Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

David Paddon of the Canadian Press reports, CPPIB posts weakest rate of return since 2009:

The Canada Pension Plan Investment Board’s annual rate of return dropped to 3.4 per cent last year, the lowest since the Great Recession, the CPPIB said Thursday in its annual report.

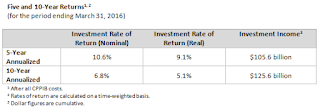

However the Toronto-based fund manager, which shepherds investments on behalf of the Canada Pension Plan, says its 10-year inflation-adjusted rate of return was 5.1 per cent — above the Chief Actuary of Canada’s benchmark of 4.0 per cent.

In addition, CPPIB notes that its assets increased over the 12 months ended March 31 by $14.3 billion to $278.9 billion.

By comparison, its 2015 rate of return was 18.3 per cent and the 2014 rate of return was 16.1 per cent — the fund’s best two years since it suffered a 18.8 per cent decline in asset value in the 2009 fiscal year amid a global market meltdown.

“Over the past 12 months, despite one of the more challenging investment environments in recent years and predominately negative equity markets, the CPP Fund generated a moderate gain,” Mark Wiseman, the CPPIB’s out going president and chief executive, said in a statement.

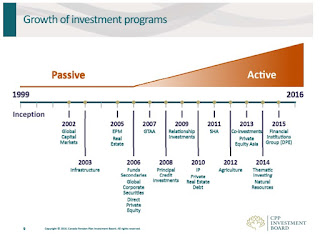

Wiseman has been instrumental in leading CPPIB as it pursued an “active” investment strategy into a variety of assets including real estate, public and private stocks and infrastructure assets around the world.

“In the first 10 years of our active management strategy, we have generated significant value for CPP contributors and beneficiaries, which would not have been earned through a passive portfolio.”

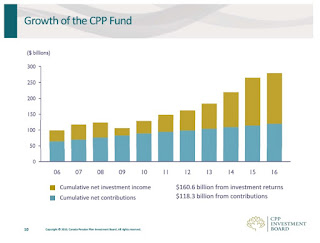

The fund says investments, after costs, have added $125.6 billion cumulatively in the past 10 years, including fiscal 2016. It says 57 per cent of its total assets are from investment income since the fund was created in 1999.

Earlier Thursday, the Canada Pension Plan Investment Board announced that Wiseman is leaving to take a senior role at U.S.-based investment firm BlackRock Inc., which has a total of about US$4.7 trillion in assets under management, including a range of products that includes mutual funds and the iShares exchange-traded funds business.

The U.S. firm said Wiseman will head its global active equity business, which manages US$275 billion, and become chairman of the company’s global investment committee when he joins the company in September.

Under Wiseman, the CPPIB has grown its head office in Toronto and added offices in other financial centres, including one last year in Mumbai, India.

Wiseman will be replaced June 13 by Mark Machin, who currently heads the fund’s international arm.

Machin, 49, joined CPPIB in March 2012. Prior to that, he spent 20 years at investment bank Goldman Sachs.

Heather Munroe-Blum, who chairs the CPPIB board, said the directors were unanimous in selecting Machin, who she said has been instrumental in shaping and executing CPPIB’s investment strategy over the last four years — a period when the fund has invested billions outside of Canada.

Earlier this year, Wiseman was named by the Liberal government as one of 14 members of a new council on economic growth to help advise federal Finance Minister Bill Morneau.

Note to readers: This is a corrected story. An earlier version said Wiseman was named to the council on economic growth this week.

Matt Scuffham of Reuters also reports, Canada’s CPPIB fund posts 3.7 pct gain in last fiscal year:

The Canada Pension Plan Investment Board (CPPIB), one of the world’s biggest dealmakers, said on Thursday it delivered gross investment returns of 3.7 percent last year despite volatile global equity markets.

The CPPIB, which manages Canada’s national pension fund, said it ended the year to March 31 with net assets of C$278.9 billion, compared with C$264.6 billion a year ago.

“This year’s results highlight the real-time impact of short-term market volatility, reinforcing why we focus on long-term results,” said Chief Executive Mark Wiseman.

