Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Hal Dardick of the Chicago Tribune reports, Mayor floats plan to fix city’s smallest pension fund:

Mayor Rahm Emanuel on Monday floated a new idea to fix the city’s smallest government worker pension system, one that he hopes will become a model to address far greater financial woes in the largest retirement fund.

Under the plan, both taxpayers and newly hired city laborers would pay more toward pension costs, and in return, workers could retire two years earlier.

But the Emanuel administration declined to say precisely how much money such an approach could save, and the mayor does not plan to press state lawmakers for approval during the final scheduled week of spring session.

City officials hope the plan would pass muster with the Illinois Supreme Court, which in March struck down an earlier Emanuel plan aimed at addressing the money shortfalls in pension funds covering laborers and municipal employees.

What “we want is a concrete and sustainable funding path that’s not going to get caught up in any legal process, and if there should be some sort of lawsuit on any of this, this is extremely strong, and should not put us in a position of two years of uncertainty like we were” on the previous plan, said Michael Rendina, senior adviser to the mayor.

The Emanuel administration provided an outline of the plan Monday. Starting next year, newly hired employees would pay 11.5 percent of their wages toward retirement, compared with 8.5 percent today. Employees hired from 2011 to 2016 also could opt to pay more into the pension fund, city officials said. In exchange, workers who make the higher pension payments could retire at 65 instead of 67. The plan would not affect people hired by the city before 2011 or laborers who have already retired.

The city would gradually increase how much it puts into the laborers’ pension fund, with the aim of reaching 90 percent funding by 2057. To come up with part of the money, Emanuel would spend all of the proceeds from a $1.40-a-month tax hike on emergency services slapped onto all city phone bills in 2014. That boosted city revenue by about $40 million a year.

The administration, however, did not provide a schedule of how payments would increase the next 40 years. City Hall officials also said they don’t yet have figures on how much money they expect to save under the proposal. The laborers’ fund is about $1.2 billion short of what’s needed to pay retiree benefits. It’s at risk of going broke in about 11 years.

Joe Healy, business manager for Laborers Local 1092, said the two unions representing city laborers have agreed to the deal, figuring that the extra employee contributions represent an equal trade for retiring two years earlier. But Healy also cautioned that the Laborers’ Annuity and Benefit Fund is still reviewing the numbers on the value of the trade-off.

Emanuel went back to the drawing board after the state’s high court rejected his 2014 plan to restore financial health to both the laborers’ fund and the Municipal Employees’ Annuity and Benefit Fund. Justices ruled that reduced cost-of-living increases violated a clause in the Illinois Constitution that states retiree benefits “shall not be diminished or impaired.”

But the court left unanswered the question of whether the city could require employees to pay more toward their retirement and also suggested the city could give employees the option of keeping their own plan or switching to a new one, provided they were offered something of value — “consideration” in legal contract parlance. With the mayor’s new plan, the earlier retirement is the consideration, Rendina said.

Ralph Martire, the executive director of the Center for Tax and Budget Accountability who was critical of the legal soundness of the Emanuel’s earlier plan, said the outline of the latest one likely would fall within the boundaries of the constitution. The city can “create any kind of new” pension plan it wants for employees yet to be hired, and it can provide options to current employees — provided one of the choices is keeping their current plan.

“I don’t see how there’s a constitutional complication to it,” said Martire, who added one caution: If future benefits fall below those provided by Social Security — which city workers don’t receive — the city could ultimately run afoul of federal law and have to pay more into the funds.

The $1.2 billion laborers’ shortfall is significantly smaller than the ones faced by city pension funds for municipal workers, police officers and firefighters. The municipal workers’ fund alone is nearly $10 billion short and at risk of going broke within eight years.

Still, the mayor hopes that the new laborers’ bill serves as a model for talks with the municipal workers’ fund, and city officials have started talking to leaders of some of the dozens of unions that represent those city employees. “If we reach agreement with them, we’ll have to come up with alternate funding source for that,” said Alexandra Holt, the city’s budget director.

Emanuel’s latest pension plan comes as he’s under pressure for solutions. After the Supreme Court ruling in March, Wall Street agencies that evaluate city creditworthiness warned the city that it could further downgrade the city’s already low debt ratings if it did not come up with a plan. At the time, Emanuel financial aides told the analysts that the city would come up with a plan within weeks.

