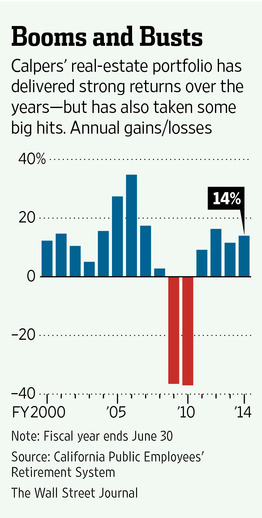

CalPERS announced last week plans to increase its real estate investments by 27 percent. This graph [above] shows the performance of the pension fund’s real estate portfolio since 2000.

As the graph indicates, the fund’s real estate investments have generally performed well, consistently netting returns of 15 percent or more.

But 2009 and 2010 were disastrous, and CalPERS lost $10 billion on real estate investments over that period.

CalPERS’ latest foray into real estate will be marked by investments in properties with “established demand”, according to the fund’s CIO, Ted Eliopoulos. Such investments include apartment complexes in cities and fully leased office buildings.

Graph credit: The Wall Street Journal.

One thought on “Chart: CalPERS’ Real Estate Returns Since 2000”

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712