Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Samantha Marcus of New Jersey Advanced Media reports, Public workers’ fight for pension adjustments hits N.J. Supreme Court:

Government workers’ fight for cost-of-living adjustments to their retirement benefits hits the state Supreme Court on Monday in a case that could pile billions of dollars onto New Jersey’s steep pension debt.

Berg v. Christie, or the COLA case as it’s known, again pits public workers against the administration, though this time for allegedly violating their contractual right to cost-of-living increases.

Restoring the increases could send the public pension system’s unfunded liabilities soaring and speed up the time frame for the funds to run dry. But if workers lose, they would see their lifetime pension checks eaten away by inflation.

Public workers will argue before the New Jersey Supreme Court on Monday morning that the state unlawfully froze their increases as part of a 2011 pension reform law that reduced workers’ benefits to save money. The state contends they are not a protected part of the benefits package.

The appellate court in 2014 ruled that retired workers were guaranteed COLAs by contract.

Retirees had lost at the trial court level, where a judge found that, based on a clause that gives lawmakers and the governor discretion over annual state spending, the state couldn’t be forced to pay cost-of-living increases. The three–person appellate panel disagreed, saying that clause was irrelevant, because “pensions are neither funded by appropriations on a pay-as-you-go basis… nor is their payment contingent on the making of a current appropriation.”

The state continued to pay out COLAs even as it skipped and underfunded pension payments.

The state’s high court has been asked to determine whether COLAs are part of workers’ nonforfeitable right to pension benefits that lawmakers granted in 1997.

The COLA suspension was part of a broader law requiring public employees and the state to pay more into the declining pension system. The overhaul was undertaken to reduce the state’s massive unfunded liability and stabilize the public pension system. Freezing cost-of-living adjustments was expected to save tens of billions of dollars over the next three decades.

Under that landmark law, COLAs could be reinstated as the seven individual pension plans become 80 percent funded. The adjustments were tied to the rate of inflation.

Public workers also sued when Gov. Chris Christie put less into the system that he’d promised under the 2011 law. Labor unions argued that violated their constitutionally protected contractual right to pension contributions.

In siding with Christie, the court cited the appropriations and debt limitations clauses in the state constitution, saying that the law could not create an enforceable contract that would bind the hands of future lawmakers and burden New Jerseyans with debt without their consent.

The U.S. Supreme Court last month declined to review the case.

Charles Ouslander, a plaintiff in the COLA case, said the current dispute is more routine and “not as complicated an issue.”

The fight over pension contributions involved bedrock constitutional issues, while Monday’s hearing is a matter of statutory interpretation, he said.

Still, a lot of money rides on it.Moody’s Investors Service warned in January that the state portion of the pension system’s unfunded liability would increase from $40 billion to about $53 billion, and the system would fall from 51 percent funded to 44 percent funded, if the court forces the state to restore the adjustments.

“The heightened burden, combined with an increase in benefit costs, would hurt New Jersey’s pension fund cash flows and funded status and the state’s ability to reach structural budget balance,” the rating agency said.

If COLAs were reinstated, and for Christie to keep up with his new payment plan that increases the pension contribution annually by one-tenth of what’s recommended by actuaries, he would need to pay $2.3 billion next year. His pension contribution in the proposed budget for the fiscal year that begins in July is $1.86 billion.

Spokesmen for Christie and the Treasury Department did not respond to requests for comment.

Gov. Christie is too busy campaigning for Donald Trump these days and even skipped attending the funeral of a New Jersey state trooper who was killed in the line of duty last week.

So what are my thoughts on New Jersey’s COLA war? It’s a very big deal and there is a lot of money at stake here. And this issue isn’t exclusive to New Jersey. I foresee COLA wars breaking out all over the United States, hampering underfunded public pensions which are already doomed.

At issue is whether the cost-of-living (COLA) increases public unions are demanding are a constitutional contractual right. If the unions succeed in getting these inflation adjustments, it will immediately push New Jersey’s underfunded pension system deeper in the red, placing it among the worst funded U.S. state pensions like Illinois and Kentucky.

I’ve long argued that we need a lot more transparency at state pensions. And when I say transparency, it’s not just in the way they report their performance, it’s also in the way they report their liabilities and what they plan on doing to tackle their pension deficit.

