she said, adding that this deal is the first time they’ve invested with IDEAL.

According to a news release, the partners plans to “leverage on this partnership to continue investing in the infrastructure sector in Mexico.”

Alejandro Aboumrad, chief executive of IDEAL, which trades on the Mexican Stock Exchange, called CPPIB and the Ontario Teachers’ Pension Plan “world class partners,” and said his company looks forward to expanding the partnership “in the near future.”

The toll road is CPPIB’s first infrastructure investment in Mexico, but there are others in South America including two in Chile, and a gas pipeline in Peru.

Hogg said the infrastructure team in CPPIB’s Brazil office, opened in Sao Paolo in 2014, played an integral role in the Mexican toll road transaction.

“Members of our Sao Paolo office were heavily involved in this deal and bringing it to a successful conclusion,” she said.

Arco Norte is one of the largest federal toll road concessions in Mexico, with more than 30 years remaining on the concession. The 233-kilometre toll road bypass surrounds Mexico City in the north, northeast, and northwest region, “providing a critical link with major trade corridors,” according to the news release.

The Canadian government has been casting an eye on the key role the country’s major pensions including CPPIB and Teachers’ are playing in infrastructure developments around the world, and is keen to bring some of these investments to home turf.

“I’m optimistic that we will find a way to invite those sorts of investors into a Canadian project,” federal finance minister Bill Morneau said at The Economist’s Canada Summit conference in Toronto on Wednesday.

Morneau said the government is working to develop the capacity to “negotiate appropriately” with these institutional investors, and acknowledged that challenges have included finding projects with sufficient scale and returns.

“On the infrastructure file, we looked at it and said we’ve got these very successful investors in Canada, the Canada Pension Plan Investment Board, Teachers, Caisse de Dépôt and others that have been investing in infrastructure around the world,” he said, “and yet they’ve not found the projects in Canada of the scale that makes sense for them or of the dynamic that allows them to create a return.”

Hogg said CPPIB is willing to invest in Canadian infrastructure, as has been done with the 407 toll highway in Ontario. But she said any deal must fit with the pension organization’s strategy of investing material amounts in large assets.

“I think there’s clearly a road to travel around what the investment might look like and because we are a large fund, a large plan, we like to invest in size — but it could be that those kind of projects are developed and, you know, we’d be glad to look at them.”

She said CPPIB welcomes Morneau’s comments because they suggest that “this is an area of focus” for the government.

“I believe that you can do great things when the public sector and the private sector are working together to develop infrastructure,” Hogg said.

“We’d be keen to invest more in Canada. We just have to be very focused on making sure that we don’t diversity our portfolio so much that it becomes unwieldy. We need to retain our focus on asset management and doing the best deal for our beneficiaries.”

I agree with Cressida Hogg, when the private sector and public sector work together on developing infrastructure, great things happen but you need to maintain the right governance or else it will spell disaster.

Also, at the Conference of Montreal on Monday, I was impressed with Luis Videgaray Caso, Mexico’s Secretary of Finance and Public Credit, who spoke eloquently on how Mexico deregulated many industries to introduce real competition (Greece and other banana republics, take note!).

At that panel discussion, Glenn Hutchins, chairman of North Island and co-founder of Silver Lake, praised Mexico for being part of the “4G world” and said “Canada needs to move up from 3G and implement 4G or else it risks not growing as fast as it needs to.” He also stated “by the time Europe goes 4G, everyone else will be on 5G”.

Hutchins also made an excellent point on having ownership rights on the [band] spectrum and that investing in towers and telecommunication infrastructure produces other ‘derivative’ jobs.

Anyways, I need to gather my notes and report on that conference but it sure would help if they were quick to post all presentations on dedicated YouTube channel.

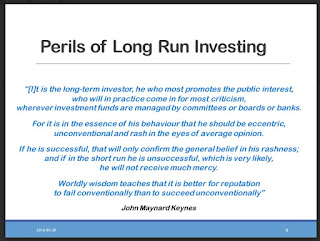

Let me end by cautioning all large pensions investing huge sums in infrastructure. Obviously it helps investing directly but you need to keep in mind deal valuations and how your collective actions influence pricing and opportunities.

It goes back to what Leo de Bever told us yesterday, big pensions and sovereign wealth funds are all looking for big deals that “move the needle” but this constant focus on scale is to the detriment of many funds which miss out on great opportunities to invest in smaller deals that fit perfectly with their long-term focus. Just a little food for thought for all you big funds looking to invest in the next big infrastructure deal.