Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

The Montreal Gazette reports, Caisse de dépôt posts 9.1% return in 2015:

A weak Canadian dollar ended up being a strong contributor to the Caisse de Dépôt et Placement du Québec’s impressive 2015 results.

With more than a quarter of its assets now in U.S. investments, the provincial pension-fund manager rode a 20-per-cent rise in the U.S. dollar to an annual return of 9.1 per cent last year, extending its solid run under Michael Sabia, chief executive since 2009.

The Caisse beat its benchmark index by a full 2.4 per cent, one of its largest margins of outperformance in the last 20 years. The average Canadian pension fund made about 5.4 per cent last year, according to a recent report from RBC Investor & Treasury Services.

“It’s again an outstanding performance for Sabia. They are very conservative, very focused,” said former Caisse executive Michel Nadeau, now director-general of the Institute for Governance of Private and Public Organizations.

Nadeau said a number of things went right for the Caisse in 2015. More than half of its assets are now invested outside Canada, whose stock market tumbled last year. It had little exposure to the hard-hit oil and gas sector. It has increased its allocation to less-liquid but more stable investments like real estate, private equity and infrastructure. And some of its major Quebec holdings, like convenience-store operator Alimentation Couche-Tard and information-technology company CGI, continued to grow and prosper internationally.

The Caisse, which manages funds for the Quebec Pension Plan and several public-sector pension plans, ended the year with assets under management of $248 billion, $22 billion more than in 2014. Only $2 billion of that was new contributions.

Its rate of return over four years is now 10.9 per cent, almost 1 per cent better than its benchmark. The 10-year number is 6 per cent, roughly what’s needed to meet the long-term needs of its depositors.

Global and U.S. equity investments were key drivers for the Caisse in 2015, both posting returns of more than 21 per cent. “Portfolios benefited from the Canadian dollar’s significant depreciation, particularly against the U.S. dollar,” the fund said in its annual summary.

Its Canadian stock portfolio slipped 3.9 per cent in 2015, about 4 percentage points less than the Toronto Stock Exchange.

Overall, the Caisse’s equity portfolio was up 11 per cent in 2015. It got a 10.6 per cent return from its inflation-sensitive investments and a 3.9 per cent gain from its fixed-income holdings.

Addressing reporters, Sabia called it “a solid year,” not just because of the gains achieved during a period of economic volatility, but because of the way the organization has grown its international expertise and adapted its investment strategies.

“Faced with a turbulent world, I think our strategy works, and works well,” he said.

The Caisse has moved an increasing percentage of its assets into international holdings, and they now account for 54 per cent, up from 41 per cent in 2011. U.S. investments alone total $73 billion or almost 27 per cent. Fully 40 per cent of the Caisse’s $55-billion real-estate portfolio is now south of the border.

The push into the U.S. and other nations including Australia, India and Mexico will continue, because that’s where the best growth opportunities are, Sabia said. In Quebec, it will give priority to companies with global aspirations, because “we have to globalize the Quebec economy.”

Sabia cautioned that future returns may not be as strong, because of the challenging economic environment, but said the Caisse will stay focused on its mission, to generate the annual returns of 6 to 6.5 per cent its depositors need.

“We can outperform the market, but if it falls 10 to 15 per cent, there’s only so much you can do,” he said. “You can’t immunize yourself.”

Frederic Tomesco of Bloomberg also reports, Caisse de Depot Posts 9.1% Return in 2015, Buoyed by Weak Loonie:

Caisse de Depot et Placement du Quebec returned 9.1 percent in 2015 as international equities, boosted by a decline in the Canadian currency, offset negative returns at home.

Net investment income at Canada’s second-largest pension fund manager was C$20.1 billion ($14.5 billion) in 2015 versus C$23.8 billion a year earlier, according to a statement issued Wednesday. Net assets rose to C$248 billion as of Dec. 31 from C$225.9 billion at the end of 2014, the Caisse said.

Results beat the 5.4 percent average increase of Canadian pension funds, as estimated in a January report by RBC Investor Services. Over four years, the Caisse said its weighted average annual return was 10.9 percent — topping the 10 percent average return of its own benchmark.

