Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Theresa Tedesco and Barbara Shecter of the National Post report, Inside the risky strategy that made Canada’s biggest pension plans the new ‘masters of the universe’:

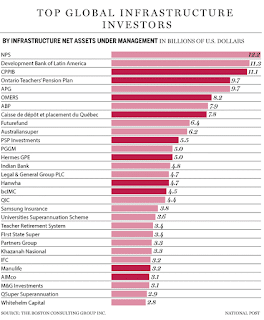

They are among the world’s most famous landlords with stakes in major airports in Europe, luxury retailers in New York and transportation hubs in South America. They rank as five of the top 30 global real estate investors, seven of the world’s biggest international infrastructure investors, and were at the table during six of the top 100 leveraged buyouts in corporate history. And they are Canadian.

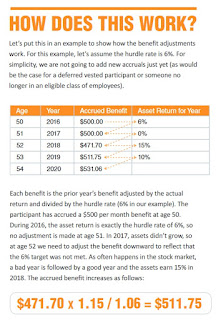

The country’s eight largest public pension funds, which collectively manage net assets worth more than $1 trillion, have acquired so much heft in the past decade that they are being lauded in international financial circles as the new “masters of the universe.” Their clout has caught the attention of major Wall Street investment firms angling for their business, as well as institutional investors around the world that are emulating their investing model (click on image).

“Canada’s public-sector pension plans are high profile, widely admired and they’re certainly bigger than they used to be,” said Malcolm Hamilton, a pension expert and senior fellow at the C.D. Howe Institute in Toronto.

A veteran Bay Street denizen, who asked not to be named because his firm has business dealings with many of the funds, added: “Asset by asset, around the world by virtue of their investments through ownership or partnership, they are as much economic ambassadors for Canada as anybody.”

But the vaunted positions these pension-plan behemoths have on the world stage is attracting closer scrutiny — and some skepticism — from industry experts at home, including the Bank of Canada, because of the increased levels of risk they are taking and the potential “future vulnerability” many of them have assumed in the pursuit of growth.

“You’re seeing more and more pension funds taking on greater risk in the past 15 years,” said Peter Forsyth, a professor of computational finance specializing in risk at the University of Waterloo in Ontario.

The eight funds, which account for two-thirds of the country’s pension fund assets or 15 per cent of all assets in the Canadian financial system, are acting more like merchant banks in going after — and financing — blockbuster deals in increasingly riskier locations and asset types.

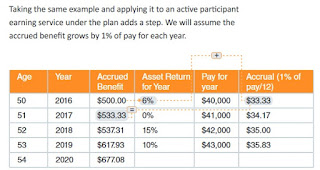

A major reason behind the pension plans’ thirst for less liquid assets, namely real estate, private equity and infrastructure — much of it in foreign places — is the low-interest-environment that has made traditional assets less desirable. Between 2007 and 2015, the big eight public pension funds’ collective allocation to these types of investments grew to 29 per cent from 21 per cent. And foreign assets jumped to account for 81.5 per cent of assets in 2015 from 25 per cent in 2007 (click on images below).

That strategy collides with their traditional image as conservative, risk-averse guardians of retirement nest eggs. Should investments go wrong, benefits would likely be slashed, contributions could be sharply increased and it is anyone’s guess who would be on the hook if there were major losses.

“On the world stage, they are the cream of the crop, but I think they are taking significant risks and they aren’t acknowledging it,” Hamilton said.

Perhaps more importantly, the pension sector in Canada lacks the same stringent cohesive regulatory oversight as banks and insurers, meaning there are less checks and balances governing a big chunk of everyone’s retirement plans. As a result, some industry participants are questioning whether public pension funds should be more closely examined.

“The pension funds are largely unregulated — what’s regulated is the payments to the beneficiaries. The investments of the pensions are not regulated,” said a veteran Bay Street risk expert who asked not to be named. “And so this is the conundrum they’re in as they move further afield … And it’s a big debate going on right now.”

