Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Benefits Canada reports, AIMCo returns 9.1% in 2015:

Alberta Investment Management Corporation (AIMCo) has reported a 9.1% rate of return on its total assets under management for the year ending December 31, 2015.

The pension fund earned more than $1.5 billion of active value-add return above benchmark and overall investment income of $7.5 billion on total assets under management of $90.2 billion.

“I am very pleased with the terrific year of performance, especially against a backdrop of change and extreme volatility across the markets,” said Kevin Uebelein, chief executive officer. “AIMCo’s investment teams remained disciplined and focused on the long term, taking well-measured active risk positions, in-line with our investment strategies and our clients’ established needs.

“That steady hand approach, and the support of the entire organization, allowed us to identify, and act upon, value-generating opportunities across all major asset classes. This result is further evidence that the ‘Canadian Model’ of public asset management is one that very well serves the needs of the public.

“During these times of intense challenge for Alberta, it is especially gratifying to be able to deliver more than $1.5 billion of over-performance against our benchmark returns, which represents a best-ever performance figure for AIMCo.”

Detailed performance information will be available in AIMCo’s annual report to be released in June 2016.

Matt Scuffham of Reuters also reports, Canada’s AIMCo records 9.1 percent rate of return in 2015:

Canada’s Alberta Investment Management Corp (AIMCo) said it performed better in 2015 than in any year since its inception in 2008, with investments in real estate and infrastructure outperforming benchmarks.

AIMCo achieved an overall rate of return of 9.1 percent and a 10.1 percent rate after stripping out government and specialty fund clients for managing short and medium-term fixed income assets and for liquidity management.

AIMCo, which manages pension and government funds for the oil-rich province of Alberta, said overall investment income was C$7.5 billion ($5.75 billion) from total assets under management of C$90.2 billion. The performance exceeded its investment benchmark by over C$1.5 billion, it said.

AIMCo said investment teams in public equities, infrastructure, private equity and real estate all significantly outperformed their market benchmarks.

Like other Canadian pension funds, AIMCo has invested in real estate and infrastructure as an alternative to low-yielding government bonds.

“This result is further evidence that the ‘Canadian model’ of public asset management is one that very well serves the needs of the public,” said Chief Executive Officer Kevin Uebelein.

AIMCo put out a press release on its results which you can read here. In its press release, AIMCo emphasizes the 10.1% return for the Balanced Fund, which is more representative when comparing it to its large Canadian peers, and it states the following:

AIMCo’s strong results in 2015 were the outcome of contributions from across the organization. Investment teams in Public Equities, Infrastructure, Private Equity and Real Estate all significantly outperformed their market benchmarks, while Money Market & Fixed Income, Mortgages and Private Debt & Loan performed equally well, providing stable value-add through difficult market conditions.

I had a chance to discuss these results with Dénes Németh, Director, Corporate Communication at AIMCo. Unfortunately, Kevin Uebelein, AIMCo’s CEO, wasn’t available but I realized that it wouldn’t have been a fruitful discussion because the a detailed discussion of these results would require me to analyze the details from the Annual Report which only comes out in June.

I like the fact that AIMCo reports its calendar year and fiscal aggregate numbers. This makes it easier to compare its performance to its large Canadian peers.

But I find it unacceptable that AIMCo and a few other large Canadian pensions make their annual report public after releasing results. The Caisse and OMERS do this and it drives me crazy. At least the Caisse publishes a lot more detail on its performance when it releases it in February.

To be fair to these organizations, there are all sorts of reasons as to why they can’t make their annual reports available at the time of reporting their results. Leo de Bever, AIMCo’s former CEO, told me: “The fiscal release is constrained by provincial reporting issues: AIMCo ultimately consolidates in part with the provincial accounts, and we could not release before they do.”

So what do I think of AIMCo’s 2015 results? They are great. AIMCo handily beat the 5.4% average return of other large Canadian pension funds which defied market volatility last year and it even performed better than its peers like OMERS, HOOPP and the Caisse (AIMCo’s Balanced Fund returned 10.1% in 2015 vs the Caisse which returned 9.1%).

While I wasn’t able to get details of individual portfolios, Dénes Németh did tell me that AIMCo’s Balanced Fund gained 10.1% vs 8% for its benchmark in 2015 and over the last four years, it gained 11.8% vs 10.6% for its benchmark. This would explain the $1.5 billion in active value-add return above benchmark last year.