Under Chief Executive Officer Michael Sabia, who took over in 2009, the Caisse has been increasing investments abroad while steadily boosting its exposure to less liquid assets such as real estate to improve diversification. Today, almost 54 percent of the fund manager’s exposure is outside Canada, with “inflation-sensitive” investments such as property or infrastructure accounting for about 17 percent of net assets.

“While not immunizing our portfolio against market movements, our strategy makes it more resilient in turbulent times,” Sabia said in the statement.

Stocks Outperform

Equities were the best performing asset class for the Caisse last year, returning 11 percent on average. U.S. publicly traded stocks advanced 19 percent while private-equity assets returned 8.4 percent, according to the statement. The Caisse’s C$22.4 billion Canadian stock portfolio declined 3.9 percent, less than the 11 percent decline of the Standard & Poor’s/TSX Composite Index.

Results overall benefited from about a 15 percent decline in the Canadian dollar against its U.S. counterpart.

With net assets of C$282.6 billion at year-end, the Canada Pension Plan Investment Board is the country’s largest pension fund manager.

In their article, Nicolas Van Praet and Bertrand Marote of the Globe and Mail report, Caisse de dépôt backs Lowe’s $3.2-billion takeover of Rona:

The Caisse de dépôt et placement du Québec is backing Lowe’s Cos. Inc.’s $3.2-billion takeover deal for Rona Inc. because the pension fund manager concluded the Quebec hardware retailer was not going to be the industry champion it once hoped.

“We would very much have liked to have Rona emerge [from its turnaround effort as] a consolidator,” Caisse chief executive officer Michael Sabia explained after announcing the pension fund’s 9.1-per-cent return for 2015. “That was just not going to be in the cards.”

The Caisse said on Feb. 3 that it would tender its 17-per-cent Rona stake to U.S.-based Lowe’s, citing the friendly nature of the deal, the significant premium being offered, and the commitments Lowe’s is making to maintain Rona’s headquarters in Quebec and local buying policy. But Mr. Sabia’s comments are the first time the Caisse has articulated in detail its thinking about the takeover. He also clarified how the pension fund sees its role as a catalyst for economic development in the context of protectionist talk swirling in media and political circles.

When Lowe’s made its first offer for underperforming Rona in 2012, the Caisse’s view was that Rona had the potential to be fixed and shouldn’t be sold for an opportunistic price. So the pension fund brokered an agreement with Invesco Ltd., Lowe’s other main shareholder, to replace Rona management and revamp the board. Now, the Caisse has concluded that although Rona is largely fixed – same-store sales have increased six successive quarters while adjusted profit rose 33 per cent in its latest quarter – industry trends are working against the company and selling is the best option.

A push by Home Depot and Lowe’s, both U.S. industry giants, to expand in Canada is one element that weighed into the Caisse’s thinking, Mr. Sabia said. Industry consolidation and Rona’s weakness in e-commerce retail are two others, he said. “Like it or not, Rona was not well positioned.”

Opposition lawmakers in Quebec’s legislature maintain the Caisse should block the deal, which faces a vote by Rona shareholders before the end of the first quarter of 2016. They’ve also suggested that the Couillard government change the pension fund’s dual mandate – which is to generate returns for depositors and stoke provincial economic development – to prioritize its economic duty and defend Quebec companies against takeovers.

Mr. Sabia rejected that view. He framed the pension fund’s role as a supporter of Quebec companies looking to expand and become industry leaders in their field, noting that Montreal-based business consultant CGI Group Inc. and design firm WSP Global Inc. have both parlayed Caisse investments into a much larger international presence. The Caisse’s recent investment in Bombardier’s train business also aligns with this thinking, Mr. Sabia said, while Rona faced competitive roadblocks in its own growth effort.

“Over all, our view is build” the Quebec companies we invest in, Mr. Sabia said. “Build, expand and play offence.”

The Caisse posted a return of 9.1 per cent for 2015, riding a diversification strategy on international stock markets to generate strong returns for its investment in Canadian dollars. Caisse equity portfolios benefited particularly from the loonie’s depreciation against the U.S. dollar, the pension fund said. Its real estate holdings had a strong showing, returning 13.1 per cent.

