Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Everett Rosenfeld of CNBC reports, Donald Trump wins the presidency, hails ‘beautiful and important’ win:

Donald John Trump will be the 45th president of the United States, capping a historic and boisterous run by an outsider who captured a loyal following across a swath of America fed up with establishment politics, the news media and elected officials.

His success was only part of a larger, crushing victory for the Republican Party, which retained the House and maintained control of the Senate.

The brash New York businessman will win at least 270 electoral votes, according to NBC News projections, and will take his Republican ticket to the White House in January. Trump had trailed Democrat Hillary Clinton in polling averages for nearly the entire election cycle, but he bucked prognostications by picking up states many pundits deemed out of his reach.

On Twitter, the president-elect called his win “beautiful and important,” while the White House issued a statement that President Obama plans to publicly address the election results, and invite Trump to the White House on Thursday to discuss handing over power.

“Ensuring a smooth transition of power is one of the top priorities the President identified at the beginning of the year and a meeting with the President-elect is the next step,” the White House statement read.

The 70-year-old real estate mogul — who is now the oldest person ever elected to a first presidential term — declared victory early Wednesday, saying Clinton had conceded the election and that it’s time for the nation “to come together as one united people.”

The Republican congratulated his Democratic rival, saying that she waged “a very very hard-fought campaign.” He also commended her for having “worked very long and very hard” over her political career.

“Now it’s time for America to bind the wounds of division — have to get together,” he said. “To all Republicans and Democrats and independents across this nation, I say it is time for us to come together as one united people.”

Trump, who had been criticized by opponents for rhetoric characterized as divisive and racist, pledged, “I will be president for all Americans, and this is so important to me.”

Trump has never before held public office, but he will be joined in the executive branch by Vice President-elect Mike Pence and a host of politicians and business executives who rallied around the GOP nominee.

Although the vast majority of pre-election surveys had indicated a slight advantage for Clinton, Trump’s campaign had frequently predicted that a vein of electoral strength existed beyond the polls, pointing to his massive crowds at his events and online support.

Clinton — who was secretary of state under President Barack Obama, a U.S. senator for New York from 2001 to 2009, and first lady during her husband’s presidency in the 1990s — had been painted as the “establishment” politician, while Trump campaigned as a political neophyte who could “drain the swamp” of government corruption in Washington.

Trump will likely face significant Democratic attempts at opposition after he enters the White House in January. In fact, Trump has elicited strong outcries from liberal and minority groups since he first characterized many Mexican immigrants “rapists” in his June 2015 campaign kickoff.

Trump rose to prominence in a crowded GOP primary field by connecting with voters who felt they had been betrayed by Washington interests. The businessman focused his early pitch on forceful answers to economic issues like trade and immigration, which resonated with those Americans who had stopped believing mainstream Republicans cared about their communities.

Many experts in economics and policy studies have decried Trump’s prescriptions as nearly impossible to implement and unlikely to achieve their desired aims. But supporters, and Trump himself, have contended that his calls for extreme tariffs and mass deportations were opening salvos in forthcoming negotiations.

And Trump, who has been famous for decades as a symbol of wealth and business acumen, channeled the image of a negotiator throughout his campaign. The real estate developer — who co-authored “Trump: The Art of the Deal” — has repeatedly claimed that other countries are taking advantage of the United States, and the White House should work to renegotiate its existing agreements.

Clinton, meanwhile, had campaigned on a set of policy proposals made more liberal for her primary contest against Sen. Bernie Sanders. While Republicans painted Clinton as too liberal — an extension of Obama’s tenure — many on the left expressed discomfort with the former secretary of state, jeering that she was more aligned with right-of-center candidates.

Yet for all of those criticisms, Clinton had appeared ahead in the race, especially after her well-received debate performances. But that lead became more tenuous when the FBI announced just 11 days before the election that it was probing new evidence regarding her use of a private email server while secretary of state. The FBI subsequently said the new probe did not turn up any reason to charge Clinton with a crime, but Democrats, and even some Trump supporters, called foul on the timing of the original announcement: Clinton’s campaign was damaged as voters were reminded of a scandal that had faded from the forefront.

