Leo Kolivakis is a blogger, trader and independent senior pension and investment analyst. This post was originally published at Pension Pulse.

Dean Beeby of CBC News reports, Document raises questions about Harper retirement policies:

Canada scores poorly among developed countries in providing public pensions to seniors, according to an internal analysis of retirement income by the federal government.

And voluntary tax-free savings accounts or TFSAs, introduced by the Harper Conservatives in 2009, are so far unproven as a retirement solution and are largely geared to the wealthy.

Those are some highlights of a broad review of Canada’s retirement income system ordered by the Privy Council Office and completed in March this year by the Finance Department, with input from several other departments.

The research, compiled in a 30-page presentation deck, was created as the government came under fire from opposition parties, some provinces and retiree groups for declining to improve Canada Pension Plan or CPP payouts through higher mandatory contributions from workers and businesses.

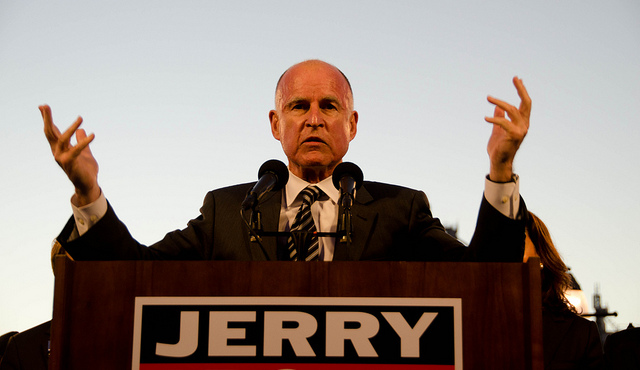

The CPP issue has already become acrimonious in the federal election campaign, with Conservative Leader Stephen Harper saying on Aug. 11 that he is “delighted” to be making it more difficult for Ontario to launch its own version of an improved CPP. The federal Liberals are hoping to use Harper’s clash with Ontario Liberal Premier Kathleen Wynne over pensions to win seniors’ votes in the province and beyond.

A heavily censored copy of the internal document was obtained by CBC News under the Access to Information Act.

The review acknowledges that Canada trails most developed countries in providing public pensions, and is poised to perform even worse in future.

Low among OECD countries

“In 2010, Canada spent 5.0 per cent of GDP on public pensions (OAS/GIS and C/QPP), which is low compared with the OECD (Organization for Economic Co-operation and Development) of average of 9.4 per cent,” it noted.

“The OECD projects that public expenditure on pensions in Canada will only increase to 6.3 per cent of GDP by 2050 – much lower than the 11.6 per cent of GDP projected for OECD countries on average.”

The document also says Canada’s public pensions “replace a relatively modest share of earnings for individuals with average earnings” compared with the OECD average of 34 countries; that is, about 45 per cent of earnings compared with the OECD’s 54 per cent.

“Canada stands out as one of the countries with the smallest social security contributions and payroll taxes.”

The Harper government since at least 2013 has resisted repeated calls to enhance CPP, saying proposed higher premiums for businesses could kill up to 70,000 jobs in an already stagnant economy. Instead, the government has promoted voluntary schemes, such as pooled pension plans for groups of businesses, as well as TFSAs.

Speaking Sunday at a campaign stop in eastern Ontario, Conservative Leader Stephen Harper said, “Our view is that, you know, we have a strong Canada Pension Plan. It is, unlike the arrangements in many other countries, it’s solvent for the next 75 years, for generations to come.”

“Our judgment is [that] what Canadians want and need are additional savings vehicles,” he said.

The document notes that participation rates for TFSAs rise with income, with only 24 per cent of those making $20,000 annually or less contributing, compared with 60 per cent in the $150,000-plus bracket.

The review also acknowledges “it is still too early to assess their effectiveness in raising savings adequacy.”

Much of the document is blacked out under the “advice” exemption of the Access to Information Act, including a section on policy questions. The research may have underpinned a surprise announcement in late May by Finance Minister Joe Oliver that the government was considering allowing voluntary contributions by workers to their CPP accounts.

The review takes issue with Statistics Canada’s data showing a sharp decline in personal savings by Canadians since 1982, arguing that when real estate and other assets are factored in, savings are as high as they have ever been. “Taking into account all forms of private savings suggests no decline in the saving rate over time.”

Ignores evidence?

The provincial minister in charge of implementing the Ontario Retirement Pension Plan, the province’s go-it-alone CPP enhancement, says the internal review shows Harper is ignoring hard evidence.

“This document is further confirmation that Stephen Harper is continuing to bury his head in the sand,” Mitzie Hunter, associate minister of finance, said in an interview. “CPP is simply not filling the gap. … It’s unfortunate that Mr. Harper has really chosen to play politics rather than address serious concerns for retirement security in Canada.”

“TFSAs, which Harper touts as a cure-all, are really untested and they’re only really benefiting the wealthiest Canadians.”

Susan Eng, executive vice-president of CARP, which lobbies for an aging population, said the review cites evidence that single seniors are especially vulnerable to poverty, and that young Canadians and the middle class are not saving enough.

“The government repeats that mandatory employer contributions would be ‘job-killing payroll taxes’ despite the briefing clearly stating that Canada’s social security contributions and payroll contributions are amongst the lowest among similar OECD countries,” she said.

But Harper spokesman Stephen Lecce argues the document also found Canada compares well with other OECD countries on income replacement, ranking third; and that the poverty rate for Canadian seniors is among the lowest in the industrial world.