CPPIB put out a press release going over its fiscal year 2016 results(added emphasis is mine):

The CPP Fund ended its fiscal year on March 31, 2016 with net assets of $278.9 billion compared to $264.6 billion at the end of fiscal 2015. The $14.3 billion increase in assets for the year consisted of $9.1 billion in net investment income after all CPPIB costs and $5.2 billion in net CPP contributions. The portfolio delivered a gross investment return of 3.7% for fiscal 2016, or 3.4% net of all costs.

“It has now been a decade since we adopted our active management strategy. This milestone presents a reasonable timeframe to take stock of our progress to date, as we position the organization to maximize returns over the long run,” said Mark Wiseman, President & Chief Executive Officer, CPP Investment Board (CPPIB). “The value that we have generated over and above our passive benchmark for the decade, as well as our absolute 10-year return, signal that CPPIB is on track to continue to perform. Nonetheless, as a long-term investor, it is incumbent that we remember that even 10 years is short in the context of our strategies to create value-building growth for multiple generations of beneficiaries. Some of our active management programs have only taken root recently, as we continue to build the required capabilities to continue to add value over the long term. We believe that the advanced maturity of our programs, and the quality and diversification of the assets in the portfolio, will generate even greater value-add in the decades ahead.”

In the 10-year period up to and including fiscal 2016, CPPIB has contributed $125.6 billion in cumulative net investment income to the Fund after all CPPIB costs, and $160.6 billion since inception in 1999, meaning that over 57% of the Fund’s cumulative assets are the result of investment income.

“Over the past twelve months, despite one of the more challenging investment environments in recent years and predominately negative equity markets, the CPP Fund generated a moderate gain. This outcome demonstrates the benefits of a resilient, highly diversified global portfolio. This year’s results highlight the real-time impact of short-term market volatility, reinforcing why we focus on long-term results,” said Mr. Wiseman. “In particular, we saw a stark contrast between the significant upswing in the final quarter of fiscal 2015 compared to the broad declines in the same quarter this fiscal year. We experienced similar quarter-to-quarter volatility in terms of currency impact, which fluctuated dramatically over the year. Importantly, we look through such volatility, relentlessly focusing on the far horizon.”

A number of other factors contributed to CPPIB’s strong fiscal 2016 results, including an overall gain from the portfolio’s private equity assets, real estate and fixed income holdings. The benefit of the Fund’s diversification across currencies also played a role in its returns, as the Canadian dollar fell modestly against most global currencies over the course of the fiscal year.

“This year, each of our investment programs fired on all cylinders, contributing positive returns to the Fund. We continued to see the benefits of a broadly diversified portfolio across geographies and asset classes, and our private assets served as a safe harbour from the rough seas of the public markets,” said Mr. Wiseman. “Our highly skilled professionals across CPPIB’s international offices completed a number of complex global transactions that will add value to the Fund for the years to come.”

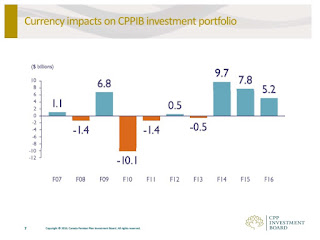

The CPP Fund is a global portfolio that holds assets denominated in many foreign currencies and we generally do not hedge these back to the Canadian dollar. Accordingly, when the Canadian dollar weakens as it did in 2015, the Fund will benefit from currency gains. Similarly, when the Canadian dollar strengthens, as it has more recently, the Fund will experience currency losses. The Fund’s largest foreign currency exposure is to the U.S. dollar. The Canadian dollar weakened by 2.1% against the U.S. dollar in fiscal 2016. We believe costly hedging of foreign investments is not appropriate for the CPP Fund. While currency exchange rate fluctuations may have a significant impact on our results in any given year or quarter, we do not expect them to have a significant impact on the Fund’s long-term performance.

