Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Nicholas A. Vardy, Chief Investment Officer at Global Guru Capital, wrote a comment for MarketWatch, How one man in Nevada is trouncing the Harvard endowment:

This past weekend, I attended a gala reception for over 500 European Harvard alumni gathered in the impressively refurbished main hall of the Deutsches Historisches Museum (German Historical Museum) in Berlin.

Harvard’s President Drew Faust regaled alumni with self-congratulatory statistics on how Harvard is spending the fruits of its current $6.5 billion fund raising campaign, refurbishing undergraduate housing and getting Harvard’ science and engineering departments up to snuff.

There was other news from Cambridge, Massachusetts that President Faust ignored in her polished plea to well-heeled alumni in Berlin.

And that has been the embarrassing performance of the Harvard endowment over the past decade.

For all of Harvard’s fund raising prowess — second only to Stanford — six years of Harvard’s current capital campaign has been barely enough to offset the decline in the value of the Harvard endowment since 2011.

Almost a decade after reaching its peak, the Harvard endowment is smaller today in nominal terms than it was in 2007.

Boasting a value $35.7 billion, Harvard’s endowment tumbled about 5% or $1.9 billion over the past 12 months. A big chunk of the most recent drop stemmed from Harvard endowment forking over $1.7 billion to the university itself– a roughly 30% subsidy to its annual operating budget.

What is of growing concern to Harvard alumni and staff is that Harvard endowment’s investment returns over the past 12 months were a negative 2%. That (yet again) trailed traditional rival Yale, which eked out a 3.4% gain.

Harvard’s Endowment: A State of Crisis

So what is the culprit behind Harvard’s poor investment performance?

Some of last year’s poor performance may be due to bad luck. After a volatile start to the year, Harvard’s portfolio of publicly traded stocks lost 10.2% through June 2016. Throw in a couple of unfortunate blow ups in Latin America, and voila — the Harvard endowment recorded its first annual loss since 2008.

Still, concern about Harvard’s poor investment performance is about more than just a single unlucky year.

Over the past decade, the Harvard endowment has generated an average gain of just 5.7%. Harvard’s five-year track record of 5.9% puts it at the back of the class among its Ivy League rivals, just ahead of Cornell.

Not that the school hasn’t noticed.

The Harvard endowment plowed through several CEOs in recent years. The recently hired former head of Columbia’s endowment will be the eighth CEO to lead the Harvard endowment — including interim heads — in the past 12 years. His predecessor left after just 18 months on the job.

The largest university endowment in the world has not lacked for investment talent. The Harvard Management Company’s staff is chock full of former Goldman Sachs partners and other high-compensated Wall Street investment talent

Nor has Harvard’s staff of around 200 former Masters of the Universe been shy about writing themselves checks for huge salary and bonuses. Former CEO Jane Mendillo earned $13.8 million in 2014. Other top traders at Harvard have made as much as $30 million in a single year.

How Nevada is embarrassing Harvard

Carson City, Nevada, is a long way from Cambridge, Massachusetts.

That’s where Steve Edmundson manages the Nevada State Pension fund — which, at $35 billion, is just about the same size as the Harvard endowment. Nevada’s State Pension fund, however, differs from Harvard in other crucial ways.

First, Steven Edmundson is the only investment professional managing the Nevada State Pension Fund. The University of Nevada, Reno, alumnus has no other internal professional staff.

His investment strategy?

Do as little as possible — usually nothing. That is because Edmundson invests Nevada’s pension fund’s assets in low-cost passive investment vehicles.

Second, Edmundson earns an annual salary of $127,121.75. That’s a long way from the multimillion dollar pay packages collected by top portfolio managers at Harvard. Ironically, his salary also matches just about exactly the $126,379 salary of an Assistant Professor at Harvard — typically a 27-year-old academic who has just completed her Ph.D.

Third, and perhaps most astonishingly, the Nevada State Pension Fund’s investment track record soundly beats the Harvard endowment over the past decade.

While Harvard returned 5.7% annually over the last 10 years, the Nevada State Pension fund has generated annual returns of 6.2%. Over five years, Nevada has extended its lead, returning 7.7% per annum, while has Harvard stagnated at 5.9%. That outperformance of 1.8% per year is a country mile in the investment world.