The overall performance was below the Caisse’s 12-per-cent return for 2014 but beat the 5.4-per-cent average for Canadian pension funds in a January estimate by RBC Investor Services. Net investment income came in at $20.1-billion, shy of the $23.8-billion the year before.

Net assets climbed to $248-billion as of Dec. 31, making the Caisse the country’s second-largest pension fund manager behind the Canada Pension Plan Investment Board. Caisse investments outside Canada now make up about 54 per cent of its total assets, up from 41 per cent five years ago. The plan is to continue ramping up those investments abroad while reviewing strategies to mitigate currency swings, said the Caisse’s chief investment officer, Roland Lescure.

“In 2015, our strategy was put to the test,” Mr. Sabia said. “Uncertainty in the face of monetary policy, disorderly currency movements and collapsing oil prices all fuelled market volatility,” he said, adding that developed countries posted anemic growth and emerging markets slowed.

Average annual returns over the past four years under Mr. Sabia’s watch reached 10.9 per cent. His five-year term as president and CEO was extended in 2013.

Lastly, Matt Scuffham of Reuters reports, Pension fund Caisse open to investing more in Bombardier:

Canada’s second-largest pension fund, Caisse de depot et placement du Quebec, said it was open to further investment in Bombardier Inc after reporting strong returns in 2015.

Quebec’s public pension fund manager agreed to buy a 30 percent stake in Bombardier’s rail business for $1.5 billion in November, providing a bigger cash cushion for Bombardier’s planemaking unit.

Asked if the Caisse would invest further in Bombardier Inc, Caisse Chief Executive Michael Sabia said: “Are we open to the idea of increasing our position? Yes. Are we going to increase our level of investment in Bombardier Inc very soon? Probably not. We have an important investment in a subsidiary of Bombardier. For now, that represents significant exposure.”

Bombardier has struggled to win new orders for its C Series plane with some potential clients looking for more certainty about its financial health before placing orders. It remains in talks over possible federal aid.

Sabia said federal aid would make Bombardier more attractive to investors by providing that certainty.

“If those risks get reduced I think you’ll probably see some change in the valuation of the company so I think that’s the catalyst. It’s a risk reduction story.”

The company last week received the first order in 16 months for its CSeries jets, sending its shares higher and overshadowing news of lower-than-expected results and plans to cut 7,000 jobs.

Sabia backed Chief Executive Alain Bellemare to turn the business around and said he should be given time.

“Alain Bellemare is doing a very good job. Turnarounds take time. Alain’s been there about a year. In the history of a turnaround those are early days so we’ll see how that progresses,” Sabia said.

The Caisse reported weighted average returns of 9.1 percent in 2015, weaker than the average return of 12 percent it achieved in 2014 reflecting volatile equity markets and global economic uncertainty.

However, it beat the average return of 5.4 percent achieved by Canadian pension funds last year, according to research by RBC Investor Services.

Over the past four years, the Caisse said its annualised return was 10.9 percent, 90 basis points ahead of the benchmark portfolio which it compares itself against.

Since Sabia was appointed in 2009, the fund has sought higher returns by investing more funds in alternative assets such as infrastructure and real estate, shifting funds out of equities and low-yielding government bonds.

“While not immunizing our portfolio against market movements, our strategy makes it more resilient in turbulent times,” Sabia said.

The Caisse said its net assets had increased to C$248 billion at the end of 2015, compared with C$226 billion 12 months earlier.

The Caisse provides us with highlights of its results here and a very detailed press release on its results here which I will be referring to in my critical analysis of its 2015 results. Please take the time to carefully read the Caisse’s press release here as it provides a lot of excellent information.

It’s also important to note that the Caisse doesn’t release its 2015 Annual Report at the same time as it releases its results. It typically releases its annual report in April because I think it has to pass Quebec’s Parliament before being made public.

This is extremely annoying and totally unacceptable. I hope the Caisse and Quebec’s government fix this in the future so that Quebecers can receive detailed information that only the annual report covers on the same day the Caisse releases its results (If Ontario Teachers and others do it, so can the Caisse).

