Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

CPPIB has a message to all women in finance, it’s actively looking for you:

At CPPIB, our goal is to have an employee population that reflects the communities in which we operate. This is because we believe that diversity – of insights, backgrounds and experiences – leads to better decisions and business outcomes. Attracting, developing and retaining talented women is particularly important to our success as a high-performing global organization. By 2020, our goal is to have half of all of our new hires be women.

To help us achieve these goals, we have a variety of programs and resources including coaching, mentoring, sponsorships, and internships that help attract women early in their careers and then provide them with ongoing development and growth opportunities so they can enjoy the most challenging and fulfilling careers possible.

As part of our commitment to supporting the development of women, we recently established a partnership with Women in Capital Markets, the largest network of professional women in the Canadian financial sector and voice of advocacy for women in our industry. An element of this partnership is a new women’s internship program designed specifically for women in undergraduate programs who are curious about business and interested in exploring and being mentored in the world of finance and investments. This four month summer internship teaches technical skills used in the financial and investment industries, enables participants to engage in meaningful work and activities designed to develop business acumen, and provides opportunities to collaborate with colleagues, leaders and industry experts.

Our focus on gender diversity was recently underscored when our President and CEO, Mark Wiseman, was honoured with a “WCM” Leadership Award. This annual award recognizes members of the financial community who have demonstrated a commitment to advancing and supporting women working in capital markets.

In receiving this award, Mark commented that “we have made a commitment to advancing the role of women at our firm and in our industry…No organization can achieve the best business results when they restrict themselves to half the population in recruiting, developing and retaining talent. This Leadership Award truly recognizes the efforts of our entire organization to advance and support the careers of women in capital markets.”

Learn more about CPPIB career opportunities and our commitment to diversity by visiting our Careers page.

Diversity, or lack of diversity, is a hot topic these days, especially in Hollywood where Viola Davis had her say on the debate at the SAG Awards over the weekend. I’m not going to get into the whole Hollywood diversity debate except to say that my favorite movie of all-time remains The Shawshank Redemption (1994) featuring one of my favorite actors, the great Morgan Freeman.

When you are a great actor, you’ll be recognized by your peers. Period. Having said this, there undoubtedly is a lack of diversity in Hollywood and more importantly, lack of diverse, original ideas which explains the crappy movies that have been coming out in the last decade.

In fact, I had an email exchange with a friend of mine who is an entertainment lawyer bemoaning all this:

In my humble opinion, Hollywood has been in a recession for over a decade, and the main reason is deflation of original ideas, not piracy!

I was watching a classic comedy, Sideways (2004), with Paul Giamatti. When is the last time Hollywood came up with a script that compares to this???

Forget it, as long as Hollywood remains oblivious to people’s reality, I’m not going to shed a tear for these jerks!

To which my friend replied:

I didn’t want to shed any tears for them either, but I couldn’t help it when they announced that Star Wars VII had earned a billion dollars faster than any other movie in history and would shatter Avatar and Titanic worldwide box office records within a month. Disney is a money-printing machine.

However, only two companies account for nearly all of Hollywood’s profits this year (Disney and Universal), while others were suffering layoffs (Paramount, Weinstein Co., and Relativity).

I found his reply very interesting and think it explains why Disney’s shares (DIS) have done well over the last five years and it may be time to buy the recent dip. If you’re looking for a recession-proof industry, this is it, but make sure you’re investing in the right company, one that reflects real diversity and has original content.

Anyways, enough on Hollywood, let’s get back to the real world and CPPIB’s push for more gender diversity. I’ve been an outspoken critic of the lack of diversity in the workplace at Canada’s Top Ten so I welcome all these initiatives to introduce a more diverse workforce.

In my opinion, it’s simply indefensible for any public pension fund, government organization, Crown corporation or even large private sector employer like a federally regulated bank not to have a truly diverse workforce.

So, in that regard, I applaud CPPIB’s push for more gender diversity. Mark Wiseman may be a creature of habit but he comes from a family with diverse interests and his partner of more than 22 years, Marcia Moffat, was a vice-president at the Royal Bank of Canada before joining Blackrock as head of the Canadian business (a little conflict of interest there but I’m sure it’s all kosher).

According to the Globe and Mail article, they met on his first day at the University of Toronto. “I am, I think, the world’s greatest Jewish Christmas tree cutter,” Wiseman said. “My kids get all the holidays.”

The chair of the Board at CPPIB, Dr. Heather Munroe-Blum, might have gotten in a bit of hot water over her own pension benefits, but there’s no denying she’s an extremely accomplished lady, receiving many accolades from the academic community including honorary degrees from various universities and the Order of Canada.

According to Wikipedia, Dr. Munroe-Blum trained as an epidemiologist and has led large-scale epidemiological investigations related to psychiatric disorders. She is the author or co-author of over 60 scholarly publications, including four books. She has served on the board of directors of the Medical Research Council of Canada (now the Canadian Institutes of Health Research) as well as on international reviews of the German Academic Exchange Service (DAAD), the Swiss National Science Foundation, and the National Institute of Mental Health (USA).

