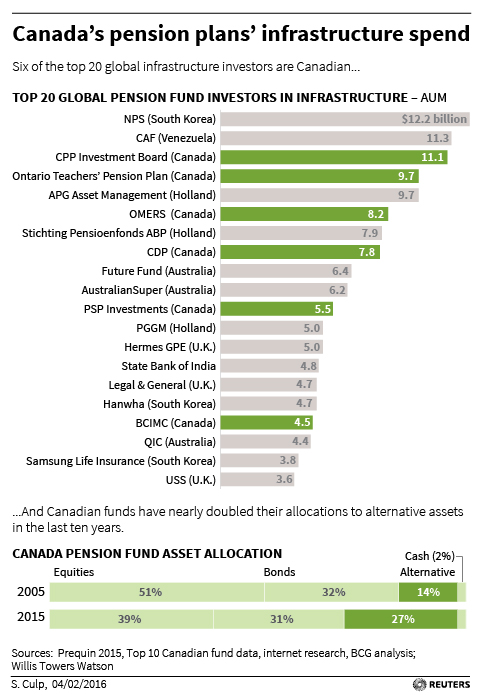

Canada’s big pension funds pioneered the process of directly investing in infrastructure; as the above chart shows, the country’s largest funds are some of the biggest infrastructure investors in the world.

But those pension funds are starting to pump the brakes on big infrastructure deals in what one official calls an “overheated” market, according to a Reuters report.

More from Reuters:

Canada’s biggest pension funds say they are walking away from more and more global infrastructure deals, citing concerns that intense competition for assets has driven valuations too far.

Some investors, particularly in private equity circles, complain that the Canadian funds – dubbed “maple revolutionaries” because of the strategy of direct equity investments they pioneered in the 1990s – have a tendency to overpay.

Senior executives at the leading Canadian funds defend the merits of past infrastructure deals, but say they are worried prices no longer reflect the illiquidity of the assets, which cannot be sold quickly like stocks or bonds.

“The market is overheated. We have stepped out of the bidding for a lot of assets over the last two or three years,” a senior executive at one of Canada’s biggest public pension funds, who declined to be named, told Reuters.

[…]

Canadian executives said their funds should avoid being drawn into bidding wars as part of competing consortia.

“You’ve got to try and avoid auctions because they can get crazy. If you’re just walking around with an open cheque book in these markets you’re going to pay too much,” said another executive with one of Canada’s three largest pension funds, who declined to be named because of the sensitivity of the issue.

The whole article is worth reading, and is filled with insights from anonymous pension officials, investment bankers and private equity insiders.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712