As such, in my analysis below, I will be referring to parts of the Caisse’s 2014 Annual Report which you should all take the time to read here. It’s important to understand that a proper analysis of any pension fund’s results requires a proper understanding of benchmarks used to gauge the risks used to add value over those benchmarks.

First, let me be nice and state flat out these are solid results. I even emailed Michael Sabia last night to congratulate him. For a guy with no investment or pension background, he managed to learn very quickly what the game is all about. He’s extremely bright, works like a dog and has surrounded himself with very smart investment people who for the most part know what they’re doing (minus their bearish bond and long emerging markets/ energy/ commodities calls which turned out to be completely wrong!!).

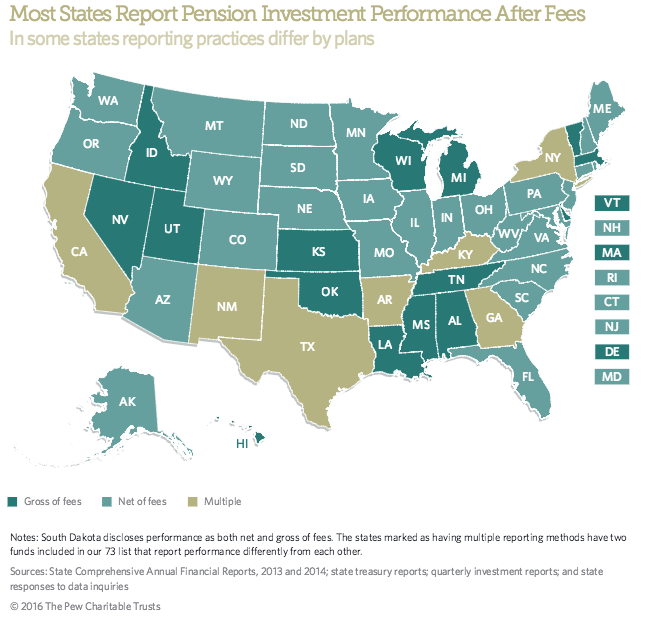

During Sabia’s tenure, the Caisse has managed to deliver very solid results focusing on shifting assets away from public markets into “more stable, less volatile” private markets, especially real estate and infrastructure. There is actually a chart in the press release which highlights this (click on image):

Those inflation-sensitive assets are mostly made up of real estate and infrastructure investments and their returns have been stable, especially when compared to Equities and Fixed Income.

Does this mean that returns in Real Estate and Infrastructure will keep delivering the same results as the recent past? Of course not, in a deflationary world all assets classes except for good old nominal bonds will get hit (just look at Japan). Also, due to stale pricing (private market assets are valued once or twice a year at the Caisse), there is a bit of an illusion going on here in terms of the real value and volatility of these private market investments.

When you read stories of Canadian oil companies which have stopped paying the rent, you know things are getting bad in Alberta’s commercial and residential real estate market. I have warned all of you that real estate as an asset class makes me extremely nervous in a deflationary environment because even though rates are low, debt levels are high, and a prolonged debt deflation crisis will hit rents and real estate values.

You can argue the same thing about infrastructure. In Greece they built these nice highways and nobody is using them because they can’t afford the tolls (it didn’t help that Troika in its infinite wisdom forced the Greek government to hike the gas tax at the worst possible time). People still use the old highways even if they are risking their lives as they are deteriorating and very dangerous.

All this to say, in a debt deflation collapse, even real estate and infrastructure can get whacked hard. If you think hiding in real estate and infrastructure is the key to avoiding a prolonged debt deflation cycle, you’re in for a nasty surprise.

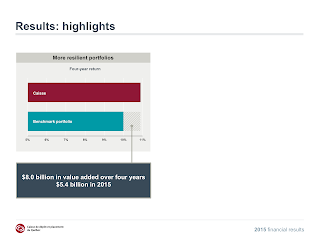

Now, let’s get back to the Caisse’s 2015 results. I want you to look at the returns of each portfolio relative to their index over the last four years and in 2015 (click on image):

You will note that over the last four years, almost every investment portfolio except for Real Estate and Infrastructure beat its benchmark. And this is where most of the money is being invested.