As it turns out, Nevada is also beating the returns of the nation’s largest public pension fund, the California Public Employees’ Retirement System, or Calpers. Nevada’s investment returns beat Calpers over one-, three-, five- and 10-year periods.

Sure, Calpers is a different beast, managing about $300 billion. However, it also has a staff of 2,636 employees to generate its returns

Edmundson is essentially a one-man band.

What is to be done?

So does Nevada’s outperformance of the Harvard endowment mean it should abandon the famous “Yale model” of endowment investing with its eye-popping allocations to alternative asset classes like private equity, venture capital, and hedge funds?

Should Harvard mimic the Nevada State Pension fund success, fire the bulk of its investment staff, and only invest in low-cost index funds ?

Although that strategy would likely improve Harvard’s investment performance, the answer remains “probably not.”

Over the past 10 years, Yale has generated an annualized return of 8.1% on its endowment with a staff of about 25 investment professionals, by definition staying true Davis Swensen’s original “Yale model.”

And after all, Yale did outperform Nevada’s 6.2% return over the past decade. An outperformance of 1.9% per year is substantial.

So it seems less that the “Yale model” itself is broken than it is Harvard’s investment team that has tripped over itself during the past decade. But it does mean that the Harvard endowment and its overpaid staff of 200 investment professionals has to get its act together.

And it had better do so … and fast.

On Friday, I went over why Harvard’s endowment was called “fat, lazy, stupid” and why the McKinsey report highlighted some disturbing issues where past investment officers manipulated benchmarks in real assets to pad their performance and justify multimillion dollar bonuses.

Over the weekend, I continued reading on Harvard’s endowment and came across this and other articles. In early October, Paul J. Lim wrote a comment for Fortune, 3 Reasons That Harvard’s Endowment Is Losing to Yale’s:

The largest educational endowment in the world is under new management, and it’s easy to see why.

Harvard Management Co., which oversees Harvard’s mammoth $36 billion endowment, has named Columbia University’s investment chief N.P. Narvekar as its new CEO. At Columbia, Narvekar produced annual total returns of 10.1% over the past decade, which trounced the 7.6% annual gains for Harvard.

The hiring comes days after Harvard’s investment fund reported a loss of 2% in the 12 months ended June 30. Making matters worse, rival Yale announced that its $25 billion endowment grew 3.4% during that same stretch, leading the student editors of the Harvard Crimson to declare: “This is unacceptable.”

The prior year wasn’t much better. While Harvard’s endowment gained 5.8% in the prior fiscal year ending June 30, 2015, that performance ranked second-to-last among all Ivy League endowments, earning half the returns of Yale.

Normally, differences of this magnitude can be chalked up to basic strategy. But the fact is, Harvard and Yale invest rather similarly. Instead of simply owning stocks and bonds, both endowments spread their wealth among a broader collection of assets that include U.S. and foreign stocks, U.S. and foreign bonds, real estate, natural resources, “absolute return” funds (which are hedge-fund-like strategies), and private equity.

Still, there are subtle differences between the two approaches. And while most investors don’t have access to—or interest in—exotic alternatives like private equity and venture capital funds, the differences between the performance of the Harvard and Yale endowments offer a few lessons for all investors.

#1) Focus your attention on what really matters.

Academic research shows that deciding on which assets to invest in—and how much money to put in each type of investment—plays a far bigger role in determining your overall performance than the individual securities you select.

But while Harvard and Yale’s investment management teams both spend time concentrating on their “asset allocation” strategies, only one gives it its full attention.

Yale runs a fairly streamlined office with a staff of just 30. That’s because the actual function of picking and choosing which stocks or bonds or real estate holdings to invest in—and how best to execute the actual trades—is farmed out to external managers at professional investment firms.

This allows the Yale Investments Office to spend all its time figuring out the optimal mix of investments based on their needs and the market climate.

Harvard, on the other hand, runs what’s called a “hybrid” system. In addition to setting asset allocation policies and hiring external managers like Yale does, the investment staff at Harvard Management Co. also directly invests a sizeable portion of the endowment itself, selecting securities and being responsible for executing the trades.

This is why HMC employs more than 200 staffers by comparison.

