Pension funds have been receiving flak from all sides lately regarding alternative investments.

The criticisms have been varied: the high fees, opacity, underperformance and illiquidity.

But, outside of official statements from pension staff defending their investments, it’s not often we get to here from the people on the other side of the argument.

Dan Primack argues in a column this week that not all alternatives are created equal—and the fight against the asset class has been “oversimplified”.

From Fortune:

Hedge funds are considered to be “alternative investments.” So is private equity. And venture capital. And sometimes so is real estate, timber and certain types of commodities.

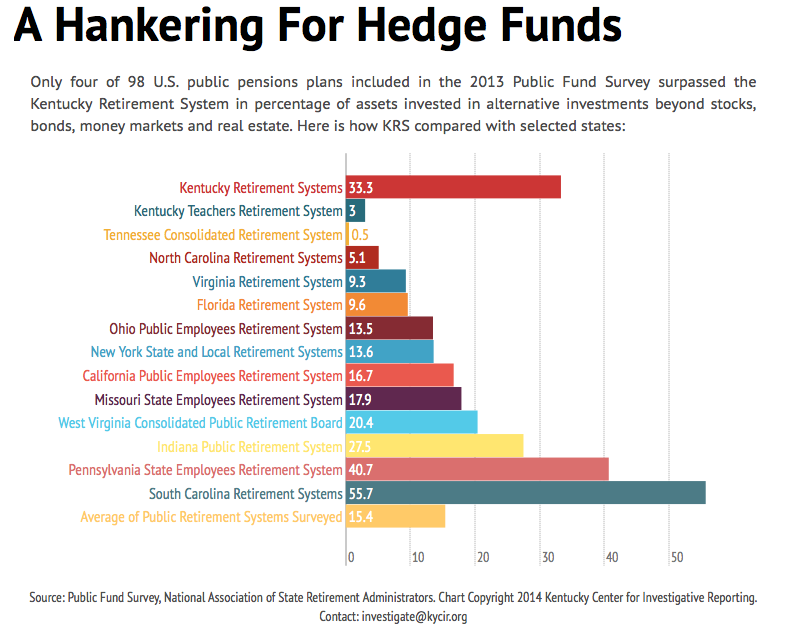

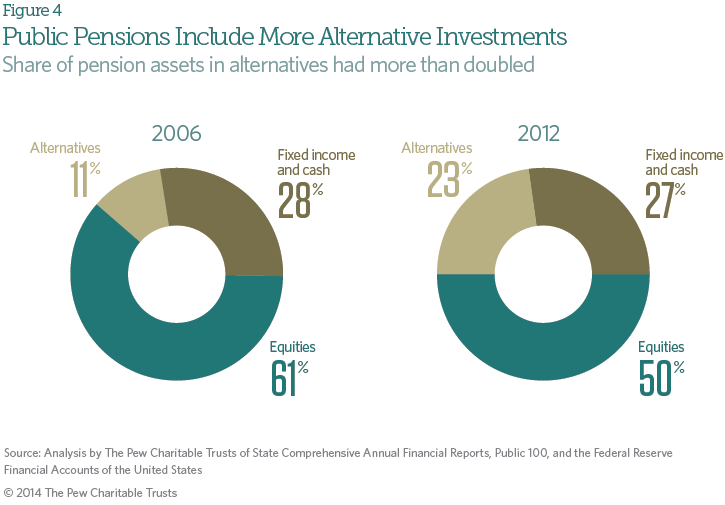

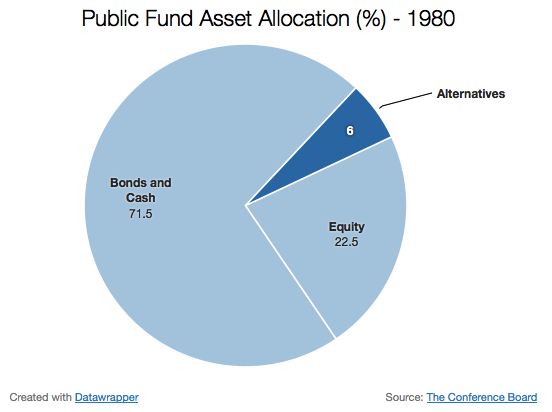

A number of public pension systems have increased their exposure to “alternatives” in recent years, at the same time that they either have curtailed (or threatened to curtail) payouts to pensioners. The official line is that the former is to prevent more of the latter, but many critics believe Wall Street is getting rich at the expense of modest retirees.

