Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.

After the CalPERS staff gave the board a correction last week for providing misinformation about private equity fees, the board member who has been grilling staff on the issue walked out of a private staff meeting because he was not allowed to record it.

The nation’s largest public pension system, one of the first to invest in private equity firms and their lucrative leveraged buyouts, expected to be a leader again this year by launching a new fee tracking system after three years of development.

But when a question from board member J.J. Jelincic in April revealed that CalPERS did not know the amount of “carried interest” earned by its private equity firms, there was a small wave of criticism in the national media.

In the traditional “2 and 20” fee structure, the private equity firm gets to keep 20 percent of the profit after earnings reach a basic amount. This performance incentive is called the “carried interest,” a term said to date back to 16th Century sea voyages.

At a board meeting last month, Jelincic questioned staff at length about the 2 percent management fee. At one point the investment committee chairman, Henry Jones, threatened to rule him out of order.

After the meeting, Jelincic wrote a letter to Anne Stausboll, CalPERS chief executive officer, complaining that the private equity staff he questioned, Real Desrochers and Christine Gogan, gave inaccurate, evasive and condescending responses.

“Staff is perpetuating the talking points and mythology of PE fund managers, who are continuously — and largely successfully — trying to convince the limited partners (CalPERS and other institutional investors) that they receive a more favorable deal than they actually do,” Jelincic said.

His letter included an excerpt of his questions to the staff pointing out that a key reply by Desrochers was incorrect. Ted Eliopoulos, CalPERS chief investment officer, read a correction to the board last week.

“We were asked if a management fee is $100 and the fee to the portfolio company is $50 and there is a 100 percent offset to the limited partner, will the general partner (the private equity firm) ultimately collect $100,” said Eliopoulos. “The answer is ‘yes.’ We should have answered ‘yes’ instead of ‘no.’”

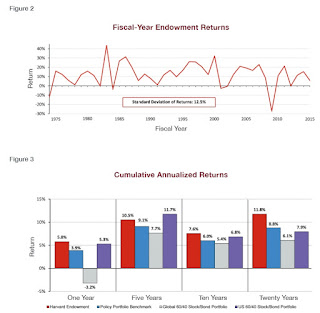

The Desrochers error and the Jelincic letter led to another small wave of criticism in the national media, notably in the Financial Times and Fortune magazine. CalPERS responded with a “For the Record” defense of its private equity investments, averaging 12.3 percent returns over the last 20 years.

Jelincic said in his letter to Stausboll that the staff should acknowledge a “breach of decorum” not only for being condescending and wrong, but also for “a general posture of implying that my questions about these topics were irrelevant, ill-informed, or silly.”

In a reply to the letter, Jones, the committee chairman, said he did not agree there had been a “breach of decorum” and would schedule a private meeting of Jelincic and top staff and consultants to get answers to his questions about private equity fees.

Jelincic said he walked out of the meeting last week after being told he could not record it. The former leader of the largest state worker union is a long-time CalPERS investment office employee, sometimes said to be at odds with top staff.

He has been on leave since 2010, when he was elected to the board by CalPERS members. After a sexual harassment reprimand was upheld, his fellow board members voted in 2011 to censure him, adding a six-month suspension of several board duties.

One thing that helped move private equity fees into the spotlight is financial reform legislation, the Dodd-Frank act in 2010, pushed through Congress with support from CalPERS and other public pension funds.

Private equity firms had generally been unregulated. The new law required firms with $150 million or more in assets under management to register as investment advisers, bringing an initial review of 150 firms by the Securities and Exchange Commission.

“In some instances, investors’ pockets are being picked,” Andrew Bowden, an SEC official, told the New York Times in May last year. “These investors may be sophisticated and they may be capable of protecting themselves, but much of what we’re uncovering is undetectable by even the most sophisticated investor.”

A Times report last October found, among other things, that CalPERS and other investors are on the hook for the uninsured part of a $115 million lawsuit settlement by the Carlyle Group for colluding to suppress the share prices of targeted companies.

Another force that has helped make private equity fees an issue is Yves Smith (the pen name of Susan Webber), who launched the “Naked Capitalism” website in 2006. She is mentioned in the national media stories this month and the Times report last October.

Smith published a 10-part series on CalPERS private equity fees, from Aug. 30 to Sept. 16, prompted by video of the board meeting last month when Jelincic questioned the two CalPERS private equity officials.

Her arguments often are supported or accompanied by comments she received from private equity experts, including Leon Shahinian, a former CalPERS private equity officer, and Michael Flaherman, a former CalPERS investment committee chairman.

“Thus the concerns we have raised about CalPERS’ program, that private equity has over the last decade persistently not generated enough in the way of performance to justify the risks, that private equity firms charge indefensibly high fees (and worse, CalPERS and other investors are ignorant of the full amount they are paying), and that SEC officials have determined many private equity general partners are stealing from investors, are all hazards to taxpayers’ health,” Smith said in her Sept. 16 post.

Smith said in a footnote to her Aug. 30 post that, to CalPERS credit, even though she lost a lawsuit to get CalPERS private equity data, CalPERS gave her the data anyway, which took six months of “often heated exchange” with CalPERS lawyers.

“If CalPERS continues to be unwilling to grapple with what the public can now see are both a huge expertise gap in private equity and a propensity to side with private equity general partners over its beneficiaries’ interests, the organization will lose its power in the wider world,” Smith said in the Aug. 30 post.

“Indeed, one can sense that is already starting to occur. Needless to say, we at Naked Capitalism do not want that to happen.”

This fall, CalPERS expects its new Private Equity and Accounting Reporting Solution to issue the first report of carried interest paid to private equity firms. About $30 billion of the $293 billion portfolio is in 700 private equity funds.

“In November, we are planning an educational session for the board on private equity that will be presented by staff and invited industry experts,” Eliopoulos told the CalPERS board last week. “This will be concurrent with our annual review of our private equity program.

“It’s important that we don’t let the recent attention on our presentation eclipse CalPERS long-standing commitment to financial transparency and reporting, and in particular, the significant steps we have taken recently to address what has been a challenge for the entire industry.”

Photo by rocor via Flickr CC License