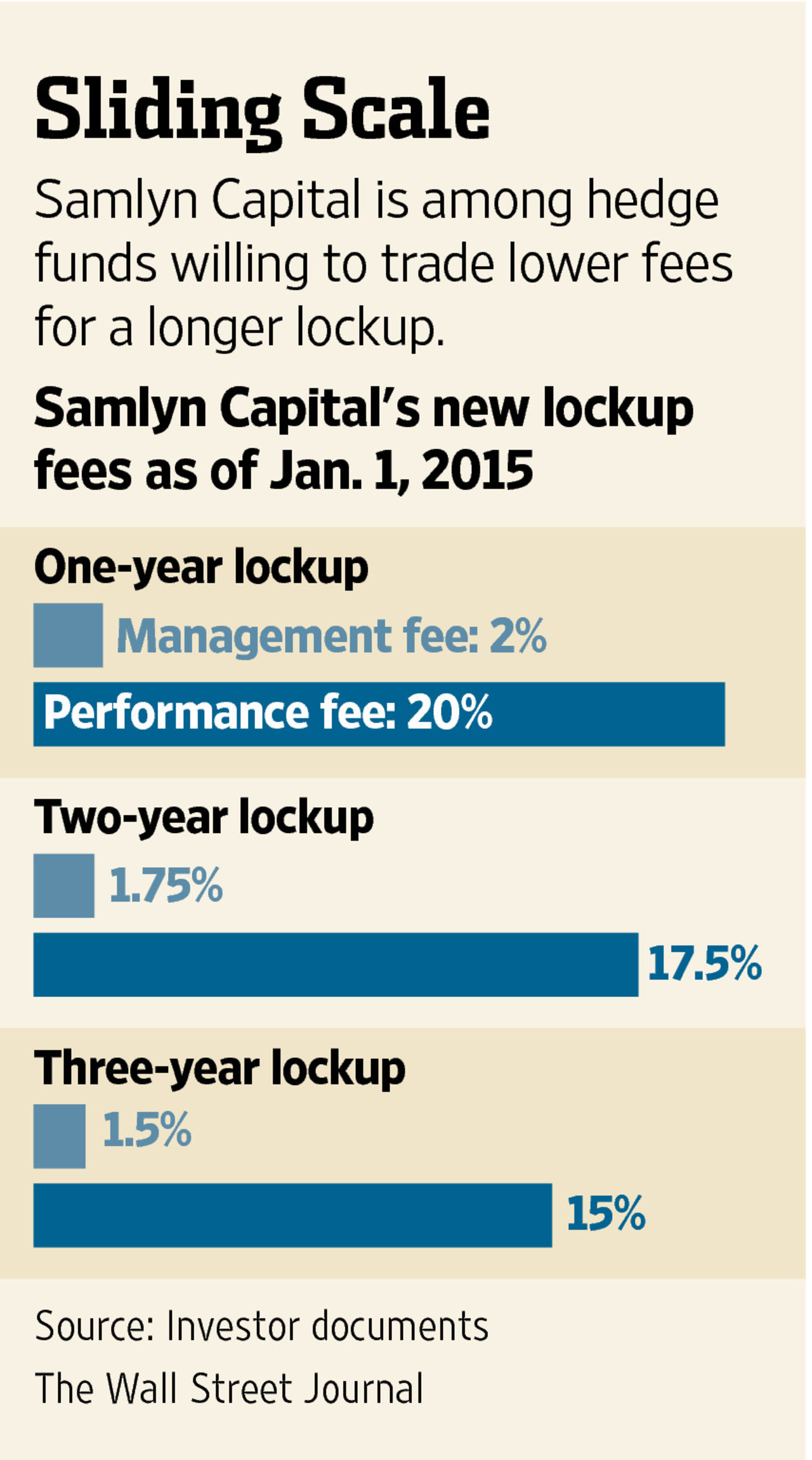

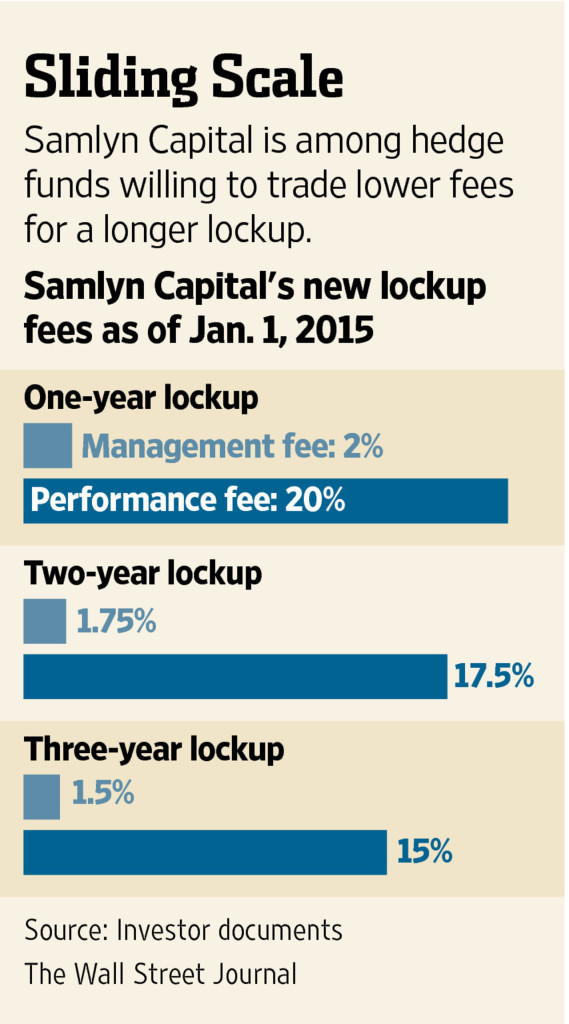

Hedge funds are looking to lock up investor funds for longer periods of time — 66 percent of hedge funds aimed to lock up funds for one year or more in 2013, according to a survey by eVestment.

In exchange, funds are willing to revise their fee structures downward.

From the Wall Street Journal:

Managers say tying up investor money for a year or more enables them to buy less easily tradable but potentially more profitable assets. It also reduces the pressure from monthly or quarterly redemption requests when performance wanes.

Extending the term also allows managers to distinguish themselves from the growing cadre of “liquid alternative” mutual funds that try to replicate hedge-fund-style trading but must allow daily redemptions.

[…]

Two-thirds of new hedge funds demanded a lockup of one year or more in 2013, a 30% increase from the previous year, according to the most recent data available from research firm eVestment. The average fund has a lockup of 377 days, eVestment said. Those pushing for longer terms include funds managed by industry stalwarts like Fir Tree Inc., GoldenTree Asset Management LLC, Trian Fund Management LP and Viking Global Investors LP, said people with knowledge of the funds.

The fact that investors have been receptive to longer lockups could indicate higher confidence:

That investors are agreeing to the extended terms, or lockups, demonstrates a significant shift in confidence since the financial crisis, when trust was shaken by rapid market losses and some fund managers prevented investors from withdrawing their money. That was quickly followed in late 2008 by Bernard Madoff ’s admission he had been running a Ponzi scheme, causing billions of dollars in losses for his investors.

“As we move further and further from 2008, people are getting more comfortable,” said Spiros Maliagros, president of $3 billion hedge-fund firm TIG Advisors LLC.

But some investors are skeptical of longer commitments:

Some observers warn that investors should be careful about allowing a manager to keep their money for so long, pointing back to the crisis when some hedge funds—particularly those holding less-liquid assets— halted withdrawals. Some investors still haven’t been paid back.

“People have forgotten a lot of the lessons from the crisis,” said Andrew Beer, chief executive of Beachhead Capital Management, which invests in hedge funds.

Several investors said they were skeptical that many hedge funds, particularly those that invest in markets that are easily traded such as stocks, need the extra leeway. Some pointed to the recent underperformance of these equity-focused funds relative to their benchmark markets as a risk of extended lockups.

View the graphic at the top of this page to see how hedge funds are changing their fee structures for longer commitments.