Long-Term Sustainability

The Canada Pension Plan’s multi-generational funding and liabilities give rise to an exceptionally long investment horizon. To meet long-term investment objectives, CPPIB is building a portfolio and investing in assets designed to generate and maximize long-term, risk-adjusted returns. Accordingly, long-term investment returns are a more appropriate measure of CPPIB’s performance than returns in any given quarter or single fiscal year.

In the most recent triennial review released in December 2013, the Chief Actuary of Canada reaffirmed that, as at December 31, 2012, the CPP remains sustainable at the current contribution rate of 9.9% throughout the 75-year period of his report.The Chief Actuary’s projections are based on the assumption that the Fund will attain a prospective 4.0% real rate of return, which takes into account the impact of inflation. CPPIB’s 10-year annualized net nominal rate of return of 6.8%, or 5.1% on a real rate of return basis, was comfortably above the Chief Actuary’s assumption over this same period. These figures are reported net of all CPPIB costs to be consistent with the Chief Actuary’s approach.

The Chief Actuary’s report also indicates that CPP contributions are expected to exceed annual benefit payments until 2023, after which a portion of the investment income from CPPIB will be needed to help pay pensions.

Performance Against Benchmark

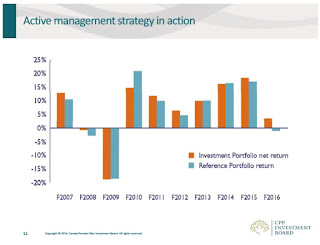

CPPIB measures its performance against a market-based benchmark, the Reference Portfolio, representing a passive portfolio of public market investments that can reasonably be expected to generate the long-term returns needed to help sustain the CPP at the current contribution rate.

In fiscal 2016, the CPP Fund’s net return of 3.4% outperformed the Reference Portfolio by 4.4%, delivering $11.2 billion in net dollar value-added (DVA) above the Reference Portfolio’s return, after all CPPIB costs.

Given our long-term view, we track cumulative value-added returns since the April 1, 2006, inception of the benchmark Reference Portfolio. Cumulative value-added over the past 10 years totals $17.1 billion, after all CPPIB costs.

“In addition to a strong focus on total Fund returns, dollar value-added is another important performance measure,” said Mr. Wiseman. “In the first 10 years of our active management strategy, we have generated significant value for CPP contributors and beneficiaries, which would not have been earned through a passive portfolio. Looking towards the next 10 years, we expect both good and bad years, but we will stay the course with our prudent and responsible long-term strategy. So, while we saw exceptional value-add above our benchmark in fiscal 2016, we know that this will not always be the case in any one-year period.”

Total Costs

CPPIB total costs for fiscal 2016 consisted of $876 million, or 32 basis points, of operating expenses, $1,330 million of investment management fees and $437 million of transaction costs. CPPIB reports on these distinct cost categories, as each is materially different in purpose, substance and variability. We report the investment management fees and transaction costs we incur by asset class and report the net investment income our programs generate after deducting these fees and costs. We then report on total Fund performance net of these fees and costs, as well as CPPIB’s overall operating expenses.

Fiscal 2016 CPPIB operating expenses reflect higher personnel and general operating expenses, such as increased staff levels and premises costs related to our headquarters and six international offices. It also reflects the continued expansion of CPPIB’s operations and further development of our capabilities to support over 25 distinct investment programs. International operations accounted for approximately 30% of total operating expenses.

Fiscal 2016 investment management fees and transaction costs reflect the continued growth in the volume and sophistication of our investing activities.

The increase in investment management fees is due in part to the continued growth in the level of commitments and the average level of assets with external managers, as the Fund continues to grow.

The increase in transaction costs corresponds with a significant increase in investment activity. This year, we completed 10 global transactions valued at over $1 billion, each involving complex due diligence and negotiations, as we worked diligently to deploy capital efficiently. Given the nature of these costs, they will vary from year to year according to the number, size and complexity of our investing activities in any given period.

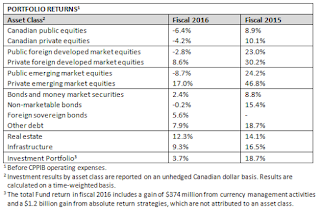

Portfolio Performance by Asset Class

Portfolio performance by asset class is included in the table below. A more detailed breakdown of performance by investment department is included in the CPPIB Annual Report for fiscal 2016, which is available at www.cppib.com.