With net assets ranging from $64 billion to $265 billion, the top eight pension funds — Canadian Pension Plan Investment Board (CPPIB), Caisse de depot et placement du Quebec, Ontario Teachers’ Pension Plan, British Columbia Investment Management Corp., Public Sector Pension Investment Board, Alberta Investment Management Corp., OMERS (Ontario Municipal Employees Retirement System and Healthcare of Ontario Pension Plan (HOOPP) — all rank among the 100 largest such funds in the world, and three are among the top 20, according to a study by the Boston Consulting Group released last February. Only the United States has more public pension funds on the global list.

The country’s giant public pension plans, flush with billions in retirement savings, began flexing their investment muscle on the heels of tougher banking laws following the financial crisis of 2008-2009.

Although Canada emerged as the darling in international financial circles for its resilience during the crisis and resulting recession — and the major banks basked in the glory — their global counterparts did not fare so well, which prompted policymakers to layer on additional regulation for all banks.

These new rules, many of which are contained in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, are supposed to protect the financial sector in times of stress by limiting risk-taking strategies. Canadian pension funds, unencumbered from those onerous banking rules, have been all too eager to rush in.

During the past 10 years, they have accumulated an eclectic mix of prime assets in unprecedented fashion. Among them: a 27-per-cent stake in the Port of Brisbane in Australia; interests in Porterbrook Rail, the second-largest owner and lessor of trains in the United Kingdom; luxury retailer Neiman Marcus Group in New York; Transelec, Chile’s largest electricity transmission company; Heathrow Airport; and Camelot Group, the U.K.’s national lottery operator.

In all, they’ve done 20 deals worth more than US$10 billion during that time, according to the Boston Consulting report.

It’s a deal binge that has created a “new world order” in which “Canada’s pension funds have barged Wall Street to stake a claim to be the new masters of the universe,” a British financial columnist noted last year.

Notably, the Canadian public pensions have invested in less conventional businesses and asset classes, where risks are generally higher than more conservative investments such as stocks and bonds. At the same time, there is potentially even more risk looming because the funds are pushing into asset classes and geographies where they have less experience.

For example, CPPIB in June 2015 paid $12 billion for General Electric Capital Corp.’s GE Antares Capital, a middle-market private-equity sponsor. The pension giant has also made a pair of recent investments in the insurance business.

Earlier this month, the Caisse announced plans to invest US$600 million to US$700 million over four years in stressed assets and specialized corporate credit in India. The Quebec-based pension group forged a long-term partnership with Edelweiss Asset Reconstruction Company, India’s leading specialist in stressed assets, which included taking a 20-per-cent equity stake in Edelweiss.

At the same time, the pension funds are increasingly barging in on the conventional bank business. The CPPIB, which invests on behalf of 19 million Canadians as the investment arm of the Canada Pension Plan, has started tapping public markets by issuing bonds to fund their large-scale deals rather than seek debt financing through the banks.

In June 2015, Canada’s largest public pension fund, with $287.3 billion in assets under management — and the eighth largest in the world — raised $1 billion by issuing five-year bonds. A follow-up offering of three-year notes raised an additional $1.25 billion.

“Pension funds used to stick with a balanced portfolio of public-traded debt and equities and a little real estate,” said Richard Nesbitt, chief executive of the Toronto-based Global Risk Institute in Financial Services. “The Canadian model of pension investment management invests into many more asset classes including infrastructure assets around the globe. Banks are still there providing support in the form of advice and corporate loans. But the banks tend to be more regionally focused whereas the pensions are definitely global.”

Meanwhile, Canada’s large pension funds are also borrowing more money to fund their investments. Since they have long time horizons relative to other investors — decades in some cases — they argue that gives them a competitive advantage in both the deal arena and the ability to tolerate more short-term volatility.

“The pressure has just been getting worse and worse, especially as interest rates continue to decline for public funds to get the returns they used to get,” said Hamilton, a 40-year veteran of the industry and former partner at Mercer (Canada).

Low interest rates have a double-whammy effect: they tend to boost the prices of assets and lower expected returns while at the same time reducing borrowing costs, making it cheaper to borrow money and increasing the incentive to use leverage.

