Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Reuters reports, Chicago mayor’s big plan to save its pension fund:

Mayor Rahm Emanuel unveiled a plan on Wednesday that he called “an honest approach” to save the city’s biggest retirement system from insolvency with a water and sewer tax to be phased in over five years starting in 2017.

The municipal retirement system, which covers about 71,000 current and former city workers, is projected to run out of money within 10 years as it sinks under an unfunded liability of $18.6 billion.

The new tax would generate $56 million in its first year and increase to $239 million annually by 2020, the mayor’s office said.

“Today, one of the big question marks that hung around the city because of past decisions — or past decisions that were not made — we have addressed,” Emanuel told an investor conference in Chicago.

“Every one of the city’s pensions has a dedicated revenue stream … to keep the promise not only to the employees, but to the city’s future and do it in a way that does not undermine the economic well-being of the city,” he said.

The plan would require approval by Chicago’s city council, which Emanuel said he intends to seek in September. Chicago then needs the Illinois legislature to approve a five-year phase-in of the city’s contribution to the pension system to attain a 90 percent funding level by 2057.

The tax comes on top of an increase in water and sewer rates between 2012 and 2015 to generate money to repair and replace aging infrastructure. Revenue rose from $644.1 million in 2011 to $1.125 billion in 2015.

The rescue plan for the municipal system follows previous action by the city to boost funding for police and fire pensions through a phased-in $543 million property tax increase, and its laborers’ system through a hike in a telephone surcharge.

Chicago’s big pension burden was a driving factor in the downgrade of the city’s credit rating last year to the “junk” level of ‘Ba1′ by Moody’s Investors Service. Standard & Poor’s warned in June it may cut the city’s ‘BBB-plus’ rating in the absence of a comprehensive pension fix.

The task of fixing the city’s pensions became harder after the Illinois Supreme Court in March threw out a 2014 state law that reduced benefits and increased city and worker contributions to the municipal and laborers’ funds.

Hal Dardick, Bill Ruthhart, and John Byrne of the Chicago Tribune also report, Emanuel proposes water, sewer tax to shore up ailing pension fund:

Mayor Rahm Emanuel on Wednesday called for a new tax on city water and sewer bills to stabilize the city’s largest pension fund, a move he portrayed as his latest tough decision to secure Chicago’s financial future.

Emanuel’s plan, which would increase the average water and sewer bill by 30 percent over the next four years, was quickly met with resistance from some aldermen who argued the city would be better off adding business taxes or even raising property taxes again to come up with the hundreds of millions of dollars a year needed to keep the city’s municipal workers’ pension fund from going bust.

Still, Emanuel projected confidence his plan ultimately would win approval in the City Council, which rarely rebuffs the mayor’s proposals and has yet to independently provide its own solution to solidify any of the city’s four major pension systems that have been woefully underfunded for more than a decade.

In a speech to about 200 financial investors Wednesday, Emanuel unveiled his water and sewer tax plan while making the case to Wall Street that his administration has done the hard work to brighten Chicago’s dark financial picture.

For the first time since he took office in 2011, Emanuel said, there are concrete plans to properly fund the retirements of the city’s police officers, firefighters, laborers and municipal workers. He told the Chicago Investors Conference that the city’s budget deficit is at a 10-year low. And he sought to make the case it all had been done without disturbing a business climate that has appealed to major corporations and startups.

“The city of Chicago met our challenges head on, dealt with them systematically, did it in a way that’s complementary to our overall economic strategy to contribute to the well-being and the overall growth strategy that is laid out for the city of Chicago,” Emanuel said from the Symphony Center’s ornate stage. “We addressed the past, but did it in a way that did not shortchange the future of the city of Chicago.”

But even as the mayor seemingly claimed victory on fixing Chicago’s financial woes, challenges remain.

Debt rating agencies have repeatedly lowered the city’s credit rating in recent years, with one placing it at junk status. The picture at Chicago Public Schools is even worse, with all three major rating agencies terming the district’s bonds junk while the Emanuel-appointed Board of Education plans to raise property taxes by $250 million next year to help pay for teacher pensions.And several aldermen expressed opposition to Emanuel’s new utility tax, including Ald. Roderick Sawyer, chairman of the City Council’s Black Caucus. Sawyer, 6th, predicted Emanuel would have a hard time building enough council support for the water and sewer tax after asking aldermen to pass a record property tax increase to fund police and fire pensions last year.

