Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst.

On Wednesday, I attended the first ever cap intro emerging managers conference here in Montreal. Before covering it, let me begin with a comment which Simon Schilder recently wrote for Hedgeweek, Emerging hedge fund managers – challenges and solutions:

Who would want to be a start-up hedge fund manager? Simon Schilder, partner at Ogier in Jersey, and TEAM BVI UK member with BVI Finance, examines the challenges facing the next generation…

******The challenges facing the next generation of hedge fund managers are starker than ever before, with increased barriers to entry caused by an ever increasing regulatory burden coupled with the continued existence of a macro-economic environment impacting upon investment performance.

For emerging managers seeking to attract investor allocations, the need to be able to demonstrate a proven track record to prospective investors has never been more important. Generally institutional investors will look to a three-year track record as a pre-requisite for investing, whilst funds-of-funds, family offices and high net worth investors will frequently be comfortable with a shorter track record than this (perhaps 12 to 18 months?). The challenge facing an emerging manager therefore is how does it achieve this track record as cost effectively as possible without drowning under the operational constraints of running an investment management business. In addition to surviving long enough to develop a track record, the “holy grail” of target assets under management (AUM) has long been spoken as being an AUM of USD100 millon, as that number then very quickly becomes USD200 million or USD300 million as the fund suddenly comes onto the radar of institutional managers whose own investment restrictions prevent them allocating their investment capital to smaller funds.

With the deck very much stacked in favour of established hedge fund managers, where does this leave emerging managers without the benefit of significant seed capital to rely upon it getting through the early years? For most emerging managers, their survival during these early years depends upon their ability to manage their cost bases efficiently and effectively. As part of doing this comes the choice of the most appropriate jurisdiction for domiciling their fund vehicle.

Given its historic cost advantages, the British Virgin Islands (BVI) has long been the natural choice of jurisdiction for emerging managers looking for a jurisdiction to domicile their hedge funds. For such managers, the traditional route was to establish as either a “Professional Fund” (being a fund for “professional investors with a minimum investment of USD100,000) or a “Private Fund” (being a fund for a maximum of 50 investors, making offers to invest on a private basis). These two categories of funds remain consistently the most popular fund vehicles for managers establishing their funds in BVI. To complement these established fund products, during 2015, the BVI introduced two new categories of funds aimed specifically at the small/ mid-sized/ emerging managers, in the form of the “Incubator Fund” and the “Approved Fund”. These two new fund products offer such managers solutions which might not otherwise be available to them.

Whilst an Incubator Fund and an Approved Fund are broadly similar fund products, there are subtle differences, which appeal for different types of investment managers.

The Incubator Fund product is aimed at the start-up investment managers, with one key feature of the regime being that upon the second anniversary of being an Incubator Fund or, if sooner, once the fund has grown beyond a stated minimum size (more than 20 investors or assets under management of more than USD20 million for two consecutive months), the Incubator Fund is required to convert to either a Private Fund, a Professional Fund or an Approved Fund. This therefore gives start-up/ emerging managers an opportunity to get a foot in the door, by offering them a cost effective regulated fund solution to bring their funds to market whilst managing their operational cost base. A point of note is that an Incubator Fund has no mandatory service providers, such that in establishing an Incubator Fund, the promoters are free to appoint as many or few service providers as it wishes, further enabling it to manage fund expenses during the early years.

An Incubator Fund is available to “sophisticated private investors” only (for these purposes, to be a “sophisticated private investor” a person must be invited to invest and the amount of his or her minimum initial investment must not be less than USD20,000). As mentioned above, Incubator Fund status is limited to two years (with a possible further 12 month extension available at the discretion of the BVI’s regulatory, the Financial Services Commission), following which the Incubator Fund must either (i) convert into a Private Fund; Professional Fund; or an Approved Fund or (ii) cease operating as a fund.

