Money managers, venture capitalists and institutional investors are increasingly donning their straw hats and getting to work in rural America.

Investments in farmlands have been on the rise. The Arkansas Teachers’ Retirement (ATRS) System, for example, has invested $73 million in farmland in the last four years.

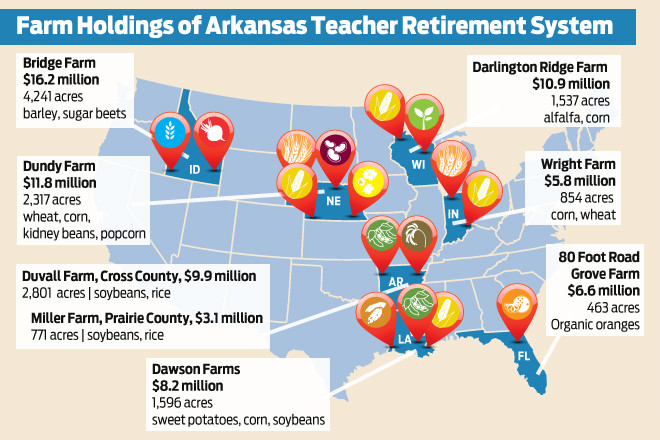

Arkansas Business takes a peek inside ATRS’ rural investments:

“To us, farmland is like a pure Arkansas-flavored investment,” said George Hopkins, ATRS executive director. “Our only regret is that we weren’t there 10 years ago.”

The state’s largest pension fund has invested about $73 million in 14,580 acres of cropland since it began building its roster of farm holdings four years ago.

ATRS owns nine farm properties scattered from Indiana to Idaho and from Wisconsin to Florida.

The May acquisition of Dawson Farms added a new crop to a roster that includes organic oranges, sugar beets, barley, alfalfa, kidney beans and popcorn as well as mainstays such as rice, wheat, corn and soybeans.

ATRS intends to allocate up to 1 percent of its nearly $14.7 billion-asset investment portfolio to agriculture property.

“We think that’s 1 percent that will provide quality returns over time,” Hopkins said.

The agri properties are a subset of the pension fund’s $1.6 billion real estate segment. The biggest chunk of that is almost $1.2 billion worth of retail, office, industrial and apartment investments. Timber property accounts for about $347 million more.

ATRS has adopted the low-risk role of landlord with its farm investments. Purchased for cash, the properties are leased for crop production that generates a reliable flow of income.

Why farmland? ATRS explains:

ATRS officials began to explore agriculture property as an avenue to further diversify its investments in early 2010.

“It’s not uncommon for people to ask us to look at doing this or doing that and investing with them,” Hopkins said. “Along the way, we were asked, ‘Have you ever thought about investing in agriculture?’

“After a while it became clear we needed to be investing in farmland. It’s a great inflation hedge, a slow and steady performer that is outside the stock market.”

Here’s a summary of ATRS’ farmland portfolio:

| Investment | Acres | Primary Crops | |

| Bridge Farm, Idaho | $16.2 million | 4,241 | Barley, sugar beets |

| Dundy Farm, Nebraska | $11.8 million | 2,317 | Wheat, corn, kidney beans, popcorn |

| Darlington Ridge Farm, Wisconsin | $10.9 million | 1,537 | Alfalfa, corn |

| Duvall Farm, Cross County | $9.9 million | 2,801 | Soybeans, rice |

| Dawson Farms, Louisiana | $8.2 million | 1,596 | Sweet potatoes, corn, soybeans |

| 80 Foot Road Grove Farm, Florida | $6.6 million | 463 | Organic oranges |

| Wright Farm, Indiana | $5.8 million | 854 | Corn, wheat |

| Miller Farm, Prairie County | $3.1 million | 771 | Soybeans, rice |

| Total | $73.2 million | 14,580 |

Photo credit: Arkansas Business