The Federal Reserve released its Report on the Economic Well-Being of U.S. Households last week, and one statistic stood out starkly from the rest: 19 percent of people between the ages of 55 and 64 have no retirement savings and don’t have a pension lined up.

The Federal Reserve released its Report on the Economic Well-Being of U.S. Households last week, and one statistic stood out starkly from the rest: 19 percent of people between the ages of 55 and 64 have no retirement savings and don’t have a pension lined up.

The Federal Reserve surveyed 4,100 people last year and retirement savings were one of the major topics. The report shed light on the dire state of retirement savings in the United States.

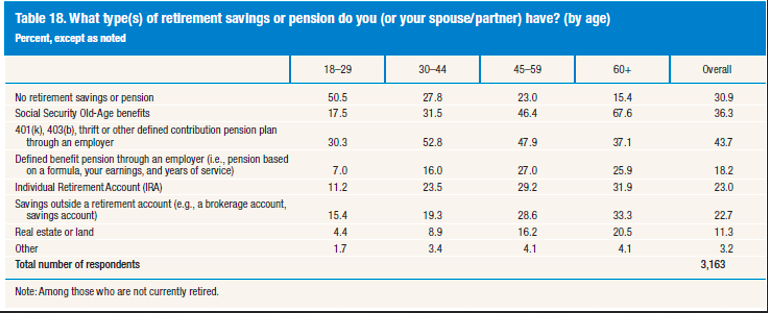

Across all age groups, 31 percent said they had zero retirement savings. When asked how they planned to get by after retirement, 45 percent said they would have to rely on social security. Eighteen percent plan to get a part-time job during “retirement”, and 25 percent of respondents said they “don’t know” how they will pay the bills during retirement.

Pension360 has previously covered how income inequality rears its head when retirement approaches, and this report provided further evidence: 54% of people with incomes under $25,000 reported having zero retirement savings and no pension. Meanwhile, only 90% of those earning $100,000 or more had either retirement savings or a pension, or both.

As 24/7 Wall St. points out, these trends could have a broader affect on the economy. What’s certain, however, is that retirement is no longer a certainty for many people:

This is no simple report to ignore, and this can affect the future of many things in America. It can affect Social Security, it can affect the financial markets via contributions and withdrawals of retirement funds, and it can affect the future workforce demographics in that older workers may simply not be removing themselves from the workforce, making it impossible for younger workers to graduate or move up.

Another retirement scare is a tale you have heard, but this quantifies it. The Fed showed that although the long-term shift from defined-benefit to defined-contribution (from pension to 401(K) and IRA) plans places significant responsibilities on individuals to plan for their own retirement, only about one-fourth appear to be actively doing so.

The researched that conducted the survey noted that the lack of retirement savings is due partially to poor planning. But many of those surveyed said they “simply have few or no financial resources available for retirement”.

Photo by RambergMediaImages via Flickr CC License

5 thoughts on “Federal Reserve: One In Five People Nearing Retirement Have No Retirement Savings”

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712