Colorado is known for its Rocky Mountains. But the state’s rocky pension funding situation is well known, too, and lawmakers spent a chunk of the last legislative session trying to smooth out that area.

Colorado recently passed House Bill 14-1292, also called the “Student Success Act.” Most of the law deals with increasing state funding for public schools.

But a small portion of the law imposes stringent, all-encompassing financial reporting and transparency requirements on all public schools. Schools will have to report salary schedules, financial audits, and investment performance reports, among other things.

(The suggested template for all schools to follow can be seen at the bottom of this post.)

Many lawmakers are hoping that new transparency standards help shed light on the state’s pensions funding and cost issues.

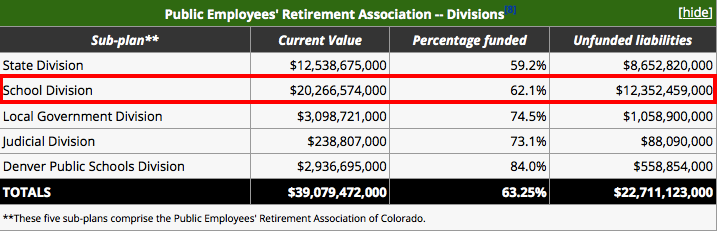

Colorado’s largest pension system, the Public Employees’ Retirement Association, was only 63.25 percent funded as of 2013.

There are five sub-sets in the system; of all the sub-sets, the “school division”—the division that caters to almost all the state’s public school employees—is by far the largest. It’s also one of the unhealthiest parts of the system, as it only has enough assets to cover 62 percent of its liabilities.

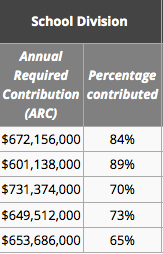

Critics of the state say that part of the reason for the underfunding issues is that Colorado has been paying less and less of its Actuarially Required Contribution (ARC).

But others say that school districts themselves could be to blame for some of the underfunding, as teacher pensions are too high. Transparency standards, they say, would shed light on those issues and make them available to remedy.

Colorado public school officials are not keen on the new reporting standards. From ChalkBeat:

A wide variety of district officials interviewed by Chalkbeat raised four main concerns about the law:

Implementation – District officials generally agree that compliance will be relatively painless for large districts but presents a greater challenge to some medium-sized and small districts. “It is going to be a lot of work for a lot of people. It depends on how big you are and how many people you have working for you,” Gustafson said.

Comparability – Even with the requirement for greater uniformity, some district officials wonder if district and school data will be fully comparable. They raise the question of likely district differences in how they account for costs borne by multiple schools – things like the salaries of special education teachers, psychologists and other staff who split their time among buildings.

Use & Misuse – District officials say they support transparency as an ideal but are openly skeptical that new financial data will see much use by the public.

“Who’s going to actually look at this website?” asked Tracy John, business manager of the 606-student Peyton School District northeast of Colorado Springs.

Anecdotally, districts say there’s little public use of financial information currently available online. “I don’t receive very many calls about transparency,” said Guy Bellville, chief financial official of the Cherry Creek Schools.

And districts are nervous that advocacy groups will use school-level financial data for their own ends, ignoring the context and nuances of why districts spend money as they do.

“Rather than build confidence in school budgeting decisions, it is more likely to provide ammunition to public education detractors who have no interest in learning the deeper context or complexity that comes with school budgeting,” argues Jason Glass, superintendent of the Eagle County Schools.

Impact on student achievement – “Tell me how this is going to impact student achievement,” Gustafson said. “This is a distraction that takes away from student achievement.” Said Boulder’s Sutter, “I’m fairly certain there are no studies about how one more accountant in the district office is going to affect outcomes.”

Below, you can see the template school districts are being asked to use to comply with the new reporting standards.

[iframe src=”<p style=” margin: 12px auto 6px auto; font-family: Helvetica,Arial,Sans-serif; font-style: normal; font-variant: normal; font-weight: normal; font-size: 14px; line-height: normal; font-size-adjust: none; font-stretch: normal; -x-system-font: none; display: block;”> <a title=”View Colorado Schools Transparency Template on Scribd” href=”http://www.scribd.com/doc/236632574/Colorado-Schools-Transparency-Template” style=”text-decoration: underline;” >Colorado Schools Transparency Template</a></p><iframe class=”scribd_iframe_embed” src=”//www.scribd.com/embeds/236632574/content?start_page=1&view_mode=scroll&show_recommendations=true” data-auto-height=”false” data-aspect-ratio=”undefined” scrolling=”no” id=”doc_62987″ width=”100%” height=”600″ frameborder=”0″></iframe>”]

Photo by