It may surprise cities that did not switch new hires to 401(k)-style plans because of huge CalPERS termination fees, not to mention the authors of a proposed initiative giving voters power over pensions.

But a CalPERS white paper that surfaced last week describes a “soft freeze” of pension plans that switches new hires to a 401(k)-style investment plan without paying a termination fee.

The March 2011 paper seems to contradict the current California Public Employees Retirement System position: When a pension plan is closed to new members, state law requires that the plan be terminated.

Termination triggers a fee large enough, when conservatively invested in bonds, to pay the pensions promised remaining plan members for decades into the future. The big fee is needed because employers and employees no longer pay into a terminated plan.

In the Stockton bankruptcy, Judge Christopher Klein said a termination fee that boosted the Stockton pension debt or “unfunded liability” from $370 million to $1.6 billion was a “poison pill” if the city tried to move to another pension provider.

One of the co-authors of the proposed “Voter Empowerment” pension initiative, former San Jose Mayor Chuck Reed, has first-hand experience with the big CalPERS termination fee.

The San Jose city council considered switching new council members to a 401(k)-style plan three years ago. But the council made no change after learning the CalPERS termination fee would be $5 million, far above the $900,000 debt or unfunded liability.

Villa Park, with another small plan (30 members, seven active), asked for an estimate to publicize high termination fees. The CalPERS estimate this year was $3.7 million. Canyon Lake and Pacific Grove also balked at high termination fees.

So, why did the CalPERS white paper issued four years ago describe a “soft freeze” that would allow switching new hires to a 401(k)-style plan without terminating the pension plan and triggering a big fee?

A CalPERS spokeswoman said the white paper assumed that the state law covering public pensions, the Public Employees Retirement Law, would be changed to allow a soft freeze without terminating the pension plan.

“The PERL could be changed to permit the soft freeze that is contemplated in the initiative, but the current wording of the initiative does not clarify this,” Amy Morgan, the CalPERS spokeswoman, said via email. “It is this lack of clarity in the initiative that leads to the uncertainty about the consequences of the initiative.”

Among other things, the initiative sponsored by a bipartisan group led by Reed and former San Diego Councilman Carl De Maio requires voter approval of pensions for new hires, government paying more than half of total retirement costs, and termination fees.

The white paper issued in March 2011 was followed in August of that year by a major CalPERS policy change. The investment earnings forecast used to set the termination fee was dropped from 7.75 percent to 3.98 percent, sharply increasing the fee.

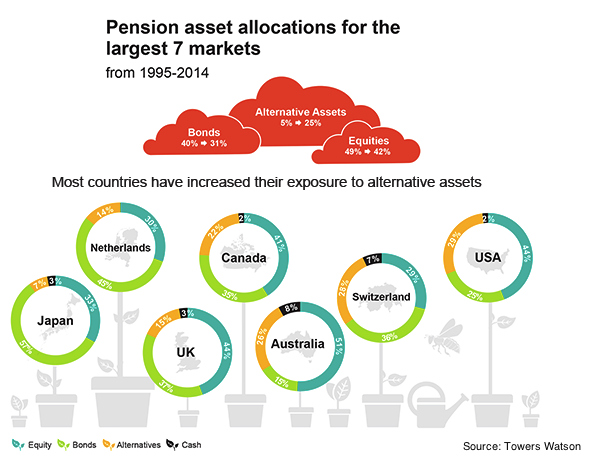

The change from the optimistic forecast for the main CalPERS fund, with its diversified portfolio of stocks and other investments, to a less risky and more predictable bond-based forecast was driven by worry that a large plan might be terminated.

CalPERS had been hit by huge recession-era investment losses, about $100 billion, and needed large employer rate increases. There was speculation about possible city bankruptcies, and Stockton and San Bernardino filed the following year.

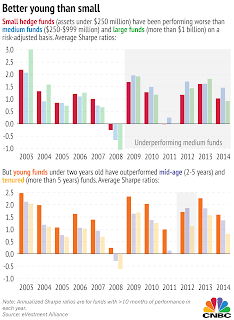

But no large pension plan has been terminated. The pooled CalPERS fund that pays for the pensions of members in terminated plans, which receive no payments from employers or employees, has a large surplus.

The Terminated Agency Pool had 249 percent of the assets (market value $194 million) needed to pay promised pensions as of June 30, 2013, the latest report said. Annual payments of $4.6 million were going to 684 retirees and beneficiaries of 90 terminated plans.

How important is the termination fee?

It’s the one way, outside of bankruptcy, that the pensions of current workers can be cut. If a terminated plan lacks the assets to cover promised pensions, the CalPERS board has the power under state law to cut the pensions to the level covered by the assets.

The white paper on plan closure was cited by the CalPERS chief executive officer, Anne Stausboll, in a reponse to a request for an analysis of the proposed initiative from the Assembly public retirement committee chairman, Rob Bonta, D-Alameda.

In addition to creating administrative challenges and threatening tax-exempt status and death and disability coverage, Stausboll said, the initiative would abolish the “California Rule” for new hires and possibly current employees.

A series of state court decisions known as the “California rule” are believed to mean that the pension promised on the date of hire becomes a vested right, protected by contract law, that can only be cut if offset by a new benefit of comparable value.

The CalPERS white paper said a “hard freeze” stops future pension earnings for current employees, presumably prohibited by the California rule. A “soft freeze” only closes the pension plan to new employees.

“When a plan administrator closes a defined benefit (pension) plan, often the administrator opens a fixed-rate defined contribution (401k-style) plan,” said the white paper. “The defined benefit plan must be administered until the last participant quits working, retires and dies.”

The white paper lists a number of reasons why staying with pensions is preferable, including lower costs from administering only one plan instead of two plans if new employees are switched to a 401(k)-style plan. A termination fee is not mentioned.

The other large state pension system, the California State Teachers Retirement System, has not had to deal with plan terminations. It has only one plan covering 1,700 employers, mainly school districts but also other education agencies.

In an early analysis of the initiative sent to stakeholders, CalSTRS sees a number of administrative, funding and other problems. The vote on whether to give new hires pensions is assumed to be by each school district or employer jurisdiction, not statewide.

Depending on the vote outcome, CalSTRS said it could be required to administer multiple plans with “inconsistent eligibility requirements, vesting rules, benefit formulas, contribution rates, retirement ages, and beneficiary and survivorship allowances.”

Attorney General Kamala Harris is expected to issue a title and summary for the initiative by tomorrow (Aug. 11). Two previous pension initiatives were dropped after the sponsors said Harris gave them inaccurate and misleading summaries, making voter approval unlikely.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.