But rather than cutting back their risk exposure, Hamilton said the funds, especially those pension plans that are maturing, are behaving the same way they did during the gravy days of high interest rates years 20 years ago. The reason they are behaving this way is because they can’t afford to suffer lower returns, he said, because either benefits would have to be cut or contributions to the plan raised to keep payouts the same.

“They are levering up and hoping for the best instead of making the tough choices,” Hamilton said. “There are alternatives, but they are not so pleasant.”

Forsyth said a main reason Canadian pension funds have avoided making tough choices is partly because of this country’s stellar record. Unlike the Netherlands, where the central bank forces public pension funds to cut benefits when there’s too much risk on the books, Canada has never really faced a systemic financial meltdown that would induce the government to enact such tough measures.

“There isn’t the same amount of pressure in Canada, because we didn’t have the financial blow-ups they had in other countries,” he said.

The Netherlands is one of only two countries whose pension system achieved the top grade in the prestigious annual Melbourne Mercer pension index in 2015 (the other is Denmark). Canada tied for fourth with Sweden, Finland, Switzerland, the U.K. and Chile, all of which are considered to have a “sound system” with room for improvement.

Nevertheless, Canada’s public pension system has pioneered new approaches to institutional investing and governance, and rates among the best in the world in terms of funding its public-sector pension liabilities.

The key characteristic of the Canadian model is cost savings. Canadian fund managers, unlike other public pension managers, prefer to actively manage their portfolios with teams — employing about 5,500 people (and about 11,000 when including those in the financial and real estate sectors) — an organizational style that allows them to direct about 80 per cent of their total assets in-house.

Cutting out the middleman creates considerable economies of scale by lowering average costs, especially through fees to expensive third parties such as Blackrock Inc. and KKR & Co. LP.

In private equity, for example, managers can charge a fee equal to two per cent of assets and 20 per cent of profits. Hiring internal staff and building up internal capabilities is far less expensive. So much so that the total management cost for most Canadian public funds is 0.3 per cent versus 0.4 per cent for a typical fund that relies on external managers.

[Note: I think this is a mistake, the total management cost for a typical fund that relies on external managers is much higher than 0.4%.]

The management style was pioneered by Claude Lamoureux, former head of Ontario Teachers’ Pension Plan, who was the first to adopt many of the core principles espoused by the late Peter Drucker in the early 1990s on creating better “value for money outcomes.” Now all large Canadians funds operate with these key principles.

“That’s the innovation. It’s a simple story of scale allowing you to disintermediate a distributor,” said a senior Canadian pension executive who asked not to be named.

The strategy may be simple, but it has had a significant impact on the bottom line. The cost savings have added up to hundreds of millions of dollars that have been invested rather than outsourced.

Since 2013, total assets under management for the top 10 major public pension funds have tripled, with investment returns driving 80 per cent of the increase.

Even so, the Bank of Canada issued a cautionary note about the challenges in its 2016 Financial System Review. In a recent study of the country’s large public pension funds, the central bank stated that “trends toward more illiquid assets, combined with the greater use of short-term leverage through repo and derivatives markets may, if not properly managed, lead to a future vulnerability that could be tested during periods of financial market stress.”

In its June 2016 paper, “Large Canadian Public Pension Funds: A Financial System Perspective,” the central bank noted the big eight funds have increased their use of leverage, but the amounts on the balance sheet are not considered high.

However, the BoC cautioned that although balance-sheet leverage — defined as the ratio of a fund’s gross assets to net asset value — varies greatly across the funds and appears “modest as a group,” it is still “not possible to precisely assess aggregate leverage using public sources” because it can take on many forms in addition to what is shown on the balance sheet.

“If not properly managed, these trends my lead in the future to a vulnerability that could create challenges on a severely stressed financial market,” the central bank paper warned.

Oversight for most public pension funds, not including the CPPIB, which is federally chartered, falls to the provinces and their regulators are non-arms’ length organizations created by, and report to, the provinces, which also directly and indirectly sponsor many of the same plans being supervised. In other words, pension regulators are not truly independent the way the Office of the Superintendent of Financial Institutions is to the financial sector.

