Chad Aldeman is an associate partner at Bellwether Education Partners and a former policy advisor at the U.S. Department of Education. This post was originally published on TeacherPensions.org.

How many teachers should be eligible for adequate retirement benefits?

My answer is all of them: For every year they work, teachers should accumulate benefits toward a secure retirement.

A reasonable person might say only those who stay for at least three or five years. That would require teachers to show some amount of commitment to the profession, and it would reward teachers for getting through the most challenging early years.

But that’s not the way current teacher retirement systems are designed. Most states require teachers to stay 20, 25, or even 30 years before they qualify for adequate retirement benefits. (The Urban Institute’s Rich Johnson and I calculated these “break-even” points across the country. Find info on your particular state here.)

In other words, today’s teacher pension systems only provide adequate benefits to teachers with extreme longevity. You don’t have to take my word for it. The California State Teachers’ Retirement System (CalSTRS) hired Nari Rhee and William B. Fornia to study whether California teachers were better off under the existing pension system or alternative retirement plans.

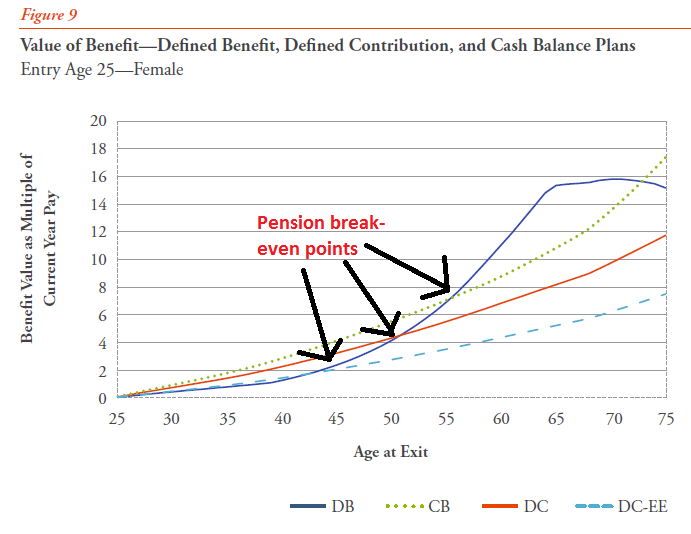

The chart below comes directly from their paper. It shows how benefits accumulate for newly hired, 25-year-old females under the current pension system (blue line), a defined contribution plan (red line), a defined contribution plan with no employer contributions (dotted blue line), and a cash balance plan (dotted green line). There are legitimate questions about whether these are perfectly fair comparisons—Rhee and Fornia ignore the large debts accumulated under traditional pension plans—but even in this analysis, it’s clear that the pension system is the most back-loaded benefit structure. Some teachers do better under this arrangement, but most don’t. Depending on the comparison, this group of teachers must stay two or three decades before the pension system offers a better deal.

Rhee and Fornia make a valid point that not all teachers enter the profession at age 25, and their paper also includes the graph below showing the actual distribution of California teachers by the age at which they began teaching. The most common entry ages are 23 and 24, just after candidates complete college (California requires most new teachers to go through a Master’s program before earning a license). The median entry age for current teachers is 29 (meaning half of all teachers enter at age 29 or younger), and the average is 33.

Rhee and Fornia’s point here is that people who begin teaching at older ages have shorter break-even points, and that teachers with shorter break-even points are more likely to benefit. This has a kernel of truth but obscures some key points.

First, it is true pension plans are better for workers who begin their careers at later ages. Pensions are based on a worker’s salary when she leaves the profession, and they don’t adjust for inflation during the interim. If a 35-year-old leaves teaching this year, she may qualify for a pension, but it will be based on her current salary right now. By the time she finally becomes eligible to begin drawing her pension, say in the year 2046, every $1 in pension wealth will be worth far less than it is today. Teachers who go straight from teaching into retirement don’t have this problem.

Consequently, it’s also true that teachers who begin their careers at later ages are comparatively better off than teachers who began at younger ages. They don’t have to wait as long, so the break-even points fall from 31 years for a 25-year-old entrant to just 7 years for a 45-year-old entrant.

But their argument starts to suffer when compared to teacher mobility patterns. Like other states, California sees much higher turnover in early-career teachers than mid- or late-career teachers. The result is that, even for a 45-year-old teacher with a relatively short break-even period of 7 years, only about half will actually reach that point.

The table below pulls together these two data points for teachers of various ages. The middle row illustrates how long the teacher would be required to stay until her pension would finally be worth more than a cash balance plan (Rhee and Fornia calculate slightly shorter break-even points for their defined contribution plans). The last column uses the state’s turnover assumptions to estimate how many California teachers will remain long enough to break even. Remember, the median teacher in California began teaching at age 29. The table below suggests this typical teacher would have had a break-even point of more than 25 years, and the state assumes that only 40.6 percent of this group of teachers will make it that far. Across the entire workforce, the majority of California teachers would be better off in a cash balance plan than the state’s current pension plan.

| Age at which the teacher begins teaching | How many years does it take for the teacher to break even on her pension plan? | What percentage of teachers like her will break even? |

|

25 |

31 |

34.6 |

|

30 |

25 |

40.6 |

|

35 |

19 |

43.7 |

|

40 |

13 |

46.6 |

|

45 |

7 |

54.2 |

California is a bit of an outlier here compared to other states—it’s a big state and seems to have lower teacher turnover than other states—but it’s still worth asking if this system is working well enough for all teachers. Rhee and Fornia’s main point seems to be that, once you exclude short- and medium-term workers, the remaining teachers tend to do pretty well under the current system. But that excludes lots of people!

I personally don’t think that’s the right way to look at things. I think it’s worth fighting for retirement systems that treat ALL teachers fairly and equitably. After all, teachers might not know how long they’ll stay in the profession. They might not like teaching as much as they thought, or life might take them on another path. And once we account for this uncertainty, the break-even points become less about raw numbers (do I have to stay 19 or 22 years?) and more about probability (what’s my realistic chance of teaching in this state for 31 years?). Looked at from that perspective, it becomes harder and harder to support pension systems with such extreme back-loading.

Photo by cybrarian77 via Flickr CC License