An Approved Fund by contrast is very much aimed at family offices and friends and family offerings. As with Incubator Funds, an Approved Fund is available to a maximum of 20 investors, but distinct from an Incubator Fund, its maximum aggregate assets under management may not exceed USD100 million (or its equivalent in another currency). Additionally and unlike an Incubator Fund, there is no time limit on the duration in which a fund can take advantage of its eligibility for Approved Fund status, such that an Approved Fund’s status is indefinite. To the extent that an Approved Fund exceeds 20 investors or assets under management of more than USD100 million for two consecutive months, it is required to notify the FSC of that fact in writing and submit an application to convert and so become recognised as either a Private Fund or a Professional Fund. Other than a requirement to have a fund administrator, there are no other mandatory service providers.

In both cases, the conversion process for an Incubator Fund or an Approved Fund is reasonably straight forward and can be implemented reasonably expediently and, critically, at the time of converting (and so availing the fund to a more onerous regulatory regime), the longer term financial viability of their investment management business will be much more certain.

I’m not qualified to discuss the pros and cons of an Incubator Fund or an Approved Fund, but I agree with Mr. Schilder, for all sorts of reasons (especially regulatory), the deck is increasingly stacked against all emerging managers (to be brutally honest, this is the worst environment to start any fund, you need some major financial reserves and lots of patience to succeed).

On Wednesday, I attended the first ever cap intro event for emerging managers held here in Montreal. The group behind this initiative is the Emerging Managers’ Board (EMB), a non-profit organization whose mission is to promote and contribute to the growth of Canadian emerging managers. It also strives to educate asset allocators and investors about the benefits of investing with local talent.

You can find a list of all the members that participated in the conference here. Admittedly, a lot of people did not show up but there was a strong presence and overall, it was a very good event.

The conference took place at Club St-James on Union street, which is a nice venue for this type of event. I got there at 9:45 in the morning just in time to listen to parts of the first panel discussion on how emerging managers can emerge featuring three speakers:

- Peter Pavlina, Managing Director at Hamersley Partners

- Jeffrey Sprotts, Chief Executive Officer at Prophecy Asset Management

- Floyd R. Simpson II, Manager Research Analyst at FIS Group

This was a good discussion filled with advice for emerging managers. They covered topics like existing emerging manager platforms, how to properly communicate and follow up with prospective investors, which consultants to target, why emerging managers should avoid pensions when trying to emerge (except those that have emerging manager platforms) and why emerging managers need to stay humble, have realistic growth expectations and communicate their process and strategy very clearly, including what their real niche/ competitive edge is relative to others (and why experience is not an edge).

After that panel discussion, Geneviève Blouin of Altervest who is president of this organization, asked me to step in for someone rom FIS who wasn’t there for the one-on-one 15-minute manager “speed dating” session. I said “sure” as I love talking shop with managers and grilling them hard (I was nice).

The first manager I met was Jean-Philippe Bouchard, Vice-President at Giverny Capital, a long only value shop that was founded by François Rochon in 1998. Prior to founding Giverny, Mr. Rochon was managing a private family portfolio. You can see their impressive returns on their website here.

Giverny Capital is basically a value investor which focuses on North American equities. They are sector agnostic but Jean-Philippe told me they don’t invest in energy or commodity shares.

In order to produce outsized returns over a long period, they have a fairly concentrated portfolio of 20-25 names and Jean-Philippe told me that the top ten positions make up roughly 60% of their portfolio (basically use the Warren Buffett approach, take concentrated bets in a few stocks you know well).

They use Factset and Morningstar to screen stocks with a high ROE and EPS growth and low debt, and focus on well run companies that are market leaders with competitive advantages and low cyclicality.

To give you an idea on stocks they invest in, I looked at their latest (US) 13-F holdings which are available here. Here you will find names like Bank of the Ozarks (OZRK), Carmax (KMX), LKQ Corp. (LKQ), Walt Disney (DIS), and Visa (V). In Canada, the fund made great returns buying Dollarama (DOL.TO) early on.

Quite impressively, Giverny Capital now manages close to $800 million and may be in line to become the next Letko Brosseau or Jarislowsky Fraser in Montreal.

After that meeting, I met Philippe Hynes of Tonus Capital, another young, bright long only portfolio manager with a value/ contrarian investment philosophy.

