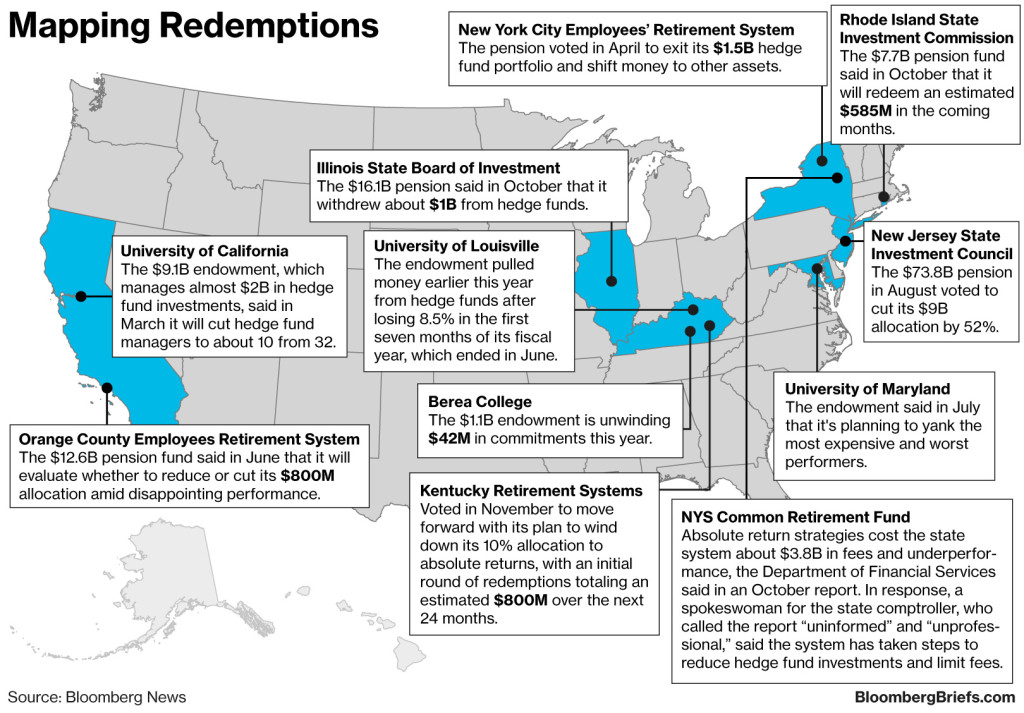

Bloomberg put together this interesting graphic, above, of pension funds and endowments that have yanked their money from hedge funds in 2016.

The third quarter of 2016 saw investors pull a net $28 billion from hedge funds — a small slice of the industry’s overall assets under management, but still the highest outflow since 2009.

More details on the trend from Bloomberg:

Unhappy with mediocre results and high fees, pensions in states like Illinois, New York and Rhode Island are slashing their allocations to hedge funds. More than one in four endowments and foundations, from colleges to museums to hospitals, are doing the same or considering it, according to a survey by consultant NEPC. Many are demanding lower fees and better terms to stick around, and usually getting it.

[…]

The backlash is part of a broader rebellion that has seen an avalanche of money move from actively-managed funds to low-cost passive products like index funds. The $3 trillion hedge fund industry, however, has become the poster child for the sins of active management because it charges among the highest fees even as performance lags. That doesn’t sit well in the political world of public pensions and endowments. They face pressure to boost returns as an aging workforce enters retirement and tuitions rise.