Yet as Harvard’s recent performance shows, it’s hard to be good at all aspects of investing.

Indeed, Robert Ettl—who has been serving as HMC’s interim chief executive and will become chief operating officer under Narvekar—noted in a recent report that the endowment’s disappointing showing “was driven primarily by losses in our public equity and natural resources portfolios.”

Ettl went on to note that “we have repositioned our public equity strategy to rely more heavily on external managers”—a tacit admission that Harvard’s internal equity managers were probably responsible for a decent portion of that poor performance.

And as for the natural resources segment of HMC’s portfolio—which involves owning physical commodities such as timber on plantations owned and managed by Harvard—that lagged its benchmark performance by a massive 11 percentage points in fiscal year 2016. As a result, Ettl said HMC recently replaced the internal head of its natural resources portfolio.

#2) Turnover is never good, especially when it comes to management.

At Yale, David Swensen has managed the school’s endowment for 30 straight years, generating annual returns of about 14% throughout his tenure, far in excess of his peers and the broad market. That long, stable tenure has allowed Yale to maintain such a consistent strategy—of being willing to delve into somewhat risky and illiquid assets including venture capital, private equity, hedge funds, and physical assets—that this approach is now called “the Yale Model.”

Harvard is another story altogether.

When Narvekar assumes his duties at HMC on December 5, he will be the eighth manager to lead Harvard’s investment portfolio—including interim heads—in the past 12 years.

And each manager has put his or her own spin on the underlying investment style, forcing the endowment to switch gears every few years.

For example, Mohamed El-Erian, who briefly ran the endowment before leaving to become CEO and co-chief investment officer at PIMCO, increased the endowment’s use of derivatives and hedge funds and exposure to the emerging markets. El-Erian’s successor Jane Mendillo then took the fund in a more traditional direction. But she had the unenviable job of unwinding HMC’s exposure to El-Erian’s illiquid bets during the global financial crisis.

Every time the endowment deploys new strategies and unwinds old ones, turnover rises. And high portfolio turnover usually leads to poor performance, higher costs, and more taxes.

#3) Don’t try to copy other investors. Success is hard to replicate.

Under both Stephen Blythe, who served for less than a year and a half before taking medical leave, and interim CEO Ettl, Harvard Management has shifted a greater portion of its equity strategy to external managers—in apparent emulation of Yale.Narvekar himself is said to be closer to Yale’s Swensen, operating a relatively small staff that relies exclusively on external managers.

But it’s hard enough for successful managers to replicate their own success. It’s doubly hard trying to emulate other successful investors.

In fact, David Swensen at Yale is on record as saying that individual investors should not even try to copy what Yale is doing with its endowment.

Instead, Swensen tells investors to keep things simple by establishing a broadly diversified portfolio and then using low-cost, low-turnover index funds as vehicles of choice.

Ironically, some investment managers argue that this is a strategy that Harvard’s endowment should focus on as well.

While Harvard’s endowment has beaten the broad stock and bond markets over the past 15 years, on a risk-adjusted basis, it has actually done no better than a basic 60% stock/40% bond approach.

This may explain why financial adviser Barry Ritholtz has argued that rather than trying to emulate the Yale Model, Harvard should be taking a page from Calpers, the giant pension fund manager that invests on behalf of California’s public employees.

A couple of years ago, Calpers made a big splash by saying that it would be cutting back on its use of expensive actively managed strategies, including hedge funds, while focusing more on low-cost index funds, which simply buy and hold all the securities in a given market.

Now those are lessons—low costs, index funds, and buy and hold—that apply to your 401(k) as much as they do to Harvard’s endowment.

Great advice, right? Wrong!! The next ten years will look nothing like the last ten years.

In fact, in their latest report (it was a video update), “A Recipe For Investment Insomnia,” Francois Trahan and Michael Kantrowicz of Cornerstone Macro cite ten reasons why markets are about to get a lot harder going forward :

- Growth Is Likely To Slow … From Already Low Levels

- The Risks Of Zero Growth Are Higher Today Than In The Past

- The U.S. Consumer No Longer The Buffer Of U.S. Slowdowns

- The World Is Battling Lingering Structural Problems

- A U.S. Slowdown Has Implications For The World’s Weakest Links

- The Excesses Of China’s Investment Bubble Have Yet To Unwind

- Demographic Trends In Japan … An Insurmountable Problem?

