Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Matt Scuffham of Reuters reports, Ontario Teachers’ Pension Plan sees lower 2016 rate of return:

The Ontario Teachers’ Pension Plan’s rate of return dropped to 4.2 percent last year from 13 percent in 2015, the fund said on Wednesday, citing unfavorable currency movements.

The results still exceeded a benchmark target of 3.5 percent for the fund, Canada’s third-biggest public pension plan.

The plan, which administers pensions for 316,000 working and retired teachers in Canada’s most populous province, said its net assets grew to C$175.6 billion at the end of 2016 from C$171.4 billion a year earlier.

The fund, which has investments in more than 50 countries, said currency movements had a negative impact of 280 basis points on its rate of return in 2016, compared with an 830-basis-point positive effect in 2015.

Ontario Teachers’ said it was 105 percent funded as of Jan. 1, meaning it had a surplus of assets with which to meet its future pension obligations. This was the fourth year it has posted a surplus after a decade of recording annual deficits.

Chief Executive Officer Ron Mock said the fund had achieved that despite major challenges in the global economy.

“Being focused on the long-term, we continue to believe having a highly diversified portfolio is the best way to pay pensions and minimize funding volatility over time,” he said.

“Last year big swings in global currencies had an impact on the short-term value of Plan assets,” he added.

Ontario Teachers’ pioneered a move by Canadian pension funds in the 1990s to invest directly in private companies, infrastructure and real estate internationally as an alternative to Canadian equities and government bonds.

No doubt, currency swings were a big factor behind Ontario Teachers’ 2016 results. Scott Deveau of Bloomberg reports, Ontario Teachers’ Posts Worst Return Since 2008 on Pound’s Drop:

The Ontario Teachers’ Pension Plan posted its worst annual return since 2008 after the plunge in the British pound and other currency moves curbed investment gains.

The 4.2 percent gain for 2016 was down from 13 percent in 2015, and trailed the fund’s average annual return of 10 percent since it was founded in 1990. It was the worst performance since the financial crisis.

Ontario Teachers’ blamed the lower returns on currency moves, after the Canadian dollar gained last year against the U.S. dollar, British pound and other currencies. The loonie added 3 percent against the U.S. dollar and 23 percent against the pound, according to Bloomberg data.

“The big mover last year was the British pound,” said Bjarne Graven Larsen, Ontario Teachers’ chief investment officer. “Usually we do not hedge in general. But we felt that before the referendum in the U.K. that it was a significant risk so we decided to hedge 50 percent of our significant position in the British pound.”

The pension fund manager, which has investments in 37 global currencies, said its returns were 7.2 percent in local currency terms, before converting to Canadian dollars. The currency swings lowered returns by 2.8 percent, compared with currency gains of 8.3 percent in 2015.

“If you look at currency in the last three years, it has actually benefited us,” Larsen said. “We don’t as a general rule hedge. We know that some years we benefit from it, some years it actually gives us a loss.”

He said the fund’s exposure to the U.S. dollar also eroded returns because more of its assets are based there.

“It might be a battle between the British pound and the U.S. dollar. A larger position in the U.S. dollar but a smaller appreciation,” he said.

Fund Returns

While the pension fund manager said it beat its benchmark return of 3.5 percent, the gains were less than the 7.6 percent return for the Caisse de depot et placement du Quebec and the 10 percent net return reported by the Ontario Municipal Employees Retirement System.

Ron Mock, Ontario Teachers’ chief executive officer, said in a year marred by market volatility, low rates, geopolitical uncertainty and the unexpected Brexit vote, the return of 4.2 percent last year wasn’t bad.

“We do think that the return environment going forward is not going to be the 10 or 12 percents we’ve witnessed over the last eight years,” Mock told reporters in Toronto Wednesday.

“We see it as a pretty solid result and most importantly a pretty solid funding position we find ourselves in,” he said, noting the plan has been fully funded for four years straight.

Fewer Currencies

As part of a broader shuffling of its portfolio, Ontario Teachers’ reduced the amount of its assets in foreign currencies to 40 percent from 60 percent of the portfolio.

“Currency, in all of the pension plans I know of, is a big issue,” Larsen said. “Some hedge. Some don’t. Half of the time, you regret your policy and half of the time you’re happy about it. There’s no easy answer.”