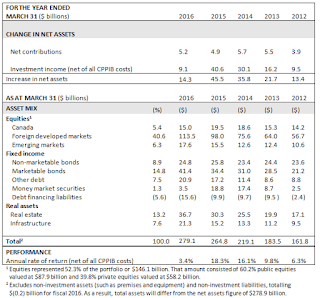

Asset Mix

We continued to diversify the portfolio by the return-risk characteristics of various assets and geographies during fiscal 2016. Canadian assets represented 19.1% of the portfolio, and totalled $53.3 billion. Foreign assets represented 80.9% of the portfolio, and totalled $225.8 billion.

Investment Highlights

During fiscal 2016, CPPIB completed 60 transactions of over $200 million each, in 12 countries around the world.

Highlights for the year include:

Private Investments

· Completed the acquisition of Skyway Concession Company LLC (SCC) with OMERS and Ontario Teachers’ Pension Plan for a total consideration of US$2.9 billion. CPPIB, OMERS and Ontario Teachers’ each owns a 33.33% interest in SCC and contributed an equity investment of approximately US$560 million each. SCC manages, operates and maintains the 7.8-mile Chicago Skyway toll road under a concession agreement, which runs for another 88 years.

· Jointly acquired Petco Animal Supplies, Inc. (Petco) with CVC Capital Partners for a total consideration of approximately US$4.6 billion. Petco is a leading specialty retailer of premium pet food, supplies and services, which operates more than 1,400 Petco locations across the U.S., Mexico and Puerto Rico.

· Signed an agreement with Wolf Infrastructure Inc. to establish a midstream energy infrastructure investment vehicle focused on acquisition opportunities in Western Canada. Wolf will focus on opportunities to create value through active management and operations of the assets held in the vehicle. CPPIB will provide equity funding in support of Wolf’s strategy with a goal to initially invest more than $1 billion in the sector.

· Acquired Antares Capital, through Antares Holdings, a subsidiary of CPPIB Credit Investments Inc., alongside Antares management, for a total consideration of approximately US$12 billion. CPPIB Credit Investments’ equity investment was approximately US$3.9 billion. Antares is a leading lender to middle market private equity sponsors in the U.S.

Public Market Investments

· Invested RMB 3.2 billion (C$688 million) in the common equity of Postal Savings Bank of China (PSBC). With more than 400 million retail customers and nearly 40,000 branches, PSBC is China’s largest bank by customers and distribution network and is the sixth largest bank by total assets in China.

· Acquired 52.9 million common shares of Entertainment One Ltd. (eOne) for £142.4 million. Following the investment, CPPIB participated in eOne’s subsequent rights issue as well as open market purchases, increasing CPPIB’s pro forma ownership interest to approximately 19.8% for a total of more than £190 million invested. eOne is a leading international independent film and television entertainment company.

· Invested US$378 million in Enstar Group Limited (Enstar), a global specialty insurance company, through two transactions for an aggregate interest of approximately 14%. In June 2015, CPPIB invested US$267 million for a 9.9% interest in Enstar. In March 2016, CPPIB completed a follow-on investment of US$111 million in Enstar for an additional 3.8% interest. Enstar is a market leader in acquiring and managing closed blocks of property & casualty insurance.

Real Estate Investments

· Formed a joint venture with Welltower Inc. to purchase a 97.5% interest in a portfolio of six seniors housing properties in Florida, known as Aston Gardens, for an aggregate purchase price of US$555 million. CPPIB is a 45% owner of the joint venture and Welltower owns the remaining 55%. The Aston Gardens portfolio comprises six private-pay primarily independent-living seniors housing properties in Florida with a total of 1,930 rental units.

· Formed a student housing joint venture entity, Scion Student Communities LP, with GIC and The Scion Group LLC (Scion). The Joint Venture, through its subsidiary UHC Acquisition Sub LLC, signed an agreement to acquire University House Communities Group, Inc. (UHC), a leading student housing portfolio in the U.S., for a total consideration of approximately US$1.4 billion, including the cost to complete current development projects. Through the Joint Venture, CPPIB and GIC will each own a 47.5% interest in UHC and Scion will own the remaining 5%.