“Can a regulator staffed by members of public-sector pension plans effectively regulate public-sector pension plans?” said C.D. Howe’s Hamilton. “In particular, can such a regulator protect the public interest if the public interest conflicts with the interests of the government and/or the interests of plan members? I think not.”

Furthermore, he said, most pension fund managers would characterize their behaviour as “prudent and creatively adapting to an unforgiving and challenging environment.”

Over at Ontario Teachers’, chief investment officer Bjarne Graven Larsen, welcomed the central bank’s scrutiny and acknowledged that risk is an integral part of any investment strategy. The trick as the pension plan evolves, he said, is to make sure there is adequate compensation for the amount of uncertainty.

“You have to have risk, that’s the way you can earn a return,” Graven Larsen said. Not every transaction will work out according to plan, of course, but he said the strategy is to ensure that losses will not be too great when assets or market conditions fail to meet expectations, even if that means taking a lower return at the outset.

Ontario Teachers’, the largest single-profession plan in Canada, recently moved its risk functions into an independent department and is also tweaking its portfolio construction in an attempt to account for the largest risks it takes and calibrate other positions to balance the potential downside.

“But you will, over time, be able to harness a risk premium and get the kind of return you need with diversified risk — that’s the approach, what we’ve been working on,” Graven Larsen said.

CPPIB, meanwhile, doesn’t have a designated chief risk officer, a key executive who plays a critical role balancing operations and risk. That absence sets it apart from other major government pension plans and other major Canadian financial institutions such as banks and insurers, according to Jason Mercer, a Moody’s analyst.

“A chief risk officer plays devil’s advocate to other members of management who take risks to achieve business objectives,” Mercer said. “The role provides comfort to the board of directors and other stakeholders that risks facing the organization are being overseen independently.”

For its part, CPPIB officials said they have created a framework that doesn’t rely on a single executive to monitor risk. Michel Leduc, head of global public affairs at CPPIB, said the pension organization has an enterprise risk management system that runs from the board of directors, through senior management, to professionals in each of the pension’s investment departments.

“This decentralized model ensures that individuals closest to the risks and best equipped to exercise judgment have local ownership over management of those risks,” Leduc said.

The risks some critics find worrisome, CPPIB officials see as a strength, courtesy of the funds’ unique characteristics, namely a steady and predictable flow of contributions — about $4 billion to $5 billion a year.

CPPIB in 2014 began shifting the investment portfolio to recognize that the fund could tolerate more risk while still carrying out the pension management’s mandate of maximizing returns without undue risk of loss.

The plan is to gradually move from a mix reflecting the “risk equivalent” of 70-per-cent equity and 30-per-cent fixed income to a risk equivalent of 85-per-cent equity and 15-per-cent fixed income by 2018.

With unprecedented amounts of money pouring into public pensions — fuelled by heightened assumptions from governments about what Canadians should expect to receive — the chorus for closer examination of the sector will likely reverberate.

After all, for all the bouquets tossed at them on the world stage, Canada’s public pension funds still have to prove whether their high-profile investments are worth the risk to those at home.

This article was written last Saturday. I stumbled across it yesterday when I read Andrew Coyne’s article on keeping tax dollars and public pension plans away from infrastructure spending.

I might address Coyne’s latest ignorant drivel in a follow-up comment (he keeps writing misleading and foolish articles on pensions), but for now I want to focus on the article above on Canada’s new masters of the universe.

First, let me commend Theresa Tedesco and Barbara Shecter for writing this article. Unlike Coyne, they actually took the time to research their material, talk to industry experts, including some that actually work at Canada’s large public pension funds (something Coyne never bothers doing).

Their article raises several interesting points, especially on governance lapses, which I will discuss below. But the article is far from perfect and the main problem is it leaves the impression that Canada’s large pension funds are taking increasingly dumb risks investing in illiquid asset classes all over the world.

I believe this was done purposely in keeping with the National Post’s blatantly right-wing tradition of fighting against anything that seems like big government intruding in the lives of Canadians. The problem is that the governance model at Canada’s large pensions was set up precisely to keep all levels of government at arms-length from the actual investment decisions, something which is mentioned casually in this article.