Trump also faced several challenges on his road to the White House, including allegations that he sexually assaulted or harassed multiple women, and several women making such claims came forward after the release of a 2005 video in which he bragged about groping women.

Still, Tuesday’s election results are a strong repudiation of the entire system of Washington politics, not just the Democrats or Clinton. A long list of Republican leaders and luminaries had come out against Trump, or at least refused to endorse their party’s new, de-facto head.

The Trump victory also marks a rejection of the mainstream news media, which extensively covered Trump’s scandals and self-contradictions. Polls showed many of the Republican’s supporters dismissed those reports.

As recently as last week, in fact, pundits on both sides suggested that Trump was not angling to win the election — he was instead interested, they said, in establishing a base of support for profitable post-race enterprises. But after an acrimonious election, Trump will now turn to building a team that can work together to implement his ideas for the country.

Scott Horsely of NPR also reports, Trump Wins. Now What?:

Donald Trump’s presidential campaign, like the business career that preceded it, was unpredictable, undisciplined and unreliable. Despite those qualities — or perhaps, in part, because of them — it was also successful.

So what should we expect from President-elect Trump, mindful that his path to the White House has defied expectations at every turn?

Some of Trump’s ambitions have been clearly telegraphed: He plans to build a wall along the U.S. border with Mexico, deport millions of criminal immigrants, unwind trade deals dating back more than two decades and repeal Obamacare. He has also promised to cut taxes and eliminate numerous government regulations — including power plant rules designed to combat global warming.

With the presidential pen and a friendly Republican Congress, Trump should have little trouble delivering on those promises.

But Trump’s campaign never really revolved around specific policy prescriptions. His agenda is not anchored to ideology but rather shaped by instinct and expedience.

“Trump operates very much from his gut,” said David Cay Johnston, author of The Making of Donald Trump. “The guiding philosophy of Trump is whatever is in it for his interests at the moment.”

When his initial tax plan prompted sticker shock among fiscal watchdogs, Trump readily shaved trillions of dollars off the bottom line. (His new plan is still a budget buster, though.) His impulsive call to ban Muslim immigrants gradually morphed into a vague prescription for “extreme vetting.” And he hastily concocted a plan to help working parents only after his daughter trumpeted a vaporware version at the GOP convention.

That flexibility seems to be just fine with tens of millions of supporters who trust Trump’s instincts and assume his success will boost the country as a whole. The campaign slogan “Make America Great Again,” which Trump trademarked just days after the 2012 election, is both vague and malleable enough to accommodate whatever nostalgic and aspirational vision his followers want to attach to it.

Supporters point to the way Trump rescued a New York skating rink that languished for years in the 1980s under city government supervision.

“What had taken the city over half a decade to botch, my father completed in less than six months, two months ahead of schedule and over a million dollars under budget,” Eric Trump told delegates at the Republican National Convention.

Backers hope the incoming president will bring similar accountability to the federal government.

One of Trump’s first tasks will be staffing up for a new administration. The celebrity businessman who turned “You’re fired!” into a catchphrase will soon be doing a lot of hiring.

“I will harness the creative talents of our people,” Trump told supporters at a victory party early Wednesday. “And we will call upon the best and brightest to leverage their tremendous talent for the benefit of all.”

Friends say assembling high-performing teams is one of the president-elect’s strengths.

“He pushes everybody around him, including you, through comfort barriers that they never thought they could ever shatter,” said Colony Capital CEO Tom Barrack, who delivered a testimonial for Trump at the party convention in July.

Trump’s daughter Ivanka told delegates her father has always promoted on the basis of merit.

“Competence in the building trades is easy to spot,” she said at the convention in July. “And incompetence is impossible to hide.”

In politics and in business, Trump has kept his organizations lean. He had only about one-tenth of the staff Hillary Clinton had, heading into the final months of the campaign.

Trump’s aides are often long on loyalty and short on formal credentials. Politico noted that the chief operating officer of the Trump Organization was initially hired to be a bodyguard, after Trump spotted him working security at the U.S. Open tennis tournament.