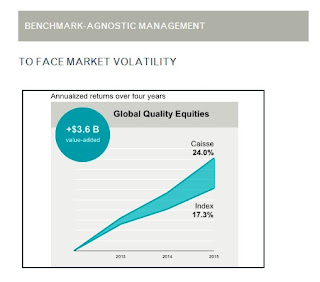

More interestingly, the outperformance in the Global Quality Equities portfolio over the last four years is particularly exceptional, 24% vs 17.3% for its benchmark index.

Wow!!! Warren Buffett, eat your heart out! The Caisse proudly displays this graphic on its site on “benchmark agnostic management” (click on image):

Does this mean that the guys and gals managing Real Estate and Infrastructure at the Caisse aren’t as good as those investing in the Global Quality Equities because the former aren’t able to trounce their benchmarks like the latter seem to be doing?

Of course not. The people managing Real Estate at the Caisse are the best in Canada and among the best in the world. They might not compete with Jonathan Gray over at Blackstone but they’re extremely qualified and excellent real estate managers. The same goes for the Caisse’s Infrastructure group which is staffed by extremely qualified investment professionals.

When it comes to analyzing a pension fund or any fund’s performance, I keep harping, it’s all about benchmarks, stupid! I used to have hedge fund guys come at me with their “unbelievably high Sharpe ratios” and I would tear them to pieces by pointing out the “unbelievably dumb risks” they were taking.

In terms of benchmarks, the Caisse’s Real Estate group has it tough, much tougher than its counterpart over at PSP. I ripped into PSP’s laughable Real Estate benchmark when I went over its fiscal 2015 results back in July (that real estate benchmark still persists at PSP, all part of the André Collin – Gordon Fyfe golden handshake back in 2004).

The Caisse’s Infrastructure benchmark is also tough to beat, tougher than the one at PSP and other large Canadian pensions. So when you have tough real estate and infrastructure benchmarks to beat, your overall benchmark is much tougher to beat which makes the fact that the Caisse beat its overall benchmark by 2.4% in 2015 and 90 basis points over the last four years that much more impressive (click on image):

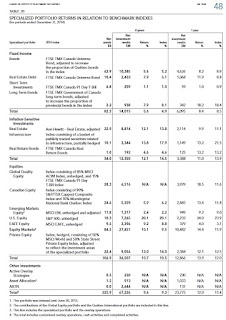

Unfortunately, it’s not that clean and simple as the Caisse also plays benchmark games and hides it through this nonsense of “benchmark agnostic management”. Have a look at the benchmarks used to gauge the value-added of the Caisse’s investment portfolios (click on image; from page 48 of the 2014 Annual Report):

You’ll notice the Real Estate benchmark is Aon Hewitt, adjusted and the one for Infrastructure is an “index consisting of a basket of publicly traded securities related to infrastructure, partially hedged.”

The real estate benchmark is a private real estate index adjusted for leverage. Basically, Aon constructs CDPQ’s index using IPD data for Canada, UK and France; and NCREIF for the US and they overlay a leverage threshold on top of the direct real estate return data. The infrastructure benchmark has public market beta in it which makes it tough to beat when those stocks are soaring. Both these benchmarks are very tough to beat.

Now, turn your attention to the benchmark for Global Quality Equities because this is where some fudging is taking place. That benchmark is an “index consisting of 85% MSCI ACWI Index, unhedged, and 15% FTSE TMX Canada 91 Day T-Bill Index“.

Huh? So the Caisse is investing in high dividend, quality global stocks like big pharmaceuticals, pipelines and utilities in this portfolio and it’s gauging its performance relative the MSCI All Country World Index and a Canadian T-bill index which yields close to zero?!?

I don’t know but when I see this type of outperformance in any public or private portfolio, my bullshit benchmark antennas immediately go up, especially when its couched under some “benchmark agnostic approach” (click on image):

Now, I’m not implying that the portfolio managers at the Caisse’s Public Equities group are not good at their jobs (just maybe not as good as the chart above implies). I like Jean-Luc Gravel and think he’s done a great job turning that ship around but I have to be intellectually honest and state the obvious: nobody else in Canada is taking this approach and for an obvious reason, it’s a slick way of gaming an inappropriate public market benchmark.