[Note to National Post reporters: Next time you want to write an in-depth article on Canada’s large pension funds, go out to talk to experts who work at these funds like Jim Keohane, Ron Mock and Mark Machin or people who retired from these funds like Claude Lamoureux, Jim Leech, Neil Petroff, Leo de Bever. You can also contact me at LKolivakis@gmail.com and I’ll be glad to assist you as to where you should focus your attention if you want to be constructively critical.]

In a nutshell, the article above leaves the (wrong) impression that Canada’s large pensions are not regulated or supervised properly, oversight is fast and loose, and they’re taking huge risks on their balance sheets to invest in assets all over the world, mostly in “risky” illiquid asset classes.

Why are they doing this? Because interest rates are at historic lows so investing in traditional stocks and bonds will make it impossible for them to attain their actuarial return target, forcing them to slash benefits and raise contributions, tough choices they prefer to avoid.

The problem with this article is it ignores the “raison d’être” for Canada’s large pensions and why they all adopted a governance model which allows them to attract and retain investment professionals to precisely take risks in global public and private markets others aren’t able to take in order to achieve superior returns over a very long period — returns that far surpass Canadian balanced funds which invest 60/40 or 70/30 in a stock-bond portfolio.

The key point, something the article doesn’t emphasize, is Canada’s well-known balanced funds charge outrageous fees and deliver far inferior results relative to Canada’s large public pension funds over a long period precisely because they are only able to invest in public markets which offer lousy returns given interest rates are at historic lows. Even the alpha masters, who charge absurd fees, are not delivering the results of Canada’s large pensions over a long period.

And it’s not just fees, even if all Canadians did was invest directly in low-cost exchange-traded funds (ETFs) or through robo-advsiors, they still won’t be as well off in the long run compared to investing their retirement savings in one of Canada’s large, well-governed defined-benefit plans.

Why? Because Canada’s large defined-benefit pensions use their structural advantages to invest across public and private markets all over the world, and they’re global trendsetters in this regard.

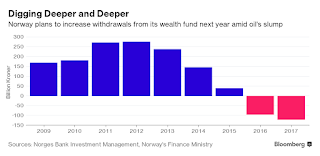

[Note: This is why last week I argued that Norway’s pension behemoth should not crank up equity risk and is better off adopting the asset allocation that Canada’s large pensions have adopted, provided it gets the governance right.]

The brutal truth on defined-contribution plans is they are leaving millions at risk of pension poverty which is why unlike the Andrew Coynes of this world, I kept harping on enhancing the CPP knowing full well Canadians are getting a great bang for their CPP buck.

And when I read about what is happening to Nortel’s pensioners, it infuriates me and reminds me that there is still a lot of work left to do in terms of pension policy in this country, like creating a new large, well-governed public pension here in Montreal in charge of managing the assets of all Canadian DB and DC corporate pensions (Montreal is home to the country’s best corporate DB pensions like CN’s Investment Division and Air Canada Pensions).

Having said all this, I don’t want to leave the impression that everything at Canada’s large public pensions is just peachy and there is no room to improve their world-class governance.

In particular, I agree with some passages in the article above. Most of the financial industry is subject to extreme regulations, regulations which do not impact Canada’s large pensions in the same way.

This isn’t a bad thing. Some of them are using their AAA balance sheet to intelligently take on more leverage or emit their own bonds to fund big investments in private markets.

A lot of this is discussed in the report the Bank of Canada put out this summer on large Canadian public pension funds. And while the report highlights some concerns, it concludes by stating:

No pension fund can achieve a 4 per cent average real return in the long run without assuming a certain amount of properly calibrated and well-diversified risk. This group of large Canadian pension managers seem generally well equipped to understand and manage that risk. The ability of the Big Eight to withstand acute stress is important for the financial system, as well as for their beneficiaries. They can rely on both the structural advantages of a long-term investment horizon and stable contributions. Moreover, they have reinforced their risk-management functions since the height of the 2007–09 global financial crisis.

