Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Adam Mayers of the Toronto Star reports, CPP’s success may signal bigger pensions ahead:

The Canada Pension Plan expects to have assets worth $1 trillion before the middle of this century.

As recently as 17 years ago, in the first year of the plan’s Investment Board, there was just $18 million in the bank. All that money was invested in Canadian government bonds. The CPP Investment Board was a coupon clipper.

Today, our national retirement scheme is a global giant, closing in on $300 billion. By 2030 it projects to be worth $500 billion. Two-thirds of all it owns is outside Canada and there isn’t a corner of the globe where it doesn’t look for opportunity.

We get royalties from intellectual property, dividends from public and private investments. Its biggest single public stock holding worth $2.3 billion is in IMS Holdings, an American company that provides IT services to the global healthcare industry. Number two is Apple.

Our plan invests in Japanese drug companies, owns nursing homes in France and seniors’ apartments in Florida. There are 17 ports in Britain, Ontario’s 407 ETR and toll roads in Chile. Its real estate holdings include prestige shopping centres and office towers in many global capitals. There is income from investments in farmland, software and internet and telecom networks. It owns stakes in electrical utilities and water treatment plants.

Based on this success — and our contributions — the CPPIB’s actuaries believe there will be enough money to pay pension obligations at current levels for the next 75 years. That’s an enviable position when many national pension plans are in trouble.

But the CPP wants to go further. It wants an even better return. So, it’s changing the mix of its investments to add more stocks and private companies, and fewer government and corporate bonds.

It’s a “modest evolution” being done in a “prudent and gradual manner,” says the CPPIB’s senior managing director Ed Cass, who is responsible for the CPPIB’s overall investment strategy.

He says it can be done safely because the CPP has deep pockets and a perpetual time horizon: The “next quarter” is 25 years, not three months.

This may eventually mean a bigger pension, or lower CPP premiums for us. Cass can’t say. The CPPIB’s mandate is to safely and profitably invest on our behalf. Ottawa and the premiers decide how much we get and how much we pay into the plan. Their third option is do nothing and keep the additional funds for a rainy day.

We sat down with Cass, who at 53 is as eclectic as the CPP’s holdings: He holds a degree in theoretical physics from Queen’s University and a law degree from Osgoode Hall.

Here’s an edited version:

What can average investors learn from the CPP?

Well, they can’t replicate what we do because we have advantages of size and scale.

But there are three things. The most important is risk tolerance. A 27-year-old should be able to take a lot more risk than a 91-year-old. We have a 75 year time horizon and so our assumptions are based on that.

The second is diversify. Diversification is the one free lunch.

It’s true, we can go to a level that’s impossible for the small investor. But there’s a ton of things individuals can do. Through Exchange Traded Funds (ETFs) you can get access to the U.S., European and Japanese stock markets. Importantly, you get diversification in terms of currency exposure.

The last thing is patience. If you can afford to be patient, be patient. If you’re changing your portfolio frequently it’s likely you’re incurring a lot of costs. Having a plan and sticking to it is very important.

What is your view of the economic outlook?

There are a number of forces that give us a lot of optimism. We think the gradual convergence of emerging market economies with developed markets is a positive development.

We think low rates may persist in the short term, but not over the long term. We see growth coming back. Not quite what we experienced in previous decades, but something approaching that.

What about interest rates?

The new normal for the overnight bank rate might be 3.50 per cent or 3.75 per cent. (That rate is currently 0.5 per cent and determines consumer rates.)

When might this happen?

Forecasting the path of rates is fraught with danger. We are confident that over our horizon, which is decades, things will normalize.

Why are you buying ports and university dorms?

They are things that are similar to bonds and have very predictable payments. As an example, take the Highway 407 (40 per cent owned by CPP). It is very easy to predict cash flow over time and it has a high income yield. That looks a lot like a bond.

The CPPIB has decided to take more investment risk. What does that mean?

Risk appetite is linked to investment horizon. We have a very long horizon, somewhere in the order of 75 years. That’s how far we look out.

Our default reference was 65 per cent equities and 35 per cent bonds, which is the (default) of an average investor. But our capacity to prudently take risk is greater than an average investor. So, we want to move to 85 per cent equities and 15 per cent bonds.

What it means is that we want a very diversified portfolio, a very safe portfolio, but one that targets a higher risk appetite than in the past.

Why now?

This is not a reaction to the current environment. This is something more fundamental. It’s predicated on those longer term views.

When you say “why now” you must place it in the context of an organization that is on an enduring path. We have undertaken several transitions since that first transfer of funds 17 years ago.

We’ve gone from 100 per cent bonds to a diversified portfolio, and from all domestic to truly global. We’ve grown from $18 million to over $280 billion today. We accomplished this in less than two decades.

So, when you consider the shift along the return/risk spectrum in this light, it is really a modest evolution. We have an exceptionally long horizon, as well as a certainty of assets. As a result, the Board concluded we can and should seek higher returns prudently.

Does that mean better pensions?

If the fund is widely successful you could increase benefits, or reduce contributions. Those are the two most logical things, but that’s a policy decision. Our statutory objective is to maximize returns without undue risk of loss.

