A newly-released study by CEM Benchmarking analyzes investment expenses and return data from 300 U.S. defined-benefit plans and attempts to answer the question: did the funds’ reallocation to alternatives pay off?

A newly-released study by CEM Benchmarking analyzes investment expenses and return data from 300 U.S. defined-benefit plans and attempts to answer the question: did the funds’ reallocation to alternatives pay off?

The simple answer: the study found that some alternative classes performed better than others, but underscored the point that “costs matter and allocations matter” over the long run.

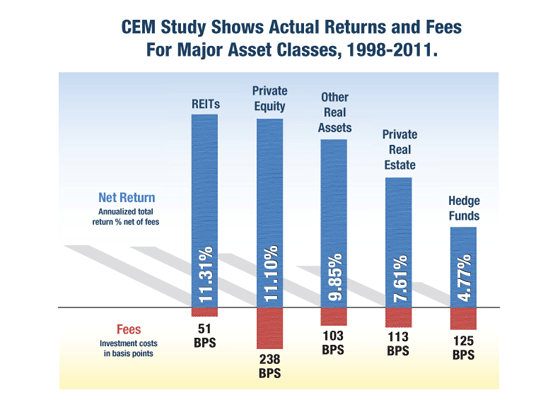

In the chart at the top of this post, you can see the annualized return rates and fees (measured in basis points) of select asset classes from 1998-2011.

Some other highlights from the study:

– Listed equity REITs were the top-performing asset class overall in terms of net total returns over this period. Private equity had a higher gross return on average than listed REITs (13.31 percent vs 11.82 percent) but charged fees nearly five times higher on average than REITs (238.3 basis points or 2.38 percent of gross returns for private equity versus 51.6 basis points or 0.52 percent for REITs). As a result, listed equity REITs realized a net return of 11.31 percent vs. 11.10 percent for private equity. Net returns for other real assets, including commodities and infrastructure, were 9.85 percent on average. Net returns for private real estate were 7.61 percent, and hedge funds returned 4.77 percent. On a net basis, REITs also outperformed large cap stocks (6.06 percent) on average and U.S. long duration bonds (8.97 percent).

– Many plans could have improved performance by choosing different portfolio allocations. CEM used the information on realized net returns to estimate the marginal benefit that would have resulted from a one percentage point increase in allocation to the various asset classes. Increasing the allocations to long-duration fixed income, listed equity REITs and other real assets would have had the largest positive impacts on plan performance. For example, for a typical plan with $15 billion in assets under management, each one percentage point increase in allocations to listed equity REITs would have boosted total net returns by $180 million over the time period studied.

– Allocations changed considerably on average from 1998 through 2011. Of the DB plans analyzed by CEM, public pension plans reduced allocations to stocks by 8.5 percentage points and to bonds by 6.6 percentage points while increasing the allocation to alternative assets, including real estate, by 15.1 percentage points. Corporate plans reduced stock allocations by 19.1 percentage points while increasing allocations to fixed income by 10.5 percentage points (consistent with a shift to liability driven investment strategies), and to alternative assets by 8.6 percentage points. For the DB market as a whole, allocations to stocks decreased 15.1 percentage points; fixed income allocations increased by 4.3 percentage points; and allocations to alternatives increased by 10.8 percentage points. In dollar terms, total investment in alternatives for the 300 funds in the study increased from approximately $125 billion to nearly $600 billion over the study period.

The study’s author commented on his findings in a press release:

“Concern about the adequacy of pension funding has focused attention on investment performance and fees,” said Alexander D. Beath, PhD, author of the CEM study. “The data underscore that when it comes to long-term net returns, costs matter and allocations matter.”

[…]

“Many pension plans could have improved performance by choosing different allocation strategies and optimizing their management fees,” Beath continued. “Listed equity REITs delivered higher net total returns than any other alternative asset class for the fourteen-year period we analyzed, driven by high and stable dividend payouts, long-term capital appreciation and a significantly lower fee structure compared to private equity and private real estate funds.”

Read the study here.

This isn’t the first study to show that pension funds have done badly by investing in hedge funds. Check out the research study by Ilia Dichev of Emory University and Gwen Yu of the Harvard Business School, published in Journal of Financial Economics and available at http://www.people.hbs.edu/gyu/HigherRiskLowerReturns.pdf: “We find that the real alpha of hedge fund investors is close to zero. In absolute terms, dollar-weighted returns are reliably lower than the return on the S&P 500 index and are only marginally higher than the risk-free rate as of the end of 2008. The combined impression from these results is that the return experience of hedge fund investors is much worse than previously thought.”

Deprecated: Function get_magic_quotes_gpc() is deprecated in /home/mhuddelson/public_html/pension360.org/wp-includes/formatting.php on line 3712