Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.

Should CalPERS continue a 16-year-old ban on highly profitable tobacco investments or consider reinvesting after a lengthy study, risking a public-relations black eye and controversy?

A committee with all 13 CalPERS board members narrowly approved a staff proposal last week to begin a two-year review of tobacco investments, including outreach to members and others and an economic study costing $500,000 in an initial estimate.

But at the request of state Treasurer John Chiang, a board member and potential Democratic candidate for governor, the chairman of the investment committee, Henry Jones, agreed to reconsider the tobacco issue next month.

“Investing in tobacco companies is harmful to public health and to our fiscal bottom line,” Chiang said in a news release. “Smoking causes addiction, disease and death. No public pension fund should associate itself with an industry that is a magnet for costly litigation, reputational disdain, and government regulators around the world.”

The push from the state treasurer was an echo of the original decision in 2000 to ban tobacco investments. The state treasurer at the time, Phil Angelides, who made an unsuccessful run for governor four years later, led the drive for divestment.

The main argument for the ban (approved with a one-vote margin like the review last week) was that tobacco would be an unprofitable investment due to litigation, regulation, and massive health-related settlements with state and local governments.

CalPERS had a surplus then and had infamously, in the view of critics, told the Legislature the previous year that a large retroactive pension increase for state workers, SB 400 in 1999, would not cost “a dime of additional taxpayer money.”

Now CalPERS is underfunded, with 74 percent of the assets needed to pay future pensions in the last report, and concerned that another major economic downturn, like the last one, could drop funding to 50 or 40 percent, making a return to full funding unlikely.

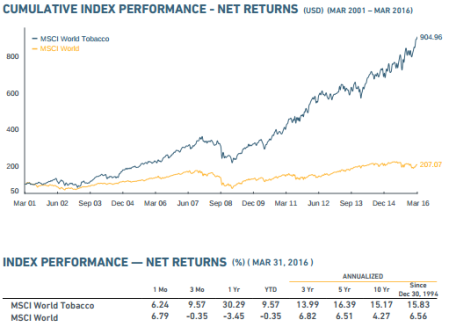

And despite the bleak outlook in 2000, tobacco has been one of the most profitable investment sectors. (see chart below) Analysts say tobacco stocks perform well in downturns, have growing sales in developing nations, and steadily pay big dividends.

“If a large enough proportion of investors avoids sin businesses, their share prices will be depressed, thereby offering the prospect of elevated returns to those less troubled by ethical considerations,” a Cambridge University professor, Elroy Dimson, said in a Credit Suisse report last year on “sin” business investments.

Tobacco’s burden is more than stigma. In 1998, four U.S. tobacco companies agreed to pay $246 billion over 25 years to settle about 40 lawsuits by states to recover medical service costs for smoking-related diseases.

California is one of the states that issued bonds that will be paid off by the tobacco money. A state treasurer’s report in 2007 said California had sold $16.8 billion worth of tobacco securitization bonds, $3.6 billion by 28 local agencies and the rest by the state.

California voters approved a 25-cents-per-pack tobacco tax, Proposition 99 in 1988, for a program to prevent and discourage the use of tobacco. In November 2012 voters narrowly rejected a $1-per-pack tax for cancer research, 49.8 to 50.2 percent.

This year, signatures are being gathered to place a $2-per-pack tobacco tax for public health care on the November ballot.

The new initiative is backed by a union representing public health care workers, SEIU, and Tom Steyer, a billionaire former hedge-fund manager, environmentalist and Democratic campaign donor, who is mentioned as a potential candidate for governor.

An analysis of the California Public Employees Retirement System divestment policy last fall found that the tobacco ban had cost $2 billion to $3 billion through 2014, depending on the methodology used, Wilshire consultants said.

CalPERS staff concluded that the cost of other divestments related to Iran, Sudan, firearms, and emerging market principles are relatively minor (in an investment fund valued at $296 billion last week) and could be reviewed under a general policy.

But the tobacco loss was deemed large enough to merit a separate review. The rationale for the new look at tobacco is the “fiduciary duty” CalPERS board members have under the state constitution to act in the best interests of pension recipients.

A union-backed constitutional amendment, Proposition 162 in 1992, a response to a state budget “raid” on CalPERS funds, made paying pensions the top priority of public pension boards, ahead of what had been an equal goal of minimizing employer costs.

A staff agenda item last week said the constitution states, among other things, that the CalPERS board “ . . . shall diversify the investments . . . so as to minimize the risk of loss and to maximize the rate of return . . .”

A substitute motion by Treasurer Chiang’s representative on the CalPERS board, Grant Boyken, to reject the review and reconsideration of tobacco investments failed on a 6-to-5 vote with one abstention.

“While my heart would absolutely love to support the substitute motion,” said board member Priya Mathur, “I think from a fiduciary perspective process is everything, and it’s really important that we engage in a robust process to review something that has substantial financial implications for the portfolio.”

Mathur’s successful motion called for an expert long-term economic study of tobacco, outreach and education to stakeholders for their input, learning how other institutional investors have offset tobacco losses, and alternatives to tobacco divestment.

The motion also scheduled a board discussion of tobacco divestment in January 2018 and a vote the following the month. Reviews of non-tobacco divestments would be triggered if losses exceed a threshold to be set later.

In the 7-to-4 vote with one abstention, voting “yes” were state Controller Betty Yee, Mathur, Bill Slaton, Dana Hollinger, Rob Feckner, Ron Lind, and Theresa Taylor. Voting “no” were Chiang, J.J. Jelincic, Michael Bilbrey, and Richard Costigan.

Katie Hagen, representing Human Resources director Richard Gillihan, abstained. Following CalPERS custom the committee chairman, Henry Jones, only votes to break a tie.

The California State Teachers Retirement System added a 21st risk factor to its investment policy as the basis for tobacco divestment: an industry product harmful to human health that results in lawsuits, regulation, and avoidance by other investors.

CalSTRS eliminated most tobacco investments by changing its benchmarks in 2000, then completed the divestment in 2009 by banning tobacco investments by active managers. A spokesman said tobacco divestment has cost CalSTRS more than $4 billion.

“CalSTRS is a patient, long-term investor, and the ultimate economic impact of divestment from tobacco cannot yet be determined,” Jack Ehnes, CalSTRS chief executive officer, said in a blog post on Aug. 21, 2013.

“Similarly difficult to assess is the social impact of this action,” he said. “What we do know is that CalSTRS no longer exerts institutional strength in this market sector and cannot attempt to leverage that financial strength to achieve reform.”

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712