Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Euan Rocha of Reuters reports, Fresh opposition to Barrick Gold Corp’s executive pay structure from Canada’s largest pension fund manager:

The Canada Pension Plan Investment Board, the country’s largest pension fund manager, on Friday joined a slew of other investors opposing Barrick Gold Corp’s executive pay structure.

Toronto-based CPPIB said it plans to come out against the advisory vote on executive compensation that Barrick will be having at its annual shareholder meeting next week.

It also said it plans to withhold support from Brett Harvey, one of Barrick’s board members and the chair of its compensation committee. CPPIB own roughly 8.1 million Barrick shares, or less than a per cent of the company’s outstanding stock.

Last week, two smaller Canadian pension funds, the British Columbia Investment Management Corp (BCIMC) and the Ontario Teachers’ Pension Plan Board, said they plan to withhold support from Barrick’s entire board in light of their concerns with Barrick’s executive compensation package.

This marks the second time in three years that Barrick is facing heat over its executive pay. The company lost an advisory vote on its executive pay structure in 2013, prompting it to lay out a new compensation program last year. However, the company’s recent disclosure that Executive Chairman John Thornton was paid $12.9 million in 2014 unleashed fresh complaints.

Barrick contends that with its new pay structure, its senior leaders’ personal wealth is directly tied to the company’s long-term success.

But its detractors including well known proxy advisory firms Institutional Shareholder Services (ISS) and Glass Lewis contend that Thornton’s pay is not clearly tied to any established and measurable long-term performance metrics.Separately, CPPIB’s much smaller pension fund rival OPTrust also expressed its dismay with Barrick’s pay structure, stating that it also plans to come out against the advisory vote on the pay structure.

“Where it comes to Mr Thornton, we cannot easily discern any link between pay and performance … OPTrust has decided to also withhold votes from returning compensation committee members,” said a spokeswoman for the pension fund manager.

The investor outrage comes amid a growing outcry about large pay packages for senior executives at some Canadian companies.

Canadian Imperial Bank of Commerce lost its advisory vote on its executive compensation structure on Thursday, in the face of blowback over mega payments to two retired executives.

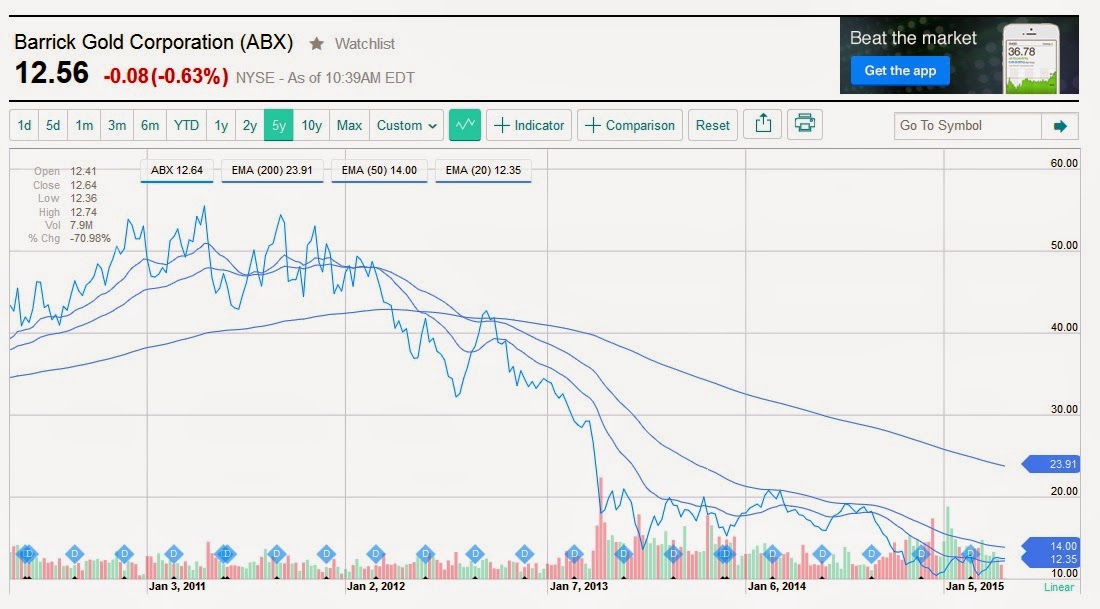

A quick look at Barrick’s five-year chart below tells me these investors are right to question executive pay at this company (click on image):

And it’s not just Barrick. If you look at Canada’s top 100 highest-paid CEOs, you will find other examples of overpaid CEOs whose executive compensation isn’t tied any established and measurable long-term performance metrics. It’s not as egregious as the U.S., where CEO pay is spinning out of control no thanks to the record buyback binge, but it’s getting there.

