Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Yaldaz Sadakova of Benefits Canada reports, HOOPP’s 2015 return slides to 5% amid volatility:

Amid slow global growth, chronically low interest rates and declining commodity prices, the Healthcare of Ontario Pension Plan (HOOPP) saw its return for 2015 slide to 5.12%, down from 17.7% in 2014. Despite this decline, its funded status has strengthened.

The plan’s 10-year return was 9.32%, down from 10.27% in 2014 (still highest 10-year return among global pensions).

“We suspected 2015 [would] be a challenging year and that’s how it played out,” said Jim Keohane, HOOPP president and chief executive officer, speaking at a press conference in Toronto on March 3. It was a year of “very high volatility and low returns,” he added.

Keohane cited pressures such as slowing growth in China, structural problems in Europe, regulatory requirements for the financial firms serving the pension plan and sliding commodity prices.

Declining energy prices in particular inflicted a lot of pain on the Canadian economy, causing the country to slip into a technical recession in 2015.

As a result of the low interest rates, HOOPP has lowered its discount rate this year from 5.8% to 5.6%, Keohane said.

The pension fund’s investment income also dipped to $3.1 billion in 2015 from $9.1 billion in 2014.

Despite the lower investment income and returns, the multi-employer plan saw its net assets grow to $63.9 billion in 2015 from $60.8 billion in 2014.

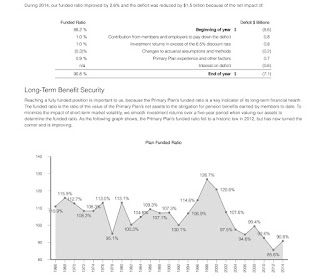

Also, HOOPP’s funded position improved last year. It stood at 122%, compared to 115% in 2014. As a result, contribution levels for employers and members have remained unchanged. “We still have one of the lowest contribution rates [among] the major plans,” Keohane said.

HOOPP, which covers Ontario’s hospital and community-based healthcare sector, has about 470 participating employers and 295,000 members.

Matt Scuffham of Reuters also reports, Canada’s HOOPP boosted by strong private equity returns:

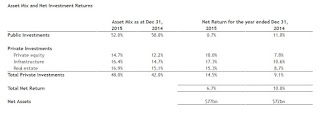

The Healthcare of Ontario Pension Plan, one of Canada’s largest public pension plans, said it achieved a return of 5.1 percent on its investments in 2015, with private equity investments the biggest contributor.

HOOPP said net assets grew to C$63.9 billion at the end of 2015 from C$60.8 billion a year earlier, and that its funded position was 122 percent at the end of 2015, up 7 percent from 115 percent in 2014.

“Even during a year of significant economic uncertainty, HOOPP remains fully funded, which means that we have sufficient resources to meet all of our current and future pension and benefit payments,” said HOOPP Chief Executive Jim Keohane.

Research by RBC Investor & Treasury Services last month showed Canadian pension funds achieved a return of 5.4 percent on their investments in 2015. The funds have pursued a strategy of directly investing in assets globally, including in private equity, infrastructure and real estate.

HOOPP’s private equity investments achieved a return of 17.7 percent in 2015.

Lastly, HOOPP put out a press release, HOOPP Strengthens Funded Ratio and Remains Fully Funded:

The Healthcare of Ontario Pension Plan (HOOPP) today announced its funded position was 122% at the end of 2015, up 7% from 115% in 2014. As a result of the stable funding position, contribution rates made by HOOPP members and their employers have remained at the same level since 2004.

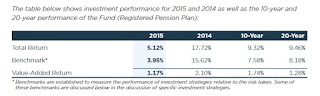

The rate of return on investments was 5.12% for the year ended December 31, 2015, with net assets growing to a record $63.9 billion from $60.8 billion in 2014. Investment income for the year was $3.1 billion down from $9.1 billion in 2014, and HOOPP exceeded its portfolio benchmark by 1.17%, or $0.7 billion. The Plan’s 5-year return stands at 12.03%, the 10-year return stands at 9.32%, and the 20-year return at 9.46%.

“Even during a year of significant economic uncertainty, HOOPP remains fully funded which means that we have sufficient resources to meet all of our current and future pension and benefit payments,” said HOOPP President and CEO Jim Keohane. “Being fully funded means we are able to consistently deliver to our members and our liability driven investing approach has been critical to ensuring the long-term health and sustainability of the Plan.”