New Jersey’s pension wars have been raging for a long time. The state failed to top up its pension system for years, which is by far the biggest reason behind its underfunded status. If you add inflation protection to the mix, it will add billions to the underfunded status of the state’s pension system.

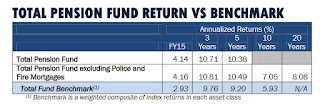

As far as investments, the New Jersey State Investment Council has been doing a decent job but nothing extraordinary. I looked at its 2015 Annual Report and noted the following (click on image):

The three and five year performance is very decent and it was the fifth consecutive fiscal year that the Pension fund outperformed its benchmark. So clearly it’s not investments that are contributing to the underfunded status of New Jersey’s state pension but the unions are right to point out the Pension Fund spent $701.4 million during the last fiscal year on fees, expenses and performances bonuses for alternative investments, including on its money-losing hedge funds (are the returns above net of fees???).

My point, however, is that no matter how well the the New Jersey State Investment Council performs, it’s not through investments that New Jersey’s pension system is going to regain its fully-funded status.

Why? Because as I keep harping, pension deficits are primarily determined by the level and direction of interest rates, not investment gains, especially when rates are at historic lows.

When rates are at historic lows and dropping, no matter how well your state pension fund managers perform, it’s a lost cause, especially if your state pension is already in deeply underfunded territory (remember, the duration of liabilities is a lot bigger than the duration of assets so a drop in rates disproportionately impacts liabilities).

Inflation protection is the other big determinant of pension liabilities. If you add inflation protection or COLAs on top of the burden of low and declining rates, it’s a huge weight on public pensions.

Moreover, it’s important to face the ugly truth: state pensions need to prepare for lower returns in a world where ultra low rates are here to stay as deflation sets in and the new negative normal takes hold.

Unfortunately, unlike Canada’s large public pensions which are going global investing directly in private equity, real estate and infrastructure, U.S. state pensions are taking increasingly more risk via private equity funds and hedge funds that are clobbering them on fees. And all those fees add up over the years, taking away from performance (but it enriches Wall Street and alternative asset managers).

The other problem that nobody is talking about is what Jim Keohane, HOOPP’s CEO, shared with me last week when I discussed super funded HOOPP’s 2015 results:

In terms of taking more risk, I noted that HOOPP is a relatively young plan and it can take a lot more risk than Ontario Teachers or OMERS which have a lower ratio of active to retired workers. Here Jim was unequivocal: “Just because you can take more risk, doesn’t mean you should.”

That got us talking about chronically underfunded U.S. public pensions taking on increasingly more risk in hedge funds and private equity funds. “That’s a recipe for disaster because when you’re starting off from an underfunded position, you should be even more cognizant of the risks you’re taking because your very path dependent and much more vulnerable to a shock.” (I’m paraphrasing here but that was his clear message).

What else does HOOPP, Ontario Teachers’ and other Ontario public pensions have that U.S. state pensions lack? Their plans have adopted the shared risk model that so many U.S. states desperately need to adopt.

Importantly, when HOOPP or Ontario Teachers reached underfunded status, they immediately went to their members to discuss cuts to their benefits. Typically, these cuts were to inflation protection, and they remained there for as long as needed until the fund reached fully funded or very close to fully funded status (not this arbitrary 80% funded status that so many U.S. public pensions are happy with).

In the U.S., you don’t have such shared risk plans at state pensions, which is why you see massive confrontations on public pensions and terrible solutions to the state pension crisis (like shifting out of defined-benefit into defined-contribution plans).

So who is going to win New Jersey’s COLA war? I don’t know. I feel for a lot of public sector employees getting screwed but the reality is New Jersey and other U.S. states are already screwed when it comes to their pension promise and unions and politicians will need to agree on very difficult cuts to shore up these public pensions. You can only kick the can down the road so far before the chicken comes home to roost.

One thing I do know, however, is that defined-contribution plans are not the solution to America’s ongoing retirement crisis. We can debate COLAs but there’s no debating that bolstering defined-benefit plans is the best way to bolster a country’s retirement system. You just need to get the governance right and introduce a shared-risk model at public pensions like New Brunswick did to tackle its pension deficit.

Photo by Bob Jagendorf from Manalapan, NJ, USA (NJ Governor Chris Christie) [CC BY 2.0 (http://creativecommons.org/licenses/by/2.0)], via Wikimedia Commons