We’ve heard what CalPERS officials had to say about the decision to cut ties with hedge funds. But how are advisors and fund managers within the industry reacting to the news?

A few anonymous hedge fund advisors have claimed that CalPERS’ problem wasn’t hedge funds as an asset class—the problem was that the pension fund was bad at picking which hedge funds to invest in. From Business Insider:

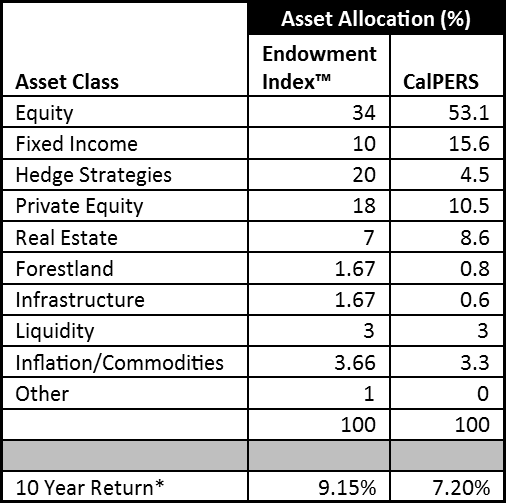

“I think CalPERS is not a particularly good hedge fund investor,” one prominent hedge fund manager told Business Insider. He cited the pension fund’s lackluster annualized rate of return of 4.8% over the last ten years. “I would redeem too.”

He continued: “I think it’s not hedge funds as an asset class. It’s the ones they invest in.”

Another prominent hedge fund manager echoed that same sentiment.

“They got what they paid for since they only invested in managers who would cut fees. So the best funds wouldn’t do that, so they had a mediocre portfolio.”

Another investment officer gave a more measured response to the New York Times:

“I think the industry is changing. There is less tolerance for underperformance in an environment when you have a relative huge outperformance with more liquid opportunities like an S.&P.-500 index fund,” said Elizabeth R. Hilpman, chief investment officer at Barlow Partners.

“There is a lot of disappointment that hedge funds have not been able to capture more of the market results,” she added.

Several advisors gave some interesting opinions to Wealth Management, too:

“All taxable investors should take notice of this decision, because if Calpers doesn’t think the asset class is adding value for them, how does any taxable investor believe the asset class can add value in their portfolio—especially those in the top couple tax brackets?” said Scott Freund, president of Family Office Research.

[…]

“We already ignore the [hedge fund] genre because they are the Groucho Marx club of investing: The only ones that will let us in are the ones in which we don’t want to be invested,” said Stephen Barnes, investment manager and chief compliance officer of Barnes Investment Advisory. “Fees are too high. Truly a ‘heads I win, tails I don’t lose’ proposition for the hedge fund manager.”

Some advisors defended hedge funds in light of CalPERS’ decision. From Wealth Management:

Ryan Graves, wealth advisor with FirstPoint Financial, said alternatives play an important role in mitigating the risks associated with traditional asset classes.

“The time for a ‘true’ hedge fund (and not the levered up investment vehicles that many morphed into pre-2008) is when valuations are high, not after the correction has already occurred,” Graves said. “Just wait for a pullback in next 12-24 months and see how they try to explain away dumping an absolute return strategy.”

“To a contrarian this might mean it is time to consider investing in hedge funds,” said Kris Maksimovich, president of Global Wealth Advisors. “The decision could push hedge funds, especially the more expensive variety, to reconsider their pricing.”

There are plenty more quotes in the linked articles.

Photo credit: Lending Memo