Tonus Capital’s investment philosophy is right on the main page of its website:

The objective of Tonus Capital is to outperform the market return over the long term. It is our firm belief that one of the best strategies to accomplish this is to focus on a small number of companies that we understand well and to invest in them when they are trading significantly below intrinsic value. We are market-cap agnostic, which means that our investment decisions are not determined by a company’s market capitalization but only by its potential to generate a strong absolute return over time.

Tonus was founded in 2007, it has an 8 year track record and currently manages roughly $70 million in AUM invested in North American equities.

Their portfolio is concentrated, consisting of 15-20 positions, mostly in financials and consumer products sector and like Giverny, Tonus is sector agnostic but it does invest a bit in the energy sector if opportunities present themselves.They focus on companies with no debt and net cash that are typically out of favor and ready to turn around over the course of the next three years.

You can view their performance below (click on image):

Philippe told me his objective is to return 50% to 100% over a three year investment horizon and if he has strong conviction, he will invest up to 10% in one company. Currently, he is 30% cash and researching which companies he wants to scale into.

[Note: Whenever you are talking to a long only or L/S equity fund, be careful to make sure the benchmarks they use to evaluate their performance matches the market cap and risk of the stocks they invest in.]

He told me he looks at IPOs of companies that are not tracked and looks at stocks making 52-week lows that fit his strict criteria to invest in and that can turn around nicely. Some examples of stocks he invested in include Sleep Country Canada (ZZZ.TO), a leading specialty mattress retailer in Canada, and Blue Bird (BLBD), the main manufacturer of school buses in North America.

I told him that I trade these markets, focus mostly on biotech but I screen over 2000 stocks in 100 industries and thematic portfolios I created for free on Yahoo Finance over the last ten years (thank you Neil Cunningham!), and I must admit, contrarian investing isn’t for the faint of heart.

I honestly prefer the approach of Martin Lalonde at Rivemont who looks at stocks making 52-week highs or breaking out to get ideas of which companies he wants to scale in and out of.

But the beauty of these investment cap intro conferences is you get to meet different individuals with different approaches and styles. Diversity is a good thing and just because a style doesn’t work for one manager, it doesn’t mean it can’t work for another who takes a longer term approach.

Let me give you another example, a couple of weeks ago, Fred Lecoq and I went to Old Montreal to visit a stock trader at Jitney who used to work with me at the National Bank. This trader is a very good trader, probably one of the best in Canada, and I know this because out of 100 + prop traders at the National Bank back in 1999, he is one of the only ones left doing this for a living, eating what he kills. He told me he has never had a losing month in over 20 years.

What’s his secret? He trades boring Canadian companies that aren’t always very liquid and he has mastered the art of reading trading action on the stocks he follows closely and will cut his losses quickly when he is wrong (he will hold positions overnight but not often).

I told him I love trading volatile biotech stocks that swing like crazy and are very liquid but I have to endure gut wrenching swings that make me puke at times (I prefer upside volatility). Not for him but he told me something good: “It doesn’t matter what you trade, trade what you’re comfortable with but cut your losses early” (I don’t but use big biotech dips to add to positions I have conviction on).

In other words, there is no one way to approach these markets. Some like trading boring stocks, others prefer trading highly volatile and risky stocks, some buy the breakouts, others look at buying 52-week lows. You need to be very comfortable trading what you are trading and be true to your nature.

Now, after those two manager meetings, the person I was replacing showed up and I was excused and asked to go upstairs to mingle. There, I hooked up with Karl Gauvin and Paul Turcotte of OpenMind Capital.

Unlike many other emerging managers, Karl and Paul come from an institutional background. They are extremely bright and nice and have developed a few adaptive smart beta and L/S equity strategies for US stocks which you can read about here.

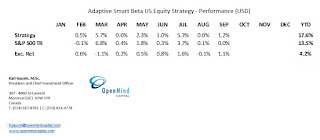

Karl shared with me the actual returns of OpenMind Capital’s Adaptive Smart Beta US Equity strategy as of September 30th (click on image):

These aren’t pro forma returns, these are actual returns of a strategy delivering in excess of 400 basis points over the S&P 500. And this is a highly scalable strategy (they calculated $5 billion capacity).

