In 2015, we repeatedly saw some of the U.S.’ largest pension funds push for more diversity on corporate boards.

Last winter, Massachusetts’ pension fund voted to begin using its proxy voting status to push for board diversity from within. Around the same time, a group of nine large pension funds, including CalPERS, CalSTRS and the New York Retirement Fund, penned a letter to the SEC asking for better disclosure of a company’s board diversity.

Research shows that a majority (60%) of institutional investors believe corporate board diversity is important on some level. Nineteen percent believe that diversity is “very important” to strong decision-making.

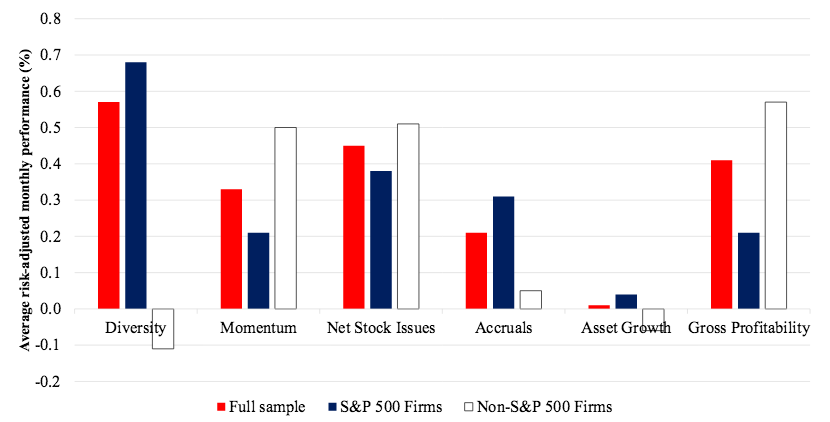

Now, in the largest study yet conducted on the subject, researchers have found that there is significant merit to pensions’ pleas: companies with diverse boards consistently outperform those without.

The findings come from a new paper, Diversity Investing, which examined 50,000 executives from over 5,000 companies dating back to 2002. The paper only looked at professional diversity – background, education, affiliations, etc. Gender and race was not included in the analysis.

Ai-cio summarizes the report:

Public company leadership with varied career backgrounds have persistently and substantially outperformed stocks from homogenous C-suites, according to the largest study to date on management diversity.

The link was most pronounced in large-cap stocks, contrary to the majority of accepted equity-market performance anomalies.

[…]

Manconi, Rizzo, and Spalt posited three potential drivers of the diversity anomaly.

First, varied expertise among executives could be correlated with an omitted risk factor, although they noted standard risk adjustments failed to produce a likely candidate.

Second, and more likely in the researchers’ view, was a link between diverse management and “quality” stocks. “An attractive feature of this explanation is that a part of the related management literature emphasizes the potential of diverse teams to make better, less biased, decisions,” according to the authors.

Finally, investors could simply undervalue well-rounded leadership, producing persistent mispricing of securities under such teams, or even find them repellent.

“Investors may be more confident assessing the quality of a homogenous team,” the authors wrote—a biotech firm led by biotech veterans inspires optimism. Or allocators and analysts could be put off by “higher perceived ambiguity in the expected performance of a diverse team.”

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712