Ontario Teachers’ said its net assets grew 2.5 percent to C$175.6 billion ($130 billion) as of Dec. 31 from C$171.4 billion in 2015.

The fund said the total value of its public and private equity investments were C$66 billion at year-end, down almost 15 percent from C$77.5 billion a year earlier. The fund said the decline was part of an effort to reduce the risk in its portfolio by lowering its exposure to equities and increasing its focus on fixed income.

To that end, the fixed-income portfolio increased to C$75.2 billion at year-end, up nearly 9 percent from C$69.1 billion the year before. The bond portfolio returned 0.8 percent.

Larsen said the portfolio was too “equity-centric” prior to that shift.

“We want more diversification in the portfolio. We want less equity risk factor. But then we’re actually buying other things that will actually yield returns. So, we’re buying more credit and we’re buying other things,” he said. “It’s still the same expected return we’re going for and better diversification.”

What else is Teachers doing? Andrew Willis of the Globe and Mail reports, Ontario Teachers Pension Plan favours minds over machines:

In an era when an increasing number of investors are embracing passive investments such as index funds, the Ontario Teachers’ Pension Plan is putting its faith in its people by allocating more capital to active investment strategies.

Teachers announced on Wednesday it earned a 4.2-per-cent return in 2016, performance that ranked behind peers but exceeded its benchmark and left the $175.6-billion plan with an $11.5-billion surplus.

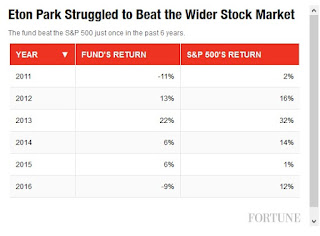

Last year, Canadian pension plans averaged a 6.8-per-cent return, up from 5.4 per cent in 2015, according to survey from Royal Bank of Canada. Teachers’ 4.2-per-cent return exceeded the 3.5-per-cent performance of its benchmark. Over the past five years, Teachers posted a 10.5-per-cent annual return, and over 10 years, gains averaged 7.3 per cent.

Teachers chief investment officer Bjarne Graven Larsen said in a news conference on Wednesday the fund turned in “solid returns,” with short-term performance reflecting a $4.5-billion negative impact from swings in currency markets last year. Gains on currency moves added 8.3 per cent to performance in 2015, when the fund was up by 13 per cent.

Approximately 60 per cent of the Teachers portfolio is invested in non-Canadian dollar assets, and the fund invests in 37 different currencies.

To reduce risk and increase future returns, Teachers chief executive Ron Mock said the fund decreased the amount of capital it allocates to passive investments in stocks and bonds, shifting the portfolio to sectors in which the fund has in-house expertise, such as real estate, private equity and larger equity ownership in select companies. Mr. Mock said the fund’s “secret sauce” is the internal investment acumen built up over 25 years of investing.

New York-based BlackRock Inc., the world’s largest asset manager, made headlines this week by announcing plans to replace actively managed mutual funds with passive vehicles that rely on computer-driven stock picks. Mr. Graven Larsen said that while Teachers also makes use of cutting-edge technology in the investment process, the fund is increasing its focus on active management.

Mr. Mock warned that investors should not expect the 10-per-cent-plus annual returns turned in by equity markets during bull markets. He said if the fund can consistently generate 4-per-cent “real returns,” after inflation, “we will be pretty happy.”

Teachers has significant investments in Britain and Mr. Mock said the fund plans to continue investing in the region in the wake of Britain’s decision to leave the European Union, because of the country’s attractive regulatory regime and solid economic fundamentals.

As CEO at one of Canada’s largest pension plans, Mr. Mock said he is in regular contact with the federal government over the Liberals’ plans to invest in infrastructure. Former Teachers CEO Jim Leech was recently named a special adviser to the planned Canada Infrastructure Bank.

Mr. Mock said that while Teachers supports the infrastructure bank concept, considerable work needs to be done to align the relationship between private investors and federal, provincial and municipal governments before the fund commits capital. He said that while there are a handful of large Canadian infrastructure initiatives that could be launched within the next year, experience in Australia and Britain shows it can take a decade to get significant projects planned, funded and permitted, in order to start construction.