It’s also impressive that this performance was generated in Public Equities and Private Markets like Real Estate, Private Equity and Infrastructure. I commend both the Caisse and AIMCo for generating active value-add in Public Equities which is one reason why they both outperformed OMERS and HOOPP.

Of course, being an astute pension analyst, I asked Dénes two simple questions: “Does AIMCo hedge currency risk and what is the weighting of private market assets in its portfolio?”(see my coverage of HOOPP’s 2015 results to understand why I asked these questions).

Dénes replied:

“With respect to the questions below, I prefer not to respond as doing so would only provide insight toward one element of many that contribute to the successful outcomes achieved by our investment teams in 2015. My concern is that without the full story, which as I have explained will come in June, your readers may put more weight on these single factors than the overall effort that led to the strong results. I hope you will understand.”

Of course I understand and while it’s fair to point this out, it’s equally fair for me to ask these questions as a large part of AIMCo’s outperformance in 2015 is explained by these two factors.

In fact, I downloaded AIMCo’s 2014 Annual Report where I was able to get answers to all these questions and a lot more. If you want to get details on its investments and benchmarks governing every investment portfolio, take the time to read AIMCo’s 2014 Annual Report.

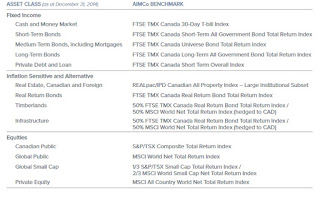

For example, here are the benchmarks governing each investment portfolio (click on image from page 33 of the 2014 Annual Report):

I’m not going to discuss the merits of each benchmark but for the most part, they’re excellent benchmarks that properly cover the risks of each portfolio (we can debate whether they should add a liquidity and leverage premium on the benchmark for PE and whether this benchmark has too much beta in it but benchmarks for private markets aren’t simple).

Now, to answer my question, roughly 25% of AIMCo’s assets were in Private Markets as of December 31st 2014 and I expect that figure stayed the same or marginally increased in 2015. Also, there is a note that states “For balanced funds, notional exposures and Client-directed currency derivatives are not included in asset class calculations.”

In fact, Leo de Bever shared this with me on AIMCo’s currency hedging policy:

“This has been a big debate in the pension industry. Some hedge, some don’t, some go 50-50 as a measure of ignorance. AIMCo tended to hedge fixed income because it was a US substitute for Canadian fixed income, but most listed equities were unhedged where FX markets were liquid to make that efficient.”

So, private market weights and currency gains had a material impact on overall performance in 2015. When you add to this outperformance in Public Equities which are unhedged, it was a great year for AIMCo.

Unfortunately, I cannot share more specifics with you until AIMCO’s 2015 Annual Report is released in June. Just go to the website and you will find it here (AIMCO really needs to revamp that annoying flash website and make it cleaner and easier to find information and download PDF and HTML information).

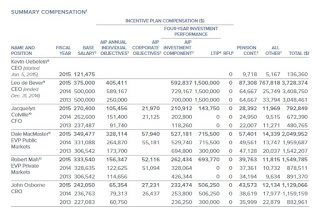

As far as compensation, once again, I cannot provide you with details until the 2015 Annual Report is available but AIMCo pays its top brass in line with what other large Canadian pensions pay (click on image from page 69 of AIMCO’s 2014 Annual Report):

AIMCo’s CEO Kevin Uebelein just started working last year so I expect to see his compensation increase and Dale MacMaster assumed the role of CIO and is doing an outstanding job, so I expect his compensation to increase too.

Going forward, I also expect AIMCo is going to have a tough time with its Real Estate holdings in Alberta and this was expressed to me in a lunch meeting I had with Kevin Uebelein back in November (read some of those details here).

I also asked Dénes Németh about the London City Airport deal which AIMCo took part in with Ontario Teachers, OMERS and Kuwait’s sovereign wealth fund but he told me they are bound by the Consortium’s confidentiality clause.

It’s too bad because I questioned that deal, stating the premium they paid was outrageous, and would love if Kevin Uebelein, Michael Latimer or Ron Mock can share more on why this is such a great asset at that valuation and more importantly, what is their long-term strategic plan for this asset?

Of course, one senior Canadian pension fund manager who didn’t bid on this asset told me: “You can’t always look at infrastructure valuations as I’ve seen assets that look cheap and turn out to be terrible investments and others that look expensive and turn out to be great investments. It really all depends on their long-term strategic plan for this asset.” Ok, fair enough, let’s hope they know what they’re doing with this London airport.

Photo by thinkpanama via Flickr CC License