Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Anna Kitanaka and Shigeki Nozawa of Bloomberg report, World’s Biggest Pension Fund Finds New Best Friend in Trump:

One of the world’s most conservative investors has found an unlikely new ally in one of its most flamboyant politicians: Donald Trump.

The unconventional president-elect’s victory is helping Japan’s giant pension fund in two important ways. First, it’s sending stock markets surging, both at home and overseas, which is good news for the largely passive equity investor. Second, it’s spurred a tumble in the yen, which increases the value of the Japanese manager’s overseas investments. After the $1.2 trillion Government Pension Investment Fund reported its first gain in four quarters, analysts are betting the Trump factor means there’s more good news to come.

“The Trump market will be a tailwind for Abenomics in the near term,” said Kazuhiko Ogata, the Tokyo-based chief Japan economist at Credit Agricole SA. “GPIF will be the biggest beneficiary among Japanese investors.”

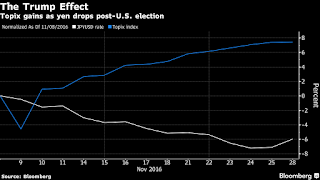

While most analysts were concerned a Trump victory would hurt equities and strengthen the yen, the opposite has been the case. Japan’s benchmark Topix index cruised into a bull market last week and is on course for its 12th day of gains. The 4.6 percent slump on Nov. 9 now seems a distant memory. The yen, meanwhile, is heading for its biggest monthly drop against the dollar since 2009.

GPIF posted a 2.4 trillion yen ($21 billion) investment gain in the three months ended Sept. 30, after more than 15 trillion yen in losses in the previous three quarters. Those losses wiped out all investment returns since the fund overhauled its strategy in 2014 by boosting shares and cutting debt. It held more than 40 percent of assets in stocks, and almost 80 percent of those investments were passive at the end of March.

Tokyo stocks are reaping double rewards from Trump, as the weaker yen boosts the earnings outlook for the nation’s exporters. The Topix is the fourth-best performer since Nov. 9 in local-currency terms among 94 primary equity indexes tracked by Bloomberg.

Global Rally

But they’re not the only ones. More than $640 billion has been added to the value of global stocks since Nov. 10, when many markets around the world started to climb on bets Trump would unleash fiscal stimulus and spur inflation, which has boosted the dollar and weakened the yen. The S&P 500 Index closed Wednesday at a record high in New York.

Bonds have tumbled for the same reasons, with around $1.3 trillion wiped off the value of an index of global debt over the same period. Japan’s benchmark 10-year sovereign yield touched a nine-month high of 0.045 percent on Friday, surging from as low as minus 0.085 percent on Nov. 9.

GPIF’s return to profit is a welcome respite after critics at home lambasted it for taking on too much risk and putting the public’s retirement savings in jeopardy.

The fund’s purchases of stocks are a “gamble,” opposition lawmaker Yuichiro Tamaki said in an interview in September, after an almost 20 percent drop in Japan’s Topix index in the first half of the year was followed by a 7.3 percent one-day plunge after Britain’s shock vote to leave the European Union. Prime Minister Shinzo Abe said that month that short-term losses aren’t a problem for the country’s pension finances.

Feeling Vindicated

“I’d imagine GPIF is feeling pretty much vindicated,” said Andrew Clarke, Hong Kong-based director of trading at Mirabaud Asia Ltd. “It must be cautiously optimistic about Trump.”

Still, the market moves after Trump’s victory are preceding his policies, and some investors are questioning how long the benefits for Japan — and GPIF — can last. Trump already said he’ll withdraw the U.S. from the Trans-Pacific Partnership trade pact on his first day in office. The TPP is seen as a key policy for Abe’s government.

“It looks good for GPIF for now,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management Co. in Tokyo. But “whether the market can continue like this is debatable.”

In my opinion, it’s as good as it gets for GPIF as global stocks surged, global bonds got hammered and the yen depreciated a lot versus the US dollar following Trump’s victory.

I’ve already recommended selling the Trump rally. Who knows, it might go on till the Inauguration Day (January 20th) or even beyond, but the truth is there was a huge knee-jerk reaction mixed in with some irrational exuberance propelling global stocks and interest rates a lot higher following Trump’s victory.

Last week, I explained why I don’t see global deflation risks fading and told my readers to view the big backup in US bond yields as a big US bond buying opportunity. In short, nothing trumps the bond market, not even Trump himself.

All these people telling you global growth is back, inflation expectations will rise significantly, and the 30+ year bond bull market is dead are completely and utterly out to lunch in my opinion.

As far as Japan, no doubt it’s enjoying the Trump effect but that will wear off fairly soon, especially if Trump’s administration quits the TPP. And it remains to be seen whether Trump is bullish for emerging markets and China in particular, another big worry for Japan and Asia.

In short, while the Trump effect is great for Japan and Euroland in the short-run (currency depreciation alleviates deflationary pressures in these regions), it’s far from clear what policies President-elect Trump will implement once in power and how it will hurt the economies of these regions.

All this to say GPIF should hedge and take profits after recording huge gains following Trump’s victory. Nothing lasts forever and when markets reverse, it could be very nasty for global stocks (but great for global bonds, especially US bonds).

One final note, I’ve been bullish on the US dollar since early August but think traders should start thinking about the Fed and Friday’s job report. In particular, any weakness on the jobs front will send the greenback lower and even if the Fed does move ahead and hike rates once in December, you will see traders take profits on the US dollar.

If the US dollar continues to climb unabated, it will spell trouble for emerging markets and US corporate earnings and lower US inflation expectations (by lowering import prices).

Be very careful interpreting the rise in inflation expectations in countries like the UK where the British pound experienced a huge depreciation following the Brexit vote. These are cyclical, not structural factors, driving inflation expectations higher, so don’t place too much weight on them.

And you should all keep in mind that Japan’s aging demographics is a structural factor weighing down growth and capping inflation expectations. This is why Japan is at the center of the global pension storm and why it too will not escape Denmark’s dire pension warning.