Trump may delegate, but there’s no doubt who’s in charge. Even if he fills his Cabinet with big personalities — Newt Gingrich has been floated for secretary of state and Rudy Giuliani for attorney general — Trump is not likely to share the spotlight.

“The only quote that matters is a quote from me!” Trump tweeted this summer, urging journalists to pay no attention to his subordinates. As late as Friday, he boasted that he didn’t need other celebrities to attract large crowds to his rallies.

“I didn’t have to bring JLo or Jay Z,” Trump said, mocking Hillary Clinton’s reliance on big-name warmup acts. “I am here all by myself.”

Trump, who prides himself on being a counter-puncher, can also be expected to use the levers of government to target his political rivals. He has already threatened on live television to appoint a special prosecutor to investigate Clinton.

“Trump’s philosophy, which he’s written and spoken about for many years, is to get revenge,” Johnston said.

Once Trump is in the White House, the news media will remain firmly focused on the new commander in chief.

“Donald is the most masterful manipulator of the conventions of journalism I’ve ever seen,” said Johnston, a Pulitzer Prize-winning former reporter for The New York Times.

Trump has long believed that even bad publicity is better than no publicity. Surprising and provocative statements are both a tool to keep the audience paying attention and a negotiating tactic.

“I always say we have to be unpredictable,” Trump told the Washington Post editorial board.

Everything for Trump is a negotiation. And much of his campaign was based on the idea that the U.S. has been getting a bad bargain.

“You look at what the world is doing to us at every level, whether it’s militarily or in trade or so many other levels, the world is taking advantage of the United States,” Trump told CNN. “And it’s driving us into literally being a third-world nation.”

As a businessman, Trump has a long history of using pressure tactics to drive hard bargains. USA Today found hundreds of examples in which employees and contractors accused Trump of not paying them for their work. They sometimes settled for less than they were owed, rather than face a lengthy legal battle against Trump and his deep pockets.

Similarly, Trump argues that if the U.S. puts pressure on other countries — by imposing import tariffs or demanding payment for military protection — they’ll quickly back down.

Some foreign policy scholars are not convinced this zero-sum mindset is appropriate.

“By threatening to drive harder bargains, he might manage to eke out a slightly larger share of the pie,” said Daniel Drezner of the Fletcher School of Law and Diplomacy at Tufts University. “But he also threatens to blow up that pie in the process.”

The stock market has sent clear signals that investors are worried about the economic fallout from a Trump administration. According to one estimate, the S&P 500 index will be worth 12 percent less under Trump than it would have been had Clinton been elected.

Count on the president-elect to loudly hype any success while downplaying any setback. And if that requires bending the truth a bit, so be it.

“People want to believe that something is the biggest and the greatest and the most spectacular,” Trump wrote in his best-selling 1987 book The Art of the Deal. “It’s an innocent form of exaggeration — and a very effective form of promotion.”

If history is any guide, the new Trump administration will not be overly constrained by facts.

Trump has shamelessly exaggerated the height of his buildings, the size of his profits, and even the number of people who showed up to cheer his presidential bid.

“When you have a huge crowd, and Trump draws huge crowds, there’s no need to exaggerate,” Johnston said. “Except in Donald’s mind where big is never big enough.”

Don’t expect that to stop now that he has achieved the biggest and most powerful office in the land.

Love him or hate him, Donald J. Trump will be the 45th president of the United States. I spent all night watching the US elections, flicking channels from CNN, ABC, CBS, NBC and FOX News, and tweeting on this historic election.

And I’m Canadian but nothing is more exciting to me than watching the actual US election because it can swing either way depending on who captures the swing states.

Last night, when Trump was leading in Florida, I started to believe he was going to pull it off, and when he won Ohio, it was a done deal for me.

People get so emotional when discussing these results but the goal of this post is to look well past the hysteria and understand what is going to happen next when president-elect Trump and his administration take office in the new year.

First, let me begin with something Francois Trahan and Stephen Gregory of Cornerstone Macro put out this morning:

If there is one thing that 2016 has taught us it is to not rule out the unlikely scenario. Indeed, the events surrounding the Brexit vote and now Donald Trump winning the U.S. presidency were unexpected to happen, at least according to the polls and their proponents. So what does all of this mean for the stock market anyway? It’s hard to know exactly what powers congress will convey on the new President but the biggest potential problem as we see things has to do with trade.

