The 2013-14 fiscal year ended June 30, which means we’ve entered a new year for public pension funds, at least in fiscal terms. It also means that the latest investment performance data is being released, and that data has some funds smiling.

California is one state that has to be happy with what it sees: big investment returns for both of the state’s major pension funds, CalPERS and CalSTRS. From SWFI:

The California Public Employees’ Retirement System (CalPERS) returned 18.42% for the fiscal year that ended on June 30th. CalPERS defeated its custom benchmark of 17.98% and surpassed last fiscal year’s return of 13.2%. The private equity portfolio of CalPERS generated 19.99% returns, just 3.31% shy of the benchmark. The asset classes of real estate and fixed income beat their respective benchmarks.

And CalSTRS saw similar success, says SWFI:

Looking toward the other Sacramento pension giant, CalSTRS posted 18.66% for the fiscal year that ended on June 30th.

The CalSTRS global equity portfolio posted 24.73% in returns. CalSTRS private equity posted 19.61% in returns.

But just because you can see the light doesn’t mean you’re out of the tunnel. CalPERS still has a lot on its plate. From the Sacramento Bee:

Happy days are hardly here again for the California Public Employees’ Retirement System, or for taxpayers who must make good on government pensions.

“There’s much, much work to be done,” said Ted Eliopoulos, CalPERS’ interim chief investment officer. “We’re ever vigilant; we try not to get too excited in good years or bad years about one-year results.”

Eliopoulos knows better than most that CalPERS remains in a deep hole.

Even with the 18.4 percent return, CalPERS estimates that it is only 76 percent funded, a remnant of overpromises made by the Legislature in 1999 and the finanical crash of 2007 and 2008. CalPERS would need to make 18 percent on top of 18 percent for several years running, and no one should expect that to occur.

CalPERS was also in the news last week when its former chief executive, Fred Buenrostro, pleaded guilty in a sordid federal criminal case in which he admitted to taking bribes of $200,000 in cash, some of it delivered in a shoebox, no less, as detailed by The Sacramento Bee’s Dale Kasler.

The case against Buenrostro and Villalobos is salacious, but it’s also a sideshow. No matter how corrupt they might have been, they would not have affected the giant pension fund in any significant way.

The far bigger problem is CalPERS’ unfunded liability. That will take years to fix.

In fact, although both funds have come a long way since 2008, neither one is out of this mess. From the Sacremento Bee:

On the surface, CalPERS and CalSTRS have recovered from the crippling multibillion-dollar losses they suffered when the housing bubble burst and the stock market crashed in 2008. CalSTRS’ portfolio, for example, has risen to $189.1 billion in market value, well above the pre-crash watermark of roughly $160 billion. Similarly, the CalPERS portfolio has soared 83 percent since bottoming out at $164 billion in 2009, putting it at $299 billion.

Despite the comeback, the funds spent several years after the crash with a much smaller pool of money to invest. That limited the amount of money they could earn. Even as they made gains, they’ve been unable to keep pace with their pension obligations, which have continued to rise as government workers accumulate years of service.

As a result, CalPERS is 76 percent funded. CalSTRS is 67 percent funded. They have more than enough money to pay pension benefits for now and the foreseeable future, but don’t have enough for the long term. Experts say 100 percent funding is ideal, although a funding level as low as 80 percent is acceptable.

To be fair, California isn’t in denial about the funding status of its two largest funds. And it isn’t letting big returns blind them to the issue, either.

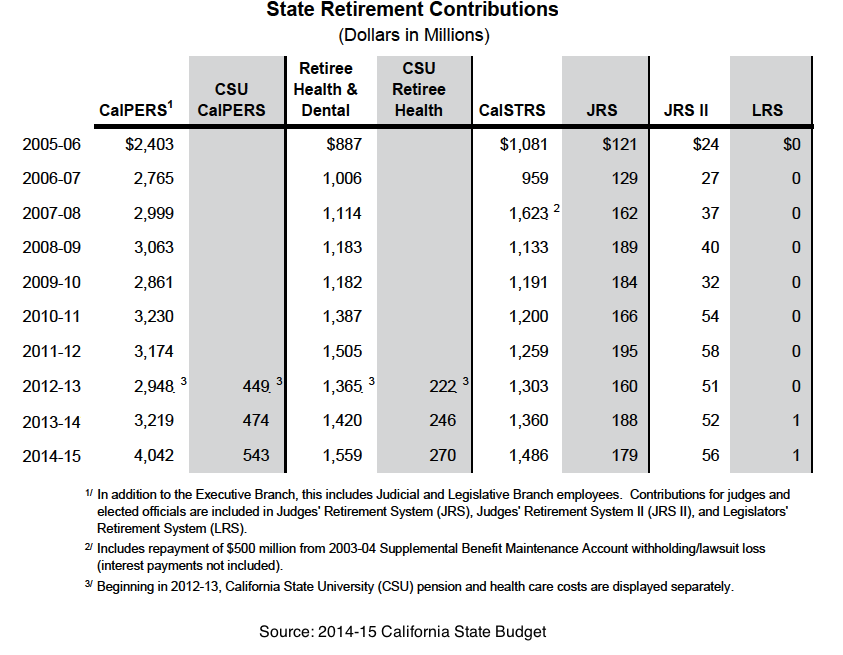

Both funds are increasing contributions rates for members and employers, and the state has increased its own 2014 contribution to both funds. The changes will bring in billions more dollars annually to the system.