Preqin released a report this month that shed light on how institutional investors perceive various alternative asset classes, and whether those investments are living up to expectations.

The report was the culmination of three months of surveys conducted by Preqin (the full report can be found here).

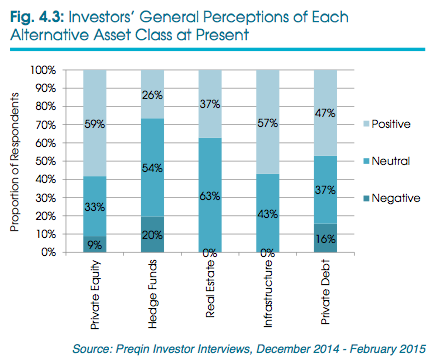

Hedge funds had the highest proportion of disappointed investors – 35 percent of survey respondents said their hedge fund investments fell short of expectations.

Meanwhile, investors were very happy with real estate, as 33 percent of survey respondents said their real estate investments had exceeded expectations.

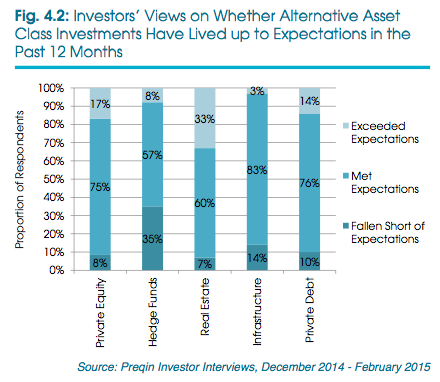

In the chart to the right, Preqin measures investors’ general perception of each alternative asset class.

Investors were generally very positive about private equity (59 percent “positive” perception) and infrastructure (57 percent “positive” perception).

The highest proportion of investors had negative perceptions of hedge funds (20 percent) and private debt (16 percent).

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712