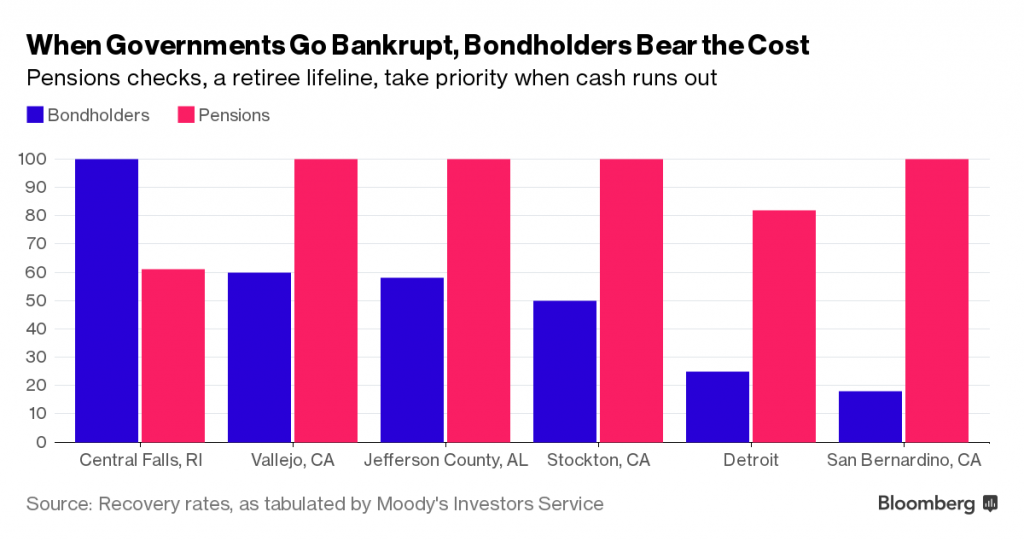

When municipalities and cities go bankrupt, who takes priority: bondholders or pensioners?

The chart above, put together by Bloomberg this week, shows the recovery rates of bondholders vs. pensioners in six instances of municipal bankruptcy.

There’s a reason the chart looks the way it does: pensions are typically protected by law in more than one way. Investors, on the other hand, are guaranteed nothing; and investing in a cash-strapped municipality comes with risks.

Pensioners typically come out unscathed, although not always: they took a big hit when Central Falls ran out of cash.

Bondholders, on the other hand, usually bear the brunt of the pain. When San Bernardino went bankrupt in 2014, bondholders recovered a mere 20 percent of their money on average. Some recovered nothing.

Credit: Bloomberg

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712