· Committed an additional US$1 billion to the Goodman China Logistics Partnership (GCLP), established with Goodman Group in 2009 to own and develop logistics assets in Mainland China, consistent with CPPIB’s 80% ownership interest in GCLP. To date, CPPIB has committed US$2.6 billion to GCLP, which has now invested in 45 logistics projects in 16 Chinese markets.

· Formed a strategic joint venture with Unibail-Rodamco, the second largest retail REIT in the world and the largest in Europe, to grow CPPIB’s German retail real estate program. The joint venture was formed through CPPIB’s indirect acquisition of a 46.1% interest in its retail platform Unibail-Rodamco Germany with an initial equity investment of €394 million. In addition, CPPIB has committed a further €366 million in support of Unibail-Rodamco Germany’s investment strategies.

Investment Partnerships

· Acquired a stake of approximately 20% in Homeplus, Tesco’s South Korean business, for US$534 million, as part of a consortium led by MBK Partners. The total transaction value was approximately US$6 billion. Homeplus is one of the largest multi-channel retailers in South Korea and the number two player in both hypermarkets and supermarkets.

Investment highlights following the year end include:

· Entered into an agreement, through a wholly owned subsidiary of CPPIB, to purchase 40% of Glencore Agricultural Products (Glencore Agri) from Glencore plc for US$2.5 billion. Glencore Agri is a globally integrated grain and oilseed business with high-quality port, logistics, storage and processing assets in Canada, Australia, South America and Europe. The transaction is expected to close in the second half of the calendar year.

· Signed an agreement with Cinven to jointly acquire Hotelbeds Group (Hotelbeds) for a total enterprise value of €1.165 billion. Hotelbeds is the largest independent business-to-business bedbank globally, offering hotel rooms to the travel industry from its inventory of 75,000 hotels in over 180 countries.

Asset Dispositions

· Sold our 45% interest in two assets, Oakwood Plaza shopping centre (Hollywood, FL) and Dania Pointe development project (Dania Beach, FL). Proceeds to CPPIB from the sale were approximately US$91.3 million. Oakwood Plaza was acquired in 2010 and Dania Pointe development was acquired in 2014 alongside our joint venture partner Kimco Realty.

· The Capital London Fund in which CPPIB is an 80% equity holder, sold 55 Bishopsgate, an office building in London, U.K. Proceeds to CPPIB from the sale were approximately £150 million. The property investment was made in 2006.

· Sold our 45% indirect stake in 600 Lexington Avenue, a Midtown Manhattan office building. Proceeds to CPPIB from the sale were approximately US$79 million. The property was acquired in 2010 alongside our joint venture partner SL Green.

Corporate Highlights

· Collaborated with S&P Dow Jones Indices, and its analytical partner RobecoSAM, in the development of the S&P Long-Term Value Creation (LTVC) Global Index. The index is designed to measure companies that have the potential to create long-term value based on sustainability criteria and financial quality. CPPIB is among six of the world’s largest institutional investors voicing their support for the index as a powerful catalyst to influence corporate and investor behaviour. As an immediate indicator of this potential, CPPIB and other investors have committed to initially allocate approximately US$2 billion to funds tracking the S&P LTVC Global Index. The creation of the index was a key recommendation stemming from CPPIB’s Focusing Capital on the Long Term initiative.

· CPPIB Capital Inc. (CPPIB Capital), a wholly owned subsidiary of CPPIB, completed two debt offerings in fiscal 2016. In January 2016, CPPIB Capital completed a $1.25 billion debt offering of three-year term notes. In May 2015, CPPIB Capital completed a $1.0 billion debt offering of five-year, medium-term notes. CPPIB utilizes a conservative amount of short- and medium-term debt as one of several tools to manage our investment operations. Debt issuance gives CPPIB flexibility to fund investments that may not match our contribution cycle. Net proceeds from both private placements will be used by CPPIB for general corporate purposes.

