Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.

Actuaries are recommending that one of California’s oldest public pension systems, the California State Teachers Retirement System formed in 1913, lower its investment earnings forecast from 7.5 percent to 7.25 percent.

If the newly empowered CalSTRS board adopts the lower forecast next week, state rates paid to the pension fund would increase by 0.5 percent of pay, an additional $153 million bringing the total state payment next fiscal year to $2.8 billion.

Rates paid by an estimated 80,000 teachers hired after Jan. 1, 2013, when a pension reform lowered benefits, also would increase by 0.5 percent, taking about $200 a year from the average salary of $40,000.

The new rate-setting power is sharply limited. But it’s a big change for CalSTRS which, unlike nearly all California public pension funds, has lacked the power to raise employer rates, needing legislation instead.

CalSTRS could only plead with the Legisture for a rate increase as the funding level of its projected assets needed to pay future pensions fell from 120 percent in 2000 to less than 60 percent in 2009. Now despite a long bull stock market, the funding level will drop from 69 percent to 64 percent if the new forecast is adopted.

Legislation expected to put CalSTRS on the path to reaching 100 percent by 2046 was finally enacted three years ago. Most of the increased cost will come from school districts as their rates more than double, gradually going from 8.25 percent of pay to 19.1 percent in 2020.

The long phase in of the school district rates, which increase to 14.43 percent of pay in July, is already said by some to be severely squeezing money available for student services and teacher pay raises.

The legislation gave CalSTRS very limited power to raise school district rates beginning in 2021. Any increase is limited to 1 percent of pay a year, and the total school district rate cannot exceed 20.25 percent of pay.

The legislation increased the state rate from 4.5 percent of pay to the current rate of 8.8 percent. In its biggest power boost, CalSTRS was authorized to raise state rates 0.5 percent of pay a year, reaching a maximum of 23.8 percent before the legislation expires in 2046.

Teachers had been paying about the same CalSTRS rate as school districts, 8 percent of pay compared to the 8.25 percent for their employers. The legislation increased the rate paid by teachers hired before Jan. 1, 2013, to 10.25 percent of pay.

Their rate was capped by “California rule” court decisions that pensions offered at hire can’t be cut, unless offset by a new benefit. The new benefit for teachers hired before 2013 made a routine annual 2 percent cost-of-living adjustment a vested right that can’t be cut.

Rates paid by teachers hired after 2012, however, were not capped but are limited. The reform calls for an equal employer-employee share of the “normal” cost, the pension earned during a year excluding the often larger debt or “unfunded liability” from prior years.

It’s the requirement that teachers hired after the pension reform pay half the normal cost that would trigger the 0.5 percent of pay CalSTRS rate increase for some teachers, if the earnings forecast used to “discount” future pension costs is lowered to 7.25 percent.

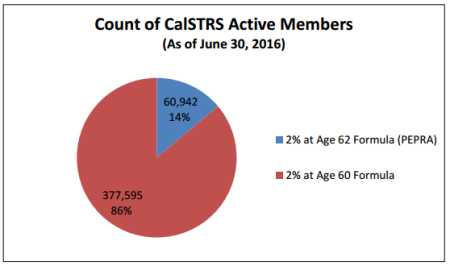

About 20,000 new hires have been hired during each of the last three years. So, CalSTRS estimates that 80,000 teachers with the new 2% at age 62 formula, about 20 percent of the total, would get a rate increase in July if the earnings forecast is lowered to 7.25 percent.

The CalSTRS board may decide whether to use its new rate power for the first time at a meeting next Wednesday (Feb. 1) in San Diego, which can be viewed by webcast after clicking on a tab on the CalSTRS website.

The board will receive an “actuarial experience” study, the first in five years. The consulting actuary, Milliman, found that over the next 30 years the life span of the average retiree is expected to increase by three years.

The report recommends lowering the earnings forecast to 7.25 percent because “there is a less than 50 percent probability” of a 7.5 percent return over the long term, based on “capital market assumptions” and dropping the inflation forecast from 3 to 2.75 percent.

“Going to 7.00% would be an acceptable alternative if the board wanted to add another level of conservatism in the actuarial assumptions by increasing the likelihood the investment assumption will be met long term,” the report said.

The state budget proposed by Gov. Brown for the new fiscal year beginning in July assumes a $153 million increase in the state payment based on a lower 7.25 percent earnings forecast.

If the earnings forecast was dropped to 7 percent, the report said, the state rate would be expected to increase 0.5 percent a year for 10 years, instead of for five years as expected under a 7.25 percent forecast.

For teachers hired after 2012 that receive lower pensions under the reform, the rate increase next year would be 1 percent of pay or about a $400 a year pay cut for the average teacher, instead of 0.5 percent of pay and a cut of $200 a year.

Though it’s not recommended, the report said the CalSTRS board could decide to leave the earnings forecast at 7.5 percent, with no rate increase for the state and new teachers, and still be on a path to full funding by 2046 because of its new power to raise rates later.

Whether earnings forecasts used by public pension funds to discount future pension obligations are too optimistic, and thus conceal massive debt, is one of the main disputes in the debate over the need for more cost-cutting reform.

The Pension Tracker at Stanford University, for example, shows that California public pension systems report a debt or unfunded liability of $228.2 billion using a 7.5 percent discount rate. The debt soars to $969.5 billion if the discount rate is 3.25 percent as used by CalPERS for terminated plans.

The California Public Employees Retirement System, which has different investment allocations and pension costs than CalSTRS, dropped its earnings forecast from 7.5 percent to 7 percent last month, causing a major rate increase that will be phased in over eight years.

The lower earnings forecast dropped the CalPERS funding level from 69 percent to 64 percent, Ted Eliopoulos, CalPERS chief investment officer, told Bloomberg News earlier this month. (As previously noted, the CalSTRS funding level also could drop from 68.5 to 64 percent.)

Consultants told CalPERS last spring that its investment portfolio would probably earn only 6.2 percent during the next decade. Higher earnings in the following decades were expected to keep earnings above 7.5 percent in the long run, a point cited by early opponents.

CalPERS staff met with employer groups, public employee union leaders, and retiree associations to explain the need for a rate increase. The Brown administration reportedly helped negotiate an agreement, and the lower forecast was adopted with little opposition.

While describing the process that resulted in the lower CalPERS earnings forecast, the new CalSTRS report said CalPERS has not yet released an official estimate of the rate increase for non-teaching school employees.

“However, information presented at the CalPERS Board meeting in December indicates the contribution rate for school employers will likely double from its current level of 13.888 percent of payroll,” said the CalSTRS report.

CalPERS had no immediate comment on the CalSTRS report yesterday.

The new CalPERS rate increase is the fourth in recent years: earnings forecast lowered from 7.75 percent to 7.5 percent in 2012, actuarial method no longer annually refinances debt in 2013, and a longer average life span for retirees in 2014.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712