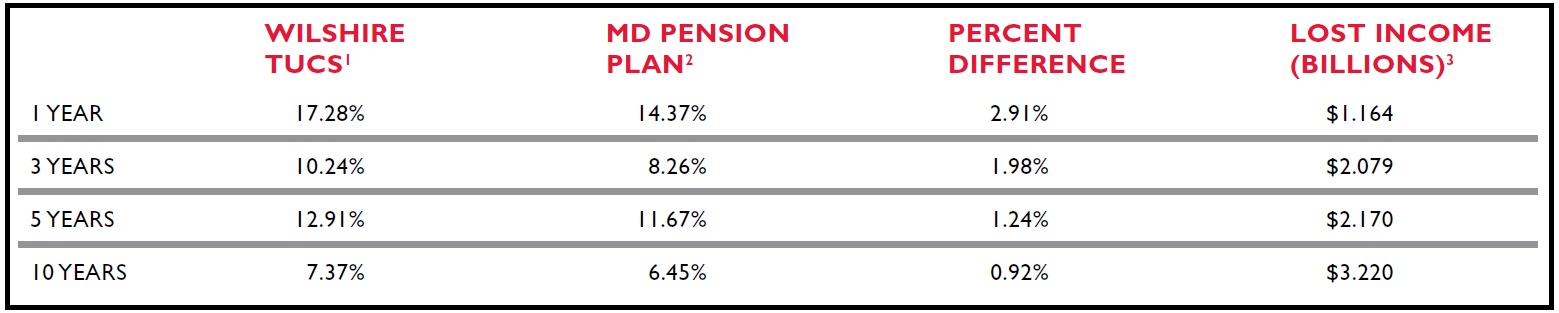

The complaint, however, generally boils down to this: Alternatives have underperformed the S&P 500 in recent years, even though many alternative funds charge higher fees than would a public equities index fund manager. In other words, state pensions are overpaying for underperformance.

Great bumper sticker. Lousy understanding of investment strategies.

The simple reality is that not all alternatives are created equal. Some, like private equity, are more tightly correlated to public equities than are others. Some are designed to chase public equities in bull markets without collapsing alongside them (that’s where the name “hedge” name from). Real estate is largely its own animal. Same goes for certain oil and gas partnerships.

Lumping all of them together because of fee strategies makes as much sense as arguing that a quarterback should be paid the same as an offensive lineman. After all, they both play football, right?

Primack uses New Jersey as an example:

For those who want to criticize public pensions for investing in alternatives, be specific. New Jersey, for example, reported alternative investment performance of 14.21% for the year ending June 30, 2014. That trailed the S&P 500 for the same period, which came in at 21.38% (or the S&P 1500, which came in at 16.99%). But that alternatives number is a composite of private equity (23.7%), hedge funds (10.2%), real estate (12.74%) and real assets/commodities (6.12%). The sub-asset class most tightly correlated to public equities actually outperformed the S&P 500 (net of fees).

Would New Jersey pensioners have been better off without private equity? Clearly not for that time period. Having avoided real estate or hedge funds, however, would be a different argument. But even that case is tough to prove until New Jersey’s relatively immature alternatives program experiences a bear market. For example, both hedge funds and the S&P 500 went red last month, but the S&P 500’s loss was actually a bit worse. And macro hedge fund managers actually had positive returns. Does that make up for years of the S&P 500 outperforming hedge? Likewise, should real estate performance receive an indirect bump from recent rises in venture capital performance, just because they are both “alternatives?”

Again, that’s a judgment call that should be based on voluminous data, rather than on knee-jerk anger that alternative money managers are getting paid while retiree benefits are getting cut. If alternative managers are helping to stem the severity of those cuts, then everyone wins. If not, then the state pension needs a change in policy. But, in either case, the specific alternative sub-asset classes should be analyzed on their own merits, rather than as one homogeneous bucket. Otherwise, critics may throw out the baby with the bathwater.

Read the entire column here.

Photo by 401kcalculator.org