Democratic lawmakers and pension experts in Illinois this week are raising concerns about the long-term implications of Gov. Rauner’s pension reform proposal.

Some experts say that the proposal would eventually reduce benefits so steeply that the consequences could push unwanted expenses on the state and pensioners alike.

From the Chicago Tribune:

Under Rauner’s proposal, veteran employees would be allowed to keep all retirement benefits they have earned up to the end of June. After that, everyone would be moved into the Tier 2 plan, with the exception of workers who opt to transfer their retirement benefits into a 401k-style retirement account similar to those now common in private industry.

Jean-Pierre Aubry, an expert on public pension plans at Boston College, termed the benefit cuts of Tier 2 “pretty draconian,” opening the door to future problems he said would be without precedent in the U.S. “There’s a lot of things in Illinois that are different from the rest of the country,” said Aubry, assistant director of state and local research at the college’s Center for Retirement Research.

Central to questions about Tier 2 is a federal tax provision sometimes referred to as the Safe Harbor rule. In short, it requires public pension plans to offer retirement benefits at least as good as the minimum workers would get if they were covered by Social Security.

Failing that, federal law requires public workers to join Social Security and pay a 6.2 percent tax to the national retirement system. Their employers would also have to kick in another 6.2 percent, costing taxpayers more money. Most public employees and employers in Illinois currently do not pay Social Security taxes.

Teacher retirement system experts say Tier 2 benefits currently meet the Safe Harbor test but will begin to fall out of compliance by 2027. The reason, they say, is that Tier 2 includes both a limit on benefits and inflation adjustments much tighter than those adopted by Social Security — leaving retirement benefits for some workers at risk of falling below what they could qualify for under the federal system.

In essence, experts are worried that by 2027 benefits will have been cut so steeply that payouts fall below federal requirements.

If that happens, public workers will be required to join Social Security, which carries a new set of costs for the state and for workers.

Read more on the issue here.

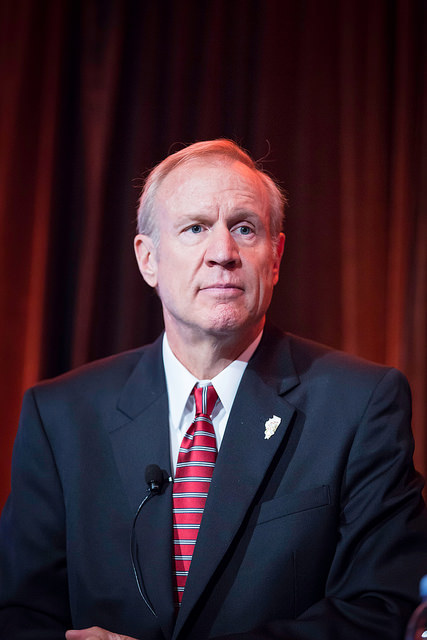

Photo by Tricia Scully via Flickr CC License

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712