Given unresolved problems with all four city pension funds, it’s uncertain whether proposing a plan for the smallest of the funds will soothe the angst felt on Wall Street over the city’s financial problems. Emanuel last week won City Council approval to borrow up to $600 million, and a lowered credit rating could increase interest costs.

Karen Pierog of Reuters also reports, Chicago, unions reach deal to rescue city pension fund:

Chicago would increase its annual contribution to its laborers’ retirement system, as would newer workers, in order to save the fund from insolvency, under an agreement in principle announced on Monday by Mayor Rahm Emanuel and unions.

While the city hailed the deal for the smallest of its four pension systems, a solution has yet to emerge for its largest fund, covering more than 50,000 active and retired municipal workers.

The city will dedicate $40 million a year from a 2014 increase in its 911 telephone surcharge to the laborers’ fund, under the agreement. Workers hired after Jan. 1, 2017, would have to contribute 11.5 percent of their salaries, while those hired after Jan. 1, 2011, would choose between contributing 11.5 percent and retiring at age 65 or contributing 8.5 percent and retiring at 67.

Chicago needs the Illinois legislature to approve later this year a five-year phase-in of the higher contributions by the city to the laborers’ system to attain a 90 percent funding level by 2057. The fund, which had $1.36 billion in assets at the end of 2014, covers nearly 3,000 active workers and 2,700 retirees.

In March, the Illinois Supreme Court tossed out a 2014 state law aimed at making the laborers’ fund and the municipal pension system solvent by requiring higher contributions from the city and affected workers and reducing benefits.

Emanuel has said that ruling put Chicago into a straitjacket by reaffirming iron-clad protection in the Illinois Constitution against reducing public sector worker pension benefits.

Chicago Budget Director Alex Holt said the deal for the laborers’ fund does not reduce benefits but gives newer workers choices as to when they can retire.

“Choice is one of the areas that the Illinois Supreme Court indicated should pass constitutional muster,” she told reporters in a conference call.

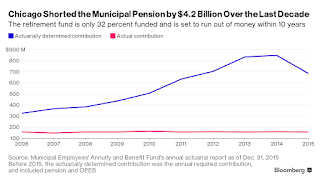

The impact of the high court’s ruling, along with new accounting changes, more than doubled the unfunded liability for the municipal fund to $18.6 billion at the end of 2015 from $7.13 billion at the end of 2014, according to an actuarial report by Segal Consulting released last week. It predicted the system will run out of money within the next 10 years in the absence of increased funding.

“We feel that the solution we laid out for laborers offers a good framework for discussions with the (municipal) fund,” said Chicago Chief Financial Officer Carole Brown.

Those new accounting changes really sting. Elizabeth Campbell of Bloomberg reports, Chicago’s Pension-Fund Woes Just Became $11.5 Billion Bigger:

Chicago’s pension-fund shortfall just got $11.5 billion bigger.

Thanks to the defeat of the city’s retirement-fund overhaul by the Illinois Supreme Court and new accounting rules, Chicago’s so-called net pension liability to its Municipal Employees’ Annuity and Benefit Fund soared to $18.6 billion by the end of 2015 from $7.1 billion a year earlier, according to its annual report. The fund serves some 70,000 workers and retirees.

The new figure, a result of actuaries’ revised estimates for the value in today’s dollars of benefits due as long as decades from now, doesn’t change how much Chicago needs to contribute each year to make sure the promised checks arrive. But it highlights the long-term pressure on the city from shortchanging its retirement funds year after year — decisions that are now adding hundreds of millions of dollars to its annual bills and have left it with a lower credit rating than any big U.S. city but once-bankrupt Detroit.

“The longer they wait to get this fixed, the more expensive it’s going to get for the city’s taxpayers,” Richard Ciccarone, the Chicago-based president of Merritt Research Services LLC, which analyzes municipal finances.

The estimate presented Thursday to the board of the municipal fund, one of Chicago’s four pensions, will add to what had been an unfunded retirement liability for the city estimated at $20 billion.

A key driver was the court ruling striking down Mayor Rahm Emanuel’s plan that cut benefits and boosted city and employee contributions. Without it in place, the fund is now set to run out of money within 10 years.

That triggered another change. New accounting rules, adopted tokeep governments from using overly optimistic investment-return forecasts to mask the scale of their liabilities, require them to use more modest assumptions once pension plans go broke. As a result, the reported liabilities jump.