HOOPP’s liability driven investing (LDI) approach has served members well by providing stability through challenging markets. It is a holistic, long-term investment approach which considers the Plan’s assets in relation to pension obligations, in order to balance risk with returns.

For more information about HOOPP’s financial results please view the 2015 Annual Report, available on hoopp.com.

2015 Return Highlights

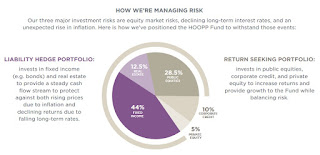

HOOPP’s liability driven investing approach utilizes two investment portfolios: a liability hedge portfolio that seeks to mitigate risks associated with our pension obligations, and a return seeking portfolio designed to earn incremental returns to help to keep contribution rates stable and affordable.

In 2015, the liability hedge portfolio provided approximately 62% of our investment income. Nominal bonds and real return bonds provided most of the income within this portfolio, generating returns of 8.9% and 2.2% respectively. The real estate portfolio was also a significant contributor during the year, with an 8.0% currency hedged return.

Within the return seeking portfolio, private equities were the largest contributor to investment income, returning 17.7% on a currency hedged basis, and other return seeking strategies also contributed to the income of the Fund. Public equities contributed 0.8%.

Rates of Return by Asset Class (Liability Hedge Portfolio)

Asset class 2015 Rate Of Return

Nominal bonds 8.9%

Real return bonds 2.2%

Real estate 8.0% (currency hedged)

Rates of Return by Asset Class (Return Seeking Portfolio)

Asset class 2015 Rate Of Return

Private equities 17.7% (currency hedged)

Public equities 0.8%

Other return seeking strategies also contributed to the income of the Fund.

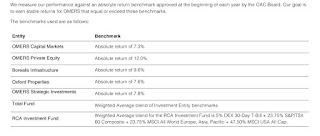

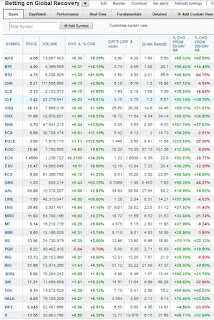

On its website, HOOPP provides an excellent year in review section here. Take the time to skim through it all but I will provide you with a nice snapshot below (click on image):

As you can see, HOOPP has achieved super funded status, a term I reserve for any pension plan with over 120% assets to cover future liabilities. And it has done this using one of the lowest discount rates in the industry (5.6%) and at a lower cost than other large Canadian defined-benefit pensions and at a fraction of the cost of mutual funds.

What this means is that the contribution rates for members and employers will remain stable at least till the end of 2017 (see more details here). Above and beyond that, it also means HOOPP’s members will enjoy full inflation protection (ie., cost of living adjustment was bumped up from 75% to 100%).

Basically, HOOPP is a pensioner’s dream because the plan is super funded and 80 cents of each dollar paid in benefits comes from investment gains at a fraction of the cost of mutual funds which unlike HOOPP, offer no guaranteed (defined) pension payment for life. That’s the brutal truth on defined-contribution plans.

Now, let me go over HOOPP’s 2015 results in a little more detail. I will be referring to HOOPP’s 2015 year in review and to HOOPP’s 2015 Annual Report. Take the time to read HOOPP’s 2015 Annual Report as there is a lot of excellent information in this document.

I also had a chance to discuss HOOPP’s 2015 results with Jim Keohane, the president and CEO. Jim was kind enough to call me while on vacation and I thank him for taking the time to speak with me.

First, the 5.1% gain in 2015 was lower than that of the average Canadian pension fund which delivered 5.4% in 2015. It was also lower than OMERS’s 6.7% gain and a lot lower than the Caisse’s 9.1% gain in 2015.

So what accounted for HOOPP’s lower return in 2015? Jim Keohane cited three factors:

- HOOPP dialed risk back last year in credit and public equities. “There was a lot of uncertainty and we didn’t feel like we were going to be properly compensated for taking risk in public markets.”

- HOOPP hedges 100% of its currency risk. “This is done on a policy basis. Again, we don’t feel like we’re being paid for taking on currency risk so we fully hedge it. On a year like 2015, this cost us but over the long-run, we feel that there are too many unknown factors governing currencies so we prefer fully hedging that risk as our liabilities are in Canadian dollars.”

- HOOPP has a lower weighting in private markets than other large Canadian DB pensions. “Real estate and private equity performed well last year, even after hedging out currency risk, but we don’t have a huge weighting in private markets like our larger peers.”