And Canada’s big pensions aren’t shy to vote against excessive compensation packages. Geoffrey Morgan of the Financial Times reports, CIBC shareholders vote down compensation-plan motion over CEO payout:

CIBC shareholders had their say on executive pay at the bank’s annual meeting Thursday and they let it be known they weren’t happy — voting down the bank’s resolution on its compensation plan.

Shareholders voted 56.9 per cent against the bank’s executive pay plan, but outgoing CIBC chairman Charles Sirois said that he didn’t believe the vote was a commentary “on our overall approach to compensation.”

“Based on feedback, we believe this year’s vote result on CIBC’s advisory resolution was significantly impacted by one specific item: the post-retirement arrangement provided to our former CEO,” Sirois said at the meeting in Calgary, his last with the bank before John Manley takes over as board chair.CIBC’s former CEO, Gerald McCaughey, was paid $16.7 million this year when the bank accelerated his retirement date. Similarly, the lender paid former chief operating officer Richard Nesbitt $8.5 million when it also sped up his departure from the company.

Analysts and investors have criticized both severance packages.

“Our belief is that shareholders were using the say-on-pay vote to express their dissatisfaction with the severance packages,” CIBC spokesperson Caroline van Hasselt said in an interview.

The vote marks the first time a Canadian company has failed a say-on-pay vote since 2013, according to Osler, Hoskin and Harcourt LLP. Sirois said a special committee would review the results of the vote, which is non-binding.

Two of the banks’ larger shareholders have said as much. The Canada Pension Plan Investment Board, which owns 404,000 shares of CIBC, and the Ontario Teachers’ Pension Plan, with 220,000 shares, voted against the motion.

Teachers said it “did not support the structure of the post-employment arrangements [with McCaughey and Nesbitt], believing them to be overly generous and not in the best interests of shareholders.”

For the same reason, Teachers’ also withheld its votes for the company’s nominated slate of directors – all of whom were re-elected although two with significantly less support than their peers.

Luc Desjardins and Linda Hasenfratz were both re-elected with 86 per cent and 85 per cent support, respectively. By contrast, every other member of the 15-person board was elected or re-elected with more than 90 per cent support.

Hasenfratz chaired the committee that oversaw executive compensation matters, of which Desjardins was also a member.

“We cannot support the members of the Management Resources and Compensation Committee based on our concerns with the succession planning process and post-employment arrangements made to both Mr. McCaughey and Mr. Nesbitt,” a statement from Teachers’ reads.

The CPPIB declined a request for comment.Despite their dissatisfaction with CIBC’s executive compensation, shareholders voted down three additional resolutions, put forward by Montreal-based Movement d’éducation et de défense des actionnaires, that would have altered the bank’s pay policies.

Shareholders voted more than 90 per cent against resolutions that aimed to close the gap between executive pay and that of frontline staff, rework the retirement benefits of all executives and restrict the use of stock options as compensation.

You might recall CIBC’s outgoing CEO Gerry McCaughey was warning about a retirement savings crisis in Canada and even said Canadians should have the choice to make additional, voluntary contributions to the Canada Pension Plan in order to avoid facing a significant decline in living standards when they retire. Of course, when it comes to his own retirement, Mr. McCaughey doesn’t have to worry one bit. CIBC paid him a nice, cushy package.

Things are slowly but surely changing at Canadian banks. BNN reports that Canada’s new bank CEOs are making less money than their predecessors as banks cut salaries and reduce CEO pensions in the face of shareholder pressure to curb super-sized executive pay:

A report on bank CEO pay by Toronto compensation consulting firm McDowall Associates shows base salaries for the new CEOs of Bank of Nova Scotia, Canadian Imperial Bank of Commerce and Toronto-Dominion Bank are all down 33 per cent compared with the outgoing CEOs’ salaries, while the base salary for the new CEO of Royal Bank of Canada is down 13 per cent compared with his predecessor.

Targeted total direct compensation – which includes grants of share units and stock options – is down between 11 per cent and 25 per cent for all four CEOs, the report shows. For example, the analysis shows Scotiabank CEO Brian Porter earned $8-million in total direct targeted compensation (excluding pension costs) in 2014, which is 25 per cent less than the $10.7-million that predecessor Rick Waugh earned in total targeted compensation in 2013.