The Teachers fund has 318,000 active and retired members, including 142 pensioners who are over the age of 100.

By the way, on the newly created $35-billion Canada Infrastructure Bank, Bill Curry of the Globe and Mail reports that Ottawa just hired Metrolinx CEO, Bruce McCuaig, to advise it. Mr. McCuaig will be joining Jim Leech, the former CEO of Ontario Teachers’, who was tapped last month to get this new federal infrastructure bank up and running.

I don’t know but Ron Mock is right, considerable work needs to be done to get better alignment of interests and the bigger, more ambitious infrastructure projects take years to set up and complete.

In the meantime, I agree with those who think Ottawa’s plan to sell airports needs to take off right now — while the market is still hot. This is something that I’m sure Ontario Teachers’ and other large Canadian pensions would invest in and help transform our airports into world class airports.

In fact, just yesterday Ron Mock told BNN that Canadians will be slow to adapt to the concept of privately-owned airports, but will eventually understand their benefit.

As far as the UK, Barbara Shecter of the National Post reports, Ontario Teachers’ Pension Plan dealmakers won’t ‘head for the hills’ as Brexit takes shape:

The Ontario Teachers’ Pension Plan is continuing to hunt for deals in United Kingdom, even as concrete steps were taken Wednesday to extricate the Britain from the European Union.

“We’re not heading for the hills by any stretch of the imagination,” chief executive Ron Mock said at a media briefing Wednesday, shortly after news broke that Britain sent a letter to the European Union that marks a significant step in its move to exit the economic partnership.

The historic breakup has not led to any bargains so far, according to chief investment officer Bjarne Graven Larsen, who noted that while currency fluctuations can sometimes make assets look cheaper, “the pricing of assets in the UK continues to go up.”

Mock said there is likely to be a period of uncertainty, but added that the pension managers are hopeful about the long-term prospects for Britain and the European Union.

The Ontario Teachers’ Pension Plan posted a 4.2 per cent return in fiscal 2016 after accounting for swings in British pound and U.S. dollar. Despite the negative impact of currency fluctuations, the plan exceeded its benchmark return of 3.5 per cent and remained fully funded for its fourth consecutive year, Teachers’ revealed Wednesday.

Net assets rose by $4.2 billion from the previous year to $175.6 billion. Beating the benchmark translated to a “value add” of $1.3 billion, the pension manager said in a statement Wednesday.

“I’m very pleased that Ontario Teachers’ remained fully funded for the fourth year in a row despite major challenges in the global economy,” said Mock, who noted that big swings in global currencies had an impact on the short-term value of the pension plan’s assets.

The fund invests in more than 50 countries with 37 global currencies, and the return on those investments in local currency was 7.2 per cent. Converting those gains back into Canadian dollars has a negative impact of 2.8 per cent. In 2015, currency gains added 8.3 per cent to returns.

At a media briefing Wednesday morning, executives told media the currency impact in 2016 would have been worse if the fund manager, which invests and administers the pensions of Ontario’s 318,000 active and retired teachers, had not hedged about half its exposure to the British pound before the surprising outcome of the Brexit vote.

While currency exposure has helped Teachers’ in the past, Mock and Graven Larsen said the exposed portion of the portfolio is being reduced to around 40 per cent from 60 per cent through a combination of asset allocation, hedging and balance sheet management.

The Ontario Teachers’ Pension Plan, which invests in stocks, bonds and real assets including real estate and infrastructure assets, has posted an average annualized return of 10.1 per cent since its inception in 1990. The five-year return is 10.5 per cent and ten-year return is 7.3 per cent. The plan was 105 per cent funded as of January 1, 2017.

More than three-quarters of the funding of members’ pensions has come from total investment income since 1990, with the remainder coming from member and government contributions.

“We make investments to pay pensions for generations,” said Graven Larsen. “Stable returns and capital preservation are essential to our ability to deliver retirement security to our members.”

Last year, Teachers’ began implementing a new strategy aimed at better integrating its asset selection approach and risk management processes. There are three strategic areas of focus: total-fund returns, value-add above benchmark returns, and volatility management.