On this last point, take the time to view HOOPP’s asset mix and how they manage risk below (click on image):

You will notice that Private Equity represents only 5% of the total portfolio (most larger peers have between 10 and 15% allocation to PE) and Real Estate represents 12.5% of the total fund (those figures are a bit higher now). And you will also notice that unlike its larger Canadian peers, HOOPP has a huge allocation to Fixed Income (44%) and no allocation to Infrastructure whatsoever.

When I asked Jim Keohane about infrastructure, he told me flat out: “We aren’t against infrastructure assets but the pricing is too expensive right now” (no kidding!!). You will recall that Jim sounded the alarm on pensions taking on too much illiquidity risk three years ago on my blog.

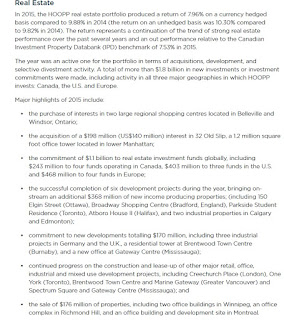

On Real Estate, you can read details on page 21 of the Annual Report (click on image):

Interestingly, Jim told me that HOOPP is doing a few greenfield projects in Real Estate, including 1 York Street in Toronto where they will be moving into. “There is a huge gap between cost of a building relative to cost of construction right now.”

He also told me HOOPP has partnered with real estate funds in Canada, the U.S. and Europe where they have an equity stake in these funds (not paying 2 & 20). In the U.K., he mentioned that HOOPP is building industrial warehouses and Amazon will be one of its tenants (great tenant).

In Private Equity, there is not much in the Annual Report but the return was spectacular given that currency risk has full hedged (click on image):

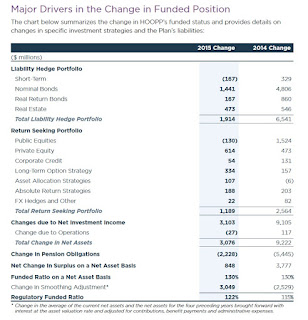

But the most important driver of HOOPP’s overall return in 2015 was good old nominal bonds in the Liability Hedge Portfolio (click on image);

In fact, nominal bonds returned 9% for HOOPP in 2015, which is spectacular given that the Caisse only returned 3.8% last year in bonds, marginally beating its index by 10 basis points (3.8% vs 3.7%). This helped HOOPP’s managers beat their overall benchmark by 117 basis points in 2015 (click on image):

I asked Jim Keohane if they juiced their bond returns using leverage via derivatives and here is what he replied: “We made a significant tactical shift in bonds which enhanced the returns. We sold bonds into the rally in January and February and bought them back at much higher yields in October and November.”

Now, I’m not going to question him on that tactical call but when I see such a huge outperformance in a bond portfolio, there’s no question that there was significant leverage used to juice those returns. Not that this is a bad thing as they obviously got it right and this added some big returns to the overall portfolio.

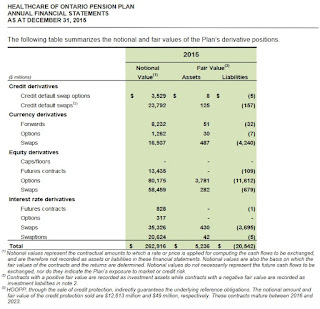

In fact, as shown in the table below from page 60 of the 2015 Annual Report, HOOPP uses derivatives extensively for all sorts of value added activities (click on image):

One thing that strikes me as odd is why HOOPP doesn’t make tactical calls like this on the Canadian currency. In fact, I told Jim that negative rates are coming to Canada and in my humble opinion, shorting the loonie was one of the easiest calls to make in the last three years and I was very vocal about this on my blog when I stated it’s time to short Canada back in December 2013.

[Note: A lot of Canadian public pensions don’t have good currency teams, they don’t understand global macro trends and this is costing them big coin in terms of tactical currency moves. Some got lucky over the last couple of years as their policy is not to hedge or partially hedge currency risk, but most of them are completely clueless when it comes to currency risk and how to make money trading currencies.]

