Most investment consultants don’t currently have systems in place to track and endorse emerging asset managers, and the barriers to such systems are more imagined than real, according to a recent survey of consultants conducted by SEIU.

The survey, titled Casting a Wider Net, queried the consultants on the barriers to tracking and promoting emerging managers.

The firms were asked:

“What challenges has your firm faced in implementing a more robust emerging/minority asset management firm program.”

Here are a sample of the responses:

– “Emerging manager operating partners often have less institutional capital experience, nascent business platforms … and limited if any real time performance track record”

– “The key challenge … is identifying a sufficient number of qualified managers with significant experience (that will meet the needs of our clients)”

– “[T]hey are often unable to meet basic client requirements such as assets under management [or] length of track record”

– “Industry recognition of the importance of diversity is not as wide as it should be”

– “Balancing our fiduciary responsibilities and our client mandates.”

Two themes emerged in the respondents’ answers. From the report:

Responses fall under two general arguments: 1) there are not enough qualified emerging managers with sufficient resources, experience and performance track records; and 2) other parties in the industry (such as clients) do not prioritize diversity. We believe these beliefs are based on the following myths:

Myth 1: There are not enough qualified asset managers with sufficient resources, experience and performance track records.

Fact: As of 2011, smaller funds managing less than $50 million returned an aggregate

13.1 percent on an annualized basis in the 15 years ended Dec. 31, higher than the 11.6

percent of funds with more than $1 billion over the same period.Moreover, roughly one-third of the $9.7 billion Chicago Teachers’ Pension Fund (CTPF), and approximately $11 billion of the New York City Retirement Systems funds are invested with emerging managers. CTPF touts its emerging management firms have out-performed their respective benchmarks for five consecutive years.

Similarly, the emerging manager portfolio for the Teacher Retirement System of Texas returned 14.5 percent in the year ended Sept. 30 [of 2014], compared to 11.6 percent for the entire fund.

Myth 2: The rest of the industry does not prioritize diversity, which makes it harder for us to implement a strong emerging manager program.

Fact: This blame-shifting is particularly concerning. Placing the responsibility on other parties in the industry enables consultants to engage in a potentially continuous cycle of avoiding changes that could increase emerging manager/MWBE growth. These deflections also raise questions of what the client standards are, and how consultant firms gauge asset management firm performance, given that several examples show it is not uncommon for emerging managers to outperform their more established colleagues.

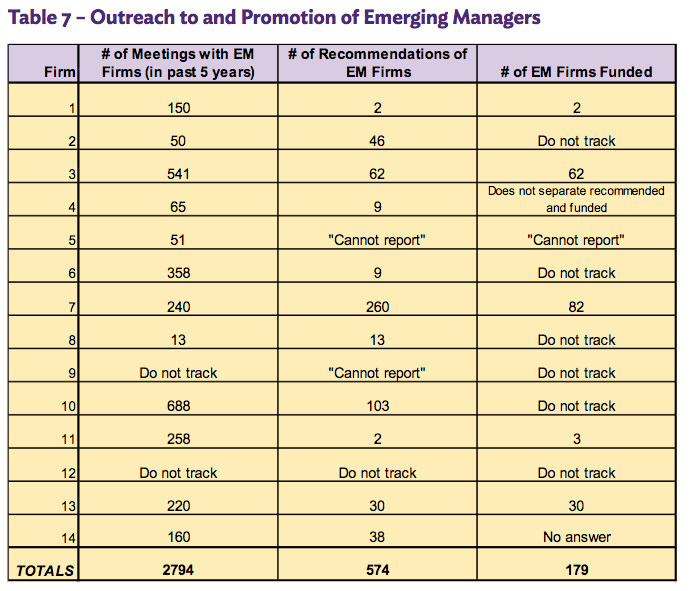

Below, see the raw results of the survey questions pertaining to meetings with emerging managers and subsequent recommendations and funding.

In the eyes of the report authors, “do not track” translates roughly to “not a priority”. They write:

The scattershot tracking and reporting illustrated in Table 7 suggests to us that many consultants have not been prioritizing work with emerging managers, as not tracking such information makes it extremely difficult for a firm to report how they prioritize diversity. Of 42 potential numeric answers to the questions in Table 7, only 28 are provided.

Especially concerning to us is that only five consultants track the number of MWBE firms that are ultimately funded, and only five firms provide numeric answers for all three questions listed in the table. Our suspicion about the lack of priority is reinforced by the fact that only one firm has explicit, concrete policies to promote emerging manager firms. Another firm only recently began tracking this data and hired a staff person to develop an emerging manager program.

Without detailed performance data on the number of emerging managers who are funded, it is difficult to identify effective strategies by which firms can be held accountable — either to themselves or their clients. Not tracking how many emerging managers achieve the ultimate goal of being funded tells us that not only are these firms not employing best practices; they do not even have sufficient information to identify what those best practices might be.

So how can investment consultants improve on this front? The report makes several recommendations.

The most obvious is to make more capital commitments to MWBE managers. Short of that, consultants can talk with their institutional clients about breaking down the barriers to diverse managers by altering RFP criteria that typically block these managers out (minimum AUM requirements, etc.). Consultants increase diversity at their own firm, specifically in leadership positions. And they can build relationships with emerging managers by communicating with them about the best opportunities to engage with consultants and institutional clients.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712