The fund’s real assets group, which includes real estate and infrastructure, had total assets of $44.3 billion at year-end, compared to $40.6 billion a year earlier. The real estate portfolio, managed by subsidiary Cadillac Fairview, totalled $26.5 billion in net assets at year-end and returned 7.7 per cent, exceeding the 7.4 per cent benchmark. The infrastructure portfolio had $17.8 billion in assets at year-end, up from $15.7 billion a year earlier.

The total value of the plan’s public and private equity investments dropped to $66 billion at the end of 2016 from $77.5 billion a year earlier. Teachers’ said the reduction was partly due to a strategic decision to reduce total portfolio risk by lowering exposure to equities and increasing exposure to fixed income securities. The investment return in the equities portfolio was 4.8 per cent, compared to the benchmark of 4.9 per cent.

The pension plan missed the benchmark return in two areas: private capital and fixed income. Private Capital investments totalled $26.6 billion at year-end, a decrease from $28.4 billion a year earlier, while the investment return was 4.3 per cent compared to the benchmark of 5.4 per cent.

Fixed Income had $75.2 billion in assets at year-end, compared to $69.1 billion at the end of December 2015. The one-year return of 0.8 per cent was slightly below the benchmark return of one per cent.

Meanwhile, natural resources investments posted a one-year return of 8.3 per cent, above the benchmark of 6.7 per cent. The investments totalled $10.5 billion at year-end, compared to $10.2 billion a year earlier.

OTPP put out a press release, Ontario Teachers’ is fully funded for fourth consecutive year:

Ontario Teachers’ Pension Plan (Ontario Teachers’) today announced it was 105% funded as of January 1, 2017, its fourth consecutive year of being fully funded. Net assets rose by $4.2 billion year-over-year in 2016 to $175.6 billion. The total-fund rate of return of 4.2% exceeded the benchmark of 3.5%, resulting in $1.3 billion in value-add.

“I’m very pleased that Ontario Teachers’ remained fully funded for the fourth year in a row despite major challenges in the global economy,” said Ron Mock, President and Chief Executive Officer. “Being focused on the long-term, we continue to believe having a highly-diversified portfolio is the best way to pay pensions and minimize funding volatility over time. Last year big swings in global currencies had an impact on the short-term value of Plan assets.”

Ontario Teachers’ has investments in 37 global currencies and in more than 50 countries. In those local currencies, the return on our investments was 7.2%. Converting the return on those investments back into Canadian dollars, the currency in which pensions are paid, had a -2.8% impact on the Plan’s total-fund rate of return. By contrast, currency gains added 8.3% in 2015.

Since its inception in 1990, Ontario Teachers’ has achieved an average, annualized return of 10.1%. The five and ten year returns are 10.5% and 7.3% respectively. Total investment income since 1990 has accounted for more than three-quarters of the funding of members’ pensions, with the remainder coming from member and government contributions.

“We make investments to pay pensions for generations. Stable returns and capital preservation are essential to our ability to deliver retirement security to our members,” said Chief Investment Officer Bjarne Graven Larsen. “Our philosophy is that we will perform better than average by having a deep understanding of what is going on in the world rather than trying to make bold forecasts.”

In 2016, Ontario Teachers’ began implementing a new strategy aimed at better integrating its accomplished bottom-up approach to asset selection with a well-established top-down risk management process. The strategy focuses on three pillars: total-fund returns, value-add (above benchmark) returns, and volatility management.

Ontario Teachers’ continues to show strong performance in pension services, according to two independent, annual studies. The plan’s Quality Service Index (QSI), which measures members’ service satisfaction, was 9.1 out of 10 in 2016, and the plan was ranked second, by CEM Benchmarking Inc., for pension service in its peer group and internationally.

2016 investment return highlights by asset class

The total value of the plan’s public and private equity investments totaled $66.0 billion at year-end, compared with $77.5 billion at December 31, 2015. The reduction from the previous year was partly due to a strategic decision to reduce total portfolio risk by lowering exposure to equities and increasing exposure to fixed income securities. The investment return in the equities portfolio was 4.8%, in-line with a benchmark of 4.9%.

Private Capital investments totaled $26.6 billion at year-end, a slight decrease from $28.4 billion a year earlier. Private Capital’s investment return was 4.3%, compared to the 5.4% benchmark.