“We understand that the can had been kicked down for many, many years, and now it’s incumbent upon us to find solutions,” Sawyer said. “This is a tough one, though. This is an additional tax that ramps up to many, many dollars a month.”

‘Pitchforks and torches’

Under Emanuel’s proposal, the new utility tax would be phased in over the next four years, with the average homeowner’s water and sewer bills increasing by $53 next year, or $8.86 on the bills sent out every two months. By the end of the four-year phase-in, that same homeowner would pay an additional $226 per year in water and sewer taxes, or $37.65 on each bill.

After four years, the proposal would amount to a 30 percent tax on water and sewer bills, or $2.51 for every 1,000 gallons of water used, the Emanuel administration said. The average annual water and sewer bill, based on 90,000 gallons of water, currently is about $684. The bills also would rise each year at the rate of inflation.

Once fully phased in, the new tax would produce an estimated $239 million a year to help reduce the $18.6 billion the city owes the municipal workers’ fund, which represents nearly all city workers except police officers, firefighters or employees who do manual labor.

Emanuel’s goal is to restore the municipal workers’ account to 90 percent funding over the next 40 years. The mayor and aldermen already have raised taxes to do the same for the city’s three other major pension funds for police, firefighters and laborers. Emanuel said he will seek a City Council vote on the water and sewer tax in September.

“I don’t take this lightly, but we are fixing the problem that has penalized the city’s potential to grow economically, and there’s a finality to it,” Emanuel said in an interview late Wednesday. “All four pensions have a revenue source.”

The taxes will be tacked on to bills that went up when, shortly after taking office in 2011, Emanuel set in motion a series of water and sewer fee increases that more than doubled those bills to upgrade water and sewer systems.

Ald. Ameya Pawar, 47th, called the new tax “the right thing to do,” noting that the alternative of not properly funding the pensions would be “catastrophic.”

But with homeowners already starting to feel the hit from last year’s property tax increase combined with a new round of assessments, Pawar acknowledged aldermen can expect complaints from constituents.

“People will be upset,” said Pawar, an Emanuel ally. “They’ve seen their water rates go up.”Far Northwest Side Ald. Anthony Napolitano, 41st, said it’s going to be difficult for him to face constituents reeling from the huge property tax increases in bills they just received and tell them to brace themselves for another hit.

“Pitchforks and torches, probably,” he said when asked how residents would react. “It’s not going to be good. Because my reaction now, in my neighborhood, after these (property) tax bills came out is, ‘We’re leaving. We’re out.’

“I get that we’re in some tough times. And people get that we have to make some concessions, that we’re going to pay more in tax dollars. People get that,” Napolitano said. “But when it happens year after year after year, people are saying ‘Why am I staying here?'”

Northwest Side Ald. Milagros “Milly” Santiago, 31st, said the mayor should consider other revenue ideas brought forward in the past year by the council’s Progressive Caucus. Those have included a tax on financial transactions, a commuter tax, a graduated income tax, a “stormwater stress” tax on businesses with large parking lots and a move to return more money to the general fund from special taxing districts throughout the city.

“We’re here evaluating the whole thing and seeing if it’s legitimate for us to vote next month on this idea,” Santiago said as she left a briefing on the mayor’s plan at City Hall. “I don’t think it’s a good idea. We’re going to have to have a closer look at it and see if there’s other ways to do it. But it’s just not good news.”

Sawyer also advocated for Emanuel to consider some of the Progressive Caucus’ tax ideas, but many are long shots or would take time and approval elsewhere.

A financial transaction tax would require state and federal approval. A graduated income tax would require approval from a gridlocked Springfield. A commuter tax, which amounts to an income tax on suburban residents working in the city, would require state approval while critics argue it could cause a flight of businesses from the city or prevent new ones from moving in.

Only the stormwater tax on businesses and shifting more money from special taxing districts are within the City Council’s power alone.

“We did get a commitment that they’re going to look at all options this year. We’re going to hold them to that,” Sawyer said.

Aldermen did come up with additional ideas. Napolitano suggested allowing video gaming, which long has been banned in the city. Ald. Anthony Beale, 9th, called for charging tolls on expressways at the Chicago border.