The Chicago fund is notable because very few governments have been affected by the change, according to Ciccarone. “The investment returns are not going to fix the problems themselves,” he said.

City officials from Emanuel to Chief Financial Officer Carole Brown have said the city is working on a solution to shore up the retirement system. Chicago has already passed a record property-tax increase that will bolster the police and fire funds.

Under the traditional way of estimating the municipal fund’s obligations, which is how annual contributions are set, the shortfall rose to $9.9 billion as of Dec. 31, based on market value of its assets, according to the actuaries report. That’s up from $7.1 billion a year earlier.

The pension is only 32 percent funded — meaning it has 32 cents for every dollar it owes — compared to 42 percent last year, according to the actuaries. And it has to sell 12 percent to 15 percent of its assets every year to pay out benefits.

City officials are having “very good discussions” with the unions about the issue, according to Emanuel, who has made clear that he disagrees with the court’s ruling to throw out his plan.

“We’re working through the issue to get to what I call a responsible way to fund their pensions within the confines, the straitjacket that the court has determined,” Emanuel told reporters at City Hall on Wednesday.

A proposal is pending in the state legislature to bolster funding for the benefit fund. The plan would ensure it’s 90 percent funded by the end of fiscal year 2055. Jim Mohler, executive director of the fund, told board members on Thursday that it’s a “fluid situation.”

I’ve already covered Chicago’s pension nightmare in detail. If you ever want to get a glimpse of America’s future pension crisis, have a look at what’s going on in Chicago because it’s coming to a city near you. I guarantee you will see a series of never-ending crazy hikes in property taxes to pay for chronically underfunded public pensions.

When Greece was going through its crisis last year, my uncle from Crete would call me and blurt: “It’s worse than Chicago here!” referring to the old Al Capone days when Chicago was the Wild West. Little did he know that in many ways, Chicago is much worse than Greece because Greeks had no choice but to swallow their bitter medicine (and they’re still swallowing it).

In Chicago, powerful public unions are going head to head with a powerful and unpopular mayor who got rebuffed by Illinois’s Supreme Court when he tried cutting pension benefits. Now, they are tinkering around the edges, increasing the contribution rate for new employeesof the city’s smallest pension, which is not going to make a significant impact on what is truly ailing Chicago and Illinois’s public pensions.

All these measures are like putting a band-aid over a metastasized tumor. Creditors know exactly what I’m talking about which is why I’ll be shocked if they ease up on the city’s credit rating.

Importantly, when a public pension is 42% or 32% funded, it’seffectively broke and nothing they do can fix the problem unless they increase contributions and cut benefits for everyone, top up these pensions and introduce real governance and a risk-sharing model.

When people ask me what’s the number one problem with Chicago’s public pensions, I tell them straight out: “Governance, Governance and Governance”. This city has a long history of corrupt public union leaders and equally corrupt politicians who kept masking the pension crisis for as long as possible. And Chicago isn’t alone; there are plenty of other American cities in dire straits when it comes to public finances and public pensions.

But nobody dares discuss these problems in an open and honest way. Unions point the finger at politicians and politicians point the finger at unions and US taxpayers end up footing the public pension bill.

This is why when I read stupid articles in Canadian newspapersquestioning the compensation and performance at Canada’s large public pensions, I ignore them because these foolish journalists haven’t done their research to understand why what we have here is infinitely better than what they have in the United States and elsewhere.

Why are we paying Canadian public pension fund managers big bucks? Because we got the governance right, paying public pension managers properly to bring assets internally, diversifying across public and private assets all around the world and only paying external funds when it can’t be replicated internally. This lowers the costs and improves the performance of our public pensions which is why none of Canada’s Top Ten pensions are chronically underfunded (a few are even over-funded and super-funded).

What else? Canada’s best public pensions — Ontario Teachers, HOOPP and even smaller ones like CAAT and OPTrust — have implemented arisk-sharing model that ensures pension beneficiaries and governments share the risk of the plan so as not to impose any additional tax burden on Canadian taxpayers if these plans ever become underfunded. This level of governance and risk-sharing simply doesn’t exist at any US public pension which is why many of them are chronically underfunded or on the verge of becoming chronically underfunded.

Below, FBN’s Jeff Flock breaks down Chicago’s growing pension shortfall. Like I said, get ready for never-ending property tax hikes if you live in cities like Chicago, it’s only going to get worse.