Bernie Martenson, senior consultant with compensation firm McDowall Associates and previously vice-president of compensation at Bank of Montreal, said it is too soon to conclude that the banks have permanently lowered CEO pay because it is common for CEOs to get raises as they spend more time in the job.

But she said a number of current pay practices, including reducing the proportion of pay awarded in stock options, suggest overall pay is likely to be lower for the new CEOs over the long-term.

“You would naturally think there would be a difference between someone of long tenure and someone who is new in the role,” Ms. Martenson said.

“But I think the reduction of stock options in the last few years is starting to have an impact in terms of wealth accumulation. If you were to look out eight or 10 years for these new CEOs and compare the value of their total equity to that of their predecessors, I think it would be lower.”

Bank CEOs are still well compensated of course, but restraint is increasingly evident. Ms. Martenson points to the CEO pension plans at all four banks. Toronto-Dominion Bank CEO Ed Clark, for example, has the largest pension of departing CEOs at $2.5-million a year, while his replacement, Bharat Masrani, will have a maximum possible pension of $1.35-million a year when he retires.

At Scotiabank, Mr. Waugh’s pension plan was capped at a maximum of $2-million a year at age 63, while Mr. Porter is eligible for a maximum pension of $1.5-million available at 65. Royal Bank’s Gord Nixon had a $2-million maximum pension at 60, while his successor David McKay will have a maximum pension of $700,000 at 55, increasing to a final maximum of $1.25-million at 60.

Retired CIBC chief executive Gerry McCaughey had no cap on the size of his pension, but his pensionable earnings that formed the base for his pension calculation were capped at $2.3-million. His successor, Victor Dodig, has his annual pension capped at $1-million.

A number of shareholder groups – including the Canadian Coalition for Good Governance – have urged companies to reform pension plans because they create expensive funding obligations that last for decades.

Michelle de Cordova, director of corporate engagement and public policy at mutual fund group NEI Ethical Funds, said bank CEOs continue to have very generous pensions “that most people can only dream of,” but she sees a sense of moderation in the trends.

Ms. de Cordova, whose fund has lobbied the banks to curb their executive pay and link CEO pay increases to those of average Canadians, hopes the pay reductions in 2014 are not a temporary trend.

“It does suggest that there is some sense that the levels that pay and benefits had reached were perhaps too high, and boards have decided they need to do something about that,” she said. “I’d say they are still very generous arrangements, but it does seem that there is a sense that there needs to be some moderation, which is welcome.”

The report says all five of Canada’s largest banks have cut the proportion of stock options they grant their CEOs in recent years.

Banks previously decided how much equity they wanted to grant CEOs each year, and split the amount evenly between grants of stock options and grants of share units. In 2014, however, stock options accounted for 20 per cent of total new equity grants at the median for the five banks, while share units accounted for 80 per cent of new equity grants.

Ms. Martenson said banks faced pressure from regulators to reduce stock options following the financial crisis in 2008 because they were deemed to encourage executives to take risks by quickly pushing up the company’s share price to reap a windfall from quickly exercising options. Share units, which track the value of the company’s shares and pay out in cash, are considered less risky because they must be held for the long-term or even until retirement, creating incentives to build long-term growth.

Anyways, don’t shed a tear for bankers. Having worked as an economist at a big Canadian bank a while ago, I can tell you there are still plenty of overpaid employees at Canada’s big banks, and many of them are hopelessly arrogant jerks working in capital markets or investment banking and the irony is they actually think they merit their grossly bloated payouts (their arrogance is directly proportional to their bonus pool!).

Those of you who want to read more on executive compensation in Canada run amok should read a paper by Hugh Mackenzie of the Canadian Center for Policy Alternatives, All in a Day’s Work?. It’s a bit too leftist for my taste but he definitely raises important points on typing CEO compensation to long term performance.

As far as Canada’s large public pensions putting the screws on companies to rein in excessive executive compensation, I think this is a good thing and I hope to see more, not less of this in the future. Of course, the CEOs and senior managers at Canada’s top ten enjoy some pretty hefty payouts themselves and sizable severance packages if they get dismissed for any other reason than performance.

But nobody is voting on their compensation, some of which is well deserved and some of which is just gaming private market benchmarks to inflate value added over a four year rolling period. Critics will charge these pensions as the pot calling the kettle black. Still, I welcome these initiatives and hope to see other large pension and sovereign wealth funds join in and start being part of the solution to corporate compensation run amok.

Photo by TaxCredits.net

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712