· In October 2015, we officially opened a new office in Mumbai, India’s financial capital, representing our seventh office, internationally. The Mumbai office expands CPPIB’s global reach and enhances our strategy to build a diversified investment portfolio. The on-the-ground presence in India will allow CPPIB to better identify new investment opportunities through local expertise and partnerships, while also monitoring current assets.

· Announced executive appointments to the Senior Management Team:

o Patrice Walch-Watson joined CPPIB as Senior Managing Director, General Counsel & Corporate Secretary. Ms. Walch-Watson joined CPPIB from Torys LLP where she was a Partner with expertise in mergers and acquisitions, corporate finance, privatization and corporate governance.

o Mary Sullivan joined CPPIB as Senior Managing Director & Chief Talent Officer. Ms. Sullivan joined CPPIB from Holt Renfrew & Co. Ltd., where she was Senior Vice-President, People. She brings a wealth of experience and leadership from renowned Canadian and global corporations to CPPIB.

If you read this press release carefully, you just get a glimpse of how massive CPPIB has become, running sophisticated operations around the world that rival powerhouses like Blackstone, Carlyle and others.

You also see how clueless the folks at the Fraser Institute are in terms of the “costly” CPP or how ignorant Andrew Coyne is when he writes on the ‘bloated state’ of the CPP, questioning the merits of active management at CPPIB (not to mention how ignorant he is on other aspects of the Fund too, calling the Reference Portfolio a “fraud”).

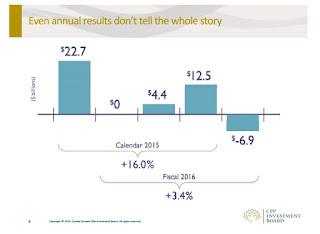

Lost in all the media circus on why Mark Wiseman is leaving the Fundare the fiscal year results which were much better than meets the eye. In fact, I had a quick chat with Mark last night and he was gracious in providing me with some key slides going over the results. I’m not going to cover all of them but will focus on some key slides.

First, just like PSP Investments, CPPIB’s fiscal year ends at the end of March. And we all know the first quarter was weak and very volatile. If you look at calendar year results, CPPIB gained 16% in 2015, outperforming all its large peers in Canada, including the Ontario Teachers’ Pension Plan which gained 13% last year (click on image):

Second, as stated in the press release above, currency swings matter a lot because CPPIB doesn’t hedge its foreign currency exposure(click on image):

We can debate the merits of not hedging F/X risk but we can’t debate the fact that on any given year, CPPIB will either enjoy bigger gains from foreign currency exposure or suffer F/X losses if the loonie rallies relative to other currencies (for those that hedge currency risk, it’s the exact opposite).

Third, have a look at the next slides and tell me that Andrew Coyne is right to question CPPIB’s active management and long-term investment strategy (click on images):

Of these, that middle slide 10 is the key one which clearly demonstrates that since embarking in many active management strategies in Public and Private Markets, CPPIB has generated $161 billion in cumulative net investment income over the last ten years (but Andrew Coyne thinks this is all a “fraud”, what a joke!).

Anyways, I really think every Canadian should stop reading silly articles and reports from Andrew Coyne and the Fraser Institute and take the time to read CPPIB’s 2016 Annual Report which goes into a lot more detail on costs, operations and strategies. The 2016 Annual report is available here.

One critical point I will make is that CPPIB and others should always include portfolio performance by asset class relative to the benchmark of each asset class for the last fiscal or calendar year and over the last four years (to gauge compensation), as well as include a clear description of the benchmarks governing each asset class. This information should be publicly available in their press releases governing results.

[Note: To be fair, the way CPPIB calculates its Reference Portfolio is much more complicated and rigorous than other large shops, so maybe they can’t show benchmarks for all investment activities too easily but I still think they should provide more information on each investment activity relative to benchmarks.]

One thing I will grant Andrew Coyne is reading these annual reports trying to find information which should be easily available is daunting and cumbersome.