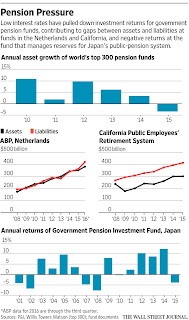

At this time, there is already a dynamic for an economic slowdown in place, one that the new president will inherit. Money supply has slowed across the developed world and rates have backed up. All of which will eventually add to a weaker U.S. economy. The real troubles with this story lie overseas where a number of countries have come to rely on the U.S. for trade. If the new President holds true on his promise to tear up trade agreements, then the outlook just got a lot more complicated. Our call for a bear market in 2017 was never about potential U.S. election results. Rather, it is about the consequences that tighter policy will bring to an already fragile world economy. As always, we shall see.

In a recent comment on lessons for Harvard’s endowment, I noted a video update, “A Recipe For Investment Insomnia,” where Francois Trahan and Michael Kantrowicz of Cornerstone Macro cite ten reasons why markets are about to get a lot harder going forward :

- Growth Is Likely To Slow … From Already Low Levels

- The Risks Of Zero Growth Are Higher Today Than In The Past

- The U.S. Consumer No Longer The Buffer Of U.S. Slowdowns

- The World Is Battling Lingering Structural Problems

- A U.S. Slowdown Has Implications For The World’s Weakest Links

- The Excesses Of China’s Investment Bubble Have Yet To Unwind

- Demographic Trends In Japan … An Insurmountable Problem?

- Central Banks Have Reached The Limits Of Monetary Policy

- Slower Growth Is The Enemy Of Portfolio Managers

- P/Es Are Hypersensitive To The Economy At This Time

These are all ten factors that President Trump will inherit and need to contend with. You should all subscribe to the high quality research Cornerstone Macro puts out as they do an excellent job covering markets and key economic trends around the world.

I might add the risks of global deflation are not fading, and if there is a severe disruption to global trade under Trump’s watch, this will only intensify global deflationary headwinds.

One area which Trump is definitely committed to is spending on infrastructure. Jim Cramer of CNBC said this morning he sees the Treasury department emitting new 30-year bonds to cover the trillion dollar spending program Trump has outlined to revamp airports, roads, bridges and ports.

Here, I will refer the Trump administration to what the Canadian federal government is doing setting up a new infrastructure bank, allowing Canada’s large pensions and other large global investors, to invest in large greenfield infrastructure projects.

I discussed this new initiative and what Canada’s large pensions are looking for in a recent comment where I also shared insights at the end in an update from Andrew Claerhout, Senior Vice-President of Infrastructure & Natural Resources at Ontario Teachers’ Pension Plan.

Why am I mentioning this? Because if Trump’s administration is really committed to “making America great again” and spending a trillion or more on infrastructure, they will need a plan, a blueprint and they definitely should talk to the leaders of Canada’s large pensions, widely considered to be among the best infrastructure investors in the world.