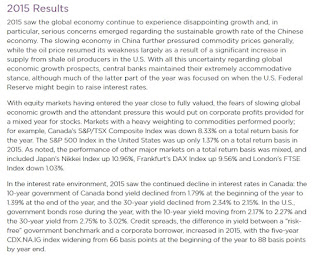

In its Annual Report, HOOPP states the following (click on image):

This helps explain the solid performance in bonds and mediocre one in Public Equities. Again, both HOOPP and OMERS delivered a lousy performance in Public Equities relative to the Caisse but it’s important to remember that the latter took risks in Public Equities that the former didn’t (more emerging markets and international exposure). And to be fair to the Caisse, it outperformed in all its public equities portfolios, including Canadian Equities (-3.9% vs -7.3% for the index).

So in Public Equities, it’s obvious the Caisse is doing something right even if I was very critical of the benchmark being used to gauge the performance of the “Global Quality Equities”.

I asked Jim Keohane what are his market thoughts. He told me he doesn’t “see another 2008 on the horizon.” They’re now neutral on U.S. and European markets and are overweight Canada. He said that both supply and demand factors explained the decline in oil but they’re overweight energy now and taking a “long-term view” as are other Canadian pensions betting on energy.

Jim also told me that he doesn’t understand why Canadian and especially U.S. banks move in unison with oil prices and that there is “no way Deutsche Bank is going under.”

But he also told me the risks he sees ahead are due to aging demographics in China, Japan, Europe and even in North America. “You can forget post-war growth rates over the next cycle, it’s just not going to happen.”

I agree with him on that and fear the worst as deflation sets in. I’m not as bullish as he is on energy and commodity names and would only trade these sectors given my long-term deflation outlook.

We also spoke about the new negative normal and interest rate sensitivity. Jim told me that HOOPP “won’t be buying bonds with negative yields” and that despite rates being at historic lows, “the Plan’s liabilities are less sensitive to a decline in rates.”

Admittedly, that last point was a bit confusing for me as I told him that the duration of liabilities is a lot bigger than that of assets so in a low rate environment, you will see liabilities skyrocket when rates decline. But he told me that duration measures the “rate of change”, not the sensitivity of liabilities to moves in rates and that they stress-test their liabilities to make sure they’re on the right track (I need to get a better understanding of this).

In terms of taking more risk, I noted that HOOPP is a relatively young plan and it can take a lot more risk than Ontario Teachers or OMERS which have a lower ratio of active to retired workers. Here Jim was unequivocal: “Just because you can take more risk, doesn’t mean you should.”

That got us talking about chronically underfunded U.S. public pensions taking on increasingly more risk in hedge funds and private equity funds. “That’s a recipe for disaster because when you’re starting off from an underfunded position, you should be even more cognizant of the risks you’re taking because your very path dependent and much more vulnerable to a shock.” (I’m paraphrasing here but that was his clear message).

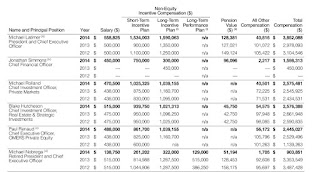

We also spoke about compensation. HOOPP is structured as a private trust, not a corporation, so it doesn’t have to publicly report compensation of its top brass. Jim told me that publishing compensation tends to inflate compensation and he told me that while HOOPP has competitive compensation, “the folks at CPPIB get compensated better at virtually every level.”

But he added: “People who come work for us come for the culture and the ability to do things they can’t do at larger shops. We’re a small team and portfolio managers here do a lot more trading across the spectrum than they’d be allowed to do at larger shops and they feel more engaged. Keeping the right culture is critical for us.”

Lastly, we talked about that silly Fraser Institute study on the costly CPP. Here Jim was an ardent defender of CPPIB and DB plans. “That study double counted costs for CPPIB and the video they put up on their website about having more freedom with your money was just terrible and totally missed the point of why DB plans are better ar providing safe, secure retirement at a reasonable cost for Canadians.”

On that note, I thank Jim Keohane for taking some time while away on vacation to speak to me. I truly appreciate it. Any mistakes in this comment will be corrected and any additional information will be added in.

As always, I remind all of you that these comments take considerable time and effort so I would appreciate if you donate or subscribe to my blog on the right-hand side under my picture to support my efforts in bringing you the very best insights on pensions and investments.

More importantly, I am actively looking for work and would appreciate all the help I can get from Canada’s Top Ten pensions which I cover in detail on this blog. I’ve reached out to the leaders of these organizations and would appreciate their help in securing full-time employment doing what I love the most, analyzing pensions and investments.

Photo by www.SeniorLiving.Org via Flickr CC License