As far as Fixed Income, I have a couple of observations to make to my former one-time boss, Marc Cormier. First, if it wasn’t for that Real Estate Debt portfolio, your marginal outperformance in 2015 and over the last four years wouldn’t be as good as it looks. Second, the Caisse’s Fixed Income team got a bunch of bearish bond calls wrong and it cost it serious performance.

When I hear that guys like Guy Lamontagne, Simon Lamy, not to mention Brian Romanchuck, are no longer at the Caisse, I ask myself what the hell is going on at the Fixed Income group because guys like that (especially Brian and Simon who I know better than Guy) are gold for any organization.

You know who else is gold for any organization? Yours truly. I bust my ass to provide all of you timely (non sanitized) information you simply won’t read anywhere else and all I ask for is a lousy donation or annual subscription to my blog on the right hand side under my picture.

I thank all the leaders at Canada’s Top Ten who have subscribed and ask many more to join them. I’d also like to remind Canada’s pension plutocrats that unlike them, I don’t have the luxury of collecting millions in compensation based on four-year rolling returns and would appreciate if they can offer me contract work or better yet, a full-time job so I too can get properly compensated for my work.

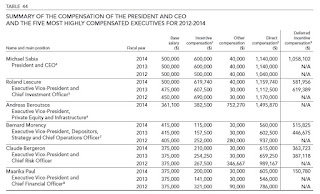

Speaking of compensation, the table below was taken from page 109 of the Caisse’s 2014 Annual Report (click on image):

As you can see, the top brass at the Caisse are compensated extremely well but not as well as their counterparts in the rest of Canada. Michael Sabia remains the most underpaid CEO in the Canadian pension fund industry (trust me, even for a million dollars, his job is no bowl of cherries).

It’s also worth noting that the head of Real Estate, Daniel Fournier of Ivanhoé Cambridge, is not part of this list because he is the CEO of the real estate subsidiary which has its own board of directors. I’m sure he’s getting paid extremely well too (perhaps more than everyone else and deservedly so) but I couldn’t find a public document which states his total compensation (no annual report for Ivanhoé Cambridge but there are activity reports here).

Below, take the time to listen to Michael Sabia discuss the Caisse’s 2015 results in a CTV Montreal report. Notice how he talks about what the Canadian economy needs and alludes to infrastructure?

Also, take the time to watch Sabia’s French interview with Gérard Fillion on RDI Économie here. Notice how much his French has improved over the last five years? He spoke about selling Rona to Lowe’s (good move as Rona would never be able to compete with Home Depot or Lowe’s).

Sabia made a good point that Quebec protectionism won’t work in this global economy and that Quebec companies that want to compete globally better focus on performance. He briefly mentioned the Caisse’s big stake in Bombardier which I think was well structured even if Bombardier’s stock keeps making new 52-week lows.

Also, a month ago, Sabia discussed the market turmoil, monetary policy and his investment strategies at the World Economic Forum in Davos, Switzerland. He spoke with Bloomberg’s Erik Schatzer on “The Pulse” stating the need to focus on the real economy.

It sounds like Michael Sabia is gearing up for a political career after he leaves the Caisse. If you ask me, he’d be a great politician. He just needs to soften up a little and come down from his high tower once in a while to talk to his employees and sit in on their meetings (a bit like Rousseau and Fyfe used to do when they were at the Caisse). He should also take the time to meet me, I don’t bite (last time we crossed paths was at CBC’s offices in Montreal).

Photo credit: “Canada blank map” by Lokal_Profil image cut to remove USA by Paul Robinson – Vector map BlankMap-USA-states-Canada-provinces.svg.Modified by Lokal_Profil. Licensed under CC BY-SA 2.5 via Wikimedia Commons – http://commons.wikimedia.org/wiki/File:Canada_blank_map.svg#mediaviewer/File:Canada_blank_map.svg