On March 5, 2013 the Dow Jones closed at over 14,000—a then-record high for the major index. One month later, it pushed the mark further and closed at 15,000; by late November, the Dow had eclipsed 16,000 for the first time in history. Now, in June 2014, the index sits just a few points away from 17,000.

The S&P 500 has come along for the ride, closing with record highs 19 times in 2014 alone.

You’d be forgiven for assuming that the nation’s public pension funds—all of whose health are intimately tied to equity markets—are enjoying the spoils of this market expansion more than anyone. But the numbers tell a different story.

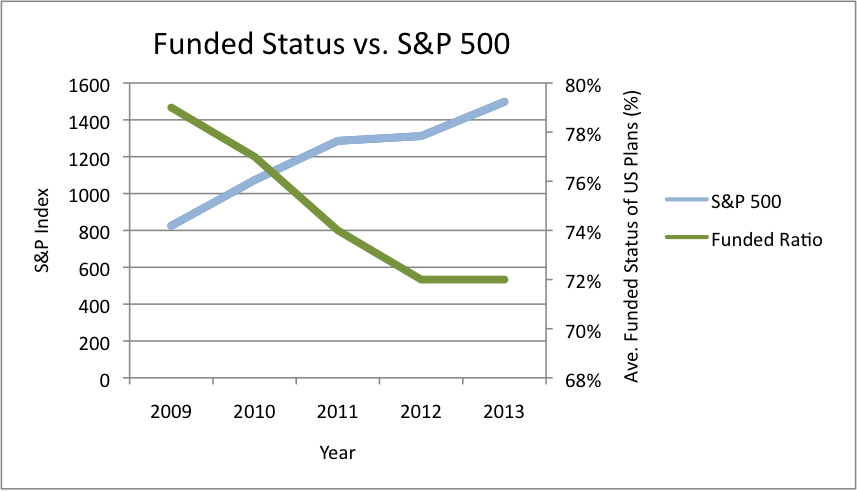

Between 2009 and 2013, while the S&P 500 saw 188 percent gains after reaching an all-time low, public pension funds across the country saw their average funded ratios decrease—from an average of 79 percent in 2009 to 72 percent in 2013.

You don’t need to be a statistician to see the problem here: equity values have skyrocketed in the last 5 years. But pension funds, at least on the surface, have not benefited. In fact, they’ve become less healthy on the whole.

Are the numbers lying? No, according to a new report from the Center for Retirement Research. But the numbers aren’t telling the whole story either, and there are a few explanations for this pension paradox.

First, it’s important to note some significant changes recently adopted by one of the world’s largest funds, the California Public Employees Retirement System (CalPERS). In 2012, on the recommendation of its actuaries, the fund lowered its discount rate to 7.5 percent from 7.75 percent. More recently, the fund began assuming larger benefit packages for a segment of its participants and longer life spans for all of them.

Those changes brought CalPERS’ funded ratio down from 83 percent in 2012 to 69 percent in 2013. But it doesn’t explain the lack of funding status improvement across the country.

For a real explanation, we turn to an accounting technique called asset smoothing, which takes annual fluctuations in the stock market and averages them over a period of (typically) 5 years.

The purpose of the policy is to keep funds focused on the long-term and to negate the panic and short-term thinking that comes with major negative fluctuations in the market.

But the flipside is the phenomena we’re witnessing now, where today’s strong returns are weighted down by bear markets of the recent past. So, despite large market gains in the last 4 years, the “smoothed” value of pension plan assets only rose 2 percent in 2013.

As the CRR report notes, 2014 is a big year for pension funds. The 2009 market losses will rotate out of the smoothing calculations, and that alone could increase the aggregate funding status of US public plans to 75 percent, according to CRR estimates.

New GASB standards have also begun kicking in, meaning many funds will begin reporting the market value of their assets rather than the smoothed values. That could bring plans’ funded ratios to around 80 percent on average, says the CRR.

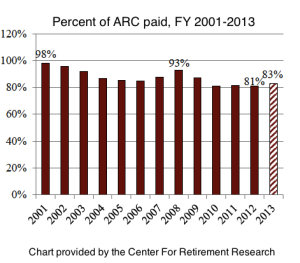

If that happens, the burden will be on state and local governments to pay their annual required contributions (ARC), in full, into their systems. All too often, they shirk this responsibility during the “good” times. Unfortunately, we’re seeing a bit of that mentality surface again.

The trend is clear: during market contractions (the tech bubble in 2001 and the financial crisis in 2008) governments scramble to cover funding shortfalls and are willing to pay nearly their entire ARC. But when the market rights itself, they are content to watch their required contributions taper off and let market gains cover the ensuing shortfall.

The trend is clear: during market contractions (the tech bubble in 2001 and the financial crisis in 2008) governments scramble to cover funding shortfalls and are willing to pay nearly their entire ARC. But when the market rights itself, they are content to watch their required contributions taper off and let market gains cover the ensuing shortfall.

Since the financial crisis, governments have slipped back into old habits. Still, we have to give credit where credit is due: governments paid more of their ARC’s in 2013 than they did in 2012. But you know the old saying: one time is an accident, two is a trend. Hopefully, 2013 wasn’t an accident. Whether it’s the start of a trend, however, remains to be seen.

This article is based on data presented in a June 10, 2014 report by the Center for Retirement Research. Read the full report here.

Photo by Andreas Poike via Flickr CC License