Their active smart beta portfolio will be adapted based on the type of volatility regime. They use their smaller cap tilt model during regime of good volatility and our larger cap tilt model during regime of bad volatility. Overlap between these two model range between 60 and 70% on average.

Now, Karl and Paul aren’t the flashy sales types, far from it, they will admit they are the worst salesmen. They are also brutally honest and tell you under which vol regime they can outperform and when they will underperform.

If you want to meet smart people who can offer you a lot more than just money management, these are the type of partners you want by your side. You should definitely talk to Karl and Paul and you can contact them here (like others I cover, they are francophone but speak English).

Speaking of super smart and nice people you want to partner up with, after Karl and Paul, I hooked up with Jacques Lussier, President and CEO of Ipsol Capital. It was Sean Sirois who introduced us (Sean used to work at Deutsche but recently joined Ipsol).

Jacques is very well known in Quebec and the rest of Canada. An academic with impeccable credentials, he used to run a mammoth fund of hedge funds portfolio at Desjardins which suffered devastating losses during the financial crisis and was eventually shut down (at the time, this fund of funds was bigger than the one at Ontario Teachers and was running beautifully for many years, until the financial crisis hit it) .

As he told me, that was a very humbling experience, but even before this happened, he was questioning why they paid hedge funds 2 & 20 for strategies they can develop cheaply internally (and started doing internally).

It was the first time I met Jacques Lussier and he really impressed me because he is humble, wickedly brilliant and has an insatiable thirst to continue learning about markets and research new strategies.

We talked about his two books but he told me he enjoyed writing his second one, Successful Investing Is a Process: Structuring Efficient Portfolios for Outperformance. You can read a book review from Mark Kritzman here.

What I like about Jacques Lussier and Ipsol Capital is they have a research driven approach to everything and despite being stacked with PhDs, they are humble enough to admit on their presentation that Return = Alpha + Beta + Luck (see a copy of their presentation from October 2015 here).

Jacques and I talked at length about smart beta, risk parity, and behavioral factors (like animal spirits) impacting markets. He told me a lot of people are doing smart beta but many models are wrong or out of date. On risk parity, he said while people make a big fuss, claiming it causes a lot of volatility in markets, the truth is risk parity strategies are not very popular with big investors (concerned with leverage in these strategies).

He also told me that while financial practitioners are good at listing risk factors, very few are good at forecasting risk factors (with exception of volatility which he said Garch models forecast with a 30-40% accuracy rate).

He also told me that unlike other large funds, Ipsol is very technology and research driven and enjoys partnering up with clients they can learn and interact with. He does not believe in 2 & 20 and he and his team are developing a platform where investors will be able to gauge the performance of all their alpha strategies very quickly (will be ready by June 2017).

Look, I am going to be honest with you, Jacques Lussier is no emerging manager, he is well known which is why Ipsol Capital manages in excess of $300 million. But if you’re looking for scale, brains, and a more fruitful relationship, you should definitely contact them here (Jacques is fluently bilingual but I must warn you, just like Karl and Paul, he’s not the ‘salesy’ type and told me “sales bore him”).

At lunch, we all sat at the same table and listened to another panel discussion featuring three panelists:

- François Rivard, President and CEO of Innocap

- Marie Helène Noiseux, professor of finance at UQAM

- Ian Fuller, Managing Director at Westfuller Advisors

This too was an excellent panel and there were some great insights from all panelists (if possible, they should record all these panel discussions).

Everyone impressed me and they all talked about staying focused, realistic and developing good meaningful relationships with investors. They all said managers need to stick to what they know best: “If you’re good at long only, stick to that, don’t try shorting stocks to charge heftier fees.”

They mentioned that running a hedge fund requires business acumen, not just investment acumen, and if you don’t take care of business, you will fail.