Fixed Income had $75.2 billion in assets at year-end, compared to $69.1 billion at December 31, 2015. The one-year return of 0.8% was slightly below the benchmark return of 1.0%.

Real assets, a group that consists of real estate and infrastructure, had total assets of $44.3 billion at year-end, compared to $40.6 billion a year earlier. The real estate portfolio, managed by the plan’s subsidiary Cadillac Fairview, totaled $26.5 billion in net assets at year-end and returned 7.7%, exceeding the 7.4% benchmark. The infrastructure portfolio had $17.8 billion in assets at year-end, up from $15.7 billion a year earlier. New investments and higher valuations for existing assets were partly offset by the impact of a stronger Canadian dollar. Infrastructure assets delivered a one-year return of 1.4%, outperforming the benchmark return of -2.3% (As country benchmarks are assigned to each asset class, conversion back to Canadian dollars results in a negative benchmark).

Natural Resources investments were $10.5 billion at year-end, compared to $10.2 billion at December 31, 2015. The one-year return of 8.3% was above the benchmark return of 6.7%.

About Ontario Teachers’

The Ontario Teachers’ Pension Plan (Ontario Teachers’) is Canada’s largest single-profession pension plan, with $175.6 billion in net assets at December 31, 2016. It holds a diverse global portfolio of assets, approximately 80% of which is managed in-house, and has earned an average annualized rate of return of 10.1% since the plan’s founding in 1990. Ontario Teachers’ is an independent organization headquartered in Toronto. Its Asia-Pacific region office is located in Hong Kong and its Europe, Middle East & Africa region office is in London. The defined-benefit plan, which is fully funded, invests and administers the pensions of the province of Ontario’s 318,000 active and retired teachers. For more information, visit otpp.com and follow us on Twitter @OtppInfo.

Attachments:

Net Assets graph

Preliminary Funding Valuation graph

Currency Impact on Total Fund Return graph

Net Investments and Rates of Return by Asset Class chart

Link to 2016 Annual Report

Benchmarks Used to Measure Fund Performance

I am glad Teachers provided links to everything I need to cover its 2016 results. Before getting started, I highly recommend you read the Report to Members, the Report from the Chair, and this Report on Investments.

I also highly recommend you read OTPP’s 2016 Annual Report and at least take the time to read the Report from the CEO (page 3), Management’s Discussion & Analysis on subsequent pages and the Report from the CIO (on page 12).

I had a chance to talk to OTPP’s President and CEO, Ron Mock, yesterday and we went over the 2016 results. I asked him plenty of questions and he was kind enough to answer them all and cover a lot of material.

I began with the most obvious, the impact of currency swings which is front and center in the news articles and in the Annual Report (click on image):

By now, everyone in the world knows Brexit hit Teachers’ results last year and if their investment staff didn’t partially (50%) hedge the Fund’s exposure to the Pound Sterling prior to the Brexit vote, the results would have been even worse.

As stated in the press release, Teachers has investments in 37 global currencies and in more than 50 countries. In those local currencies, the return on our investments was 7.2%. Converting the return on those investments back into Canadian dollars, the currency in which pensions are paid, had a -2.8% impact on the Plan’s total-fund rate of return. By contrast, currency gains added 8.3% in 2015.

Ron told me that in terms of asset returns, 2016 was actually better than the previous year, but when you factored in currency swings, it really detracted from the performance.

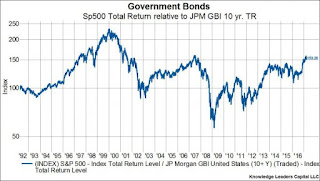

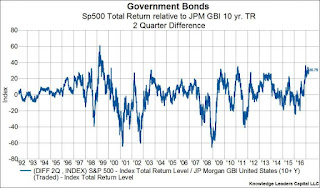

Like CPPIB, Ontario Teachers’ typically doesn’t hedge currencies. This means in years where the euro, yen, pound, and US dollar are up relative to the Canadian dollar, they enjoy currency gains but in years where the CAD is doing relatively better, they take a hit on currencies.

The chart below shows OTPP’s currency exposure by country (click on image):

As you can see, the biggest exposure is to the US dollar ($49.6 B) which I recently discussed and stated that I’m still long despite the recent selloff, followed by the euro ($7.8 B) and then the Pound Sterling ($4.5 B).