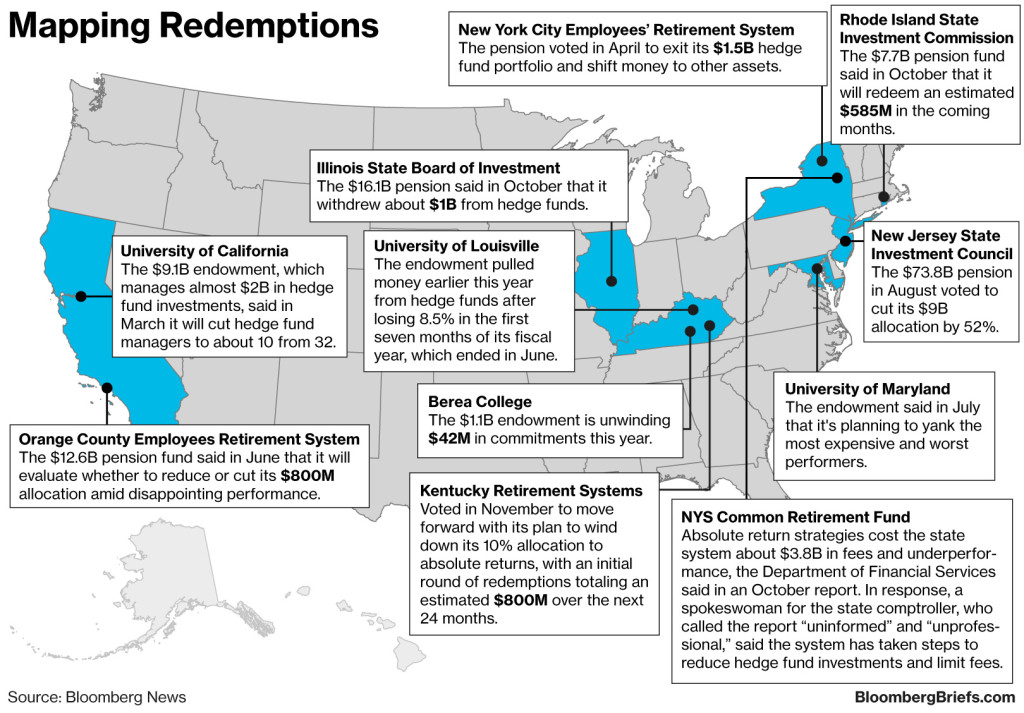

There is another reason why I mention this. The US has a huge pension problem as many public sector pensions are chronically underfunded. There is a growing appetite for infrastructure assets around the world, including in the United States where large public pensions are looking to increase their allocations.

If a Trump administration sets up the right program on infrastructure, modeled after the Canadian one, and establishes the right governance, it will be able to attract capital from US public pensions starving for yield as well as that from Canadian and global pensions and sovereign wealth funds which would welcome such a program as it fits perfectly with their commitment to infrastructure as an asset class.

The big advantage of integrating US and global pensions as part of the solution to rebuilding America’s infrastructure is that it will limit the amount the US needs to borrow and will make this ambitious infrastructure program more palatable to deficit hawks like Paul Ryan (who might not be the speaker of the House come January).

And if it’s done right, it will allow many US public pensions to invest massively in domestic infrastructure, allowing them to collect stable cash flows over the long run, helping them meet their mounting future liabilities. The same goes for Canadian and global pensions which would also invest in big US infrastructure provided the governance is right.

What else can Trump do to make America great again? He should consider bolstering Social Security for all Americans and modeling it after the (now enhanced) Canada Pension Plan where money is managed by the Canada Pension Plan Investment Board.

One thing Trump should not do is follow lousy advice from Wall Street gurus and academics peddling a revolutionary retirement plan which only benefits Wall Street, not Main Street.

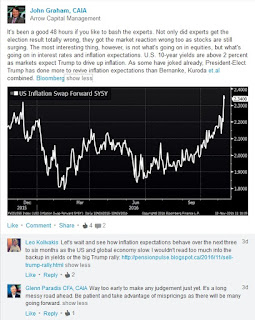

Speaking of Wall Street, I just noticed how the stock market is surging as I end this comment, which goes to show you why you should NEVER listen to big hedge funds, gurus or market strategists warning you of doom and gloom if Trump is elected.

I warned all my readers last week when I went over America’s Brexit or biotech moment to ignore all these doomsayers on Trump and go long healthcare (XLV) and especially biotech stocks (IBB and equally weighted XBI) which are surging today.

Unlike many blowhard prognosticators, I put my money where my mouth is and if you made money on my call to go long biotech stocks last week, please do the right thing and contribute to this blog on the top right-hand side under my picture. Thank you.

As for president-elect Trump, he has the toughest job ahead of him but if he surrounds himself with a truly great team and focuses his attention on fixing the economy (not the divisive crap) using pensions to invest in infrastructure, then he might go down in history as a one of the best presidents ever.

In fact, I’m convinced his huge ego will drive him to fulfill this legacy which is why I take all these doomsayer scenarios with a shaker of salt. Never short the United States of America. Period.