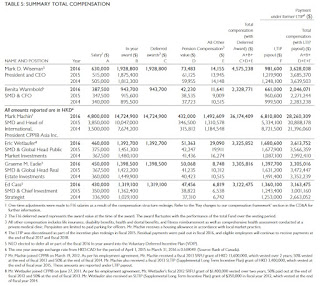

Still, I will provide you with a summary table on total compensation because Canadians have a right to know how much we pay senior public pension fund managers (click on image, from page 82 on 2016 Annual Report):

As you can see, CPPIB’s senior managers are very well compensated but they’re also delivering the long and short-term results to justify their compensation (they beat all their large Canadian peers in calendar year 2015 and have done very well over the last four fiscal years which is how the bulk of their compensation is determined).

In my opinion, this compensation, while hefty for most Canadians, is very fair given the long-term results they have produced and it’s hardly “outrageous” by any stretch of the imagination given their skill sets and the assets they manage. (By the way, don’t fall off your chair, Mark Machin’s compensation is reported in Hong Kong dollars and I include footnotes to explain details).

What else can I share with you? I’d like to see a little more “ethnic” diversification at CPPIB’s senior level (click on image):

I know, these top jobs are very competitive and only the “best of the best” get them but I have a problem when I look at an image of CPPIB’s top brass (or that of any Canadian public pension) and it doesn’t reflect our country’s diverse population.

All of Canada’s Top Ten need to do a much, MUCH better job diversifying their workforce at all levels of their organization. Period, end of discussion.

On diversity, I’d like to see Canada’s Top Ten adopt specific programs targeting women, visible minorities, aboriginals and people with disabilities and publish a detailed “Diversity Report” every year and include it in their annual report (I know, it’s a hassle but Canadians have a right to know this information).

[Note: CPPIB recently initiated a program to focus more on gender diversity but I would like to see more done with measurable action plans and regular reports that provide hard statistics on diversity at all levels of the organization.]

Finally, I would like to end by addressing some nonsense the media is spreading about Mark Wiseman’s “abrupt” departure. There is nothing cynical going on here. The man received a great offer to move on and work for the world’s largest asset manager where he will be reporting to someone and doing all sorts of interesting things.

Also, the person replacing Mark Wiseman wasn’t named in a hasty decision. The Board was aware of Mark’s departure and they had time to carefully think about a suitable replacement (hint: look at my Davos clip in my last comment and you’ll get a clue of when the Board was informed to start looking for someone).

Mark Machin (pronounced Maychin) was Mark Wiseman’s right hand and personally responsible for CPPIB’s international expansion over the last four years. He has over 20 years experience working at Goldman Sachs and is more than capable of taking over the helm at CPPIB.

Mark Wiseman has nothing but good things to say about him and from by brief email exchange with Mr. Machin congratulating him, he seems like a very nice and decent guy (Mark told me he is).

So stop reading all the garbage in the media and trust the Board at CPPIB is on top of things. CPPIB is in very capable hands and Mark Wiseman will stay on for the next few months (as a senior advisor) to make sure the transition process goes very smoothly. I have no worries and trust Mark Machin will do an outstanding job as the new CEO of CPPIB.

Below, the appointment of an internationally-focused executive to head up Canada’s largest pension fund is the right choice, says Leo de Bever, the former head of the Alberta Investment Management Corporation. If you’re tired of Leo Kolivakis, listen to Leo de Bever, he’s much wiser than me!

Also, BNN’s Paige Ellis reports on her conversation with outgoing CPPIB CEO, Mark Wiseman. The soon-to-be head of Global Active Equity at BlackRock says his decision to leave the firm was not motivated by compensation. He also explains why he gave CPPIB’s board of director notably less notice than his predecessor.

Third, Kevin O’Leary says this on Mark Wiseman: “four years is enough, time to play in the big league.” You got love “Mr. Wonderful”, even though his remarks on working at CPPIB are a bit off (it’s nothing like public service!), whenever he smells opportunity, he pounces on it!

Lastly, Canada Pension Plan Investment Board names Mark Machin to replace outgoing CEO Mark Wiseman. Machin heads CPPIB’s international investments. Bloomberg’s Scott Deveau reports.