Lecce also cited a series of measures, including boosting Guaranteed Income Supplement payments and introducing income splitting for pensioners, that together have removed about 380,000 seniors from the tax rolls since 2006.

“Our position is clear, consistent with our Conservative government’s efforts to encourage Canadians to voluntarily save more of their money, we are consulting on allowing voluntary contributions to the Canada Pension Plan.”

So the CBC got hold of an internal document which questions Harper’s retirement policies? All they need to do is read my blog on a regular basis to figure out that there isn’t much thinking going on in Ottawa when it comes to bolstering Canada’s retirement system.

I’ve repeatedly blasted the Harper Conservatives for pandering to Canada’s powerful financial services industry which is made up of big banks, big insurance companies and big mutual fund companies that love to charge Canadian retail investors huge fees as they typically underperform markets.

In the latest pathetic display of sheer arrogance (and ignorance), our prime minister criticized Ontario’s new pension plan, calling it a “tax” and stating he’s ‘delighted’ to slow down Kathleen Wynne’s pension plan.

Amazingly, and quite irresponsibly, the Conservatives pledged to let first-time buyers withdraw as much as $35,000 from their registered retirement savings plan accounts to buy a home, in a yet another election move aimed at the housing market.

Now, think about this. Canada is on the verge of a major economic crisis which will be worse than anything we’ve ever experienced before and instead of bolstering the Canada Pension Plan for all Canadians, the Conservatives are pandering to big banks which are scared to death of what will happen when the great Canadian housing bubble pops as Chinese demand dries up fast.

Great policy, have over-indebted Canadians use the little retirement savings they have to buy a grossly overvalued house in frigging Toronto, Vancouver or pretty much anywhere else so they can spend the rest of their lives paying off an illiquid asset that will make them nothing compared to a well-diversified portfolio over the next 30 years.

“Yeah but Leo, you can never lose money in housing, especially when you buy in a top location. Never! It’s the best investment, much better than investing in these crazy markets. Plus, you pay no capital gain tax on your primary residence when you sell it.”

I’ve heard all these points so many times that I just stopped getting into arguments with friends of mine who think “real estate is the best investment in the world.” Admittedly, I’ve been bearish on Canadian real estate forever but the longer the bubble expands, the harder the fall.

And mark my words, it will be a brutal decline in Canadian real estate, one that will last much longer than even the staunchest housing bears, like Garth Turner, can possibly fathom. But unlike what Garth thinks, the problem won’t be inflation and rising U.S. interest rates. It’s going to be all about debt deflation and soaring unemployment. When Canadians are out of a job and paying off crushing debt, they won’t be able to afford their grossly overvalued house and lowering rates and changing our immigration policies to bring in “rich Chinese, Russians, Syrians, etc” won’t make a dent to the decline in housing once debt deflation is in motion.

Enough on housing, let me get back to the Harper’s retirement policies and be fair and objective. Unlike the Liberals, I like TFSAs and think they benefit all Canadians who are prudent and save their money. Sure, higher income earners like doctors, lawyers, accountants, dentists, and engineers are the ones that are saving the most using TFSAs but the reason is because they need to save since they have no defined-benefit retirement plan to back them up.

But there are also many blue collar workers and lower income workers who are using their TFSAs too. Yes, they can’t contribute their $10,000 annual limit but they’re contributing whatever they can to save for their future.

I have a problem with people who categorically criticize TFSAs. We get taxed enough in Canada and this is especially true for high income professionals with no defined-benefit plan. Why in the world wouldn’t we want to encourage tax-free savings accounts?

Having said this, when it comes to retirement, there’s no question in my mind that all these high income professionals and most other hard working Canadians are better served paying higher contributions to their Canada Pension Plan to receive better, more secure payouts in the future.

In other words, enhancing the CPP should be mandatory and the first policy any federal government looks to implement. Period. You simply can’t compare tax-free savings accounts or any other registered retirement vehicle available to having your money pooled and managed by the Canada Pension Plan Investment Board.

Now, the Harper Conservatives aren’t stupid. They know this. They read my blog and know the brutal truth on defined-contribution plans. But they’re caught in a pickle, pandering to the financial services industry and dumb interests groups which claim to look after small businesses.

If our big banks and other special interest groups really had the country’s best interests at heart, they wouldn’t flinch for a second on enhancing the CPP for all Canadians, building on the success of the CPPIB and other large well-governed defined-benefit plans which are properly invested across global public and private markets.

I will repeat this over and over again, good retirement policy makes for good economic policy, especially over the very long run. Canadian policymakers need to rethink our entire retirement system, enhance the CPP for all Canadians and get companies out of managing pensions altogether. We can build on the success of CPPIB (never mind its quarterly results) and other large well-governed DB plans. If you need advice, just hire me and I will be glad to contribute my thoughts.

On that note, back to trading these crazy, schizoid markets dominated by high-frequency algorithms. Don’t worry, the flash crash of 2015 is over, for now. If you watched CTV News in Montreal last night, you saw a lot of nervous investors worried about their retirement. This is why I hate defined-contribution plans because they put the retirement responsibility entirely on the backs of novice investors who will do the wrong thing at the wrong time (like sell in a panic as some big hedge fund loads up on risk assets).

Photo credit: “Canada blank map” by Lokal_Profil image cut to remove USA by Paul Robinson – Vector map BlankMap-USA-states-Canada-provinces.svg.Modified by Lokal_Profil. Licensed under CC BY-SA 2.5 via Wikimedia Commons – http://commons.wikimedia.org/wiki/File:Canada_blank_map.svg#mediaviewer/File:Canada_blank_map.svg