UK investments are significant for Teachers, especially in private markets like infrastructure where they hold major stakes in airports and other investments in that country. This is why exactly one year ago, Ontario Teachers’ was assessing Brexit risk very closely.

Now, after the fact, anyone could say they should have fully hedged the risk of a yes vote for Brexit and they would have looked like superstars, but that vote was very close and it was a stunner. Thank goodness they partially hedged their currency exposure but even that decision wasn’t a given.

Anyway, Ron told me that Teachers’ implemented a new strategy focusing on three pillars: total-fund returns, value-add (above benchmark) returns, and volatility management.

That last component — volatility management — was to ensure they can maintain the funded status or reduce the volatility of the funded status as much as possible. This new strategy has all sorts of implications in terms of investments, including currency exposures which they decided to limit to 40% from 60% of the portfolio through a combination of asset allocation, hedging and balance sheet management.

Why not fully hedge currency exposure just like HOOPP and OMERS do which is one big reason they both outperformed Teachers’ last year? The way Ron explained it is fully hedging currency exposure adds costs and it could have serious implications on liquidity needs in the short run.

I take a more intuitive approach when thinking of currencies. I believe the US economy will continue to dominate the global economy for many more years which is why I want to be long US dollars over the long run. Moreover, I think the Canadian economy is going to run into all sorts of problems in the next few years so if you ask my opinion, Canadian pensions are better off not fully hedging their currency exposure.

Can there be unexpected negative surprises? Sure, the eurozone might blow up sending the euro even lower, but I think the best way to play currencies is not to hedge or hedge partially like Teachers did when there is significant event risk.

Anyway, if I had to bet, I’d bet Teachers, CPPIB and I believe now PSP will gain from currency exposure this year as they all don’t hedge for the most part.

The important thing to note is big currency swings matter a lot to Canadian pensions that don’t fully hedge currency exposure and they add or detract from net results (I wish every Canadian pension fund had a dedicated section on currency hedging and exposure in their respective annual report).

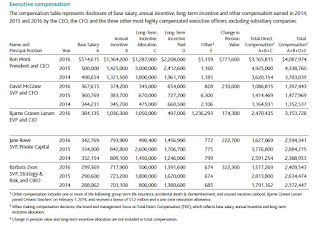

What else did Ron and I discuss? Compensation. In particular, Ron told me the new strategy had implications on compensation so he enlisted the help of the top investments officers at OTPP to draft and discuss it and then they did a survey to see if the rest of the investment staff were on board.

Ron told me everyone overwhelmingly agreed with the three pillars of the new strategy and the new compensation system, which sort of surprised me somewhat because I told him “there are always egos at pension funds who want their compensation based primarily on individual targets.”

He told me it all stems from the plan’s mission statement and that every employee at OTPP signed off on five core values of the organization, “humility being the first one.”

So, what does this mean in practice and how does it change investment decisions in the short and long run? Ron told me that compensation “has to align with the mission statement” and it was lower last year “because value-add was lower”.

And as you can see from the table below, he wasn’t kidding, apart from Bjarne Graven Larsen who is the new CIO and holds the top investment job at OTPP, all other senior executives including Ron saw their total compensation go down in 2016 (click on image):

Moreover, from now on every investment decision will take into account total fund volatility targets. “You might not see a significant change in a month, but over the next few years, it will represent a significant change,” Ron said.

Are you confused? Well let me clarify. Ron agrees with Jim Keohane and Hugh O’Reilly, the best measure of a pension plan’s success is its funded status, so even if they return double digit gains, add value over a benchmark, it’s meaningless if the pension plan’s funded status deteriorates and that should be reflected in their compensation.

Remember something I keep harping on, pensions are all about managing assets AND liabilities. If rates sink to new secular lows and liabilities skyrocket, it doesn’t matter if pension assets gain, in that scenario, the increase in liabilities will more than swamp any increase in assets, so the funded status will necessarily deteriorate.

Interestingly, Ron told me OTPP was implementing something akin to Bridgewater’s All-Weather approach looking at how their total portfolio would do under various growth/inflation scenarios. He said they were exposed to the “low growth/ high inflation” scenario which was the main reason they decided to reduce their equity exposure and increase their exposure to real assets.