- Central Banks Have Reached The Limits Of Monetary Policy

- Slower Growth Is The Enemy Of Portfolio Managers

- P/Es Are Hypersensitive To The Economy At This Time

Also, Suzanne Woodley of Bloomberg notes this in her recent article, The Next 10 Years Will Be Ugly for Your 401(k):

It doesn’t seem like much to ask for—a 5 percent return. But the odds of making even that on traditional investments in the next 10 years are slim, according to a new report from investment advisory firm Research Affiliates.

The company looked at the default settings of 11 retirement calculators, robo-advisers, and surveys of institutional investors. Their average annualized long-term expected return? 6.2 percent. After 1.6 percent was shaved off to allow for a decade of inflation1, the number dropped to 4.6 percent, which was rounded up. Voilà.

So on average we all expect a 5 percent; the report tells us we should start getting used to disappointment. To show how a mainstream stock and bond portfolio would do under Research Affiliates’ 10-year model, the report looks at the typical balanced portfolio of 60 percent stocks and 40 percent bonds. An example would be the $29.6 billion Vanguard Balanced Index Fund (VBINX). For the decade ended Sept. 30, VBINX had an average annual performance of 6.6 percent, and that’s before inflation. Over the next decade, according to the report, “the ubiquitous 60/40 U.S. portfolio has a 0% probability of achieving a 5% or greater annualized real return.”

One message that John West, head of client strategies at Research Affiliates and a co-author of the report, hopes people will take away is that the high returns of the past came with a price: lower returns in the future.

“If the retirement calculators say we’ll make 6 percent or 7 percent, and people saved based on that but only make 3 percent, they’re going to have a massive shortfall,” he said. “They’ll have to work longer or retire with a substantially different standard of living than they thought they would have.”

Research Affiliates’ forecasts for the stock market rely on the cyclically adjusted price-earnings ratio, known as the CAPE or Shiller P/E. It looks at P/Es over 10 years, rather than one, to account for volatility and short-term considerations, among other things.

The firm’s website lets people enter their portfolio’s asset allocation into an interactive calculator and see what their own odds are, as well as how their portfolio might fare if invested in less-mainstream assets (which the company tends to specialize in). The point isn’t to steer people to higher risk, according to West. To get higher returns, you have to take on what the firm calls “maverick” risk, and that means holding a portfolio that can look very different from those of peers. “It’s hard to stick with being wrong and alone in the short term,” West said.

At least as hard though is seeing the level of return the calculator spits out for traditional asset classes. Splitting a portfolio evenly among U.S. large-cap equities, U.S. small-cap equities, emerging-market equities, short-term U.S. Treasuries, and a global core bond portfolio produced an expected return of 2.3 percent. Taking 20 percent out of short-term U.S. Treasuries and putting 10 percent of that into emerging-market currencies, and 10 percent into U.S. Treasury Inflation Protected Securities, lifted the return to 2.7 percent. Shifting the 20 percent U.S. large-cap chunk into 10 percent commodities and 10 percent high-yield pushed the expected return up to 2.9 percent. Not a pretty picture.

Moral of the story: Since most people’s risk tolerance isn’t likely to change dramatically, the amount you save may have to.

I’ve long warned my readers to prepare for a long bout of debt deflation, low and mediocre returns, and high volatility in the stock, bond and currency markets.

If you think buying index funds or using robo-advisors will solve your problems, you’re in for a rude awakening. No doubt, there is a crisis in active management, but there will always be a need to find outperforming fund managers, especially if a long bear market persists.

All this to say that I take all these articles with a shaker of salt. That “one-man phenom” in Nevada was very lucky that the beta winds were blowing his way during the last ten years.

Luck is totally under-appreciated when considering long-term or short-term performance. For example, I read an article in the Wall Street Journal, King of Pain: Fund manager is No. 1 with a 40.5% gain, discussing how Aegis Value’s Scott Barbee survived tough times, wins our contest easily with 12-month skyrocket.