No doubt, they have reinforced their risk-management functions since the global financial crisis and some of the more mature and sophisticated funds are monitoring liquidity risks a lot more closely (OTPP for example), but all the risk management in the world won’t prevent a large drawdown if another global financial crisis erupts.

And it is important to understand there are big differences at the way Canada’s large pensions manage risk. As mentioned in the article, CPPIB doesn’t have a chief risk officer, instead they opted to take a more holistic view on risk and have ongoing discussions on risk between department heads (this wasn’t always the case as they used to have a chief risk officer).

Is that a good thing or bad thing? Do you want to have a Barbara Zvan in charge of overseeing risk at your pension fund or not? There is no right or wrong answer here as each organization is different and has a different risk profile. CPPIB is not a mature pension plan like OTPP which manages pensions and liabilities tightly, so it can focus more on taking long-term risks in private markets and less on tight risk management which it already does in a more holistic and individual investment way.

I personally prefer having a chief risk officer that reports directly to the Board, not the CEO, but I also recognize serious structural deficiencies at some of Canada’s large pensions where different department units work in a vacuum, don’t share information and don’t talk to each other (this is why I like CPPIB’s approach and think PSP Investments is also moving in the right direction with PSP One).

Are there risks investing in private markets? Of course there are, I talk about them all the time on my blog, like why these are treacherous times for private equity and why there are misalignment of interests in the industry. Moreover, there are big cracks in commercial real estate and ongoing concerns of pensions inflating an infrastructure bubble.

That is all a product of historic low interest rates forcing everyone to chase yield in unconventional places. We can have a constructive debate on pensions taking on more risk in private markets, but at the end of the day, if it is done properly, there is no question that everyone wins including Canada’s pension leaders which get compensated extremely well to deliver stellar long-term results but more importantly, pension beneficiaries who can rely on their pension no matter what happens in these crazy schizoid public markets.

But I am going to leave you with something to mull over, something the Bank of Canada’s report doesn’t discuss for obvious political reasons.

In 2007, I produced an in-depth report on the governance of the federal public service pension plan for the Treasury Board of Canada going over governance weaknesses in five key areas: legislative compliance, plan funding, asset management, benefits administration, and communication.

If I had to do it all over again, I would not have written that report (too many headaches for too little money!), but I learned a lot and the number one thing I learned is this: there is always room for improvement on pension governance.

In particular, as Canada’s large pensions engage in increasingly more sophisticated strategies across public and private markets, levering up their balance sheets or whatever else, we need to rethink whether there are structural deficiencies in the governance of these large pensions that need to be addressed.

For example, I’ve long argued that the Office of the Auditor General of Canada is grossly understaffed and lacking resources with specialized financial expertise to conduct a proper independent, comprehensive operational, investment and risk management audit of PSP Investments (or CPPIB) and think that maybe such audits should be conducted by the Office of the Superintendent of Financial Institutions or better yet, the Bank of Canada.

In fact, I think the Bank of Canada is best placed to be the central independent government organization to aggregate and interpret all risks taken by Canada’s large pensions (maybe if they did this in the past, we wouldn’t have had the ABCP train wreck at the Caisse).

Just some food for thought. One thing I can tell you is that we definitely need more thorough operational, investment and risk management audits covering all of Canada’s large pensions by independent and qualified experts and what is offered right now (by the auditor generals and other government departments) is woefully inadequate.

But let me repeat, while there is always scope for improving governance and oversight at Canada’s large pensions, there is no question they are doing a great job investing across public and private markets all around the world and their beneficiaries are very lucky to have qualified and experienced investment professionals managing their pensions at a fraction of the cost in would cost them to outsource these assets to external managers (the figures cited in the article above are off).

That is a critical point that unfortunately doesn’t come out clearly in the article above which leaves the impression that all Canada’s large pensions are doing is taking undue risks all over the world. That is clearly not the case and it spreads a lot of misinformation on Canada’s large, well-governed defined-benefit pensions which quite frankly are the envy of the world and deservedly so.