At one point, Ian Fuller talked about how he’s seen smart but abrasive and arrogant managers who rubbed him the wrong way and so even if he liked their strategy and thought they were very good, he would pass from recommending them to the family offices he works with (couldn’t agree more, seen my fair share of arrogant hedge fund jerks, who needs them?).

Marie Helène Noiseux talked about the need to develop good long term relationships with your clients and I agreed with her on that front.

But it was François Rivard of Innocap who really struck a chord with all his comments. This guy knows what he’s talking about and it shows. He told emerging managers in the room that many of them need a “reality check” and to ask themselves tough questions on whether they truly are “institutional quality funds.”

He rightly noted “institutional clients are not for everyone” and quite often, especially when starting off, you are better off focusing on high net worth and family offices who are not as onerous in their demands.

He is absolutely right. There are so many emerging managers out there wasting their time focusing on institutions which are never going to invest with them right off the bat. Unless you’re Chris Rokos or Scott Bessent and possibly have one up on Soros, forget institutional money, they will not invest in your new fund. They will choose established hedge funds and put them on Innocap’s managed account platform (or invest through the traditional fund route).

Having said this, François Rivard did mention that they were approached by a large US pension which wanted to invest $500 million in 10 niche emerging managers ($50M allocation for each) and these are mandates he and his team at Innocap are more than happy to assist clients with (I highly recommend you contact François here and talk to him about such mandates and other ways they can assist you in managing your hedge fund allocations).

During the Q & A, I asked the panelists about the importance of developing incubator funds and what they thought of operational risks and slippage costs at smaller funds and whether sliding performance fees make sense for some strategies where returns are lumpy.

Again, François Rivard answered all my questions nicely. He said incubator funds exist but your need a sponsor. As far as operational risks and slippage at smaller funds, he noted many big prime brokers are cutting smaller managers, not dealing with them (even if they have $100M or $200M under management) and this impacts their performance (Innocap has ways to address this issue).

As far as fees, he said there is a “repricing revolution” going on in the industry and many big investors are fed up with paying 2 & 20 and refuse to even with marquee names. “They are seeing managers get extremely rich but little benefits to their plan members.”

I couldn’t agree more which is why in my comment on Rhode Island meets Warren Buffett, I expressly stated hedge funds and private equity funds, many of which are underperforming and have a misalignment of interests with their limited partners, are effectively buying allocations and collecting fees no matter how well or poorly they perform.

This comment was suppose to be brief and it’s way too long. Let me end by thanking Geneviève Blouin of Altervest, Charles Lemay of Addenda Capital, and many others who helped organize this conference.

I am also glad I ran into former colleagues of mine like Simon Lamy who was previously a VP, fixed income at the Caisse. Simon hooked up with Keith Porter, previously AVP, emerging markets at the Caisse and CIO and emerging markets portfolio manager at Altervest, and along with Vincent Dostie, they just launched an emerging markets funds (Mount Murray Investment) which I truly hope will be a huge success. All great guys with solid experience.

I did my part in bringing exposure to emerging managers and hopefully the following conferences will be just as interesting with great insights from respected panelists.

Some advice for follow-up conferences. First, please put panels between tables during those speed dating sessions because if the tables are too close, it gets chatty and hard to hear each other in the room.

Second, if possible, please tape panel discussions with guest experts and put them on a dedicated YouTube channel. It would also be nice if managers discuss their fund and strategy in a five minute clip on this YouTube channel (to my surprise, very few emerging and existing managers harness the power of social media).

But Geneviève told me she hates running after managers and I don’t blame her one bit. In fact, I reached out to a few I met last night asking them to provide me with 3 key insights they learned from the conference and only Philippe Hynes of Tonus Capital came back to me:

- Importance of keeping true to our style

- Importance to understand the supply and demand dynamics of the industry and see if the product the manager is supplying is competitive and in demand

- It is very hard for small managers to penetrate the pension plan circle, especially in Quebec as they are very conservative, but the product needs to be differentiated

Anyways, I hope you all enjoyed reading this comment. You can find a list of all the members that participated in the conference here.