At this point I had to bite my tongue because I’m a well-known delfationista who thinks we have yet to see secular lows on US long bond yields but I trust the folks at Teachers have done their homework and they know which economic scenario their Fund is most exposed to (to be fair, Ron put it this way: “We realized we are under-invested for this scenario”).

Anyway, the critical thing to remember is the new system is looking to reduce risk while obtaining the required rate of return and everyone at Teachers is on board. “It has unleashed a level of innovation and horizontal communication to better structure all our portfolios, placing the plan’s mission statement front and center.” (I am paraphrasing a bit here but that’s what he told me)

In terms of private markets, I asked him if it’s getting tougher to find opportunities. He said yes but they have expert partners that can assist them in finding great opportunities and better managing companies and other investments like airports where one of their consultants was the previous CEO of Heathrow airport for many years.

He agreed with me that most of the direct investments at Canada’s mighty PE investors come from co-investments and said it would be “naive” to think you can go it alone in private equity. I stated it would also be against the best interests of the plan’s beneficiaries and he agreed.

But one thing he said that I learned from is that when a private equity fund wraps up and it comes to the end of its life, quite often the private equity partner will go to Teachers and ask it if it wants to bid on a portfolio company as part of its exit strategy. Ron told me since they sit on the board and know the company well, if they like it, they will bid on it to own it directly after the fund wraps up.

And on co-investments, Teachers typically is the lead investor, does most of the due diligence and knows the deals very well, often presenting opportunities to other LPs who are part of the syndicate on the deal. Interestingly, he added that it’s a mutually beneficial partnership with all their general partners across many asset classes including private equity: “Sometimes they come to us with deals, sometimes we go to them with deals.”

He added: “This is why it’s critical to select the right partners who have the right culture and alignment of interests.”

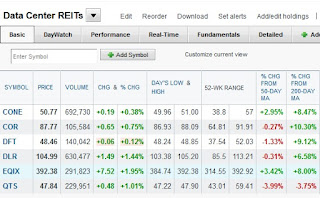

For example, in my last comment going over why PSP is investing in data centers, I mentioned Ontario Teachers’ acquisition of Compass Datacenters, a wholesale data center developer it acquired in partnership with RedBird Capital Partners.

On private debt, he told me that “Teachers isn’t there yet” doing some fund deals in private equity but if they were to significantly increase this activity they would opt for the same approach of CPPIB and PSP, namely, find the right talent, seed them with a platform where they own 100% of the assets.

Ron gave me a good example of how Teachers selects its private deals, citing its acquisition of OGF, France’s leading funeral home company. “It has 45% of the market, is very well positioned, and we are contributing to its long-term success with our own value creation plan.”

By the way, they do this for every private market investment, implement a value creation plan and then routinely benchmark themselves against it. Ron was adamant about one thing: “Long gone are the days of financial engineering, either you roll up your sleeves and drive EBITDA growth by increasing operational efficiency, or forget making money in private equity.”

This is the philosophy that permeates every private market activity, including infrastructure where they have a team of engineers with airport and other expertise at their disposal and renewables where they invested with PSP in major sustainable investments, and recently announced a clean energy partnership with Anbaric, a leader in the development of clean energy transmission and microgrid projects.

That’s why I was laughing when I read last night that students, teachers, and climate activists are continuing to pressure the Ontario Teachers’ Pension Plan to immediately stop investing in the destruction of their future by divesting from fossil fuels.

Apart from being ignorant of Teachers’ commitment to renewable energy, it shows that a few plan members don’t understand the plan’s mission statement and why it’s virtually impossible to divest from fossil fuels (not to mention it’s not in their best interests).

Anyway, I’ve covered a lot, I am really tired (exhausted) so I am going to wrap it up here. I think you should all take the time to carefully read OTPP’s 2016 Annual Report and this Report on Investments.

Let me end by thanking Ron Mock for taking the time to speak with me, I know he’s a very busy man but I always enjoy our conversations and still firmly believe Ontario Teachers’ is very lucky he’s at the helm of this venerable organization. If there are any mistakes or things that need editing, I will ask Ron and his senior staff to get back to me and I will edit this comment.