Ald. Howard Brookins, 21st, urged a more traditional solution: another property tax increase. Brookins argued raising property taxes is more fair to lower-income residents and can be written off on federal tax returns. But he acknowledged another increase might not have enough support.

“This (the water and sewer tax), everyone is going to pay it equally; whether you live in a million-dollar home or a $50,000 home, we all have to use water, and it disproportionately affects the people of my community,” Brookins said. “We have to think long term and get away from the stereotypes about property taxes and start explaining to people why a property tax is fairer than the other taxes and fees that they are going to ultimately end up paying.”

Ald. Joe Moore, an Emanuel ally, said he’d be willing to entertain Brookins’ push for another property tax increase, but said “it’s kind of difficult to go to that well again” so soon. The water and sewer tax, he said, “might be the best of a bad set of options. … We have to do something.”

‘Once and for all’

While Emanuel’s utility tax would not require approval from state lawmakers, proposed changes he laid out Wednesday in how municipal workers contribute to their retirements would.

The mayor plans to ask the General Assembly and Republican Gov. Bruce Rauner to sign off on altering the municipal fund pension system to save about $2 billion over the next 40 years. The legislative changes to the pension fund would require newly hired employees, starting next year, to increase their retirement account contributions to 11.5 percent of their salary from 8.5 percent.

Employees who were hired from 2011 to 2016 and already receive lower retirement benefits would have the option of increasing their contributions to 11.5 percent. In exchange, they would be eligible to retire at age 65 instead of 67.

But employees hired before 2011 would see no changes, after the Illinois Supreme Court struck down Emanuel’s earlier attempt to reduce their benefits, citing a constitutional clause that states their benefits shall not be diminished or impaired. “You can’t touch existing employees, that’s walled off,” Emanuel told investors.

Emanuel and affected unions have an “agreement in principle” on identical changes to the much smaller city laborers fund, with additional city contributions coming from a $1.90-per-month-increase on landline and cellphones billed to city addresses that was approved by the City Council two years ago.

Last year, the mayor pushed through a $543 million property tax increase, phased in over four years, to come up with enough funding for police and fire pensions. No changes were made to the retirement age or contribution amounts for those two unions.

Emanuel stressed in his speech to investors that Chicago’s overall fiscal health is on the rebound.

“Chicago was in a pension penalty box. It had not addressed its problems,” Emanuel said. “Denial is not a long-term strategy, and for too long Chicago was operating where denial was the long-term strategy.”

Richard Ciccarone, president and CEO of the municipal bond analysis firm Merritt Research Services, attended the conference and said he thought the crowd was generally impressed with the mayor’s argument.

“He reinforced his strategy, which he said has been his since Day One, and that is that you can’t solve the fiscal problems without having economic growth. I think he made his case,” Ciccarone said. “I got the impression that they made headway with a lot of people here.”In a question-and-answer session with the investors after Emanuel’s speech, the mayor was asked if he had enough votes from aldermen to pass the plan. “Yes,” Emanuel replied without hesitation.

The mayor continued to project that certainty in his interview with the Tribune, while also lavishing praise on the aldermen he must win over.

“The lion’s share of the aldermen did not create the problem, but the lion’s share of the aldermen in there have been part of the solution. I am confident they will take the necessary steps,” Emanuel said.

“They have never wavered, their knees have never buckled and they will answer the call of history to solve the problem once and for all.”

Back in May, I covered Chicago’s pension patch job and stated this:

When Greece was going through its crisis last year, my uncle from Crete would call me and blurt “it’s worse than Chicago here!”, referring to the old Al Capone days when Chicago was the Wild West. Little did he know that in many ways, Chicago is much worse than Greece because Greeks had no choice but to swallow their bitter medicine (and they’re still swallowing it).

In Chicago, powerful public unions are going head to head with a powerful and unpopular mayor who got rebuffed by Illinois’s Supreme Court when he tried cutting pension benefits. Now, they are tinkering around the edges, increasing the contribution rate for new employees of the city’s smallest pension, which is not going to make a significant impact on what is truly ailing Chicago and Illinois’s public pensions.

All these measures are like putting a band-aid over a metastasized tumor. Creditors know exactly what I’m talking about which is why I’ll be shocked if they ease up on the city’s credit rating.

Importantly, when a public pension is 42% or 32% funded, it’s effectively broke and nothing they do can fix the problem unless they increase contributions and cut benefits for everyone, top up these pensions and introduce real governance and a risk-sharing model.