A good interview with Ed Cass who was appointed to the position of Senior Vice President and Chief Investment Strategist at CPPIB a little over two years ago.

Mr. Cass is obviously a very smart guy, holding a Bachelor of Science (Honours) degree in Theoretical Physics from Queen’s University and a Bachelor of Laws from Osgoode Hall Law School, but the message he lays out here is very simple and clear: CPPIB is a global powerhouse with deep pockets and a very long investment horizon and can take risks in public and private markets and patiently sit through any economic cycle.

Now, I think it’s important Canadians understand some of the key takeaways from this brief interview (I will add some insights):

- CPPIB is a global powerhouse that invests across public and private assets. It invests and co-invests with top private equity funds, top hedge funds, and invests directly in real estate, infrastructure and natural resource assets all over the world. This diversification across geographies and public and private markets and the ability to invest directly in large transactions is something that no individual Canadian investor and even mutual fund can do at the scale and scope of CPPIB.

- CPPIB has huge comparative advantages over mutual funds, private equity funds, and even other large Canadian pension funds. You can read about these advantages here.

- CPPIB is massive but cost efficient. Never mind that flimsy and grossly biased study from the Fraser Institute claiming it is an extremely costly plan. Real experts who understand large pensions like Keith Ambachtsheer and his partners at KPA Advisory Services tore into that study as did I for its dumb comparisons and faulty conclusions (word to the wise: never blindly trust anything that comes out of the Fraser Institute which is bankrolled by Canada’s powerful financial services industry that has its own agenda on pensions).

- CPPIB is opportunistic and very patient. Go back to read my comments on CPPIB bringing good things to life and a more recent one on CPPIB going on a massive agri hunt. These are huge, scalable deals that no Canadian mutual fund can engage in and to be honest, apart from PSP Investments, very few other large Canadian pension funds can engage in.

- CPPIB has a great leader at its helm. I won’t hide it, I like Mark Wiseman and think very highly of him. We don’t always see eye to eye on everything but when I talk to him and listen carefully to what he says, he comes across as an exceptionally bright, nice, hard-working leader who really understands and believes in the long view and has done an outstanding job leading this mammoth pension fund. He has put in place the right people to lead his teams and they are all doing a great job.

As far as what Ed Cass says on interest rates, I beg to differ as I think ultra low rates and the new negative normal are here to stay for years, especially once the global deflation tsunami hits us.

Then again, with China manipulating its stock market and central banks fighting deflation tooth and nail, things might be a lot better in the global economy than meets the eye. I trade stocks every day and I’m baffled at some the moves in the resource sector.

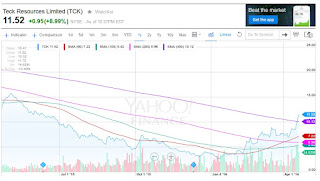

For example, shares of Teck Resources (TCK) are up another 9% at this writing on Wednesday mid-day (click on image):

Amazingly, the share price of Teck hit a low of $2.56 (USD; I only trade U.S. shares even though it was best to buy this one in Canada earlier this year) on January 13th and is now breaking out and in a position to make a new 52-week high if this momentum carries through.

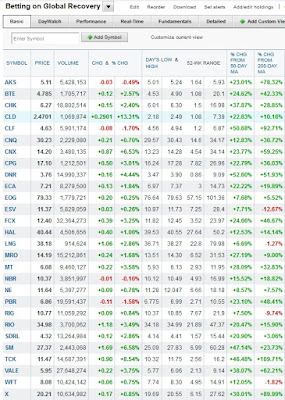

And it’s not just Teck, a sample of stocks I track leveraged to global growth are indeed acting as if oil will double this year and the global economic recovery is well under way (click on image):

I remain highly skeptical of all these counter-trend rallies no matter how powerful they are and think they’re largely driven by algos and momo traders. Having said this, one Canadian hedge fund manager told me this morning: “Things have changed, adapt and leave it alone.”

Maybe things have changed, maybe the world is in much better shape than we think, or maybe we are all smoking some hopium like those nuns I mentioned in my last comment on China’s pension gamble, believing in fairy tales and unicorns. I don’t know but since mid-January the explosive moves have been in emerging markets (EEM), Chinese shares (FXI), energy (XLE), metals and mining (XME) and industrials (XLI).

So, Ed Cass is right, focus on ETFs, diversify and rebalance your portfolio when there are huge market dislocations like we had at the start of the year. Unlike him, I prefer to play U.S. ETFs (I am long USD over a very long period because I think the U.S. has the best economy by far) and I would say rebalance every time an ETF goes way above it 200-day moving average or way below its 400-day moving average (for oversold trends, I prefer using the 400-day moving average).

As far as books, I have about 300 books on finance but the ones I recommend to individuals are classics like William Bernstein’s The Four Pillars of Investing and The Intelligent Asset Allocator or Marc Litchenfeld’s Get Rich With Dividends. Of course, a simple and cheap classic to read on stocks is Peter Lynch’s One Up on Wall Street (a real classic).

On that note, it’s back to the stock market for me and trying to make sense of these schizoid markets driven by algos, high frequency traders and unscrupulous hedge fund sharks.