California is a state known for its positive vibes, but those vibes have not historically extended to its financial condition. That’s changed just a bit in the last week, due to a string of financially sound (and therefore surprising) budget decisions on the pension front.

It happened last Tuesday, when Gov. Jerry Brown signed into law a section of the state’s new budget that addressed CALSTRS’ $74 billion shortfall by raising contributions rates from teachers, school districts and the state. The budget also addressed CalPERS’ underfunding by increasing the state’s 2014-15 contribution by a pretty sizeable amount.

An important note: it took Moody’s less than 24 hours to upgrade California’s credit rating after seeing this budget—from A1 to Aa3—and predictably, those pension provisions were a big reason why. That’s important, because states need all the positive reinforcement they can get when it comes to making these politically tough decisions.

And they were politically tough (albeit economically obvious) decisions—the California Teachers Association donated $290,000 to state politicians during the last election cycle, and put $4.7 million in Gov. Brown’s coffers to help elect him in 2010.

Okay, now the details of the budget.

The portion of the budget summary that addresses the state’s pension systems, which you can read here, leads with this line:

In its 101‑year history, contributions to CalSTRS have rarely aligned with investment income to meet the promises owed to retired teachers, community college instructors, and school administrators.

Indeed. That’s refreshingly honest, even if those issues only represent a fraction of California’s larger pension problems.

To be fair, the state’s recent pension reform law addressed some of these issues in 2012 by raising retirement ages and reducing benefits. But it wasn’t enough, and the budget says as much:

Even with those changes, and despite recent investment success, the viability of CalSTRS ultimately requires significant new money on an annual basis.

My god, the state budget has become self-aware! And it doesn’t matter if lawmakers are playing the part of Captain Obvious here. It’s still a positive sign to see this stuff, in writing, in the document that’ll be determining the state’s expenditures for the next fiscal year.

Onto the numbers: The budget directs an additional $276 million in contributions from teachers, schools and the state to the CALSTRS system in fiscal year 2014-15. That will be accomplished by:

- Increasing teacher contribution rates from 8 percent of pay to 10.25 percent of pay, to be phased in over the next three years.

- Increasing school contribution rates from 8.25 percent of payroll to 19.1 percent of payroll, to be phased in over the next seven years.

- Increasing the state’s contribution rate from 3 percent of payroll to 6.3 percent of payroll over the next three years.

The budget gives the CALSTRS Board the authority to increase school and state contributions if they see fit. On the other hand, the Board gets the authority to reduce them, too.

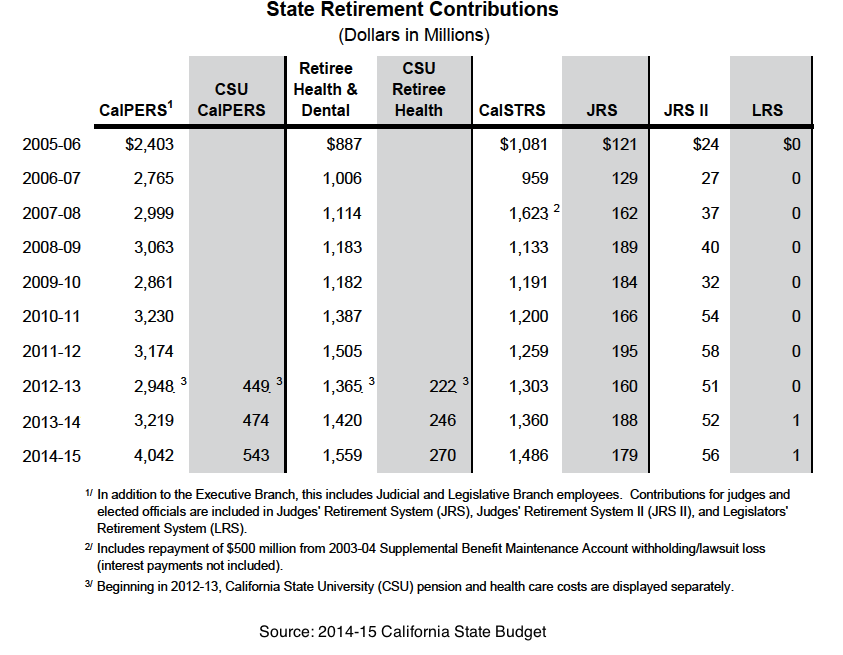

CalPERS is also set to receive a big contribution from the state, which is good news because California was consistently lagging behind in that department before modestly increasing its contribution last year. But 2014 represents a big step forward, as the state increases its contribution by 20 percent.

This coming fiscal year (2014-15) will also represent the 7th straight year California has increased its contribution to CalSTRS. All told, the plan is to fully fund CALSTRS in 30 years.

Of course, that projection is contingent on CalSTRS meeting its investment return assumptions, which currently sit at 7.5% annually. How likely is it to meet that target over the next 30 years?

“Highly unlikely,” said Gov. Brown at a press conference back in May.

He’s right. And it’s important to maintain perspective.

This is but a small step on the road to responsibly managing the state’s pension funds. Declaring victory now is like buying a house on a 30-year mortgage, making the first payment without a hitch and then proclaiming, “We did it!”

All the same, it is a step forward, and you need to crawl before you can walk. Let’s hope California learns how to run sooner than later.

Photo by Steve Rhodes via Flickr CC License