When people ask me what’s the number one problem with Chicago’s public pensions, I tell them straight out: “Governance, Governance and Governance”. This city has a long history of corrupt public union leaders and equally corrupt politicians who kept masking the pension crisis for as long as possible. And Chicago isn’t alone; there are plenty of other American cities in dire straits when it comes to public finances and public pensions.

But nobody dares discuss these problems in an open and honest way. Unions point the finger at politicians and politicians point the finger at unions and US taxpayers end up footing the public pension bill.

This is why when I read stupid articles in Canadian newspapers questioning the compensation and performance at Canada’s large public pensions, I ignore them because these foolish journalists haven’t done their research to understand why what we have here is infinitely better than what they have in the United States and elsewhere.

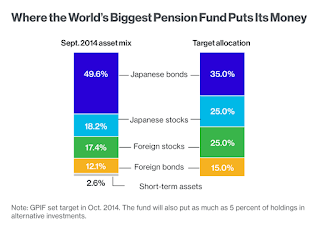

Why are we paying Canadian public pension fund managers big bucks? Because we got the governance right, paying public pension managers properly to bring assets internally, diversifying across public and private assets all around the world and only paying external funds when it can’t be replicated internally. This lowers the costs and improves the performance of our public pensions which is why none of Canada’s Top Ten pensions are chronically underfunded (a few are even over-funded and super-funded).

What else? Canada’s best public pensions — Ontario Teachers, HOOPP and even smaller ones like CAAT and OPTrust — have implemented a risk-sharing model that ensures pension contributors, beneficiaries and governments share the risk of the plan so as not to impose any additional tax burden on Canadian taxpayers if these plans ever become underfunded. This level of governance and risk-sharing simply doesn’t exist at any US public pension which is why many of them are chronically underfunded or on the verge of becoming chronically underfunded.

I have not changed my mind on Chicago’s pension patch job. It’s going from bad to worse and just like Greece, they’re implementing dumb taxes to try to shore up insolvent public pensions instead of addressing serious governance and structural flaws of these pensions.

But unlike Greece, Chicago and Illinois are part of the United States of America, the richest, most powerful country in the world, so they can continue kicking the can down the road, for now. Still, what message is Chicago sending to its own residents and to potential workers looking to move there?

I’ll tell you the message: apart from one of the worst crime rates in the nation, get ready for more property taxes and hikes in utility rates to conquer a public pension beast which has spiraled out of control.

And the sad reality is while these taxes might help at the margin, they’re not going to make a big difference unless they are accompanied by a change in governance, higher contributions and a cut in benefits (get rid of inflation protection for a decade!).

There’s an even bigger problem which I want policymakers to wrap their heads around: chronic public pension deficits are deflationary.

Let me repeat that: Chronic and out of control public pension deficits are DEFLATIONARY. Why? Because it forces governments to introduce more property taxes or utility rate increases (another tax) to address them, leaving less money in the hands of consumers to spend on goods and services.

The other problem with raising taxes and utility bills is they are regressive, hurting the poor and working poor a lot more than Chicago’s ultra rich.

Now I’m going to have some idiotic hedge fund manager tell me “The answer is to cut defined-benefit pensions and replace them with cheaper defined-contribution plans.” NO!!! That is a dumb solution because the brutal truth on DC plans is they are failing millions of Americans, exposing them to pension poverty which is even MORE DEFLATIONARY!!

I want all of you to pay attention to what is going on in Chicago because it’s a cancer which will spread throughout parts the United States where chronic pension deficits are threatening municipalities, cities and states. And this slow motion train wreck will have drastic economic consequences for the entire country.

On a personal note, it’s sad to see what is happening to this great American city. My father did his psychiatry residency in Chicago after leaving Greece over fifty years ago. His uncle had left Greece long before him and owned a great restaurant in Chicago for many years. He even had Al Capone as a silent partner (not by choice) and the restaurant was thriving during the city’s heydays (Capone would send two guys to pick up his share of the revenues every week and once in a while the guys would be replaced because they stole money and were probably left sleeping with the fish. Capone never bothered my great uncle).

Anyways, Chicago’s glory days are long gone. This city is headed the way of Detroit (some think it’s already there and even a lot worse). No matter what Mayor Rahm Emanuel does, there is no saving Chicago from its pension hellhole.