When I drilled into his latest holdings, I noticed almost half the portfolio is in Basic Materials and Energy, and his top holdings include WPX Energy (WPX), Coeur Mining (CDE) and Cloud Peak Energy (CLD), all stocks that got whacked hard in January and came roaring back to triple or more since then.

This transformed Scott Barbee from a zero into a hero but does this mean he will be able to repeat his stellar 12-month returns? Of course not, to even think so is ridiculous (in fact, I recommend he books his profits fast and exits energy and basic materials altogether).

I’m telling you there is so much hype out there and caught in the crosswinds are retail and institutional investors who quite frankly don’t understand the macro environment and the structural changes taking place in the world which will necessarily mean lower and volatile returns are here to stay.

The lessons for Harvard endowment is don’t pay attention to Nicholas Vardy, Barry Ritholtz or any other so-called expert. They all don’t have a clue of what they’re talking about.

As far as replicating the Yale endowment, I think it makes sense to spend a lot more time understanding the macro environment and strategic and tactical allocation decisions, and this is definitely something David Swensen and his small team do exceptionally well (Swensen wrote the book on pioneering portfolio management and he is an exceptional economist who was very close to the late James Tobin, a Nobel laureate and long-time professor of economics at Yale).

But Harvard’s endowment doesn’t need advice from anyone or to replicate anyone, it has exceptionally bright people working there and their new CEO will need to figure out how to manage this fund by capitalizing on the internal talent and only farming out assets when necessary.

The articles above, however, confirmed my suspicions that several past investment officers got away with huge bonuses that they didn’t really deserve based on the performance of the fund and certain sub asset classes, like natural resources.

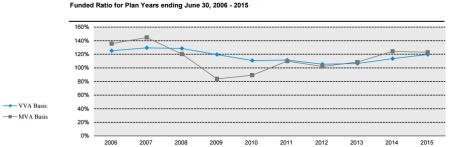

On LinkedIn, I had an exchange with one individual who wrote this after reading my last comment on Harvard’s endowment criticizing the benchmarks they were using for their real assets:

This issue is even more critical especially for pensions and endowments which invest more directly into real assets which are typically held for the long-term (not divested yet) as their bonuses tend to be annually paid out based on these real assets’ valuations (which are marked-to-model), hence, can be subject to massage or manipulation if their fiduciary awareness and governance are not deep, etc…

To which I replied:

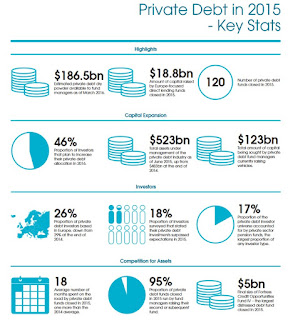

[…] keep this in mind, pensions have a much longer investment horizon than endowments and they have structural advantages over them and other investment funds to invest in private equity, real estate and increasingly in infrastructure. If they have the skill set to invest directly, all the better as it saves on costs of farming out these assets. Now, in terms of benchmarks governing these private market assets, there is no perfect solution but clearly some form of opportunity cost and spread (to adjust for illiquidity and leverage) is required to evaluate them over a long period but even that is not perfect. Pensions and endowments recognize the need to find better benchmarks for private markets and clearly some are doing a much better job than others on benchmarking these assets. The performance of these investments should be judged over a longer period and in my opinion, clawbacks should be implemented if some investment officer took huge risks to beat their benchmark and got away with millions in bonuses right before these investments plummeted.

Let me give you an example. Let’s say Joe Smith worked at a big Canadian pension fund and took huge opportunistic risks to handily beat his bogus real estate benchmark and this was working, netting him and his team big bonuses right before the 2008 crisis hit.

And then when the crisis hit, the real estate portfolio got whacked hard, down close to 20%. Does this make Joe Smith a great real estate investor? Of course not, he was lucky, took big risks with other people’s money and got away with millions in bonuses and had the foresight to leave that pension before the crisis hit.

Legally, Joe Smith did nothing wrong, he beat his benchmark over a four-year rolling return period, but he was incentivized to game his benchmark and it was up to the board to understand the risks he was taking to handily beat his benchmark.

Here I discuss real estate but the same goes for all investment portfolios across public and private markets. People should be compensated for taking intelligent risks, not for gaming their benchmark, period.