My father and brother are psychiatrists at McGill and I think very highly of doctors, especially those on the front lines fighting mental illness in our society.

Was CPPIB’s focus on more gender diversity pushed from the top? I don’t know but knowing a bit about Heather Munroe-Blum (never met the lady), I can guarantee you she’s definitely no pushover and had something to do with it.

And again, while I applaud all these initiatives on introducing more diversity at the workplace, the sad reality is that a lot more needs to be done. When I look at CPPIB’s board of directors or it senior management team, I see a lot of white Anglo-Saxon Canadians, but I definitely don’t see a snapshot of Canada’s diverse population.

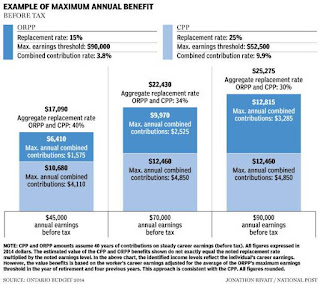

I’m not going to sugarcoat it. Diversity initiatives are all great but when you dig a little deeper at CPPIB or the rest of Canada’s Top Ten, you’ll see how pathetically diverse they are at the board or senior management level. And while women are properly represented at the board level (by law, they have to be!), we have yet to have a woman nominated to the position of CEO of a major Canadian pension fund (hopefully that will change with Ontario’s new ORPP).

What else? I challenge all of Canada’s Top Ten to take a page from the Royal Bank of Canada and publish their own Diversity Blueprint and provide their own vision and priorities for diversity and inclusion and back it up with hard statistics that are readily available on their website.

For example, the Royal Bank publishes a Diversity and Inclusion Report as well as an Employment Equity Report and a diversity report card setting out initiatives and whether they were met.

Now, the Royal Bank isn’t exactly a paradigm of diversity, especially in upper management and a lot of this stuff is corporate marketing fluff, but it has done more than any other organization to promote diversity at all levels and unlike other organizations, it has a recruitment program specifically designed for people with disabilities.

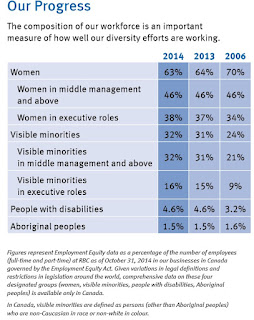

On page 5 of its Diversity and Inclusion Report, the bank provides us with hard numbers (click on image):

You might be wondering why don’t all of Canada’s big banks, large public pension funds, Crown corporations and government organizations follow the Royal Bank and publish their own diversity reports reflecting objectives and a scoreboard (it would be nice if they published statistics on pay equity too).

The answer is pure laziness and nobody really wants to report on diversity at all levels of their organization because if they did, most Canadians would be appalled.

When I privately confront the leaders of Canada’s Top Ten pensions on diversity in the workplace, especially in regard to persons with disabilities, they either dismiss me or state some generic statement like “we take employment equity very seriously.”

Really? Where are the statistics in your annual report or on your website? Worse still, when applying to jobs at Canada’s Top Ten pensions, some of them don’t even ask you to self-identify your gender or whether you’re a visible minority, aboriginal or person with a disability.

My favorite is when I confront leaders and they assure me “they take diversity seriously” but always make sure they hire the “best and brightest” no matter their gender, sexual orientation, ethnicity or disability.

Of course, this is all nonsense as the unemployment rate for people with disabilities is running close to 75% and it’s not because they lack competence or skills for jobs (the unemployment rate for aboriginals is equally appalling). In most cases, they’re more skilled and a lot more competent than people with no disability but our society systematically discriminates against people with disabilities and so do our public and private organizations.

All this to say I welcome any initiative which focuses on diversity but there’s a lot more that needs to be done on this front at all of Canada’s Top Ten public pensions.

And just so you know, while CPPIB is publicly discussing gender diversity, others like the Caisse have made significant improvements in terms of diversity in the workplace under Michael Sabia’s watch. But you won’t hear of this push for diversity at the Caisse which is one of the few public pensions that asks candidates to self-identify when applying to positions.

Still, the Caisse also needs to hire more people with disabilities and allow them to access that bloody elevator at the main entrance on Jean-Paul Riopelle which is only reserved for big shots like Sabia.

Let me stop right there because this is a topic that makes my blood boil for a lot of personal reasons and the leaders at Canada’s Top Ten all know exactly what I’m talking about. While they quietly make off like bandits in what is essentially a rigged system, Canada’s best senior pension and investment analyst has been relegated to the blogosphere, in large part because he suffers from Multiple Sclerosis (and is doing just fine, knock on wood!).

Photo by Nick Wheeler via Flickr CC License