In all likelihood, a judgment on the constitutionality of Illinois’ 2013 pension reform law will in the next six months.

In all likelihood, a judgment on the constitutionality of Illinois’ 2013 pension reform law will in the next six months.

Former Illinois attorney general Ty Fahner doesn’t want the state to be blindsided by the result. If the law is overturned, he says, there needs to be another plan in place.

Fahner is asking lawmakers from around the state to start developing alternate reform ideas. From the News-Gazette:

“I still hope and expect, I truly do, that the court may find Senate Bill 1 constitutional. Whether that’s a false hope or not, I need to make the point that even if they do, after all of that, we’re still in terrible shape as a state,” Fahner said. “If they overturn it, there will be incredible hardship, which is what we are trying to get people to focus on now, not because it will change their decision, but I think there has to be a debate, a discussion, right now, because if you wait until the spring when the court finally rules, it’s going to be a little bit too late.

“They’re going to be in the middle of the budget at the end of the session. Whether it’s Quinn or Rauner, they’re going to have a difficult time. I think they need to talk now.”

He’s encouraging candidates for governor and the Legislature to address the question, and wants voters to ask them about it.

“That’s all we’re trying to do with this,” said Fahner, whose group is pushing what it calls a “What If?” initiative. “It’s so profound and the damages could be so terrible that people have to think about it now and not just give a political reaction later that, ‘We’ll have to sort it out.'”

State Rep. Adam Brown, R-Champaign, said he was “more than happy to be a part of the conversation” about an alternative pension plan.

“But at this point, there are just too many unknowns,” he said.

[…]

[Senate President John] Cullerton’s spokesman John Patterson advised patience.

“It has been a long struggle to get a law through the General Assembly and now a case to the courts,” he said. “Given the complexity of the issue and the difficulty in gettting to this point, we should now see what the courts have to say. There are a lot of people with a lot of opinions, but they aren’t on the Illinois Supreme Court, and it is the justices who will ultimately tell us what can and cannot be done.

“At this point the case is still before the trial court, so it seems a bit premature to already be predicting its demise. Let’s let the judiciary do its job.”

As for Republican gubernatorial candidate Bruce Rauner’s proposal that state employees be moved into 401(k)-style, Fahner said, “The idea of a 401(k) is great, but I’m not sure it would work in the current situation.”

Fauher also questions whether the reform law goes far enough. From the News-Gazette:

“[The law] only scratches the surface of the state’s problems. We also have to look at what drives jobs from the state. We’ve got to do a lot to make this a more jobs-friendly state.”

This year, he said, 26 percent of the state budget is devoted to pension payments. By 2024, pension payments would eat up a third of the budget.

He said that would lead to higher property taxes, fewer teachers and less money for social services.

“A lot of people say this isn’t a problem, all you do is just raise more taxes. This goes back to the jobs issue. We could raise taxes again, but we already know what the job losses have been,” Fahner said. “We’re losing jobs because it’s a very hostile work environment with regulations and everything else. If you have less jobs, you have less people to pay the taxes which fund all of these needs, and that’s what is happening to us.”

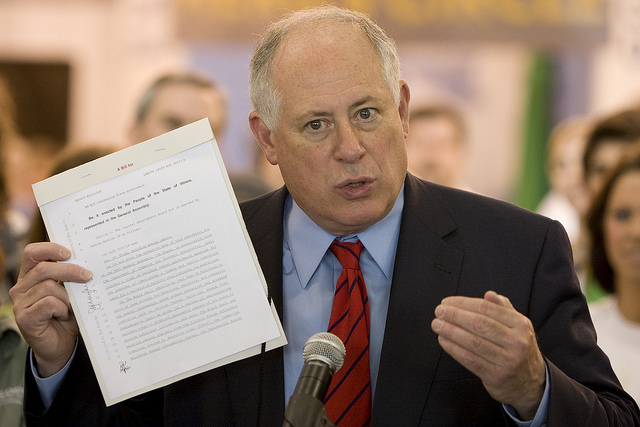

Governor Pat Quinn has said he doesn’t have a “plan B” in place if the law is deemed unconstitutional.

Lawyers representing groups challenging Illinois’ pension reform law asked for more time to file arguments this week. The request would have extended the deadline by a month.

Lawyers representing groups challenging Illinois’ pension reform law asked for more time to file arguments this week. The request would have extended the deadline by a month.